IG Test und Erfahrungen

| 🏦 Min. Einzahlung | USD 0 |

| 🛡️ Geregelt durch | FCA, ASIC, MAS, BMA |

| 💵 Handelskosten | USD 6 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Keine |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instrumente | Anleihen, Commodities, Kryptowährungen, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Zinssätze |

Zuletzt aktualisiert am Mai 8, 2023

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu IG

Founded in 1974 and ASIC-regulated since 2001, IG has a long history of providing safe and secure trading, low trading fees, and a vast range of trading instruments.

Our research found that IG has over 320,000 clients worldwide and has been the largest CFD broker in the world by revenue for the last few years. It has two low-cost trading accounts with no minimum deposit requirements and offers trading on over 17,000 instruments, all of which can be accessed on its award-winning app and web trader platform.

For more traditional investors, IG also runs a fully licenced stock brokerage on the side. And in addition to a wide range of trading tools, IG has a world-class selection of educational and market analysis materials to get new traders started.

| 🏦 Min. Einzahlung | USD 0 |

| 🛡️ Geregelt durch | FCA, ASIC, MAS, BMA |

| 💵 Handelskosten | USD 6 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Keine |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instrumente | Anleihen, Commodities, Kryptowährungen, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Zinssätze |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Streng reguliert

- Enge Spreads

- Tolle Plattformauswahl

- Ausgezeichnete Bildung

- Ausgezeichnete Marktanalyse

Nachteile

- Hohe Mindesteinlage

Is IG Safe?

IG is regulated by 17 national authorities and is publicly listed on the London Stock Exchange, making it safer than any privately-held broker and one of the safest brokers in the world.

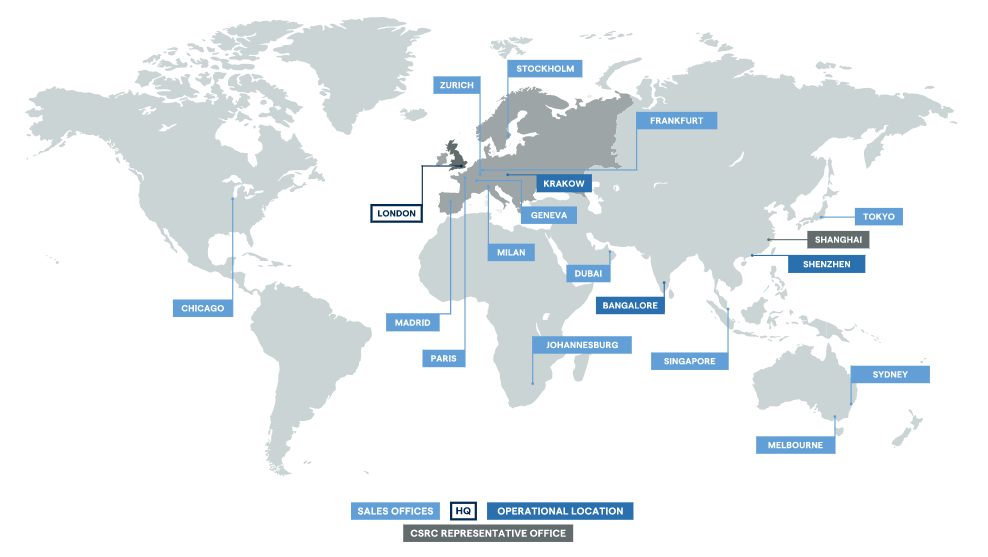

ASIC Regulation: Founded in 1974 and headquartered in the United Kingdom, IG is the largest Forex and CFD broker by revenue (as of May 2022), with over 320,000 clients worldwide. IG has 19 offices across the world and is regulated by the best national authorities, including the Deutsch Securities and Investments Commission (ASIC).

Safety Features: One of the world’s top regulators, ASIC ensures that IG segregates its client funds from its operating capital, limits leverage to 30:1 on major Forex pairs, provides negative balance protection, bans bonuses and other promotions, and bans binary trading for retail (non-professional) traders. Although these limitations may seem restrictive, ASIC’s core focus is to ensure that traders are well-protected.

