XM Test und Erfahrungen

Zuletzt aktualisiert am November 22, 2024

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu XM

Als weltweit beliebter Broker mit einem großen Kundenstamm und einem guten Ruf ist XM für die meisten deutschen Trader eine gute Option. Das Unternehmen hat einige der niedrigsten Gebühren in der Branche, bietet exzellente Forschung und Ausbildung und hat eine einsteigerfreundliche Handels-App. XM verfügt zudem über eine hervorragende Auswahl an Handelswerkzeugen und sein Kundenservice ist reaktionsschnell und gut geschult.

Die Regulierung von XM durch die CySEC in Europa gibt deutschen Händlern/innen die Gewissheit, dass sie fair behandelt werden. Ihre Guthaben werden bei erstklassigen Banken getrennt gehalten und sie erhalten einen automatischen Schutz vor negativen Salden.

| 🏦 Min. Einzahlung | USD 5 |

| 🛡️ Geregelt durch | CySEC, ASIC, DFSA, FSCA |

| 💵 Handelskosten | USD 6 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Keine |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instrumente | Commodities, Energien, Stock CFDs, Forex, Indices, Metalle |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Streng reguliert

- Ausgezeichnete Bildung

- Free deposits and withdrawals

Nachteile

- Begrenzte Plattformauswahl

Ist XM Group sicher?

Als CySEC-regulierter Broker ist XM für seine Zuverlässigkeit und Vertrauenswürdigkeit bekannt.

CySEC-Regulierung: Das Unternehmen XM wird von der australischen ASIC und der DFSA in Dubai reguliert und ist für das Outward Passporting bei der FCA registriert, was bedeutet, dass die deutschen Kunden von XM von der Cyprus Securities and Exchange Commission (CySEC) betreut werden. Die CySEC gilt als starke Regulierungsbehörde und stellt sicher, dass die Broker ihre Kunden fair behandeln.

Sicherheitsmerkmale: Wie von der CySEC gefordert, schützt XM seine Händler/innen durch:

- die Trennung der Kundengelder von den Firmengeldern in erstklassigen Banken

- den automatischen Schutz der Händler vor einem negativen Saldo, was bedeutet, dass die Händler nicht mehr als ihre ursprüngliche Einzahlung verlieren können.

- die Begrenzung der Hebelwirkung auf 30:1, um das Risiko der Händler zu verringern

- die Teilnahme an einem Anlegersystem, so dass Einwohner von EWR-Ländern wie dem Vereinigten Königreich einen Anlegerschutz von bis zu 20.000 EUR erhalten.

Unternehmensangaben

Wir haben alle Lizenzen und Vorschriften im Online-Register der Aufsichtsbehörde überprüft. Im Folgenden sind Einzelheiten zu XMs CySEC-reguliertem Unternehmen aufgeführt:

XMs Handelsinstrumente

Das Angebot an Handelsinstrumenten von XM, darunter über 57 Devisenpaare und über 1200 Aktien-CFDs, hat uns beeindruckt.

XM verfügt über eine ähnliche Auswahl an Instrumenten wie andere Broker, bietet aber eine größere Auswahl an Forex-Paaren. Auf Grund der CySEC-Bestimmungen ist die maximale Hebelwirkung für alle Vermögenswerte gering, obwohl dies für alle CySEC-regulierten Broker gleich ist.

Vollständige Liste der Instrumente und Hebelwirkung:

- Devisen: Das Angebot an Devisenpaaren von XM entspricht dem Branchendurchschnitt und umfasst die Hauptpaare (EUR/USD, GBP/USD und USD/JPY), die Nebenpaare (NZD/CAD, EUR/JPY und USD/ZAR) und die exotischen Paare (SGD/JPY).

- Aktien-CFDs: Bei XM ist die Anzahl der verfügbaren Aktien-CFDs wesentlich größer als bei den meisten anderen Brokern. Die Auswahl umfasst einige der wichtigsten US-Unternehmen, darunter Apple, Amazon, Facebook, Bayer und Google, um nur einige zu nennen. Beachten Sie, dass die meisten Aktien-CFDs nur auf MT5 verfügbar sind.

- Rohstoffe: Das Rohstoffangebot von XM ist durchschnittlich. Dazu gehören Gold und Silber sowie Softs wie Kaffee, Mais, Sojabohnen und Weizen.

