-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

The US labour market is slowing; there’s no doubt about that. We’ve seen a run of poor results from various data outlets showing that employers across the country are cutting back on new hires and letting people go. But how deep is the slowdown? With the NFP due tomorrow, we don’t have long to find out.

It has been a brutal week for the markets. Yesterday’s JOLTS report (7.67 million job openings vs 8.1 million expected in July) came hot on the heels of weaker-than-expected manufacturing data. Traders and investors responded as expected, with tech stocks taking the brunt of the anxiety. Nvidia’s share price, now a closely watched bellwether for overall market health, has fallen over 10% this week and will likely continue to slide.

With tomorrow’s NFP forecast to be 160k and last month’s coming in well under expectations at 114k, there is a near-certainty of further disappointment. How the markets will respond is up for debate. The Fed will hope that the softening labour market has been at least partially priced in, but given the panicky responses to other recent setbacks, that is unlikely.

The nervousness has also fed into the currency markets. All major currencies are up against the USD, with the EUR/USD and the GBP/USD enjoying a sustained bull run over the week. A weak NFP will only add fuel to the fire, especially given that the European and British central banks have less wiggle room than the Fed.

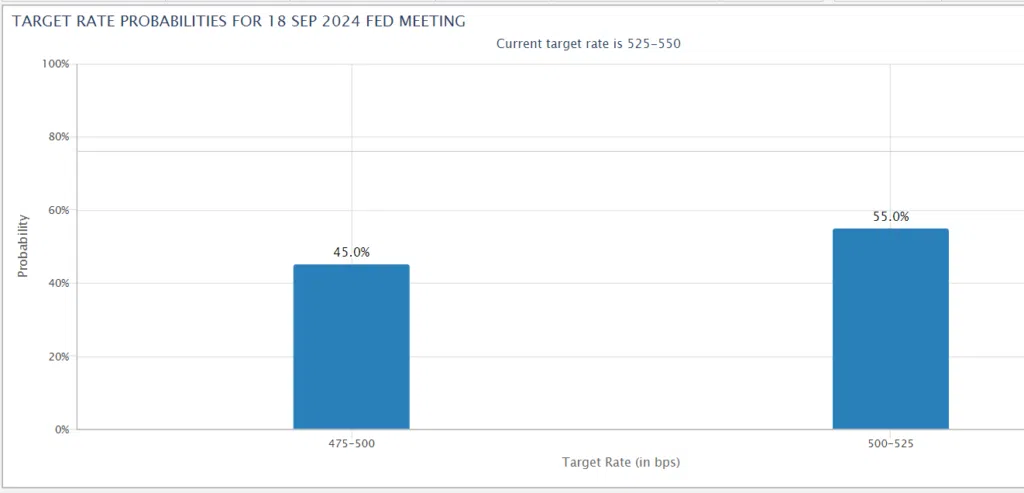

The odds of a 50-bps rate cut on September 18th have risen as the underwhelming data has rolled in. Futures traders are now almost evenly split, with 45% expecting a 50-bps cut and 55% expecting a 25-bps cut. In other words, it’s too close to call. Uncertainty is the market’s worst nightmare, and whatever the decision is, we will see serious volatility.

Leaders from across the investment industry are now publicly calling for the Fed to move fast and hard. Andrew Law, CEO and Chairman of Caxton Associates, makes a particularly strong argument:

“Some will question whether the Fed can or should radically alter its stance just months before the forthcoming presidential election. I would, however, ask an alternative question: can the central bank afford to stay with a policy that is no longer appropriate? By doing so it would risk its political impartiality.

The worst possible outcome for Fed independence would be for it to be forced by markets to further adjust rates between scheduled policy meetings in the weeks leading up to the election because of a clear deterioration of the labour market, or a financial event linked to the high policy rate. The September policy meeting is the last opportunity to adjust before the election.”

Whether the Fed listens to these public calls remains to be seen.

With the European and British central banks now unsure of how fast they can safely cut rates, we can expect a weaker USD in the short term. But the US economy has shown itself to be resilient, and the longer term still looks brighter for the USD vs. other major currencies and the DXY overall.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.