IG’s holding company, the IG Group, is also listed on the London Stock Exchange and is a constituent of the FTSE 250 Index, adding a further level of regulatory scrutiny.

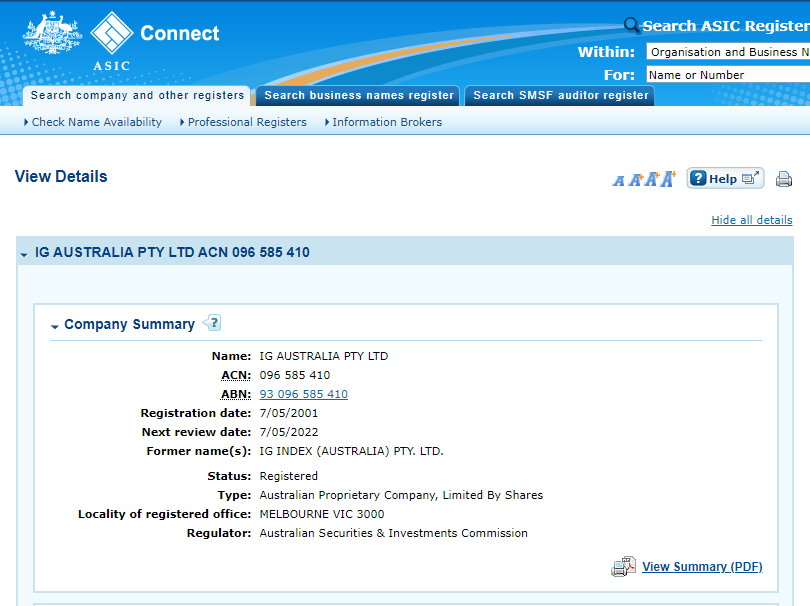

We confirmed each of the licences and regulations on the regulator’s online register. See below for details of IG’s ASIC-regulated entity:

Company Details:

IG Trading Instruments

The sheer volume of tradable instruments available at IG is staggering. Not only does IG offer one of the widest selections of shares to trade in the industry, but there are three different methods of trading them. It also offers innovative CFDs such as Sectors, the Crypto Index, and AUD-denominated international CFDs that are impossible to find at other brokers.

Widest Range of Trading Instruments: IG’ has one of the widest (if not the widest) range of financial instruments to trade in the CFD industry, with over 13,000 share CFDs and instruments that are hard to find at similar brokers, such as ETFs and Options.

AUD-denominated CFDs: Deutsch clients can gain access to a special selection of AUD-denominated CFDs from a broad selection of international markets and asset classes. By trading AUD-denominated CFDs, Deutsch residents can avoid paying conversion fees usually associated with USD or EUR denominated indices, commodities, and cryptocurrencies.

Weekend Trading: In a first for any broker, IG also offers weekend trading on GBP/USD, USD/JPY, and EUR/USD. Spreads are higher over the weekend (averaging 6 pips on the EUR/USD) and are fixed.

See below for details on IG trading instruments and leverage:

- Forex: IG has more pairs to trade than most other Forex brokers, but ASIC regulations limit Forex leverage to 30:1.

- Shares (Real/CFDs/DMA): IG offers three types of share trading. Firstly, it operates as a fully licensed stockbroker. Clients can buy or sell shares with low commissions from a range of international exchanges. Secondly, it offers share CFD trading on one of the largest ranges in the industry. Lastly, IG offers direct market access (DMA) when trading share CFDs. This method of trading is only available on the L2 Dealer platform, and other fees from exchanges and stock borrowing may also apply.

- Commodities: IG offers trading on a broad range of commodities, including gold, silver, iron ore, Brent and US crude, natural gas, and soft commodities such as coffee, sugar, and live cattle.

- Indices: IG offers trading on more indices than other similar brokers and includes the likes of the NASDAQ, FTSE100, DAX30, and Hang Seng. IG also offers bespoke indices such as a Cannabis Index and an Emerging Markets Index. Major indices can also be traded over the weekend.

- Cryptocurrencies: With 10 crypto pairs and the Crypto 10 Index (an index of the ten largest coins) available for trading, IG offers a wider range than is available at most other brokers. Crypto trading is available 7 days a week, unlike most other asset classes.