- Aktien-Indizes: Das Angebot von XM an Indizes ist im Vergleich zu anderen ähnlichen Brokern etwas eingeschränkt und umfasst unter anderem den US30Cash, UK100Cash, US500Cash und den EU50Cash.

- Energien: Das Angebot von XM im Bereich Energie ist durchschnittlich und umfasst Brent, Erdgas und Öl.

- Aktien: Das Aktienangebot von XM ist im Vergleich zu anderen Brokern begrenzt.

XMs Konten- und Handelsgebühren

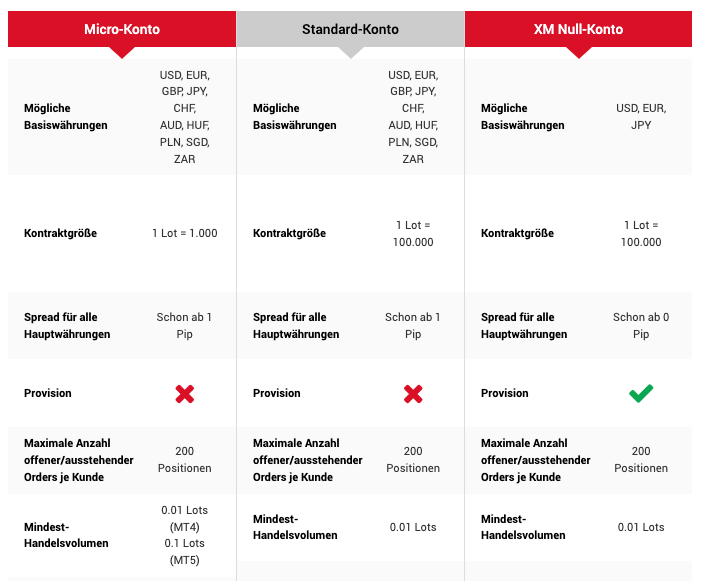

XM verfügt über drei Kontotypen, die sowohl für Anfänger als auch für erfahrene Händler/innen geeignet sind.

Handelsgebühren: Alle XM-Konten haben eine Mindesteinlage von 5 USD, so dass sie auch für Anfänger zugänglich sind. Die Spreads beginnen bei 1,6 Pips auf EUR/USD auf den beiden kommissionsfreien Konten, sinken aber auf 0 Pips auf dem Zero-Konto im Austausch für eine Gebühr von 7 USD (round turn).

Konto-Handelskosten:

Weitere Einzelheiten zum Konto:

- Micro-Konto

XMs Einstiegskonto, Mindesteinlagen beginnen bei 5 USD und die Spreads liegen bei durchschnittlich 1,7 Pips auf EUR/USD, was breiter ist als bei anderen Market Makern ähnlicher Größe. Als Basiswährungen für dieses Konto gelten USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD und ZAR.

- Standard-Konto

Wie beim Micro-Konto beträgt die Mindesteinlage 5 USD, und die Spreads liegen im Durchschnitt bei 1,7 Pips auf EUR/USD, was breiter ist als bei anderen Market Makern ähnlicher Größe. Im Gegensatz zum Micro-Konto entspricht ein Lot dem Gegenwert von 100.000 Einheiten, und das Mindesthandelsvolumen beträgt 0,01 Lots. Außerdem bietet es die gleiche breite Palette an Basiswährungen wie das Micro-Konto.

- XM-Zero-Konto

Die Mindesteinlage für das XM-Zero-Konto beträgt 5 USD, und es wird eine Gebühr von 3,5 USD pro Lot pro Seite erhoben, aber die Spreads beginnen bei 0 Pips für EUR/USD. Die Basiswährungen, die auf diesem Konto verfügbar sind, sind USD, EUR und JPY.

- Islamisches Konto

XM bietet islamische Konten für Händler/innen mit muslimischem Glauben an. Zu unserer Zufriedenheit haben wir festgestellt, dass XM keine zusätzlichen Gebühren für islamische Konten erhebt. Dies ist ungewöhnlich, da die meisten anderen Broker für islamische Konten eine Verwaltungsgebühr anstelle der Swaps erheben.

Ein- und Auszahlungen bei XM

Zu unserer großen Freude sind alle Ein- und Auszahlungen über 200 USD kostenlos. Die Einzahlungen waren in weniger als einer Stunde auf unserem Handelskonto und die Auszahlungen in zwei Tagen auf unserem Bankkonto.

