-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Checking a broker’s regulatory status is a simple process for all the major regulators and only takes a couple of minutes (and could save you a lot of money and heartache!)

A closer examination of the main regulators in the world is required, we are also going to discuss how to check if a broker is regulated. Some of the main regulators in the world are:

- South African Financial Services Conduct Authority (FSCA)

- Australian Securities and Investment Commission (ASIC)

- UK Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

South African Financial Services Conduct Authority (FSCA)

The South African FSCA is well-regarded but is not considered one of the best international regulators. Many South African traders like to work with FSCA regulated brokers as this provides local protection and requires the broker to have a local office and local bank accounts.

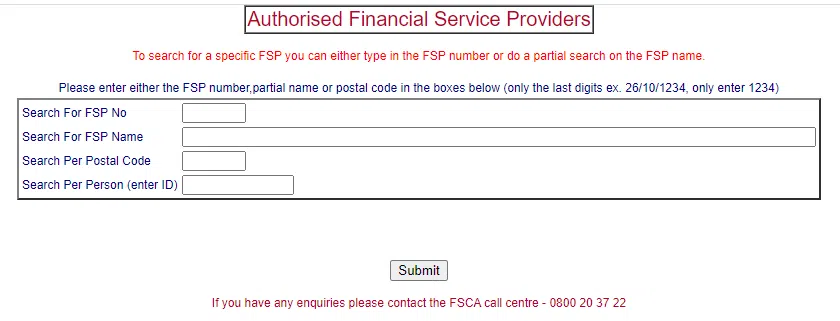

Checking if a broker is regulated by the FSCA is easy. The FSCA offers a search tool for all authorised Financial Service Providers (FSPs) here: https://www.fsca.co.za/Fais/Search_FSP.htm.

This is what the search window looks like:

The best way to use this search function is to input the brokers FSP number, which they are legally required to display at on their website.

For instance, here is Khwezi Trade’s FSP notice and number at the bottom of its webpage:

You will notice that Khwezi Trade is not the name of the Financial Services Provider regulated by the FSCA, but is actually Khwezi Financial Services. This is quite common as brokers are often part of a larger financial company. It does mean that searching by broker name using the FSCA’s search tool can be quite tricky, so use the FSP number if you can.

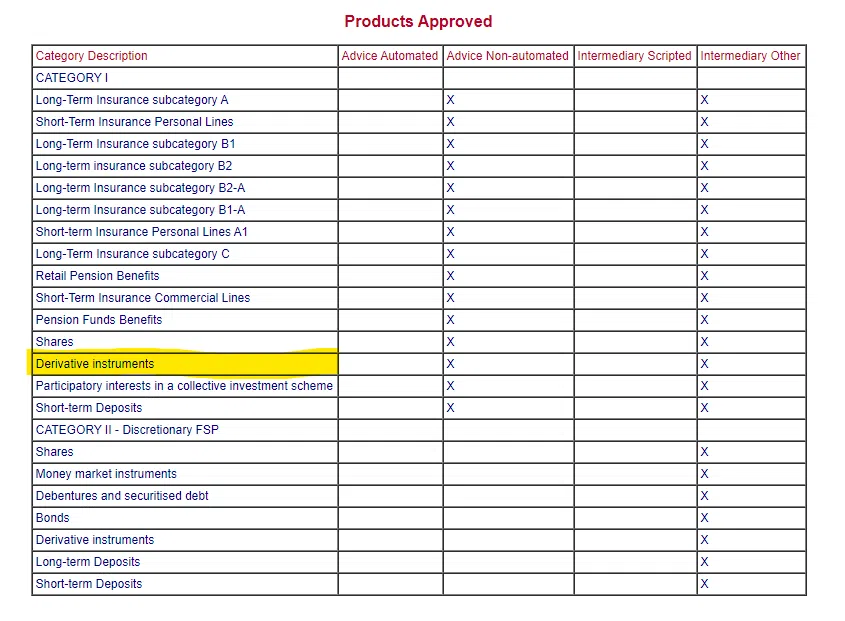

Using this information from Khwezi Trade’s website we can then search the FSCA database. Here we can see that Khwezi Financial Services is indeed an authorised FSP:

We can also see that Khwezi Financial Services is approved to offer derivative instruments. This is important as all Forex CFD trading is derivative trading.

Australian Securities and Investment Commission (ASIC)

The Australian financial regulator has an excellent global reputation and is continually active in combatting broker fraud and manipulation. Many of the most respected Forex brokers in the world are Australian, and ASIC is an important part of their reputation for trustworthiness.