- Options: IG offers a range of daily, weekly, future, stock index, and share options. Options give you the right, but not the obligation, to buy or sell an asset before a certain date. Options traders are generally trading volatility in the markets or hedging another trade.

- Bonds: IG offers Bonds from Germany, UK, the US, France, Italy, and Japan, a wider range than other brokers. Both spot and futures are available.

- ETFs: At IG, there is a range of ETFs available to trade, such as stock index ETFs that track an index or basket of stocks and currency ETFs that track multiple currencies. Like share trading, ETFs can be both bought via IG Market’s stock brokerage service or speculated upon using leverage.

- Interest Rates: IG also offers 6 interest rate CFDs to speculate on. Interest rate CFDs are generally used to hedge other trades that will be affected by interest rate changes.

- Sectors: Another unique product offered by IG, sectors are industry-specific CFDs. IG offers 44 UK and Deutsch sectors such as Fixed Line Telecoms, Beverages, Financials, and Tobacco.

IG’s Accounts and Trading Fees

Although IG only offers two accounts, its trading fees are low compared to other Forex brokers.

Trading Fees: IG’s accounts have no minimum deposit requirements, making them accessible to all traders. The CFD trading account is commission-free, with spreads that start at 0.75 pips on the EUR/USD. IG’ DMA Account has a spread of 0.165 on the EUR/USD and a commission that reduces with increasing trading volumes. The trading fees on both of these accounts are significantly lower than other brokers.

Account Trading Costs:

We opened and tested IG’s CFD trading account:

CFD Trading Account

No minimum deposit is required to open a CFD trading account. You can choose to trade on either the MT4 platform, in which case spreads will average at 0.75 pips on the EUR/USD, or on the IG platform, where spreads average at 0.86 pips on the EUR/USD. However, there are marked differences between using the MT4 and IG proprietary platforms.

DMA (Direct Market Access) Account

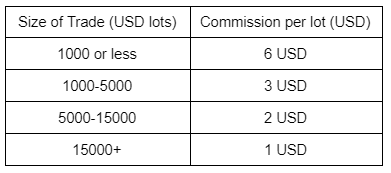

Spreads average at 0.165 pips on the EUR/USD, and commissions are based on the trading volume (see below for more details). Traders can only use the L2 Dealer platform when choosing the DMA account option.

While the 6 USD round-turn commission is slightly lower than average compared to other brokers, this can be reduced even further with high volume trading:

Professional Traders

There is also a professional account that allows for higher leverage (200:1 for Forex pair) in exchange for less regulatory protection. To qualify for a professional account, you must have placed ten significantly leveraged trades per quarter for the last four quarters, have a portfolio exceeding 50,000 USD, and have a minimum of one year’s professional derivatives trading experience.

IG’s Deposits and Withdrawals

IG charges no deposit or withdrawal fees for bank wires, but credit card and PayPal deposit fees are higher than other brokers.

In line with Anti-Money Laundering policies, IG returns all non-profit funds to the original deposit source.

Accepted Deposit Currencies: While IG does allow traders to select different base currencies other than AUD, new accounts are always denominated in AUD by default. This can only be changed by emailing the IG support team with your name, date of birth and address, and the account number you would like to change.

This obviously takes some time and is a serious hassle for traders who trade exclusively in USD CFDs and want to avoid the 0.5% conversion fee. In addition, IG does not publish the list of base currencies it supports – so traders will have to email customer support to find out whether their chosen base currency is available.

See below for details on IG deposit and withdrawal fees and processing times:

Deposits

Traders can deposit funds via debit/credit card (Visa and Mastercard), bank wire transfers (also available on BPAY), and PayPal.

- Bank Wire: Deposits by bank wire are free of charge and take up to three business days to reflect. There is no minimum deposit requirement for bank wires.

- BPAY: Deposits by BPAY are also free of charge and should reflect within one working day. If proof of payment is uploaded to the My IG dashboard, the funds will be made instantly available.

- Paypal: Deposits via Payal are also instant, but traders are charged a 1% fee per transaction.

