Turn Trade strategy is a mechanical trend trading strategy that trades in the direction of the prevailing and dominant trend. Developing a solid mechanical trade strategy is critical to the success of any size trading account. Mechanical strategies help traders find less obvious trading opportunities – they come both big and small.  Focusing on particular opportunities is an essential skill because markets tell a non-stop story, so traders need a way to break that up. Having a mechanical system, it removes the subjective analysis and allows for focus. Even though Turn Trade strategy is a trend trading strategy, it tries to buy low and sell high. But it does so in the context of trading in the direction of the dominant trend. It works using:

Focusing on particular opportunities is an essential skill because markets tell a non-stop story, so traders need a way to break that up. Having a mechanical system, it removes the subjective analysis and allows for focus. Even though Turn Trade strategy is a trend trading strategy, it tries to buy low and sell high. But it does so in the context of trading in the direction of the dominant trend. It works using:

- Moving averages – one of the most popular indicators among traders to gauge the market trend.

- Bolinger Bands to discover overbought and oversold conditions in the market.

- Multiple time frame analysis to time the market. We cover this in a separate article and so will not cover it below in detail.

Turn Trade Strategy

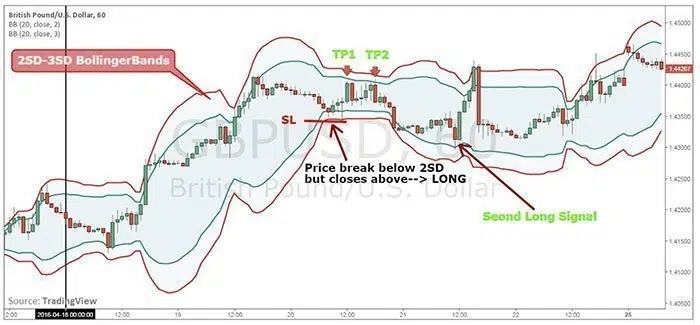

As established above, we use two main sets of technical indicators for this strategy. I have chosen to leave our Multiple Time Frame Analysis to cover it in more detail. We use a simple moving average with a 20-period applied to the daily chart. The 200-day moving average is regarded to be one of the most important moving averages in technical analysis. Since 20 is a multiple of 200, 20 it carries a lot of weight as it is simple to calculate with. The 20-SMA includes a full month’s worth of trading data. Thus, it gives a trader a good idea of the average price of during the current month. The second technical indicator used is the Bollinger Bands. Bollinger Bands are a volatility indicator utilised to spot overbought and oversold conditions. Bollinger Bands are used on the 1h time frame. A Turn Trade setup requires two sets of Bollinger Bands. One should have three standard deviations (3SD) and the second with two standard deviations (2SD). The two bands will form a trading channel that contains the price action within it.

Figure 1: Turn Trade Setup configuration

Buying Strategy

- On the Daily chart price needs to be above the 20-SMA;

- Only take long positions using the 1h time frame to time the market;

- Wait for the price to break below, but needs to close above the lower 2SD-3SD Bollinger Bands before buying at the current market price;

- Stop Loss 10 pips below the swing low;

- Take partial profit at 50% of risk (i.e. If you risk 50 pips then take profit 25 pips above the entry)

- Move SL to BE once TP1 reached;

- Take profit on the second half of the trade once price tests the upper 2SD-3SD Bollinger Bands;

Selling Strategy

- On the Daily chart price needs to be below the 20-SMA;

- Only take short positions using the 1h time frame to time the market;

- Wait for the price to break above, but needs to close below the upper 2SD-3SD Bollinger Bands before selling at the current market price;

- Stop Loss 10 pips above the swing low;

- Take partial profit at 50% of risk (i.e. If you risk 50 pips then take profit 25 pips below the entry)

- Move SL to BE once TP1 reached;

- Take profit on the second half of the trade once price tests the lower 2SD-3SD Bollinger Bands;

Examples

Looking at the Daily GBP/USD chart below, you can see that in the middle of April we broke above the 20SMA. This means that the predominant trend is up. So we’re only going to take long positions as per the Trade Turn strategy.

Figure 2: GBP/USD Daily Chart

Switching to the 1H time frame (see Figure 3) we’re going to wait for all conditions to line up before entering a long position. Notice that at the first retracement into the lower 2SD-3SD Bollinger Bands a long signal is triggered. Now, both of our profit taking areas have been reached in the following hours.

Figure 3: GBP/USD 1H Chart

Turn Trade strategy demonstrates the power of trading with the trend. And taking advantage of using multiple time frame analysis to time the market. Trading with the trend means fewer losses and thus a good reason using the Turn Trade strategy in your trading.