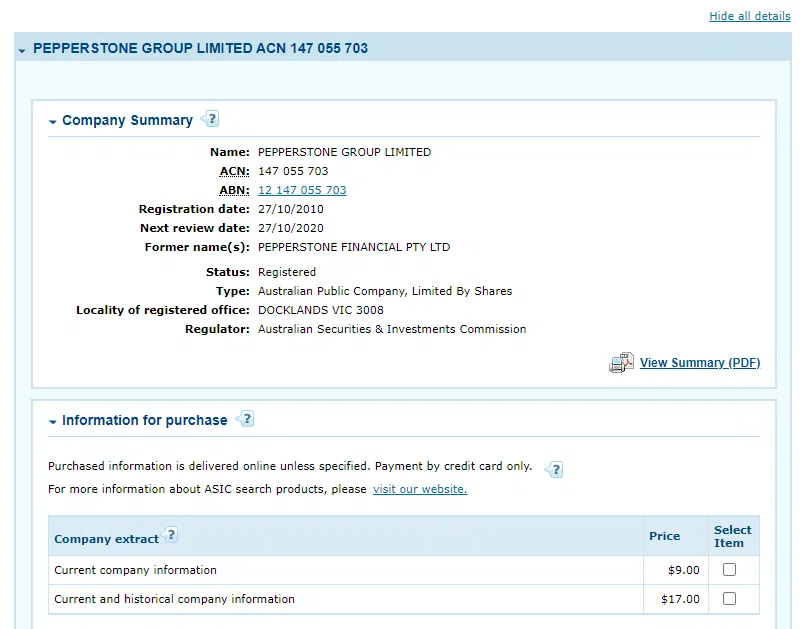

Checking a broker’s regulatory status with ASIC is a very similar process to the South African FSCA’s, the ASIC search tool can be found here: https://connectonline.asic.gov.au/.

Unfortunately, detailed information on each company in the ASIC database is only available via purchase. See below for Pepperstone’s ASIC entry:

Like the FSCA, all ASIC-regulated brokers are required to publish their ASIC licence on their homepage. We have had a few reports of unregulated brokers claiming to be based in Australia and using the names of regulated financial companies, so it is always best to check thoroughly.

UK Financial Conduct Authority (FCA)

The UK’s Financial Conduct Authority is seen as the best financial regulator in the world. It’s no surprise that their search function is the easiest to use and the most thorough, you can access it here: https://register.fca.org.uk/s/.

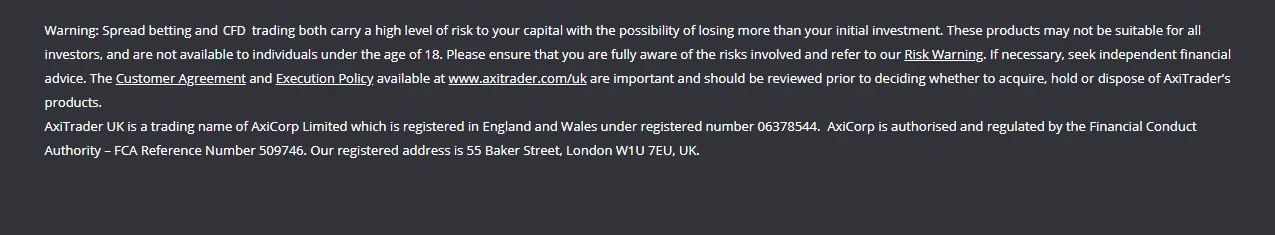

Like other major regulators, all brokers with an FCA licence are required to publish their FCA reference number on their website, here is AxiTrader’s FCA number at the bottom of their website:

