Skilling Test und Erfahrungen

Zuletzt aktualisiert am Mai 21, 2024

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu Skilling

Das 2016 gegründete Unternehmen Skilling ist ein innovativer Broker, der von Europas lokaler Regulierungsbehörde CySEC reguliert wird. Es bietet vier einfache Kontooptionen, ausgezeichnete Handelsbedingungen, eine breite Palette von handelbaren Vermögenswerten und eine große Auswahl an Handelsplattformen. Der wichtigste Nachteil ist das Fehlen von Bildungsmaterial, was dazu führen könnte, dass sich Anfänger für Unterstützung woanders umsehen.

Die Standardkonten von Skilling erfordern eine Mindesteinlage von 100 EUR und haben Spreads ab 0,8 Pips (EUR/USD), was enger ist als bei den Einstiegskonten anderer Broker. Beim Premium-Konto verringern sich die Spreads auf 0,1 Pips (EUR/USD) bei einer Kommission von 6 USD (round turn), doch die Mindesteinlage beträgt 5000 EUR – für die meisten Anfänger unerschwinglich.

Es werden MT4, cTrader, TradingView und die hauseigene Handelsplattform von Skilling unterstützt, wobei eine nahtlose Integration zwischen cTrader und der eigenen Plattform von Skilling möglich ist – ein Novum in der Branche.

Alles in allem ist Skilling ein guter Allround-Broker mit einem transparenten und kundenorientierten Ansatz, der sowohl Anfängern als auch erfahreneren Händlern/innen gefallen wird.

| 🏦 Min. Einzahlung | EUR 100 |

| 🛡️ Geregelt durch | CySEC, Fi, FSA-Seychelles |

| 💵 Handelskosten | USD 7 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, cTrader, Skilling Trader |

| 💱 Instrumente | Commodities, Kryptowährungen, Stock CFDs, Forex, Indices, Metalle |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Copy Trading Konten

- Enge Spreads

- Tolle Plattformauswahl

Nachteile

- Keine Swap-freie Kontooption

- Begrenzte Ausbildung

Ist Skilling sicher?

Skilling ist ein sicherer Broker für deutsche Händlerinnen. Er wird von Europas lokaler Regulierungsbehörde CySEC in Zypern reguliert.

Das 2016 gegründete skandinavische Maklerunternehmen Skilling bietet seine Dienstleistungen seit 2018 europaweit und seit April 2020 sogar weltweit an.

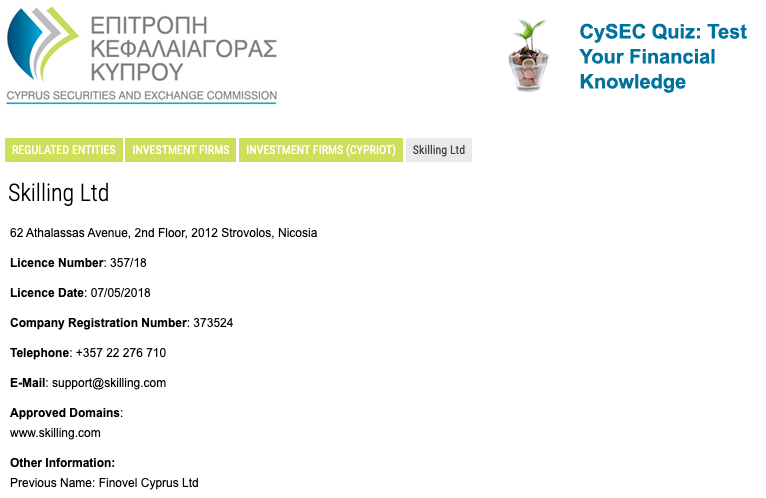

Regulierung: Deutsche Händler/innen werden über die Skilling Ltd. betreut, die von der Cyprus Securities and Exchange Commission (CySEC) zugelassen und reguliert wird.

Sicherheitsmerkmale: Die CySEC gilt als seriöse Regulierungsbehörde mit strenger Aufsicht. Daher beschränkt sie den maximalen Hebel für den Devisenhandel auf 30:1 und stellt sicher, dass die Broker einen Schutz gegen negative Salden bieten, was bedeutet, dass Händler/innen nie mehr Geld verlieren können, als sie auf ihren Handelskonten haben. Zudem sind alle Broker verpflichtet, die Kundengelder von ihrem Betriebskapital zu trennen.

