Interactive Brokers Test und Erfahrungen

| 🏦 Min. Einzahlung | USD 1 |

| 🛡️ Geregelt durch | FCA, CFTC, ASIC, MAS |

| 💵 Handelskosten | USD 5.40 |

| ⚖️ Max. Hebelwirkung | 50:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | Clientportal, Trader Workstation, IBKRmobile |

| 💱 Instrumente | Anleihen, Kryptowährungen, Stock CFDs, ETFs, Forex, Futures, Indices, Shares |

Zuletzt aktualisiert am Mai 8, 2023

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu Interactive Brokers

Founded in 1977 and listed on the NASDAQ, Interactive Brokers is one of the best-regulated brokers in the industry. Ideal for sophisticated, active traders, Interactive Brokers is in a league of its own with the astounding number of assets on its books and its feature-rich platforms. However, its website and complicated account structure may leave less experienced Deutsch traders reeling.

Interactive Brokers’ world-class research, trading tools, and education will leave traders of all experience levels satisfied, and consistent with its excellent reputation, Interactive Brokers’ trading costs are some of the lowest in the industry. Spreads start at 0.1 pips (EUR/USD) in exchange for a round turn commission of 4.4 USD.

One complaint traders may have is that it does not offer third-party platforms like MT4 and MT5, and traders can only fund their accounts by bank transfer and BPay.

| 🏦 Min. Einzahlung | USD 1 |

| 🛡️ Geregelt durch | FCA, CFTC, ASIC, MAS |

| 💵 Handelskosten | USD 5.40 |

| ⚖️ Max. Hebelwirkung | 50:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | Clientportal, Trader Workstation, IBKRmobile |

| 💱 Instrumente | Anleihen, Kryptowährungen, Stock CFDs, ETFs, Forex, Futures, Indices, Shares |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Streng reguliert

- Niedrige Mindesteinlage

- Enge Spreads

- Große Auswahl an Anlagen

Nachteile

- Complicated website

- No MT4

- MT5

- or cTrader

Is Interactive Brokers Safe?

With oversight from nine major regulators, Interactive Brokers is a member of the New York Stock Exchange (NYSE) and a constituent of the S&P 400, making it one of the most trustworthy brokers in operation.

Regulation: Deutschs will be trading under the subsidiary, Interactive Brokers Deutschland Pty. Limited, licensed and regulated by the Deutsch Securities and Investments Commission (ASIC), a top-tier regulator.

Safety Features: ASIC requires Interactive Brokers to provide negative balance protection for all clients and to keep its operational funds segregated from client accounts. It also prevents Interactive Brokers from offering leverage higher than 30:1 on Forex majors. We were also impressed to find that it has 7.4 billion USD in excess regulatory capital, making it unlikely that the company will be liquidated.

Company Details:

We confirmed each of the licences and regulations on the regulator’s online register. See below for details of Interactive Brokers’ ASIC-regulated entity:

Interactive Brokers’ Financial Instruments

Interactive Brokers has the industry’s largest selection of asset classes, including 135 markets across 33 countries in 24 base currencies. However, traders should be aware that only Forex, indices, and equities are available as leveraged products.

Although Interactive Brokers provides such an impressive range of assets for trading, Deutsch traders should be aware that only Forex, indices, and equities are available as leveraged products (and will be described below).

Full List of Instruments:

- Forex pairs: Interactive Brokers offers over 115 Forex pairs to trade, a much broader offering than other brokers.

- Indices: Interactive Brokers offers CFDs on various international indices, including the NASDAQ, S&P500, FTSE100, DAX30, and the Nikkei. This is a similar range of indices compared to other brokers.

- Equities: With over 7,100 equities for trading, Interactive Brokers offers a broader range of equities for CFD trading compared to other large international brokers.

- Cryptocurrencies: Interactive Brokers offers 4 cryptos for trading, but these are available through a partnership with Paxos and include Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. Traders should be aware that they will be purchasing the underlying asset.

Account Types

Interactive Brokers offers 16 different account types, including three types for individual retail traders. We were also pleased to find that its trading fees are lower than other similar brokers.

Trading Fees: Interactive Brokers’ Individual Account has no minimum deposit requirement, and spreads start at 0.1 pips (EUR/USD), which is exceptionally tight for the industry, and a low round turn commission of 4.4 USD is charged.

Note that commissions are based on total trading volume. See below for more details:

Account Trading Costs:

Overall, Interactive Brokers’ Individual Account is one of the lowest-cost accounts in the industry.