- Credit and Debit Cards: While deposits made with a debit card are free of charge, IG charges a fee of 1% on deposits made by Visa credit cards and a 0.5% fee on deposits made by MasterCard credit cards. Deposits will reflect instantly for both debit and credit cards. The minimum deposit requirement is 300 AUD on credit cards, and the maximum deposit per day is 50,000 USD.

Withdrawals

IG does not charge a fee for withdrawals, but the minimum withdrawal amount is 200 AUD. Withdrawals are processed on the same day but may take two to five days to reflect. Same-day transfers are also available, but there is a charge of 15 AUD per transfer and a minimum withdrawal amount of 2000 AUD.

While withdrawal costs are low and withdrawal times are average for the industry, IG does charge fees on deposits via credit card and Paypal. This is unnecessary and not common among other brokers. On the other hand, being able to make instant deposits via BPAY is a bonus for Deutsch traders – especially considering that they are free of charge.

Mobile Trading Apps

IG’s mobile trading experience is average – while MT4 and the IG app are available on both Android and iOS, L2 Dealer is only available on desktop.

IG’s Mobile App

We were pleased to find that IG recently created an iOS app, whereas before, the platform was only available as a Progressive Web App (PWA) for iPhone browsers. It also links to ProRealTime, an advanced charting package (click here for more on IG’s trading tools).

We tested the app on an iPhone 11 and found that it does a surprisingly good job of balancing ease of use with its incredible functionality. Impressively, we could trade all 17,000 trading instruments available at IG on the app. It features advanced interactive charts that sync perfectly with the web trader version of the platform, alerts, and market sentiment readings. It also features news and analysis from IG’s in-house team and the Reuter’s live feed:

The only difficulty we had was finding how to add instruments to our watchlist. Additionally, it doesn’t have predefined watchlists, which makes it almost impossible to sift through IG’s massive list of instruments.

MT4 Mobile App

IG offers MT4 on a mobile trading platform, available for both Android and iOS. Although there is slightly limited functionality compared to the desktop version of the platform, with reduced timeframes and fewer charting options, traders will still have access to analytics with technical indicators, graphical objects, and a full set of trading orders.

L2 Dealer is not available on mobile devices due to the complexity of the platform.

IG’s Other Trading Platforms

IG supports three trading platforms across mobile and desktop devices, including its own web-based platform and MT4. It also offers the L2 Dealer platform for DMA trading, which is unavailable at other brokers.

This platform lineup won IG the award for Best Multi-Platform Provider from 2016-2020 at the ADVFN International Financial Awards.

Web Trading Platform

Many similar brokers to IG offer their own trading platforms, but IG’s web-based platform is unusually customisable and functional when compared to other brokers’ own platforms.

We were impressed by the fast execution speeds, that you can compare up to four timeframes on a single chart, that charts open from nearly any view, and that they display live market prices. We also enjoyed the excellent technical analysis tools, including Autochartist and PIAfirst, and that it features integrated risk-management modules.

One minor issue we had was that the platform setup is complex, though you can save custom layouts. Other downsides to IG’ trading platform are the lack of automation and that traders will not be able to take the platform with them if they decide to switch brokers.

MetaTrader 4

We found that IG offers the standard version of MT4 plus twelve add-ons and six indicators, transforming MT4 into a state-of-the-art trading platform. Most brokers only provide the out-of-the-box version, which does not provide all the necessary functionality.

Other unique advantages of IG’s MT4 platform include the automated trading functionality achieved through the use of EAs, the 18 custom apps created by IG, and the free Autochartist plugin. Note that MT4 users do not have access to Reuters News, Bloomberg, or FIX API.

L2 Dealer

L2 Dealer, a specialist platform designed by IG, offers direct market access (DMA) free of charge as long as clients maintain a balance of 2000 AUD. This platform is not recommended for beginner traders as the complexity of trading the DMA market is only suitable for traders who understand the terminology and risks involved.

The primary advantage of the L2 Dealer software is trading Forex at market prices, with liquidity from major providers. The L2 Dealer platform also functions as a specialist share trading platform and provides market depth from a range of exchanges (including full market depth from the LSE) and an ‘Iceberg’ facility, which break large shares orders into smaller tranches. Like IG’ web-trading platform, the L2 Dealer platform also has integrated access to ProRealTime, a web-based charting package for advanced traders.

