-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

It’s been almost a year since Hamas’ massive terrorist attack on Israel, and the ensuing conflict in the Middle East has been rarely out of the headlines ever since.

It has ebbed and flowed, with a particularly bad flare-up in April sending investors flocking to haven assets. Following the most recent escalation – i.e. Israel’s assault on Hezbollah in Lebanon and the wave of missile strikes from Iran in response – we are seeing a familiar pattern.

The usual haven assets—gold, oil, and the dollar—are all up, marking a sharp turnaround from recent trends. Crude oil, in particular, has seen a steep climb in price. Earlier this month, WTI was trading as low as 65 USD per barrel due to forecasts of weaker global demand and news of an increase in Saudi Arabia’s output. Prices are now hovering around 72 USD per barrel, with a large build in US inventories preventing too much movement to the upside.

Gold hit yet another record high of 2,685 USD per troy ounce last week but has since stabilised, as USD strength is holding further bullish moves in check.

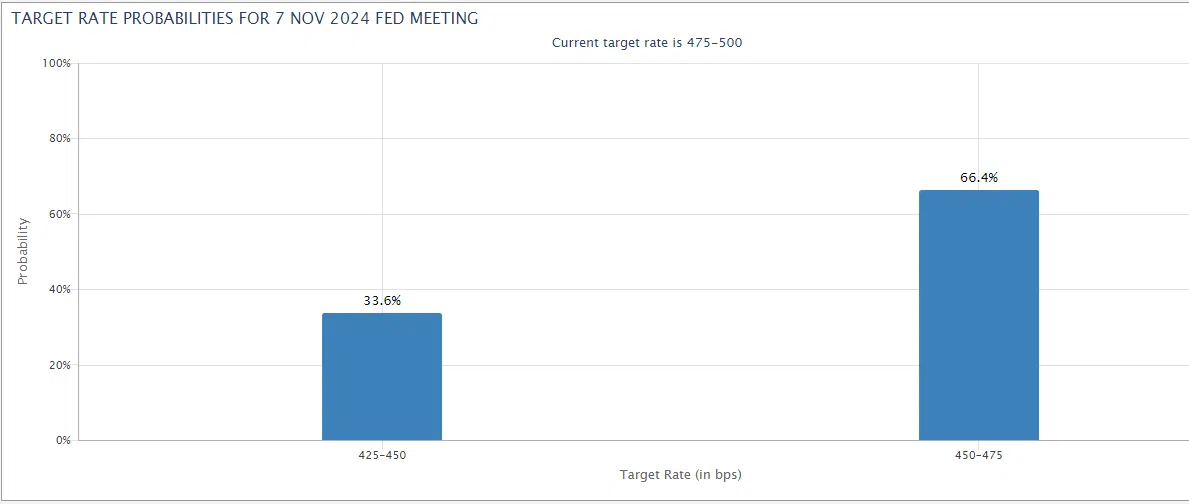

Speaking of which, the dollar has seen a remarkable turnaround this week, with the DXY climbing steadily from 100.2 on Monday to 102 today as traders and investors dump riskier currencies in favour of the greenback. The dollar’s ascent has been helped by stronger-than-expected US jobs data, with futures traders paring back the chances of another 50bps rate cut in November to below 35%, as a result.

JOLTS Job Openings rose to 8.04 million in August from a revised-up 7.71 million in July, and ADP Employment Change – an estimate of private payrolls growth – came out at 142K in September, beating the previous month’s 103K and expectations of 120K. Markets now await the US’s most important labour report, the Nonfarm Payrolls (NFP) scheduled for release tomorrow, Friday 4th October.

Elsewhere, the Governor of the BoE’s dovish comments in an interview have seen an 8% slide in the GBP/USD, and the EUR is weakening after lower-than-expected inflation data for September.

The official headline inflation rate in the Eurozone came in at 1.8%, the first time it has fallen below the European Central Bank’s (ECB) target of 2.0% in 39 months. The data increases the chances the ECB will cut interest rates more aggressively, which would be negative for the EUR as it discourages foreign capital inflows.

Overall, the standard fundamentals point to a stronger USD, and tensions in the Middle East add broad support. If we see a continuation or escalation of hostilities, expect gold, oil, and the USD to push even higher. On the contrary, any de-escalation could lead to a rapid resumption of risk flows, pulling all three haven assets back down.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.