Unternehmensangaben

Wir haben sämtliche Lizenzen und Vorschriften im Online-Register der Aufsichtsbehörde überprüft. Im Folgenden sind Einzelheiten zu Skillings CySEC-reguliertem Unternehmen aufgeführt:

Skillings Handelsinstrumente

Skilling verfügt über ein breiteres Angebot an Handelsinstrumenten als die meisten anderen Broker, und wir waren besonders von der Anzahl der für den Handel verfügbaren Kryptowährungen beeindruckt.

Das stetig wachsende Angebot an Finanzinstrumenten für den CFD-Handel bei Skilling beinhaltet Forex, Aktien-CFDs, Indizes, Futures, Kryptowährungen und Rohstoffe.

Vollständige Liste der Instrumente und Hebelwirkung:

- Devisen: Mit über 73 Währungspaaren bietet Skilling ein breiteres Spektrum als die meisten anderen Makler. Dazu gehören die Hauptwährungen (EUR/USD, GBP/USD und USD/JPY), die Nebenwährungen (NZD/JPY, GBP/JPY und USD/ZAR) und die exotischen Währungen. Bitte beachten Sie, dass Händler/innen nur mit 53 Paaren auf den MT4-Plattformen handeln können.

- Aktien-CFDs: Skilling bietet über 750 Aktien-CFDs für den Handel an, eine breitere Palette als bei anderen großen internationalen Brokern. Die verfügbare Auswahl umfasst einige der wichtigsten US-amerikanischen, britischen und europäischen Börsenplätze.

- Indizes: Bei Skilling stehen 16 Indizes für den Handel zur Verfügung, was in etwa dem Durchschnitt bei anderen vergleichbaren Brokern entspricht. Die beliebtesten Indizes sind diejenigen, die die Aktien einiger der größten und weltweit anerkannten Unternehmen zusammenfassen. Zu den verfügbaren Indizes gehören u.a. der S&P 500, der UK 100, der NASDAQ 100 und der Dow Jones 30.

- Rohstoffe: Im Vergleich zu anderen Brokern bietet Skilling den Handel mit 6 Rohstoffen an, was sehr begrenzt ist. Zu den Rohstoffen gehören Silber, Gold und Brent Crude Oil.

- Kryptowährungen: Das Angebot von Skilling umfasst 50 Kryptowährungen, eine beeindruckende Auswahl im Vergleich zu den meisten anderen Brokern. Dazu gehören u.a. Bitcoin, Ethereum, Tron, Dash und Ripple. Die Spreads variieren erheblich im Vergleich zu anderen traditionellen Fiat-Währungen. Es ist zum Beispiel nicht ungewöhnlich, dass die Spreads bei Bitcoin bis zu 75 Pips betragen, wenn Sie also mit diesen Währungen handeln, sollten Sie auf Ihre Margen achten.

Alles in allem bietet Skilling ein breiteres Spektrum an Vermögenswerten an, als es bei anderen Brokern üblich ist. Bemerkenswert ist die Anzahl der Devisenpaare, Aktien-CFDs und Kryptowährungen.

Skillings Konten- und Handelsgebühren

Im Vergleich zu anderen ähnlichen Brokern sind die Handelsgebühren von Skilling durchschnittlich.

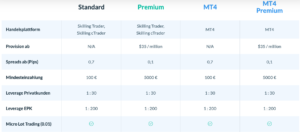

Handelsgebühren: Das Angebot von Skilling umfasst zwei kommissionsfreie Konten, bei denen die Handelskosten in den Spreads enthalten sind, und zwei Konten mit engeren Spreads und einer Kommission pro Lot. Die gebührenfreien Konten haben niedrigere Mindesteinlagen als die gebührenpflichtigen Konten.

Konto-Handelsgebühren

Wie in der Tabelle zu sehen ist, sind die Handelsgebühren bei den Premium-Konten niedriger als bei den Standard- und MT4-Konten. Allerdings sollten Händler/innen wissen, dass diese Handelskosten auf den bei Skilling verfügbaren Mindestspreads basieren. Die durchschnittlichen Handelsgebühren liegen bei den Premium-Konten bei etwa 9 USD, was in etwa dem Branchendurchschnitt entspricht, und bei den Standard-Konten bei 10 USD, was etwas über dem Durchschnitt liegt.

Standard-Konto: Das Standard-Konto erfordert eine Mindesteinlage von 100 EUR, bietet einen maximalen Hebel von 30:1 und ist über die Skilling Trader-Plattform oder den cTrader verfügbar. Die Spreads beginnen hier bei 0.70 Pips auf EUR/USD. Es fallen keine Gebühren an.