Platform Comparison:

Opening an Account with IG

The account opening process at IG is slower than at other brokers and requires detailed information regarding the state of your finances and your trading knowledge.

It took us about 15 minutes to open an account at IG, but our accounts were only ready for trading once our documentation had been verified, which took two days. However, we were pleasantly surprised to receive a phone call from customer service to assist with any troubleshooting issues.

All Deutsch traders are eligible to open an account at IG, and with no minimum deposit required, new traders don’t have to worry about funding the account right away.

IG offers joint and individual accounts, but we will focus on opening an individual account:

- Firstly we clicked on the “Create Live Account” button at the top of the page, where we were directed to register an account with our country of residence, full name, and email address. We also had to create a username and password.

- Once this step was completed, we were asked to complete a short form that helped IG understand the state of our finances and trading knowledge. While most brokers omit this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- Once this form was completed, we had to submit the Know Your Customer (KYC) documentation:

- IG requires proof of identification (such as a current passport, ID card, or driver’s licence)

- Proof of address such as a utility bill or bank statement that is less than six months old.

- Once our documentation had been submitted, our account was ready for trading in 2 days, which is slower than other brokers.

We advise you to read IG’s risk disclosure, customer agreement, and terms of business before you start trading.

Overall, IG’s account opening process is relatively hassle-free, and all documents can be uploaded digitally. But identity verification does take longer than other brokers – most other brokers will be able to verify your identity within a matter of hours rather than days.

IG’s Trading Tools

IG has a wide range of unique and useful trading tools, but they are exclusive to particular trading platforms. Most other brokers offer trading tools that function whatever platform a trader is using.

ProRealTime (IG Platform and L2 Dealer only)

Only available on L2 Dealer and IG Market’s own platform, ProRealTime is a downloadable advanced charting package with advanced analytical features and monitoring tools. Intended for technical chart traders, ProRealTime allows clients to automate their trading and features a fully customisable interface. ProRealTime is free of charge for clients that trade at least four times per calendar month; otherwise, a fee of 40 AUD per month will be charged to use the tool.

Autochartist (MT4 only)

Free for all IG clients, Autochartist is an award-winning automated technical analysis tool that plugs into MT4 and scans all available CFD markets for trading opportunities.

Autochartist’s advanced pattern recognition engine identifies the strongest potential trading opportunities and predicts future price movements. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

The market scanner provides statistically significant market movements and identifies important price levels that are catalysts for market movements.

IG’s Trading Signals (IG platform only)

IG has partnered with Autochartist and PIAfirst to provide users of IG’ own web-based platform with free trading signals. Autochartist is an automated technical analysis tool that scans the markets and analyses data across multiple timeframes to provide users with trading opportunities. PIAfirst is a trading strategy service provided by market professionals that delivers award-winning analysis and easy-to-implement trading strategies to users.

Trading signals from both Autochartist and PIAfirst are easy to access from the drop-down Signals menu in IG Market’s trading platform. Each signal also provides the accompanying analysis, allowing beginner traders to learn how both technical and fundamental analysis can be used to spot trading opportunities.

MT4 Indicators (MT4 only)

Like most brokers who offer MT4, IG offers a package of indicators to all users of the platform. When you download MT4 from IG, you get six of the most popular indicators on the MT4 platform for free. You’ll also receive more than 12 add-ons when you download MT4 from IG. These enable you to customise the platform to your own preferences and trading needs. Add-ons include:

- Mini terminal: Allows traders to adapt MT4’s deal tickets and charts to their preferences with a host of highly configurable new features.

- Trade terminal: Control all trades from a single, powerful window.

- Stealth orders: This allows traders to keep their trades anonymous.

- Correlation matrix: Enables traders to see how correlated their watched markets are and limit risk accordingly.

- Sentiment trader: This allows traders analyse market sentiment or view a historic price vs. sentiment chart.

Partial Fills and Points Through Current (IG platform only)

For high-volume traders, IG offers two trading tools to reduce the change of trade rejection.

