-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Unlike with the stock market, which trades for set hours every weekday, the Forex market trades 24 hours a day for five days of the week. The weekend break leaves an opportunity for prices to move while the market is closed which causes a gap between the closing prices and the opening prices. But gaps can be created for other reasons as well, and they give traders trading opportunities.

When trading forex gaps, there is little concern about what or by whom, because traders are just using technical chart analysis to see the trends. In this kind of trade, a trader doesn’t need to read up the news or be aware of the context surrounding the cause of the gap.

What is a Gap?

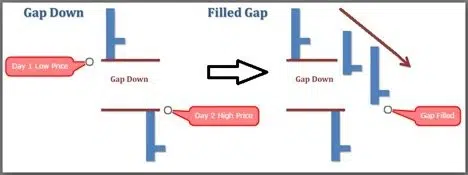

A gap is when a currency pair opens the day (or any other time unit measurement) above or below the previous closing price. Usually, gaps happen over the weekend, at the opening of the new trading week, and occurs when the Monday opening price is significantly different than Friday’s closing price. However, gaps can also form in the middle of the trading session during releases high-impact economic news, as liquidity dries out and causes gaps in price.

Figure 1: Gap Up

Not all gaps look the same, as the reason for them forming can be different. Gaps have different shapes; some are larger than the others. Traders can profit from trading on the opposite side of the gap, as the gap is filled, as well as in the direction of the gap. There are four main types of gaps that exist.

Figure 2: Gap Down

Type of Gaps

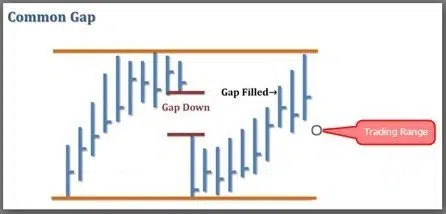

Common Gaps

As the name suggests, they occur frequently. A common gap has no real fundamental reason for existing in the market and is more just a psychological effect that happens when the market consolidates. Most common gaps are filled the same day they are made.

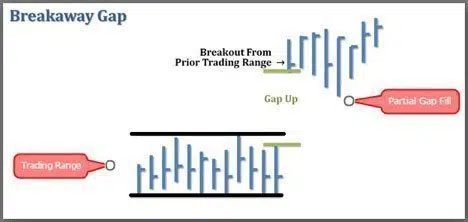

Breakaway Gaps

Less frequent than the common gap, a breakaway gap is not likely to be filled in the short-term. However, it could get a partial fill. A breakaway gap will first have a consolidation period, where price activity stays within a trading range as the market agrees on a price. The breakaway from this trading range can cause a gap in price either above or below the range which can be due to either some news events or because of supply and demand imbalances. Most of the time the Breakaway gaps occur at the beginning of a new trend.

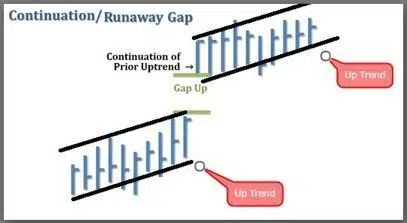

Runaway Gaps

The Runaway Gaps are also known as the Continuation Gaps because they don’t get filled, and the market tends to trade in the direction of the gap. Runaway Gaps happen during a strong trend and occur in the middle of the trend as it shows a high level of interest from market participants. The Runaway Gaps also work as great support and resistance levels in the direction of the prevailing trend.

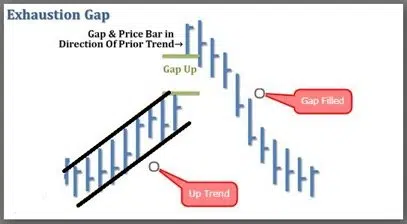

Exhaustion Gaps

Exhaustion Gaps are a reversal signal as they happen at the end of a trend. Exhaustion Gaps are caused by traders fear of missing the trend. The traders who missed the trend find it difficult, as a strong trend will not give traders many opportunities to break in. As the trend develops, traders who missed the start of the trend will jump in – creating a buying/selling hysteria right at the top/bottom which exhausts the price – hence the name exhaustion gaps.

Important Notes When Trading Gaps

Keep in mind that not every gap is tradable. The main factor to consider when trading gaps is to ensure you have enough of a profit margin. In the case of common gaps or breakaway gaps, the actual gap needs to be big enough. Otherwise, the risk to reward ratio suffers. Traders should only look to trade gaps that are at least in the 40-50 pips range.

Another important note – time matters. If the gap doesn’t get filled in the first few hours, there is a high probability that the market will continue in the direction of the gap. Once traders become familiar with the different gap types, they will have the opportunity to find their strategies for gap trading.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.