-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

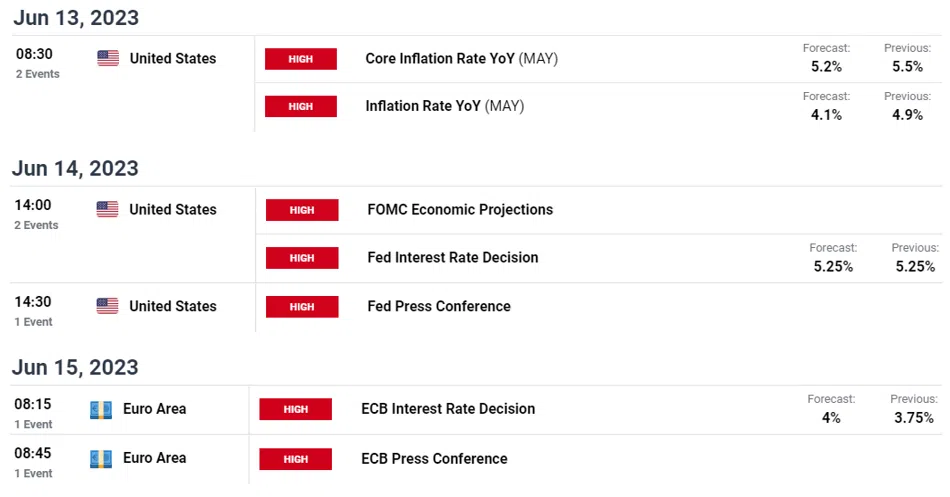

On Tuesday, the May inflation report will be published, and on Wednesday, the Federal Reserve Monetary Policy Committee will decide on whether to raise interest rates. We also have the European Central Bank´s monetary policy decision on Thursday, though the market is more confident here.

Looking at Tuesday’s inflation report, the forecast is for headline inflation to cool to 4.1% from 4.9% and core inflation to drop to 5.2% from 5.5%. But there is real uncertainty here as the market has been so frequently wrongfooted by data releases recently. The higher the inflation print, the better it will be for the USD, though risk assets – such as stocks and commodities – will be hit hard by any major overshoot of the forecast.

The inflation figures may directly affect the Fed’s monetary policy decision on Wednesday. The current market expectation is for the Fed to hold rates steady in June, but once again, there is very little certainty here. Some analysts are predicting a hike, pointing to the series of surprise data releases showing that the US economy is still overheating.

Mohammed El-Erian writes in the FT today that a decision to “skip” an increase in rates in June has major logical flaws:

There are two issues with this approach. First, an additional month of data is unlikely to significantly enhance the Fed’s understanding of the effects of a policy tool that acts with variable lags. Second, recent data favours a hike for a central bank that has repeatedly insisted that it is “data dependent”.

No wonder some other Fed officials favour a hike this week. Their viewpoint points to the series of data surprises, including most recently higher job vacancies and robust monthly employment creation, as well as the lifting of immediate concerns regarding the US debt ceiling and banking instability.

The current probability of a rate rise by the Fed is between 20-30%, so if there is a surprise increase, the EUR/USD will be hit hard and the DXY will make major gains.

Finally, we will see the ECB’s interest rate decision on Thursday. Here the market is more comfortable, pricing in a 25bps raise. Traders will be looking for any forward-looking statements from the committee members. Though these may be in short supply, given the economic pressure on the eurozone.

Central banks and traders are very much in reactive mode, so keep in mind that any change in the mood will only be temporary and that fresh data releases could easily alter the course of the markets.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.