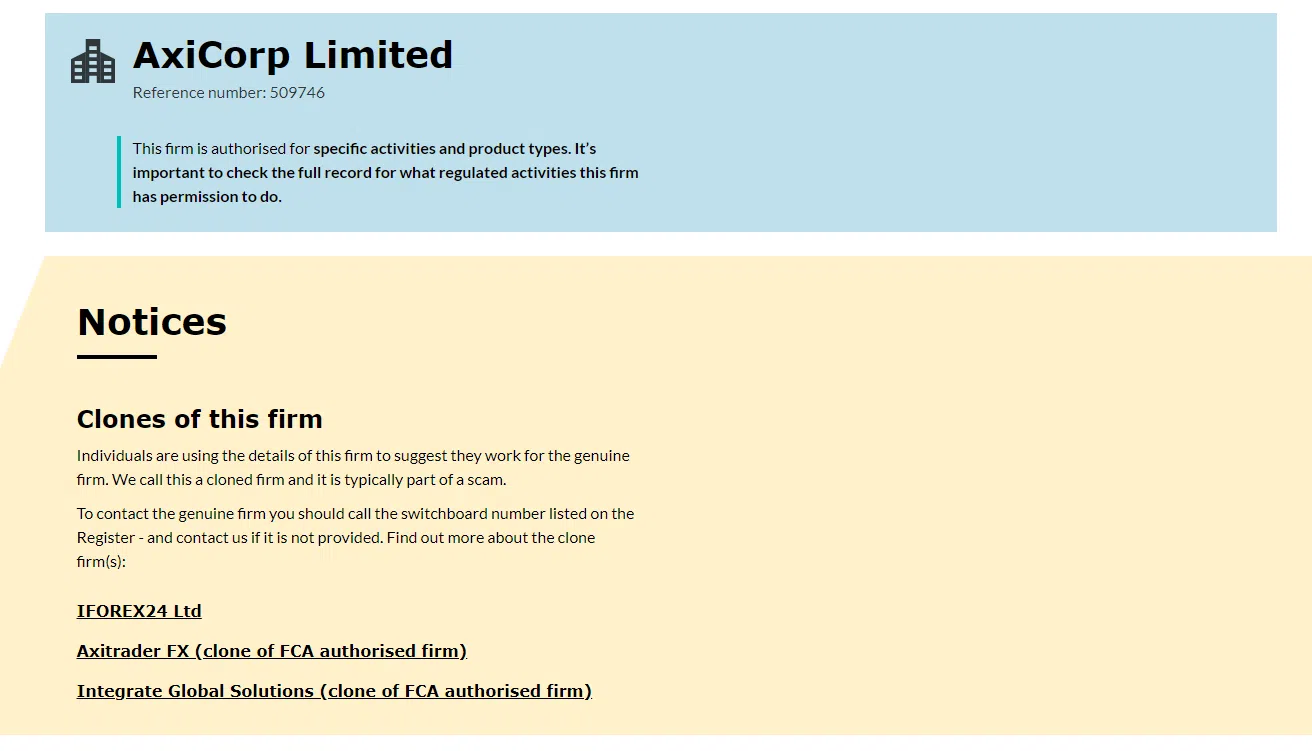

Like Khwezi Trade in South Africa, AxiTrader is the trading name of a larger financial group, in this case, the FCA licence holder is AxiCorp Limited. Using the FCA reference number, we can search the FCA’s database of registered companies and find AxiCorp Limited’s entry:

Notice that the FCA also warns of unregulated brokers that are attempting to use AxiCorp’s identity to scam unwary traders.

Cyprus Securities and Exchange Commission (CySEC)

CySEC is the foremost regulator in the EU and Cyprus has a long history of regulating online Forex brokers. As a European regulator, all brokers with a CySEC licence must abide by the EU’s MiFID II legislation. Among other things, this requires limits on leverage and the removal of trading bonuses.

CySEC’s broker search tool functions much like the FCA’s and all CySEC licenced brokers are required to publish their licence number on their website. CySEC’s database and search tool can be found here: https://www.cysec.gov.cy/en-GB/entities/investment-firms/cypriot/

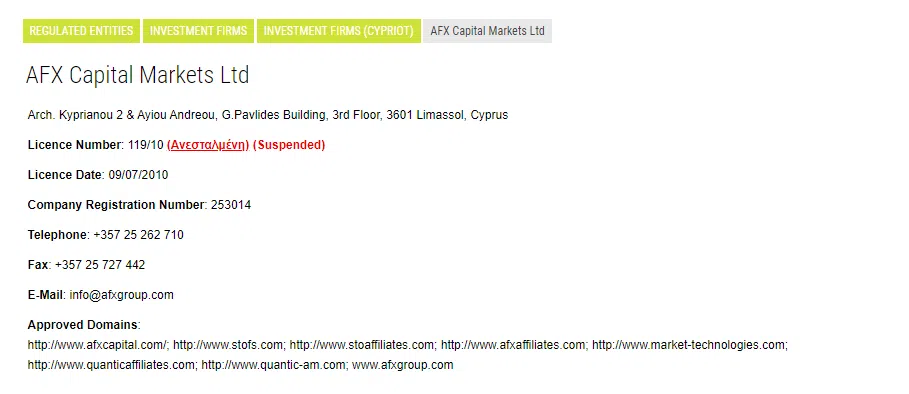

Below, we can see the entry for AFX Capital Markets, which went bankrupt last year and is suspected of several wrongdoings, including using client money to cover operational costs.

CySEC makes it clear that AFX Capital Market’s licence has been suspended. A clear sign not to trust a broker.

Other Regulators

There are many other small regulators around the world, and Forex brokers will hold licences with them to avoid the restrictions placed on them by ASIC, CySEC and the FCA.

Commonly seen small regulators include the Seychelles FSA, the Mauritius FSC, St Vincent and Grenadines FSA, the Belize IFSC and the Bahamas SCB. While being regulated by one of these smaller regulators does not mean that a broker is bad, it does mean that traders are not as well protected.

The best and most trustworthy brokers are regulated by at least one of the three major regulators (FCA, CySEC, ASIC) or the FSCA. It is common for brokers to have multiple regulators, one for each region in which they operate.