Premium-Konto: Beim Premium-Konto handelt es sich um ein kommissionsbasiertes Konto mit rohen Spreads, wobei die Spreads bei 0,1 Pips beginnen, aber eine Handelskommission von 35 USD/10 Lot erhoben wird. Die Hebelwirkung ist ebenfalls [fxs-broker-property identifier=”leverage”], aber die Mindesteinlage beträgt 5000 EUR, so dass dies wahrscheinlich kein Konto für Anfänger ist. Der Handel wird auch über die Skilling Trader-Plattform und den cTrader angeboten.

MT4-Konto: Für das MT4-Konto ist eine Mindesteinlage von 100 EUR erforderlich, es bietet eine maximale Hebelwirkung von 30:1, und ist, wie der Name schon sagt, nur auf der MT4-Plattform verfügbar. Die Spreads beginnen bei [fxs-broker-property identifier=”eur_usd_spread_smallest_account”] Pips auf EUR/USD und es werden keine Gebühren erhoben.

MT4-Premium-Konto: Dieses Konto ist ähnlich wie das oben beschriebene Premium-Konto, aber der Handel wird nur auf der MT4-Plattform angeboten. Die Hebelwirkung beträgt bis zu [fxs-broker-property identifier=”leverage”], und die Spreads beginnen bei 0,1 Pips mit einer Kommission von 35 USD/10 gehandelten Lots. Die Mindesteinlage für dieses Konto beträgt ebenfalls 5000 EUR.

Ein- und Auszahlungen

Laut Skilling werden alle Regeln und Vorschriften zur Bekämpfung der Geldwäsche eingehalten. Einzahlungen können nur über ein auf den Händlernamen registriertes Bankkonto oder eine auf den Händlernamen registrierte Karte vorgenommen werden; Einzahlungen durch Dritte sind nicht zulässig. Auszahlungen müssen auf dasselbe Konto oder mit derselben Methode erfolgen, von dem/der die Gelder stammen.

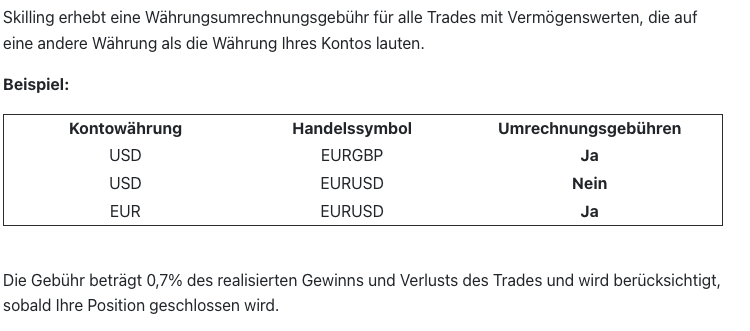

Handelskonto-Währungen: Die Handelskonten können nur in fünf Basiswährungen – EUR, USD, NOK, SEK und GBP – geführt werden, was im Vergleich zu anderen Brokern durchschnittlich ist. Sollten Sie jedoch mit einem Instrument handeln, das nicht in EUR denominiert ist, wird Ihnen eine Währungsumrechnungsgebühr berechnet. Bei Skilling wird eine Währungsumrechnungsgebühr von 0,7% erhoben, zusätzlich zu den Gebühren, die Ihr Bankinstitut berechnet. Im Folgenden ist ein Beispiel dafür aufgeführt, wann Währungsumrechnungsgebühren anfallen:

Ein- und Auszahlungen: Bei Skilling gibt es eine Reihe von Ein- und Auszahlungsmethoden, für die keine Gebühren anfallen. Bitte denken Sie daran, dass Ihre Bank oder Ihr Kartenaussteller Ihnen möglicherweise Gebühren für internationale Überweisungen berechnet. Es kann aber auch sein, dass Ihre Bank oder der Zahlungsdienstleister Gebühren erhebt. Einzahlungen erfolgen in der Regel sofort (außer Einzahlungen per Banküberweisung und Debit-/Kreditkarten), und Auszahlungen werden innerhalb von 24 bis 48 Stunden bearbeitet.

Ein- und Auszahlungen können über folgende Kanäle vorgenommen werden:

Alles in allem bietet Skilling viele Zahlungsmethoden an, erhebt keine Gebühren für Ein- oder Auszahlungen und hat durchschnittliche Bearbeitungszeiten für Transaktionen.

