Infinox Test und Erfahrungen

Zuletzt aktualisiert am Mai 8, 2023

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu Infinox

With two low-cost accounts, a good range of Forex pairs, excellent market analysis materials, and good trading tools, INFINOX is a decent all-around broker.

INFINOX offers traders the choice of a commission-free STP account or a commission-based ECN account, both with a minimum deposit of 1 GBP (or currency equivalent). Trading costs range between 8 – 9 USD per lot traded, much lower than average for the industry. Trading is available on both the MT4 and MT5 platforms, and INFINOX also offers a great social trading app, especially good for beginners starting their trading careers.

However, we were unhappy with the lack of transparency regarding deposits and withdrawals and were also disappointed by non-responsive customer support and INFINOX’s weak FAQ section.

| 🏦 Min. Einzahlung | GBP 1 |

| 🛡️ Geregelt durch | SCB, FCA, FSC, FSCA |

| 💵 Handelskosten | USD 8 |

| ⚖️ Max. Hebelwirkung | 1000:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instrumente | Commodities, Kryptowährungen, Energien, Stock CFDs, Forex, Indices, Metalle |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Enge Spreads

- Low minimum deposits

- Excellent Market Research

Nachteile

- Non-responsive customer support

- Extreme Hebelwirkung

- Begrenzte Basiswährungen

Is INFINOX Safe?

Yes, INFINOX is a safe broker for Deutsch traders to trade with, and it offers Deutsch traders negative balance protection.

Regulation: INFINOX’s Deutsch clients will be trading under the subsidiary, INFINOX Limited, regulated by the Financial Services Commission of Mauritius (FSC), which handles most of INFINOX’s international business outside of Europe. See below for INFINOX’s sign-up notice:

Safety Features: As mandated by the SCB, INFINOX segregates all funds from the company’s operating capital at top-tier banks and will not use client funds in its operation or any other investment. It also provides all clients with negative balance protection, meaning traders cannot lose more than their initial deposit.

Company Details:

We confirmed each of the licences and regulations on the regulator’s online register.

INFINOX’s Financial Instruments

We were dissatisfied with INFINOX’s instrument range, especially the low number of stock CFDs, but it offers over 49 Forex pairs.

Full List of Instruments and Leverage:

Forex pairs: With over 49 pairs available for trading, INFINOX offers a decent range of Forex pairs. It also offers much higher leverage – up to 1000:1 on the majors.

Cryptocurrencies: INFINOX offers a good range of crypto crosses, including Bitcoin, Ethereum, Litecoin, Ripple, and other specialty cryptocurrencies. The maximum leverage is 1:33, which is much higher than other brokers. However, traders should know that trading with this type of leverage on such a volatile asset is risky. It can lead to increased profits but also big losses.

Metals: INFINOX offers 6 metals, including silver and gold crosses with the USD.

Energies: INFINOX offers spot contracts on both Brent and WTI oil; this is a slightly limited range compared to other brokers.

Indices: INFINOX offers CFDs on various international indices, including the NASDAQ, S&P500, FTSE100, DAX30, and the Nikkei – a similar range of indices compared to other brokers.

Share CFDs: An unspecified number of equity CFDs exist, but, given the math, the total cannot exceed 150 unless INFINOX failed to update the 300+ assets mentioned on its website.

Overall, INFINOX has fewer instruments to trade than most other brokers, which may leave some traders dissatisfied.

INFINOX’s Trading Accounts

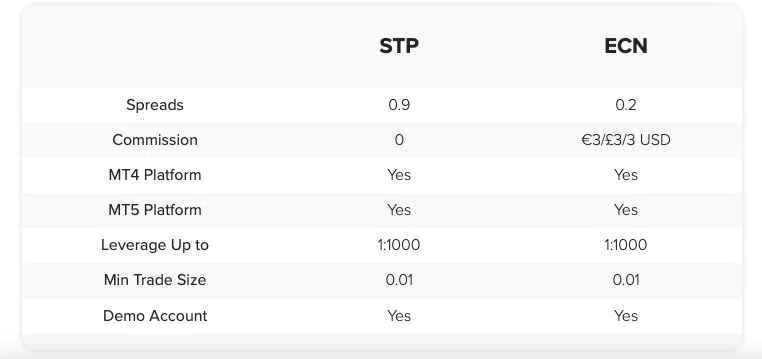

Like many other brokers, INFINOX gives traders the choice of a commission-free account and a commission-based ECN account.

