-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

This sponsored article was written by HFM´s analysis team. Read our HFM review to find out more about HFM and its excellent research and market analysis.

USDIndex, Daily

The US dollar index fell to a 9-month low amid dovish comments from Fed Chair Powell that sent bond yields tumbling and sparked a rally in stocks, dampening demand for the dollar. The index lost -0.89% in yesterday’s trading.

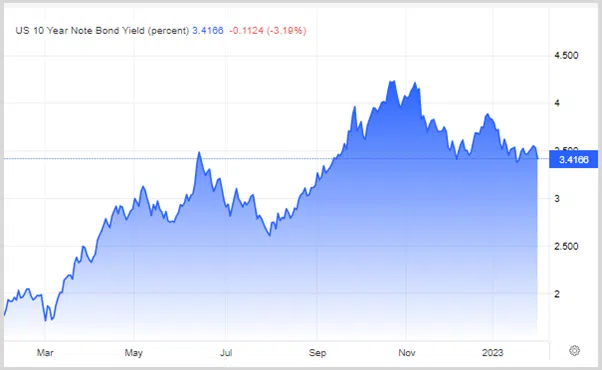

The US 10-year Treasury yield fell to 3.39% on Wednesday, approaching a low not seen since April last year, as investors digested the latest FOMC statement and the Fed Chair’s comments. However, the FOMC language appeared more dovish, as officials now see inflation easing somewhat.

https://tradingeconomics.com/united-states/government-bond-yield

The FOMC, as expected, raised the Fed’s funds target range by 25 bps to 4.50%-4.75% and said inflation had eased somewhat but remained high and “sustained” rate hikes would be appropriate. Fed Chair Powell said inflation remains well above the long-term goal and tightening is needed for some time, to ensure inflation falls to the 2% target. However, he said that the disinflationary process had begun, indicating that the Fed’s aggressive pace of rate hikes had begun to wane.

US economic news was mostly weaker than expected and weighed on the Dollar. Jan’s ADP job change rose +106k, weaker than the expected +180k and the smallest gain in 2 years. Also, Jan’s ISM manufacturing index fell –1.0 to 47.4, weaker than the expected 48.0 and the steepest pace of contraction in over 2.5 years. Additionally, December construction spending unexpectedly fell -0.4% m/m, weaker than the expected unchanged and the biggest drop in 4 months. On the positive side, December JOLTS job vacancies unexpectedly rose +572k to a 5-month high of 11.012 mn, suggesting a stronger-than-expected labour market fall to 10.3 mn.

Technical Review

USDIndex broke the 101.23 support that it has held for the last 10 days. Further decline is projected for the 100.00 round figure and further to the 61.8% FR level around 99.00. Meanwhile, a move to the upside would bring about a short-term rebound. As long as trading takes place below the resistance at 102.43, downside bias will still apply. All technical indicators are still supportive of the downside, but with the NFP still to come this week, volatility has prevailed to new lows of 100.65 in early trades on February 2. The price is currently below the 26-day EMA, the RSI is at 31 and the MACD is aligned with the signal line on the ground floor.

Click here to access HFM´s Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.