Mobile Handelsplattformen von Skilling

Im Vergleich zu anderen ähnlichen Brokern ist die Unterstützung der mobilen Handelsplattform von Skilling hervorragend.

Skilling unterstützt eine ganze Reihe von Handelsplattformen, darunter den hauseigenen Skilling Trader, MT4, cTrader und TradingView.

Als Branchenneuheit hat Skilling auch die nahtlose Integration zwischen Skilling Trader und cTrader vollzogen, eine einzigartige Funktion, die als One Account. Zwei Plattformen. Dies ermöglicht es den Händlern/innen zu wählen, welche Plattform sie nutzen möchten, während sie ein einziges Handelskonto mit der gleichen Marge, dem gleichen Wallet und den gleichen Handelsbedingungen haben.

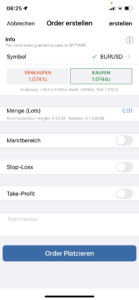

Skilling Trader

Der Skilling Trader ist sowohl für Android- als auch für iOS-Geräte verfügbar und überzeugt durch sein Design. Die Anwendung ist einfach zu bedienen und einzurichten und verfügt über eine Vielzahl von Funktionen, einschließlich eines Handelsassistenten, der Sie durch die App führt. Mit der App können Händler/innen ganz einfach Geld überweisen, abheben und einzahlen, nach Instrumenten suchen und Watchlists erstellen. Darüber hinaus verfügt sie über eine große Auswahl an technischen Indikatoren und Charts in verschiedenen Zeitrahmen sowie über verschiedene Zeichenwerkzeuge. Besonders gut gefallen hat uns auch die einfache Ausführung von Aufträgen und die Tatsache, dass alle Bildungsmaterialien und Marktnachrichten von Skilling in der App verfügbar sind.

|  |  |

Skilling cTrader

Bei cTrader handelt es sich um eine fortschrittliche Handelsplattform, die speziell für die Arbeit mit Marktausführungskonten entwickelt wurde. Wie bereits erwähnt, ist Skilling insofern einzigartig, als es sich mit Spotware, den Entwicklern von cTrader, zusammengetan hat, um cTrader nahtlos in die eigene Handelsplattform von Skilling zu integrieren.

Die mobile cTrader-App bietet die meisten der besten Funktionen der Desktop-Version, einschließlich der kompletten Palette an Ordertypen, Preisalarmen, Handelsanalysen und Symbolüberwachungslisten. Allerdings wurden die Charttypen auf 4 reduziert.

MT4 Mobile App

Unsere Erfahrung zeigt, dass die MT4-App es Händlern/innen ermöglicht, von überall aus zu arbeiten, und zwar mit neun Zeitrahmen, 30 Indikatoren und interaktiven Währungsdiagrammen. Wir konnten bestehende Aufträge schließen und ändern und Gewinn/Verlust in Echtzeit berechnen. Zudem finden wir die Suche nach Instrumenten einfacher als bei den Webtrader-Versionen der Plattformen.

TradingView

Vor kurzem hat Skilling sein Angebot an Handelsinstrumenten um TradingView erweitert. TradingView ist für alle Kunden/innen kostenlos. Es handelt sich um ein hervorragendes Tool für die Recherche, das Charting und das Screening jedes Instruments. Weitere Merkmale der TradingView-Plattform von Skilling sind:

- Über 50 intelligente Charting-Tools

- Über 100.000 benutzerdefinierte Indikatoren und Skripte

- Synchronisiertes Layout für mehrere Charts

Händlern/innen sei gesagt, dass MT4 und MT5 seit dem 23. September 2022 aus dem App Store entfernt wurden. Ob und wann sie wieder auf iOS-Geräten zum Download bereitstehen, ist unklar. Weitere Neuigkeiten zu diesem Thema finden Sie in unserem YouTube-Video unten:

Weitere Handelsplattformen

Im Vergleich zu anderen ähnlichen Brokern ist die Plattformunterstützung von Skilling hervorragend und bietet eine großartige Copy-Trading-Plattform.