Trading Fees: Clients may choose between the commission-free straight-through processing (STP) account or a commission-based electronic communication network (ECN) alternative. As per INFINOX’s FAQ section, the minimum deposit amount is £1 or equivalent in your base currency. Fees are around 8-9 USD per lot traded on both accounts.

Account Trading Costs:

As you can see from the table above, trading costs on the ECN account are marginally lower than those on the STP account, and these fees are similar to those of other good brokers.

STP Account: The STP Account requires a minimum deposit of only 1 GBP (or currency equivalent), and no commissions are charged for Forex trading. Spreads average at 0.9 pips (EUR/USD), and leverage is up to 1000:1 for Forex trading.

ECN Account: The minimum deposit is also 1 GBP, and spreads average at 0.2 pips (EUR/USD) in exchange for a commission of 6 GBP/EUR/USD (round turn). Leverage on the ECN account is also up to 1000:1.

Deposits and Withdrawals

Although we were pleased to find that INFINOX offers more account funding methods than other brokers, it does not publish any information about its fees nor the processing times on its website.

Like most brokers, INFINOX does not allow funding to or from third parties. Therefore, all withdrawal requests from a trading account must go to a funding source in the trader’s name.

Accepted Deposit Currencies: Deutschs will be pleased to that INFINOX allows trading accounts to be denominated in EUR, USD, GBP, and AUD. This means that Deutschs will not have to pay currency conversion fees on deposits and withdrawals unless they are trading on instruments with other base currencies such as the EUR/USD.

Deposits and Withdrawals: We were disappointed that INFINOX does not publish any information regarding the fees associated with depositing or withdrawing funds.

The Legal Documents state that “INFINOX may charge for incidental banking-related fees such as wire charges for deposits/withdrawals. INFINOX reserves the right to change its fee structure and/or parameters at any time without notice. Fees do not currently but may in the future include such things as statement charges, Order cancellation charges, Account transfer charges, telephone order charges, or fees imposed by any interbank agency.”

According to customer service, INFINOX does not charge a withdrawal fee. Clients

can withdraw funds from their INFINOX account at any time, day or night, and withdrawals are processed on the same day. We recommend checking the fee structure with customer service before depositing funds.

Traders should also be aware that to make a withdrawal, they must submit a request either in writing, by telephone, or by email.

See below for a list of payment methods:

- Bank Wire

- Astropay

- Credit Card

- Dusupay

- Finrax

- Mifinity

- Neteller

- OZOW

- Perfect Money

- Skrill

- Sticpay

- Swiffy Pay

- Zotapay

We tested deposits and withdrawals in AUD via a Visa credit card and found that our deposit was processed almost instantly, and it took 2 days for our withdrawal to arrive in our account. This withdrawal time is around the industry average.

INFINOX’s Mobile Trading Apps

With both MT4 and MT5 available, INFINOX’s mobile trading platform choices are average compared to other brokers.

MT4 and MT5 Mobile Trading

The MT4 and MT5 trading platforms are available on both Android and iOS mobile devices and tablets. While most of the desktop features are available, there is some loss in functionality, including reduced timeframes and fewer charting options.

Other Trading Platforms

Like its mobile trading platform support, INFINOX offers support for MT4 and MT5.

MT4 and MT5

The main benefit of using third-party platforms such as MT4 and MT5 is that traders can keep their customised versions of the platforms should they choose to migrate to another broker. Both MT4 and MT5 are available for Windows, Android, iOS, and web browsers.

Overall, INFINOX’s platform support is about average when compared to other brokers. Additionally, MT4 and MT5 are generally more difficult to set up and are less user-friendly than the web-based platforms available at some other brokers.

INFINOX’s Social Trading

INFINOX also offers a social trading app, IX Social. The app is essentially a trading portal that allows you to link your MT4 or MT5 accounts, and follow or copy the trades of more experienced, successful traders for a small fee per traded lot. In the Discover tab, you will find traders in the Spotlight or Top Live Traders. You can either copy or follow these traders. Their positions will be copied automatically. The copy trading service is user-friendly and well-designed.

|  |  |

Platform Overview

Opening an Account at INFINOX

The account opening process at INFINOX is hassle-free, and accounts are ready for trading in one day.

