-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

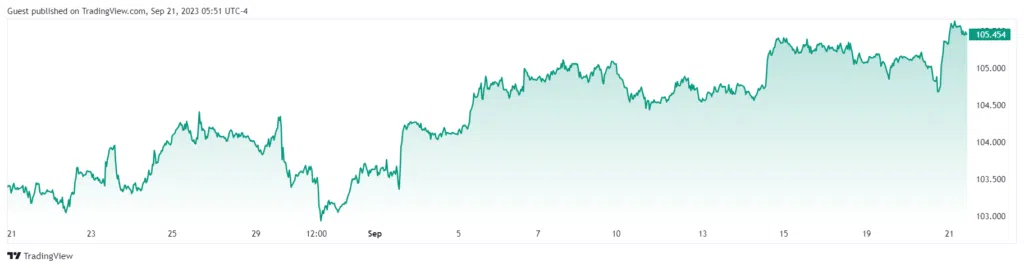

The USD surged against other major currency pairs as markets digested another “hawkish pause” from the Fed.

For most of the year, analysts and traders had been hoping for, and predicting, a quick fall in rates once the Fed had reached the end of its rate hike cycle. Over the same period, Jay Powell, Chairman of the Federal Reserve, has been warning against such a prediction, pointing to a resilient economy and stubborn inflation.

In his statement after the decision to pause rate hikes on Wednesday, 20th September, Jay Powell hammered his point home yet again. This time backed up by strong evidence that the US economy would remain stronger than its international peers, with growth expected to continue and unemployment to remain low.

Daleep Singh, former Fed official and Chief Global Economist at PGIM Fixed Income, laid out the decision in stark terms: “What they’re saying there is if you have stronger growth for this year and next, it increases the risk that core inflation does not descend as much as they hope and expect. Therefore, there is a potential need to keep nominal interest rates somewhat higher than they previously forecast.”

The Fed’s projections for interest rates remained somewhat consistent with the version presented in June, with the median interest rate projection for 2023 remaining unchanged at 5.6%, implying 25 basis points of additional tightening this year.

But for 2024, the Fed sees interest rates falling only to 5.1%, a radical shift from the previous projection of 4.6%. This signals interest rates are expected to persist at elevated levels for a longer period.

The reaction in the currency markets was immediate, with the EUR/USD testing its May low of 1.0630 overnight. After trading sideways for most of the week, the DXY also jumped to its highest level since March.

With the ECB all but announcing an end to its interest rate hikes last week and inflation falling unexpectedly in the UK, it is difficult to see anything but bullish fundamentals for the USD in the near future.

While the argument for higher interest rates for longer seems to be accepted by the markets, it is also important to point out that they remain unconvinced there will be another rate hike this year. Swap markets continue to price in a 66% probability that rates will remain unchanged when the Fed meets again in November.

Technical Analysis

Following the Fed announcement on Wednesday, the EUR/USD probes a prior swing-low at 1.0635, seen in May this year, which coincides closely with the Fibonacci Retracement level of 38.2. A break below this level could open the way past the psychological handle of 1.06100 to the 1.05160 level that was tested multiple times at the beginning of 2023.

The death cross that formed between the 200 SMA (pink) and the 50 EMA (purple) on the 13th of September is further confirmation of the continuing downward momentum. Additionally, the RSI at 34 remains just above oversold territory, and although the MACD looks set to crossover at some point in the near future, looking at the fundamentals, when it does, it may only be temporary.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.