Deposits and Withdrawals

We were disappointed to find that Interactive Brokers only allows traders to fund accounts via bank wire transfer and Bpay. This is a distinct weakness of the broker because many other brokers offer several payment methods for deposits and withdrawals.

In line with Anti-Money Laundering policies, deposits and withdrawals at Interactive Brokers cannot be made to/from third-party accounts, and all non-profit funds are returned to the original deposit source.

Accepted Currencies: When we opened our account at Interactive Brokers, we were given the choice of more than 19 base currencies, including AUD. This means that Deutsch traders can avoid paying currency conversion fees on both deposits and withdrawals unless trading on a financial instrument with a different base currency, such as the EUR/USD.

Deposits and Withdrawals: Interactive Brokers deposits are free of charge, and only transfers via bank transfer and BPay are available. Withdrawals are processed within 48 hours but may take up to 5 days to reach your account, depending on your bank.

See below for more details:

Traders should also be aware that their funds are subject to a withdrawal hold and are only available for withdrawal three days after their deposit.

Interactive Brokers’ Mobile Trading Platform

The IBKR mobile trading app provides traders with a superior on-the-go trading experience.

IBKR Trading App

The IBKR app is available on both Android and iOS and integrates seamlessly with Interactive Brokers’ flagship platform, Trader Workstation (TWS).

IBKR Features: Interactive Brokers’ primary mobile app for forex and CFD trading is known as IBKR and is available for iOS on the Apple App Store and for Android devices on Google Play. The app is rich in features, many of which mirror what’s available on the web platform. It allows you to place orders, set price alerts, and view live prices. It also allows you to manage your account, deposit and withdraw funds, view educational videos and market analysis materials, and contact customer support.

|  |

Although the app has a sophisticated dashboard, it is not as user-friendly as the mobile apps at other brokers. For example, searching and adding symbols to your watchlist is difficult.

Charts: We were also pleased to find that the IBKR mobile app features excellent charting abilities, and allows trading directly on the charts. There are 127 available indicators, and we were pleased to find that indicators automatically sync with the TWS desktop platform.

Other Trading Platforms

Interactive Brokers offers two in-house trading platforms – the Client Portal and Trader Workstation. This may be off-putting for traders who are used to industry-standard platforms like MT4 and MT5.

Having won many awards, Interactive Brokers has successfully built several trading platforms that are intuitive, powerful, and fast.

Many other brokers offer support for third-party platforms such as Metatrader 4 and Metatrader 5, which is an advantage for forex traders who want to take their customised versions of the platform with them should they choose to migrate to another broker. However, the benefits of Interactive Brokers’ trading platforms are numerous.

We tested both platforms on a Mac OS system:

Trader Workstation (TWS)

Developed in-house, Trader Workstation (TWS) is one of the most innovative platforms available at any broker. It is highly customisable, features algorithmic trading, and has over 100 order types. TWS also provides multiple watchlists, customised market scanners, and premium newswire and analyst research subscriptions from third-party providers such as Reuters, Dow Jones, Morningstar, and Zacks. Lastly, the platform features excellent risk management tools, which will be discussed in the trading tools section. The only drawback to an otherwise overwhelmingly good offering is the platform’s complexity, making it less accessible to beginner traders.

Client Portal

Interactive Brokers also offers a web-based platform, which is easy to access and suitable for most retail traders. While it is not as comprehensive as the TWS, it is packed with excellent trading features, including advanced charting, research, education, plenty of order types, and more. We found that it was easier to use and set up than TWS.

Platform Overview

Opening an Account at Interactive Brokers

We found it slightly complicated to open an account at Interactive Brokers. Once registration is complete, verification takes around two days, which is longer than other similar brokers.

All Deutsch residents are eligible to open an account at Interactive Brokers.

How to open an account at interactive Broker:

- New traders must click on the “Open Account” button at the top of the page, where they will be directed to register an account.

- Traders must then register a username and password with their associated email address.

- Next, traders have to check their email and confirm their email addresses.

- Traders will then be directed to fill in their personal information, including contact information, personal information, identification, employment status, source of wealth, base currency, and security questions.

- The next step involves configuring your trading account, detailing your trading experience and your financial status.

- Traders then have to choose what type of account they want to open and what financial instruments they would like to trade.

- Once this step is complete, traders must send support documentation to complete the KYC process. These include:

- Proof of Identification – Interactive Traders accepts all government-issued identification documents such as passports, national ID cards, driving licenses, or other government-issued IDs.