All Deutsch residents are eligible to open an account at INFINOX.

Creating an account is straightforward, the process is fully digital, and accounts are available for trading within one day:

New traders will have to click on the “Sign Up” button at the top of the page, where they will be directed to register an account.

- INFINOX’s intake form requires clients to register an account with a name, email address, country of residence, telephone number, leverage, and base currency.

- Traders then need to select their preferred account type and platform (MT4/MT5).

- Once this step is complete, traders must send support documentation to complete the KYC process. These include:

- Proof of Identification – INFINOX accepts all government-issued identification documents such as passports, national ID cards, driving licenses, or other government-issued IDs.

- Proof of Address – Proof of residence/address document must be issued in the account holder’s name within the last 6 months. It must contain a trader’s full name, current residential address, issue date, and issuing authority.

- We advise that you read INFINOX’s risk disclosure, customer agreement, and terms of business before you start trading.

Once our documentation had been submitted, our account was ready for trading within 8 hours, which is around the industry average.

INFINOX’s Trading Tools

With VPS services and Autochartist, INFINOX’s trading tools are average compared to other brokers. We were disappointed to find that INFINOX does not have an Economic Calendar.

- VPS Services: INFINOX offers VPS services for all traders, but it is unclear what the conditions are for using these services. A Virtual Private Server (VPS) is a remote terminal solution that benefits from reduced latency and downtime, unaffected by power cuts or computer crashes. Even when the trading terminal is closed, the INFINOX VPS will keep trading.

- Autochartist: INFINOX also supports Autochartist, the industry-standard trading signals provider. Autochartist provides traders with automated alerts for opening and closing trades, a volatility analysis tool that allows you to optimise take-profit and stop-loss levels better, and integrated market reports. Autochartist is available on both MT4 and MT5. Unfortunately, it is unclear whether an extra fee is attached to using Autochartist.

Trading Tools Overview:

Education

INFINOX’s education is limited compared to other large international brokers.

On the INFINOX website, traders will come across a tab labelled ‘IX Intel.’ This section is divided into Research, Education, and In the Press. The education section is essentially a blog-style repository of materials with little structure, but there is a section that covers Forex and another for trading platforms. We also couldn’t find many materials that cater to more experienced traders. That said, the articles are in-depth and comprehensive.

IX Premium is only available for traders who deposit over 1000 USD. In addition to what is available in the education and research sections, traders can access one-on-one sessions, webinars, and a monthly investment report.

Education Comparison:

Research

INFINOX provides an excellent selection of market research materials.

Most of the research content is presented in the analysis blog, which is updated daily with thoughtful insight on recent and future events across a range of CFD markets. The research is further divided into various sections, including:

- Latest Market News

- Espresso Morning Call

- Market News

- Financial Data Commentary

- Forex

- Indices

- Commodities

The materials are comprehensive, detailed, in-depth, and on par with some of the large international brokers.

Customer Service

Like many other brokers, INFINOX’s customer support is available 24/5, but the customer service agents are largely unresponsive.

INFINOX’s customer support is available via live chat, email, and telephone in 15 different languages. We tried contacting customer service via live chat and had no response for a whole day. This is a big downfall for the broker because beginner traders are likely to have many questions regarding the use of different platforms, account queries, and deposits and withdrawals.

Safety and Industry Recognition

Regulation: Founded in London in 2009, INFINOX is a relatively new Forex and CFD broker. It is regulated by several authorities, including the UK’s FCA, the SCB of Bahamas, The FSC of Mauritius, and the FSCA of South Africa. See below for more details:

- INFINOX Capital Ltd is authorised and regulated by the Financial Conduct Authority under Registration Number 501057.

- INFINOX Capital is a registered trading name of IX Capital Group Limited, authorised and regulated by the Securities Commission of The Bahamas (‘the SCB’) under Registration Number SIA F-188.

- INFINOX Limited is authorised and regulated as an Investment Dealer by Mauritius Financial Services Commission (FSC) under License Number GB20025832.

- INFINOX Capital Ltd SA is an authorized Financial Services Provider and is regulated by the Financial Services Conduct Authority under FSP No 50506 (INFINOX Capital Ltd SA acts as an intermediary for INFINOX Capital, which is Authorised and Regulated by the Securities Commission of the Bahamas.) INFINOX is a trademark belonging to INFINOX Capital Ltd, a registered company in the United Kingdom under company number 06854853.

