-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

A bad week for the USD got even worse yesterday as returning risk appetite was compounded by lower-than-expected inflation figures in the US.

For the first time in four months, US CPI data didn’t overshoot market expectations, boosting market optimism about a cut in interest rates and piling further pressure on an already weak dollar.

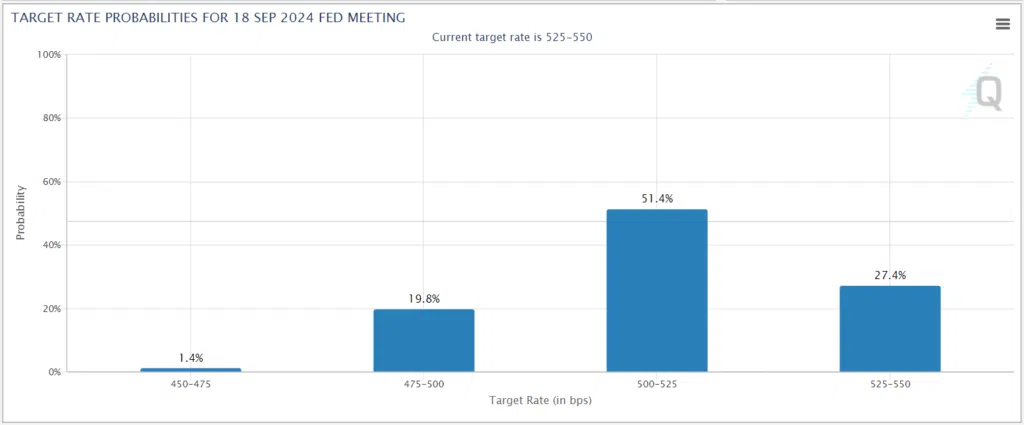

Prior to the data release, futures traders expected a single rate cut in November of this year. After the CPI figures were released, the chances of a September rate cut increased to 72%, with a July rate cut not out of the question either, with a 35% chance.

Markets reacted quickly, with the EUR/USD rising to 1.0895 overnight before losing ground in today’s trading. The S&P 500 closed up 1.2%, setting another record high, and gold climbed to 2395 – close to its all-time high set in April this year.

But this bout of optimism may be short-lived, and analysts are expressing caution. Eric Winograd, senior economist for fixed income at AllianceBernstein said “there is nothing in here that tells us that inflation is going to come down to the Fed’s [2%] target in the near term”.

Speaking two days ago, Jay Powell, Chair of the Federal Reserve, also advocated caution, saying that he expected inflation “will move back down on a monthly basis to levels that were more like the lower readings we were having last year [but] my confidence in that is not as high as it was”.

Market optimism was tested today by the US weekly Initial Jobless Claims data. Last week, the unexpected increase in first-time applications for unemployment benefits triggered a USD selloff. But Jobless Claims came in about expected, keeping the pressure on the USD. Fragility remains, though, and markets will be waiting for the EU inflation data release tomorrow, which could still slam the brakes on the EUR/USD’s bull run.

Technical Analysis

On the release of the lower-than-expected inflation data, the EUR/USD soared towards the 1.0900 level from 1.0820 on Wednesday. Today the pair continued its upward move, but slumped briefly and then moved sideways after the release of US jobless claims at 222k, slightly above the forecasted 220k, but below last week’s 232k.

The pair now sits at the 1.0863 resistance-turned-support level, which closely corresponds with the Fibonacci 38,2% level of the October – December 2023 uptrend.

EUR/USD Daily Chart on TradingView, prepared by Alison Heyerdahl

With the RSI at 62.7 and the price riding high above all three moving averages (50, 100, and 200-day EMAs), the short-term outlook is strongly bullish despite today’s brief downturn.

If a breakout is confirmed with a bullish follow-through above the trendline (blue), we could soon see a move towards 1.0980. On further strength, the focus will turn to the 1.1000 psychological handle.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.