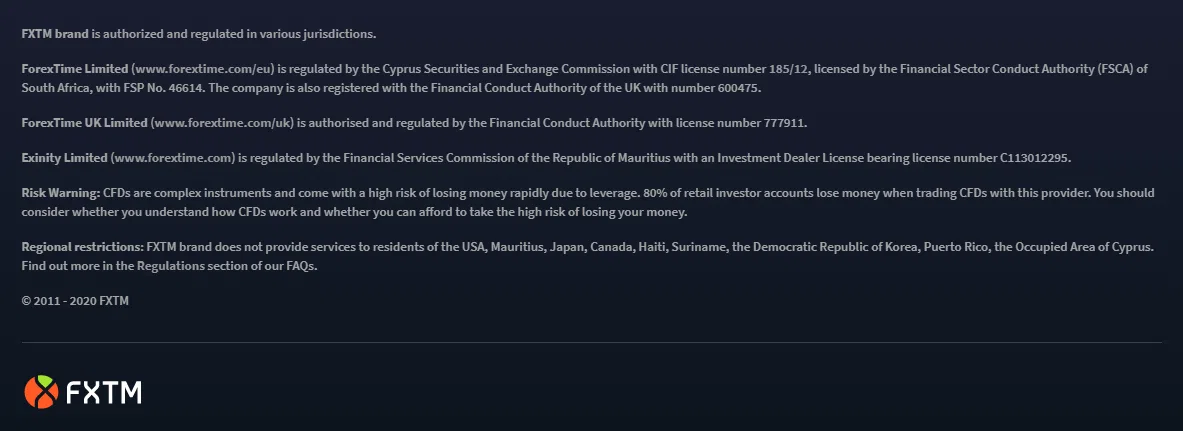

It is common for brokers to have multiple regulators, one for each region in which they operate. A good example of this is FXTM, below is a screenshot from the bottom of their website:

We can see that FXTM and its subsidiary companies are regulated by CySEC, the FSCA, the FCA, and the Mauritius FSC. This allows FXTM to offer its services to traders all over the world.

IOSCO Investor Alerts Portal

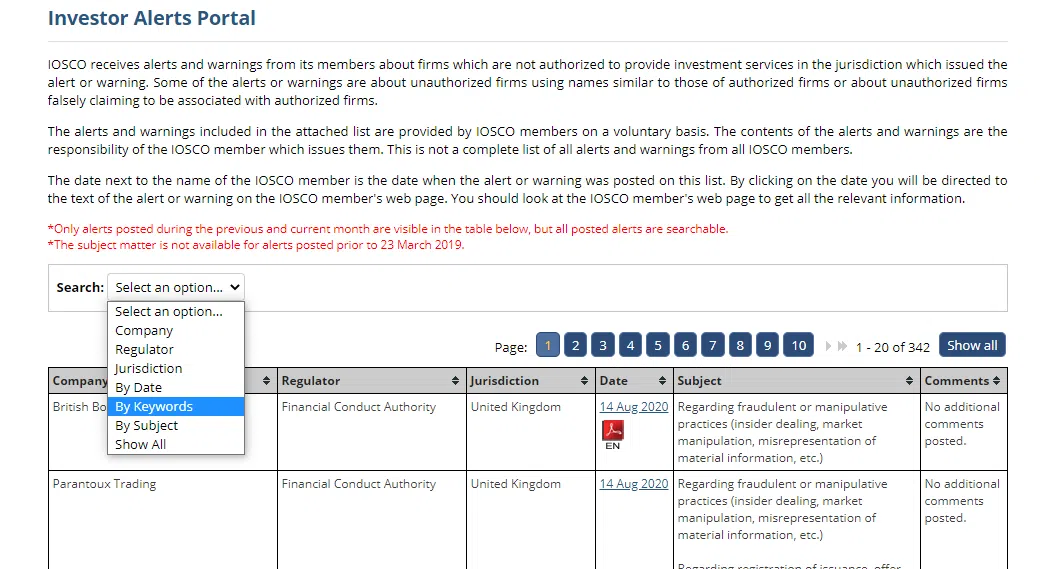

When checking a broker’s regulation, there is one other useful tool. The International Organization of Securities Commission (IOSCO) maintains a list of every investor warning issued by every regulator in the world, and this is available here: https://www.iosco.org/investor_protection/?subsection=investor_alerts_portal

✔️If you are concerned about a broker for whatever reason, do check this database before you part with any funds.

This list contains a huge number of entries so the easiest way to search is using the keyword option, see below:

We recently had a question from a trader regarding a broker called RedfordFX. They had contacted him out of the blue and he was suspicious. So, let us run a search for this company using the IOSCO keyword tool.

As you can see, the CNMV (the Spanish financial regulator) released a warning about RedfordFX on August 3, 2020. Obviously, not a broker to trust!

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.