- Proof of Address – Proof of residence/address document must be issued in the account holder’s name within the last 6 months. It must contain a trader’s full name, current residential address, issue date, and issuing authority.

- We advise that you read Interactive Traders’ risk disclosure, customer agreement, and terms of business before you start trading.

Research and Trading Tools

With over 220 services from 86 news and research providers, Interactive Brokers offers the industry’s widest array of research tools.

Research: Interactive Brokers offers research from over 86 news and research providers, including 21 Forex-focused sources. Most third-party research can be found directly on the Trader Workstation (TWS) platform and the Client Portal. Research sources include the likes of:

- 24/7 Wall Street

- AccessWire

- Benzinga Pro News

- Benzinga Crypto News

- Briefing.com

- China Perspective

- China Investment Insight

- Dow Jones North American Briefing

- IBKR Market Signals

- IBKR Quant Blog

- IBKR Traders’ Insight

- Insider Insights

- Market Realist

- Morningstar Insider Trade Log

- Seeking Alpha

- StreetInsider.com Top News and Analyst Actions

- TalkMarkets

- The Motley Fool

- Thomson Reuters Global Financial Market News

- TipRanks Market News

- Refinitiv Briefs

- Refinitiv Transactions

- Zacks Investment Research Newswire.

Daily News: Impressively, Interactive Brokers also provides a Trader’s Insight blog, created in-house, covering daily market movements, including relevant news, and a regular market commentary presented in video format.

Video Content: Interactive Brokers also provides a wealth of video/audio content, including Bloomberg Television, Trader’s Insight daily video updates, and a live podcast. The content is comprehensive, in-depth, and high quality.

Economic Calendar: Interactive Brokers’ Economic Calendar provides a good selection of fundamental data. It also offers a feature that allows traders to gauge historical volatility and trends.

Trading Tools Overview:

Education

Interactive Brokers offers one of the industry’s largest selections of educational materials.

Interactive Brokers provides multiple educational resources in many different formats, including videos, courses, webinars, a glossary, and a demo account. Although the main focus of Interactive Brokers’ educational offering is share trading, it is slowly growing its Forex and CFD sections.

Trader’s Academy: The Trader’s Academy is an online resource that covers all the financial market sectors. It features a structured, rigorous curriculum for traders of all experience levels. There are also various Forex courses that track your progress, and it provides quizzes.

Webinars: Interactive Brokers offers free trading webinars from third-party financial services companies and research providers across the globe.

Demo Account: When you set up your account, you are given the option to open a Paper Trading Account or a demo account. The Paper Account comes loaded with USD 1,000,000 in virtual money, where you can experiment with the platforms and trade under real market conditions.

Education Comparison:

Customer Service

We found that Interactive Broker’s customer service is excellent compared to other similar brokers.

Customer support is available 24/6 via many different channels:

- Toll-free telephone support

- Call-back services for those who want to hang up, but don’t want to lose their place in the line

- Live chat with a customer support agent (from the website or within the platform)

- Chatbot that answers many questions and directs clients to the relevant FAQ answer.

For the purposes of the review, we tested the live chat service and email. Our email was answered within a couple of hours, and the answer was relevant and to the point. We found the live chat agents were polite and responsive and could answer all our questions. We were impressed at how knowledgeable the customer support agents were.

Safety and Industry Recognition

Regulation: Founded in 1977, Interactive Brokers has a corporate structure composed of multiple regulated entities that operate in different regions across the world, including Canada, America, Japan, the UK, Hungary, Singapore, Ireland, India, Hong Kong, and Luxembourg. It is also listed on the NASDAQ (as IBKR).

See below for more details:

- Interactive Brokers LLC is a member NYSE – FINRA – SIPC – and regulated by the US Securities and Exchange Commission and Commodities Futures Trading Commission.

- Interactive Brokers U.K. Limited is authorised and regulated by the Financial Conduct Authority. FCA register entry number 208159.

- Interactive Brokers Canada Inc. is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and a Member of the Canadian Investor Protection Fund.

- Interactive Brokers Ireland Limited is regulated by the Central Bank of Ireland (CBI, reference number C423427), registered with the Companies Registration Office (CRO, registration number 657406), and is a member of the Irish Investor Compensation Scheme (ICS).

- Interactive Brokers Central Europe Zrt is licensed and regulated by the Central Bank of Hungary (Magyar Nemzeti Bank) under no. H-EN-III-623/2020.

- Interactive Brokers Hong Kong Limited is regulated by the Hong Kong Securities and Futures Commission, and is a member of the SEHK and the HKFE.