Awards

INFINOX has won numerous awards; some recent ones include:

- 1000 Companies to Inspire Britain, 2020, London Stock Exchange Group

- Best Trading Account Margin Rates 2020, Professional Traders Awards

- 2020- Broker of the Year, Global 100

- 2021 – Most Trusted Broker Asia

- 2021- Best Forex Introducing Broker Programme, Global Forex Awards 2021 – Retail

- 2021- Best Forex Copy Trading Platform, Global Forex Awards 2021 – Retail

- 2021- Best CFD Broker UK 2021, Global Forex Awards 2021 – Retail

- 2021- Best Forex Copy Trading Platform, World Business Outlook Awards

- 2021- Best FX Broker, Dubai Forex Expo

Evaluation Method

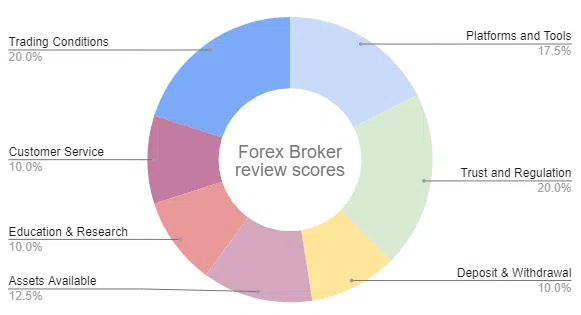

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker, the platform offering of the broker, and the trading conditions offered to clients, summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

INFINOX Disclaimer

Trading Forex is risky, and each broker must detail how risky the trading of Forex CFDs is to clients. INFINOX would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83.14% of retail investor accounts lose money when trading CFDs with INFINOX. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Final Word

INFINOX will be a difficult choice for many Deutsch traders. On the one hand, it has low trading costs, a great social trading service, excellent market analysis, and a decent range of Forex pairs.

On the other hand, it lacks transparency regarding non-trading fees like deposits and withdrawals, and its customer service is largely unresponsive.

Redaktionsteam

Chris Cammack

Leiter Inhalt

Chris kam 2019 zum Unternehmen, nachdem er zehn Jahre lang in den Bereichen Forschung, Redaktion und Design für politische und finanzielle Publikationen tätig war. Aufgrund seines Werdegangs kennt er sich mit den internationalen Finanzmärkten und der Geopolitik, die sie beeinflusst, bestens aus. Chris hat ein scharfes Auge für die Redaktion und einen unersättlichen Appetit auf aktuelle finanzielle und politische Themen. Er gewährleistet, dass unsere Inhalte auf allen Seiten die Qualitäts- und Transparenzstandards erfüllen, die unsere Leser/innen erwarten.

Alison Heyerdahl

Senior Finanzredakteurin

Im Jahr 2021 kam Alison als Autorin zum Team. Sie hat einen medizinischen Abschluss mit Schwerpunkt Physiotherapie und einen Bachelor in Psychologie. Ihr Interesse am Forex-Handel und ihre Liebe zum Schreiben hat sie jedoch dazu gebracht, den Beruf zu wechseln. Sie verfügt nun über mehr als acht Jahre Erfahrung in der Forschung und Inhaltsentwicklung. Bislang hat sie über 100 Broker getestet und bewertet und kennt die Welt des Forex-Handels in- und auswendig.

Ida Hermansen

Finanzredakteurin

2023 kam Ida als Finanzredakteurin zu unserem Team. Sie hat einen Abschluss in Digitalem Marketing und einen Hintergrund in Content Writing und SEO. Zusätzlich zu ihren Marketing- und Schreibfähigkeiten interessiert sich Ida auch für Kryptowährungen und Blockchain-Netzwerke. Ihr Interesse am Krypto-Handel führte zu einer größeren Faszination für die technische Analyse von Devisen und Preisbewegungen. Sie entwickelt ihre Fähigkeiten und Kenntnisse im Forex-Handel ständig weiter und beobachtet genau, welche Forex-Broker die besten Handelsbedingungen für neue Händler/innen bieten.

Broker vergleichen

Finden Sie heraus, wie Infinox im Vergleich zu anderen Brokern abschneidet.

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.