In Übereinstimmung mit den Richtlinien zur Bekämpfung der Geldwäsche wendet XM eine “Rückgabepolitik” an, d.h., dass Auszahlungen nur an die ursprüngliche Finanzierungsquelle zurückgegeben werden können.

Basiswährungen: Bei der Eröffnung unseres Kontos stellten wir fest, dass das Kundenportal Händlern/innen erlaubt, Geld in 11 Basiswährungen einzuzahlen, darunter EUR, USD, GBP, AUD, CHF, JPY, RUB, HUF, PLN, ZAR und SGD. Da wir Einzahlungen von einer deutschen Bank mit einem EUR-Handelskonto vorgenommen haben, wurden uns keine Währungsumrechnungsgebühren berechnet.

Gebühren: Der Einzahlungsvorgang ist 24 Stunden am Tag geöffnet und vollständig automatisiert. Wir haben mit großer Freude festgestellt, dass XM alle Überweisungsgebühren abdeckt und keine versteckten Gebühren oder Kommissionen für Ein- und Auszahlungen vorsieht. Allerdings werden für Ein- und Auszahlungen per Überweisung unter 200 USD oder dem entsprechenden Währungsbetrag Gebühren erhoben.

Bei unseren Tests mit Einzahlungen per Kreditkarte haben wir festgestellt, dass unsere Zahlung innerhalb einer Stunde bearbeitet wurde und es zwei Tage dauerte, bis unsere Auszahlung auf unserem Konto ankam. Diese Fristen liegen im Durchschnitt der Branche.

Im Folgenden sind weitere Einzelheiten zu den Ein- und Auszahlungsmethoden bei XM aufgeführt:

Mobile Handelsplattformen von XM

Bei unserer Überprüfung haben wir festgestellt, dass XM drei mobile Handelsplattformen anbietet, was mehr ist als bei anderen Brokern, darunter MT4, MT5 und die XM App. Alle Plattformen sind sowohl auf Android als auch auf iOS verfügbar.

Wir haben die XM-App auf einem iPhone 11 getestet:

Wir waren begeistert, dass wir direkt über die XM Mobile App handeln konnten und dass sie mit unseren MT4- und MT5-Konten verknüpft werden konnte.

Wir haben festgestellt, dass die XM-App sehr einfach einzurichten und zu nutzen ist. Zudem war es einfach, nach unseren Vermögenswerten und Geschäften zu suchen und sie zu überwachen:

MT4/MT5 Mobiles Handeln

Die MT4- und MT5-Apps von XM für den mobilen Handel bieten ähnliche Funktionen wie die Desktop- und Webtrader-Versionen der Plattformen. Händler/innen können auf alle bei XM verfügbaren Instrumente zugreifen (mit der Ausnahme, dass der Aktien-CFD-Handel nur auf MT5 verfügbar ist) und haben Zugriff auf dieselben Charts. Zudem sind alle Handelsauftragsarten verfügbar. Lediglich die Anzahl der Indikatoren ist sowohl bei der MT4- als auch bei der MT5-Mobilanwendung reduziert.

Handelsplattformen von XM

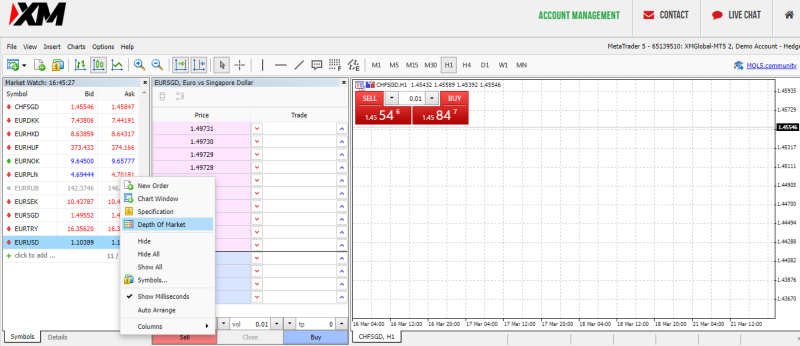

XM bietet eine durchschnittliche Auswahl an Handelsplattformen, darunter den Webtrader und die Desktop-Versionen von MT4 und MT5.

Die Plattformen MT4 und MT5 sind sowohl für Mac als auch für PC verfügbar.