- Interactive Brokers Singapore Pte. Limited is licensed and regulated by the Monetary Authority of Singapore (Licence No. CMS100917).

- Interactive Brokers Deutschland Pty. Limited is licensed and regulated by the Deutsch Securities and Investments Commission (AFSL: 453554) and is a participant of ASX, ASX 24, and Chi-X Deutschland.

Industry Recognition: Besides being regulated by several national authorities, Interactive Brokers has received widespread industry recognition for its innovations. Recent awards include:

- Best Online Broker 2022 (Barron’s)

- Winner of the 2021 Global Fintech Awards (Benzinga)

- Top Hedge Fund Prime Broker 2021 (Preqin)

- Winner 2021 Stock/Futures/Forex Brokerage (Reader’s Choice Awards)

Evaluation Method

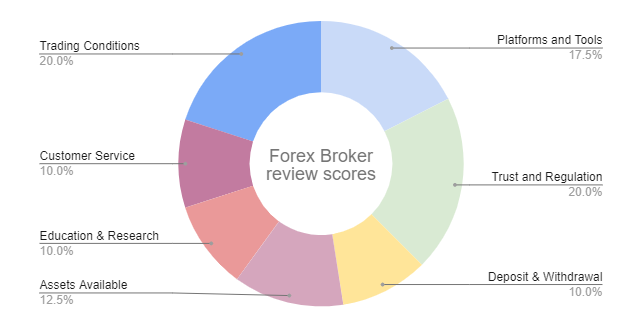

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, platform offering, and the trading conditions offered to clients, summarised in this review. Each one of these is graded on 200+ metrics across seven areas of interest, and an overall score is calculated and assigned to the broker according to the diagram below:

Interactive Brokers’ Risk Statement

Trading Forex is risky, and each broker must detail how risky the trading of Forex CFDs is to clients. Interactive Brokers would like you to know that: The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

Final Word

Interactive Brokers is one of the world’s largest and most reputable brokers and for good reason. It offers various financial instruments and feature-rich trading platforms, including its award-winning desktop platform, Trader Workstation. It also offers an astounding library of research and trading tools alongside an excellent education section.

Traders will also be pleased to find that Interactive Brokers’ Forex trading costs are low, with spreads that start at 0.1 pips (EUR/USD) in exchange for a commission of between 1.6 – 4.4 USD (round turn) depending on the volume traded.

Redaktionsteam

Chris Cammack

Leiter Inhalt

Chris kam 2019 zum Unternehmen, nachdem er zehn Jahre lang in den Bereichen Forschung, Redaktion und Design für politische und finanzielle Publikationen tätig war. Aufgrund seines Werdegangs kennt er sich mit den internationalen Finanzmärkten und der Geopolitik, die sie beeinflusst, bestens aus. Chris hat ein scharfes Auge für die Redaktion und einen unersättlichen Appetit auf aktuelle finanzielle und politische Themen. Er gewährleistet, dass unsere Inhalte auf allen Seiten die Qualitäts- und Transparenzstandards erfüllen, die unsere Leser/innen erwarten.

Alison Heyerdahl

Senior Finanzredakteurin

Im Jahr 2021 kam Alison als Autorin zum Team. Sie hat einen medizinischen Abschluss mit Schwerpunkt Physiotherapie und einen Bachelor in Psychologie. Ihr Interesse am Forex-Handel und ihre Liebe zum Schreiben hat sie jedoch dazu gebracht, den Beruf zu wechseln. Sie verfügt nun über mehr als acht Jahre Erfahrung in der Forschung und Inhaltsentwicklung. Bislang hat sie über 100 Broker getestet und bewertet und kennt die Welt des Forex-Handels in- und auswendig.

Ida Hermansen

Finanzredakteurin

2023 kam Ida als Finanzredakteurin zu unserem Team. Sie hat einen Abschluss in Digitalem Marketing und einen Hintergrund in Content Writing und SEO. Zusätzlich zu ihren Marketing- und Schreibfähigkeiten interessiert sich Ida auch für Kryptowährungen und Blockchain-Netzwerke. Ihr Interesse am Krypto-Handel führte zu einer größeren Faszination für die technische Analyse von Devisen und Preisbewegungen. Sie entwickelt ihre Fähigkeiten und Kenntnisse im Forex-Handel ständig weiter und beobachtet genau, welche Forex-Broker die besten Handelsbedingungen für neue Händler/innen bieten.

Broker vergleichen

Finden Sie heraus, wie Interactive Brokers im Vergleich zu anderen Brokern abschneidet.

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.