Skilling Trader

Beim Skilling Trader handelt es sich um die von Skilling entwickelte Handelsplattform. Sie ist intuitiv und einfach gestaltet, verfügt aber über eine ganze Reihe von technischen Indikatoren und Zeichenwerkzeugen und ist für Händler/innen aller Erfahrungsstufen geeignet. Dank der vollständigen Integration mit der cTrader-Plattform von Skilling, dem Web- und Mobile-Support und einem Handelsassistenten für Anfänger ist die Skilling Trader-Plattform flexibel genug, um die meisten Händler/innen zufrieden zu stellen.

cTrader

Bei cTrader handelt es sich um eine moderne, intuitive und leistungsstarke Handelsplattform mit fortschrittlichen Handelsfunktionen, wie z. B. schnellem Einstieg und individueller Codierung, sowie einer Vielzahl von Indikatoren, die Ihnen helfen, bessere Handelsentscheidungen zu treffen. Die Plattform umfasst ein komplettes Charting-Paket und Spotware bietet eine Bibliothek von Indikatoren und Robotern. Händler können mit dem Automate Editor auch ihre eigenen Algorithmen entwerfen.

Metatrader 4 (MT4)

In unserem Test haben wir festgestellt, dass Skiling die Standardversion von MT4 anbietet, die über 24 grafische Objekte und 30 integrierte Indikatoren verfügt. Der wichtigste Vorteil der Verwendung von Drittanbieter-Plattformen wie MT4 ist, dass Händler/innen ihre eigenen angepassten Versionen der Plattformen behalten können, falls sie sich entscheiden, zu einem anderen Broker zu wechseln. MT4 ist für Windows, Android, iOS und den Webbrowser verfügbar.

Skilling Copy

Beim Social Trading handelt es sich um einen Dienst, der es Anlegern ermöglicht, den Handelsstrategien von Profis, die auch als Signalanbieter bekannt sind, zu folgen und deren Trades zu kopieren. Die Skilling cTrader Copy-Plattform bietet Händlern die Möglichkeit, aus über 1000 verschiedenen Strategien und Anbietern zu wählen, denen sie folgen und die sie kopieren können. Anhand der detaillierten Leistungsstatistiken können Sie die Strategieanbieter und ihre Investitionserfolge recherchieren sowie ihre Leistungsergebnisse und ihren Handelsstil überprüfen, um die für Sie am besten geeignete Strategie zu ermitteln.

Im Allgemeinen werden die Handlungen erfahrener Devisenhändler/innen als Leitfaden für Anfänger verwendet. Auf diese Weise wird die Zeit für Marktforschung und Analysen vor dem Forex-Handel reduziert. Social Trading ist nützlich für Händler/innen, die keine Zeit für Schulungen oder unabhängige Investitionsentscheidungen haben.

Kontoeröffnung bei Skilling

Der Prozess der Kontoeröffnung und -verifizierung bei Skilling ist nahtlos und einfach, und die Konten sind sofort für den Handel bereit.

Alle in Deutschland wohnhaften Personen sind berechtigt, ein Konto bei Skilling zu eröffnen, sofern sie die folgenden Mindesteinzahlungsanforderungen erfüllen:

- Standard-Konto: 100 EUR

- Premium-Konto: 5000 EUR

- MT4-Konto: 100 EUR

- MT4 Premium-Konto: 5000 EUR

- Auf der Startseite von Skilling muss man auf die Registerkarte ” Registrieren ” klicken, wo man aufgefordert wird, ein Konto mit einer E-Mail-Adresse und einem Passwort einzurichten. Als nächstes werden Sie nach Ihrem Namen, Ihrem Geburtsdatum, Ihrer Telefonnummer, dem Land Ihres Wohnsitzes und Ihrer Adresse gefragt.

- Im nächsten Schritt müssen Sie Ihre Finanzdaten ausfüllen, einschließlich Beschäftigungsstatus, Branche, Jahreseinkommen und Ersparnisse sowie Herkunft der Mittel.

- Danach müssen die Händler/innen ein Formular ausfüllen, in dem sie ihre Handelserfahrung angeben.

- Um Kunden als Privatpersonen zu akzeptieren, benötigt Skilling die folgenden Dokumente:

- Identifikationsnachweis – Bei Skilling werden alle staatlich ausgestellten Identifikationsdokumente wie Reisepass, Personalausweis, Führerschein oder andere staatlich ausgestellte Ausweise akzeptiert.

- Adressennachweis – Der Wohnsitz-/Adressennachweis muss innerhalb der letzten 6 Monate auf den Namen des Kontoinhabers ausgestellt worden sein und den vollständigen Händlernamen, die aktuelle Wohnadresse, das Ausstellungsdatum und die ausstellende Behörde enthalten.

- Anschließend kann man Geld auf sein Konto einzahlen und mit dem Handel beginnen.