Im Rahmen dieses Tests haben wir die Webtrader-Plattformen von XM getestet.

MetaTrader 4 (MT4) und Metatrader 5 (MT5)

Da XM Plattformen von Drittanbietern wie MT4 und MT5 anbietet, haben Händler/innen den Vorteil, dass sie ihre eigene, individuell angepasste Version der Plattform mitnehmen können, falls sie zu einem anderen Broker wechseln möchten. Zudem gibt es für beide MetaTrader-Plattformen Tausende von Plugins und Tools.

Wie man sieht, wirkt der MT4 Webtrader etwas veraltet, aber er ist sehr anpassungsfähig. Es stehen drei Charttypen zur Verfügung, darunter Linien-, Balken- und Candlestick-Charts, und Sie können auf eine große Auswahl an Indikatoren in verschiedenen Zeitrahmen zugreifen. Siehe unten:

Bei unserer Überprüfung des MT5 Web Trader haben wir festgestellt, dass er eine umfangreiche Marktanzeige bietet:

Ein weiteres Plus beim Handel mit XM ist das MT4-Multiterminal, das bei anderen Brokern nicht oft verfügbar ist. Es ermöglicht Händlern/innen, mehrere MT4-Konten von einem einzigen Terminal mit einem Login und Passwort zu eröffnen und zu verwalten.

Vergleich der Plattformen:

Kontoeröffnung bei XM

Die Kontoeröffnung bei XM verlief schnell und einfach. Unser Konto war in weniger als einem Tag eröffnet, und der Kundendienst von XM stand uns bei technischen Fragen und Fragen zum Konto jederzeit zur Verfügung.

Es dauerte etwa 5 Minuten, um ein Konto bei XM zu eröffnen, und nachdem unsere Unterlagen eingereicht worden waren, waren unsere Konten noch am selben Tag für den Handel bereit. Die Kundendienstmitarbeiter von XM waren sehr hilfsbereit und gaben sachdienliche und sofortige Antworten.

Als deutsche Händler/innen sind Sie berechtigt, ein Konto bei XM zu eröffnen, wenn Sie die Mindesteinlage von [fxs-broker-property identifier=”deposit”] einzahlen.

Wie man ein Konto bei XM eröffnet:

- Wir klickten auf die Schaltfläche “Konto eröffnen” oben auf der Seite.

- Dann gaben wir unsere persönlichen Daten ein und wählten unsere bevorzugte Handelsplattform (MT4/MT5), die Basiswährung und die Höhe der Hebelwirkung.

- Danach mussten wir unsere Finanzdaten angeben und Fragen zu unseren Handelskenntnissen beantworten.

- Zur Überprüfung unseres Kontos mussten wir eine Kopie unseres deutschen Personalausweises oder Reisepasses mit der Unterschriftenseite und eine Kopie einer aktuellen Stromrechnung oder eines Kontoauszugs vorlegen. Diese Dokumente wurden in Form von hochwertigen Digitalkamerabildern eingescannt.

Sobald alle unsere Dokumente eingegangen waren, konnte das Konto noch am selben Tag eröffnet werden.

XMs Forschungs- und Handelsinstrumente

Wir haben herausgefunden, dass XM hervorragende technische Analysetools anbietet und dass die hauseigene Zusammenstellung von Forschungsdaten die anderer Broker weit übertrifft. Zudem bietet XM mehrere hauseigene Trading-Tools, die mit MT4 und MT5 kompatibel sind.

Wir haben festgestellt, dass der Marktanalysebereich von XM aus einer Marktübersicht, Nachrichten, XM Research, Handelsideen, technischen Zusammenfassungen, einem Wirtschaftskalender, XM TV und einem Podcast besteht. Weitere Details:

- Märkte im Überblick: In dieser Rubrik werden regelmäßig Artikel eines Drittanbieters, Reuters, veröffentlicht, die alle aktuellen Marktnachrichten enthalten.

- Nachrichten: Die neuesten Marktnachrichten, die ebenfalls von Reuters bereitgestellt werden, werden einige Male pro Stunde aktualisiert.

- XM Research: Das Team von XM Research liefert regelmäßig Artikel über technische Analysen, Forex-Vorschauen, Marktkommentare, Finanzmärkte, Sonderberichte und Börsennachrichten.

- Handels-Ideen: Dieser Bereich wird von einer dritten Partei, nämlich Analyzzer, zur Verfügung gestellt und befasst sich damit, wie die verschiedenen Instrumente im Vergleich zueinander abschneiden.

