-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Yesterday, Trump’s resounding victory in the US election sent shockwaves through the markets.

Market participants had been stockpiling cash for days, preparing to move once the result became clear. The size of Trump’s victory surprised many political analysts but not traders.

By 00:00 GMT, Trump had clinched Georgia and North Carolina, and exit polls showed that Harris had fallen short of Biden’s support in 2020. The markets had made up their minds.

The DXY (US dollar index), S&P Futures and Bitcoin spiked. Trump’s economic policies of higher tariffs and lower immigration are seen as inflationary and are, therefore, bullish for the dollar. While the potent mix of tax cuts and deregulation he has advocated is a boon for corporations and the crypto industry, which has been a particular target of the SEC during the Biden administration.

The DXY registered its largest daily gain this year, rising over 1.5% to 105.1, as the dollar gained against its peers. The EUR/USD was hit harder than most, dropping over 2% to its weakest level in 4 months, below 1.07. Bitcoin set a new record high above 75,000 USD. The Dow, NASDAQ and S&P 500 all surged to new records, too, with the Dow posting its best day since 2022.

Today, things are calmer, and the dollar has given up some gains, with the DXY falling as low as 104.4. With Trump looking set to complete the “red sweep” – Republicans holding the presidency and both houses of Congress – any serious reversal from these positions is looking unlikely.

But traders are already moving on. The FOMC is making an interest rate decision today and is widely expected to cut rates by 25 basis points. While there will be no specific forward guidance in the decision notes, Jay Powell’s press conference after the decision will be closely studied, especially given Trump’s past comments threatening the political independence of the Federal Reserve.

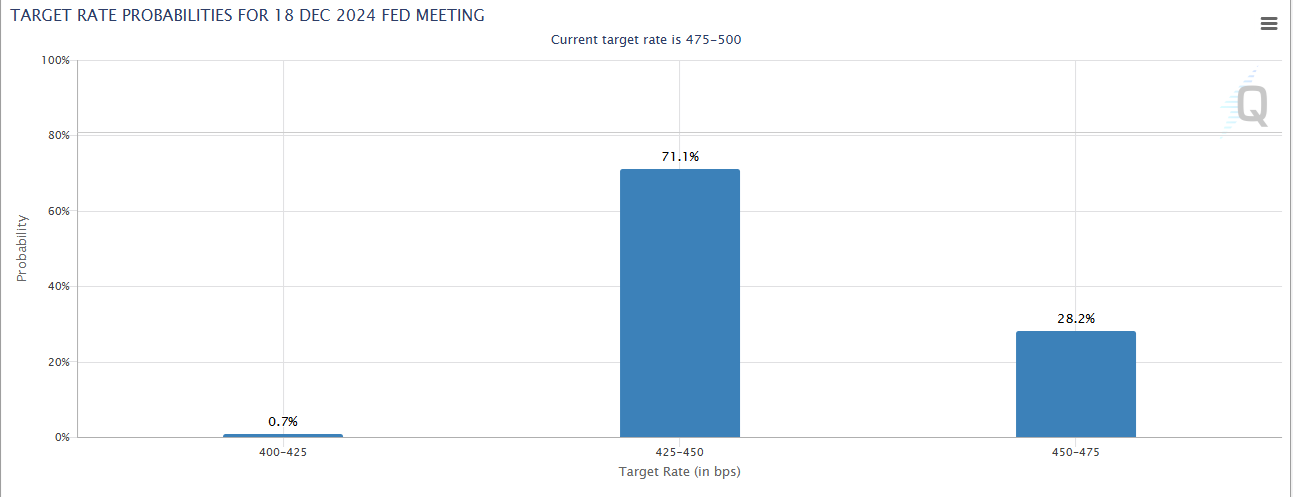

Traders will also be looking for any hints as to the Fed’s thoughts on the size of the rate cut in the December 18 meeting. Currently, traders are approximately 30/70 split on whether the Fed will hold rates steady or cut them by a further 25 basis points.

Unless something extraordinary happens in the press conference, don’t expect the mood to change hugely. The market is still very much in thrall to the Trump Trade, and it will take some time – or a major unexpected event – to change the paradigm.

That said, once the initial market jubilation has run its course, traditional trade elements will return – at least in the currency markets – and the USD should come down from its highs against other major pairs.

Technical Analysis

Following Trump’s victory yesterday, the dollar rallied across the board, with the EUR/USD having broken below the 200-day EMA and the key support zone at the 1.0777 level. Having retreated to new multi-month lows in the 1.0685 – 1.0680 band on Wednesday, the pair trades positively today and is currently testing that key resistance zone at the 1.0776 level.

Should the price hold below this level or retreat further towards the 1.0725 level, sellers will remain in control in the short term and may achieve their negative targets of 1.0650 and, below that, the yearly low of 1.0600.

On the other hand, a break above the 1.0777 level may see a push towards the November high of 1.0925 before hitting the 1.1000 level.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.