Alles in allem ist das Kontoeröffnungsverfahren bei Skilling vollständig digital und problemlos, und die Konten sind sofort für den Handel bereit.

Skilling für Anfänger

Obwohl Skilling sehr übersichtlich ist und seine Produktpalette sehr detailliert beschreibt, bietet es wenig Aufklärung. Dafür ist die Marktanalyse detailliert und wird regelmäßig aktualisiert.

Bildungsmaterial

Das Bildungsmaterial von Skilling ist im Vergleich zu anderen Maklern sehr begrenzt.

Die Bildung beschränkt sich auf einen kurzen Abschnitt mit dem Titel “Was ist CFD-Handel?” Darin werden die Grundlagen der Funktionsweise von Differenzkontrakten erläutert und kurze Erklärungen zu Hebelwirkung, Margin und CFD-Kosten gegeben.

Die Skilling-eigene Handelsplattform, der Skilling Trader, verfügt außerdem über den Skilling Trade Assistant, der Ihnen die Grundlagen des Handels erklärt und Ihnen hilft, Ihren ersten Handelsauftrag zu platzieren.

Bildung im Überblick:

Analysematerial

Im Vergleich zu den Angeboten anderer ähnlicher Makler ist das Marktanalysematerial von Skilling durchschnittlich.

Das eigene Analystenteam von Skilling verfasst täglich und wöchentlich aktuelle Marktanalysen, die auf der Registerkarte ” Trading Articles ” veröffentlicht werden. Obwohl der Inhalt von hoher Qualität ist, würden wir erwarten, dass Skilling Analysen in verschiedenen Formaten bereitstellt.

Handelsinstrumente im Überblick:

Kundendienst

Der Kundendienst ist per Telefon, Live-Chat und E-Mail auf Deutsch, Englisch, Schwedisch, Norwegisch, Deutsch und Malaiisch verfügbar. Der telefonische Kundendienst ist von Montag bis Freitag von 08:00-17:00 Uhr MEZ erreichbar, der Live-Chat von Montag bis Freitag von 08:00-22:00 Uhr MEZ.

Im Rahmen dieser Bewertung fanden wir die Live-Chat-Agenten reaktionsschnell und sachkundig.

Bewertungsmethode

Bei der Bewertung unserer Partner legen wir Wert auf Transparenz und Offenheit. Deshalb haben wir unser Bewertungsverfahren veröffentlicht, das eine detaillierte Aufschlüsselung des Skilling-Angebots enthält. Im Mittelpunkt dieses Prozesses steht die Bewertung der Zuverlässigkeit des Brokers, des Plattformangebots des Brokers und der den Kunden angebotenen Handelsbedingungen, die in dieser Bewertung zusammengefasst sind. Jeder dieser Punkte wird benotet, und es wird eine Gesamtnote berechnet und dem Broker zugewiesen.

Risikoerklärung

Der Devisenhandel ist riskant, und jeder Broker ist verpflichtet, seine Kunden über das Risiko des Handels mit Forex-CFDs zu informieren. Skilling informiert darüber: Bei CFDs handelt es sich um komplexe Instrumente, bei denen aufgrund der Hebelwirkung ein hohes Risiko besteht, schnell Geld zu verlieren. Bei 69 % der Kleinanlegerkonten kommt es beim Handel mit CFDs bei diesem Anbieter zu Geldverlusten. Daher sollten Sie abwägen, ob Sie die Funktionsweise von CFDs verstehen und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren.

Überblick

Mit Skilling haben wir in den letzten Jahren eine neue Welle von Brokern erlebt. Die vier einfachen Konto-Optionen, die ausgezeichneten Handelsbedingungen und der völlig transparente Ansatz sind allesamt Markenzeichen eines erfrischend kundenorientierten Geschäftsmodells. Kostenfreie Ein- und Auszahlungen, ein verantwortungsvoller Umgang mit der Hebelwirkung und ein gutes Angebot an Handelsplattformen sind ebenfalls sehr willkommen. Nachteilig ist das Fehlen einer ernstzunehmenden Bildungssektion, was jedoch für erfahrene Händler keine große Rolle spielen dürfte. Darüber hinaus würden wir uns längere Öffnungszeiten des Kundendienstes und eine niedrigere Mindesteinlage für die Premium-Konten wünschen.

Finden Sie heraus, wie Skilling im Vergleich zu anderen Brokern abschneidet.Broker vergleichen

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.