- Technische Zusammenfassungen: Dieser Abschnitt befasst sich mit den verschiedenen Trends der XM-Instrumente.

- XM TV: XM TV bietet täglich vom XM-internen Analystenteam Forex-Nachrichten, technische Analysen und einen wöchentlichen Forex-Ausblick an.

- Podcast: XM’s Handels-Podcast, Global Market Insights, versorgt Händler/innen mit aussagekräftigen und informativen Inhalten, die aktuelle Informationen für Online-Investitionen und Updates zu wirtschaftlichen Ereignissen auf der ganzen Welt umfassen.

- Wirtschaftskalender: Bei XM gibt es einen guten Wirtschaftskalender. Er verfügt über eine Filterfunktion, mit der Sie nach Ländern, Datentyp und Bedeutung filtern können.

Bildungsmaterialien

In unserer Bewertung haben wir festgestellt, dass XM eine ausgezeichnete Auswahl an Bildungsmaterialien anbietet, die sowohl für Anfänger als auch für erfahrenere Händler/innen geeignet sind. Das Unternehmen bietet auch ein Demo-Konto, das nicht abläuft. Allerdings sind die meisten dieser Materialien nur in englischer Sprache verfügbar.

Die Bibliothek von XM mit Bildungsmaterialien ist Weltklasse und kann sich mit einigen der besten Broker der Welt messen. Das Bildungsangebot umfasst XM Live, Live Education, Lehrvideos, Forex-Webinare, Plattform-Tutorials und Forex-Seminare. Diese Materialien sind detailliert und gut strukturiert. Zu unserer Freude ist das Bildungsmaterial für alle Besucher der XM-Website zugänglich, obwohl einige Bereiche eine Registrierung erfordern. Siehe unten für weitere Details:

- XM Live: Hier können sich die Besucher von Montag bis Freitag zwischen 06:00 und 15:00 Uhr GMT über die von XM angebotenen Produkte und Dienstleistungen sowie über die Grundlagen des Handels informieren und ihre Fragen von den Moderatoren beantworten lassen.

- Live Education: XM verfügt über den Basic Room für Anfänger und den Advanced Room für erfahrene Händler/innen. Live Education ist im Wesentlichen eine Reihe von Live-Webinaren, die von Montag bis Freitag von 06:00 – 15:00 Uhr GMT stattfinden. In diesen Webinaren werden die Grundlagen des Handels und die Analyse von Handelssitzungen behandelt. Der Advanced Room behandelt außerdem Themen wie die Vorbereitung auf einen Handel, die Verfolgung des Echtzeithandels und Live-Debatten.

- Bildungsvideos: XM bietet eine umfangreiche Bibliothek von Videos zu Themen wie:

- Einführung in die Märkte

- Grundlagen des Handels

- Fundamentale Analyse

- Technische Analyse

- Geldmanagement

- Psychologie des Handels

- Handelsstrategien

- Mehr über Forex-Trading

- Forex-Webinars: Die kostenlosen Webinare von XM werden von 67 hochqualifizierten Devisenprofis in 19 Sprachen, einige davon auf Deutsch, an sieben Tagen in der Woche angeboten.

- Plattform-Tutorials:Das XM-Team hat eine Vielzahl von Video-Tutorials entwickelt, die die Besonderheiten der MT4- und MT5-Plattformen sowie der Handelsinstrumente von XM erklären.

- Forex-Seminar: Das Team von XM hat eine Vielzahl von Video-Tutorials entwickelt, die die Besonderheiten der MT4- und MT5-Plattformen sowie der Handelsinstrumente von XM erklären.

Bildung im Vergleich:

Scrollen für mehr DetailsBrokerAnfängerkursKurs für FortgeschritteneGut strukturierte AusbildungBildungsqualitätWebinareKundendienst

Der Kundendienst von XM ist 24 Stunden am Tag und 5 Tage die Woche erreichbar und sehr gut geschult.

Der Kundendienst von XM steht rund um die Uhr in über 30 Sprachen, darunter Deutsch, per E-Mail, Telefon und Live-Chat zur Verfügung.

Im Rahmen dieser Bewertung haben wir den Live-Chat und die E-Mail getestet. Unsere E-Mail wurde innerhalb eines Tages beantwortet, und die Antwort war sachdienlich und auf den Punkt gebracht. Die Live-Chat-Mitarbeiter waren in der Lage, alle unsere Fragen schnell und zu unserer Zufriedenheit zu beantworten. Bei Bedarf stellten sie auch Links und zusätzliches Lesematerial zur Verfügung.

Sicherheit und Anerkennung der Industrie

Regulierung: Die XM Group wurde 2009 gegründet und hat ihren Hauptsitz in Zypern. Sie hat sich zu einer großen und gut etablierten internationalen Investmentfirma mit über 3.500.000 Kunden weltweit entwickelt. XM ist ein Markenname der Trading Point Group und wird von den folgenden Behörden reguliert:

- Trading Point of Financial Instruments Ltd wurde 2009 gegründet und wird von der Cyprus Securities and Exchange Commission reguliert. (CySEC 120/10)

- Trading Point of Financial Instruments Pty Ltd wurde 2015 in Australien gegründet und wird von der Australian Securities and Investments Commission reguliert. (ASIC 443670)

- Trading Point of Financial Instruments UK Ltd wurde 2016 gegründet und wird von der Financial Conduct Authority reguliert. (FCA 705428).

- Trading Point MENA Limited wurde vom Dubai Financial Services Board zugelassen und reguliert (Referenznummer F003484).

- XM Global Limited ist von der Belize IFSC lizenziert unter license number 000261/158.

Auszeichnungen

Im Laufe der Jahre hat XM zahlreiche Auszeichnungen für seine Dienste und Angebote erhalten, darunter:

- Best FX Service Provider 2022 (Awarded by City of London Wealth Management Awards 2022)

- Best Customer Support 2022 (Awarded by CFI.co 2022)

- Best Forex Trading Support 2022 (Awarded by Global Forex Awards 2022)

- Best FX Educational Broker in the MENA region 2022 (Awarded by Dubai Expo Awards 2021)

Alles in allem halten wir XM für einen vertrauenswürdigen und sicheren Broker, da er sich seit langem durch verantwortungsvolles Handeln auszeichnet, international streng reguliert ist und in der Branche großen Anklang findet.

Bewertungsmethode

WBei der Bewertung unserer Partner legen wir Wert auf Transparenz und Offenheit. Deshalb haben wir unser Bewertungsverfahren veröffentlicht, um die Transparenz in den Vordergrund zu rücken. Im Mittelpunkt dieses Prozesses steht die Bewertung der Zuverlässigkeit des Brokers, des Plattformangebots des Brokers und der den Kunden angebotenen Handelsbedingungen, die in dieser Bewertung zusammengefasst sind. Jeder dieser Punkte wird benotet, und es wird eine Gesamtnote berechnet und dem Broker zugewiesen.

Haftungsausschluss der XM Group

Der Devisenhandel ist risikoreich, und jeder Broker ist verpflichtet, seine Kunden über das Risiko des Handels mit Forex CFDs zu informieren. Die XM Group informiert darüber: Bei CFDs handelt es sich um komplexe Instrumente, bei denen aufgrund der Hebelwirkung ein hohes Risiko besteht, schnell Geld zu verlieren. 71,61 % der Konten von Privatanlegern verlieren beim Handel mit CFDs bei diesem Anbieter Geld. Sie sollten abwägen, ob Sie die Funktionsweise von CFDs verstehen und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren. Bitte beachten Sie unsere Risikohinweise.

Überblick

Als streng regulierter Market-Maker-Broker bietet XM den Handel mit über 1000 Instrumenten an, darunter mehr als 57 Forex-Paare. Im Vergleich zu anderen ähnlichen Brokern sind die Handelsbedingungen durchschnittlich, mit Spreads von 1,7 Pips (EUR/USD) auf dem Standard-Konto und 0,8 Pips (EUR/USD) auf dem Ultra-Low-Konto. Die Mindesteinlage ist mit 5 USD für alle Kontooptionen niedrig und eignet sich daher gut für Anfänger.

Darüber hinaus bietet XM den Handel auf den beliebtesten Plattformen – MT4 und MT5 – an und ermöglicht alle Handelsstrategien neben einem erstklassigen Repository an Bildungs- und Marktanalysematerialien und einem ausgezeichneten Kundendienst.

Finden Sie heraus, wie XM im Vergleich zu anderen Brokern abschneidet.Broker vergleichen

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.