Partial Fills

IG now offers clients partial fills on their online trades. If you are a high-volume trader, you will be able to accept a partial fill to increase your chance of successful execution.

If you choose to use this feature, IG will only ever partially fill your order as an alternative to outright rejection. IG will never partially fill your order as an alternative to filling it in its entirety. So if you trade in a size so large that we cannot fill your entire order rather than reject your entire order IG will be able to fill you in the maximum size possible.

Point Through Current

Points through current will give traders even more control of their execution by allowing them to trade through the current IG price. This feature will reduce your chance of a price rejection in volatile market conditions and increase the likelihood of successful execution when trading in large sizes.

While IG will still fill an order at the best possible price, the chance of a successful execution is increased when using ‘points through current.

API (Custom-built trading platforms only)

API stands for Application Programming Interface. It is a program that connects two applications – for example, your IG trading account and your custom-built platform. Trading with APIs enables you to gain direct access to IG’s ecosystem, providing you with faster order execution and more control, enhancing your trading experience.

IG’s Research and Analysis

IG’s research and analysis are comparable with most other large international brokers, with a constant feed of news and thoughts from the in-house trading team.

News and trade ideas, trading strategy education, and analysis of upcoming financial events are frequently published at IG. The analysis is written by the IG Global team of analysts who have professional backgrounds in trading at some of the major investment banks.

IG sends free Morning Call and The Week Ahead reports daily and weekly, respectively. Each promises to deliver an analysis of major economic events and corporate news before the opening of the markets.

Research Comparison:

IG’s Educational Content

IG’s educational section is more detailed and better-structured than most other brokers and is suited to both beginners and more experienced traders.

Awarded Best Forex Educators 2018 (UK Forex Awards), IG has plenty of current and accessible educational material for beginner traders. Reports and daily analysis are emailed to anyone who signs up, and 24-hour support is available.

IG has a wide variety of educational materials to get traders started. These include the IG Academy, a section on Managing Your Risk, a Trading Strategy section, Webinars and Seminars, and a glossary of terms. See below for details:

- IG Academy: Online trading courses covering topics for beginner, intermediate and advanced traders. Live, structured classroom-style lessons are run daily and offer traders the opportunity to get personal feedback and interact with market analysts.

- Managing your risk: IG provides several materials outlining how traders can reduce their risk. It also includes information on the various risk management tools offered at IG.

- Trading Strategy: This section teaches traders how to look at the markets, use trading tools, and understand technical trading language.

- Webinars and seminars: IG Market’s webinars and seminars help build traders’ confidence and cover topics ranging from platform walk-throughs to upcoming trading opportunities.

- Glossary: The glossary provides comprehensive definitions and explanations of various financial terms.

Education Comparison:

IG’s Customer Support

IG’s customer support is knowledgeable, responsive, and available 24 hours a day.

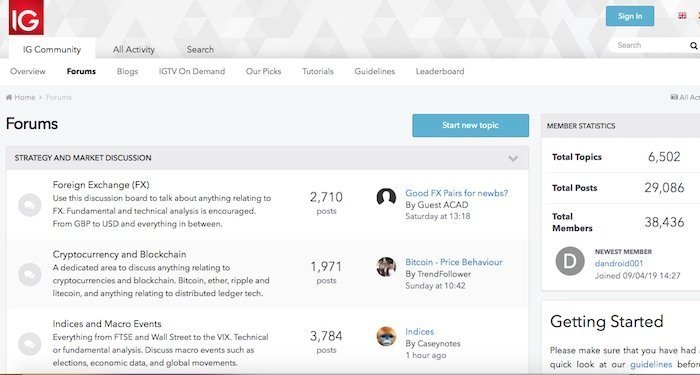

Clients support is available by phone, email, Twitter, and live chat, 24hrs a day from 8 am Saturday to 10 pm Friday (GMT). In addition, the peer support platform offers assistance from other traders and IG staff in a forum discussion, which is an ideal additional resource for beginner traders who have questions about the platforms, analysis, and trading ideas. See below:

For the purposes of the review, we tested the live chat service and email. Our email was answered within a couple of hours, and the answer was relevant and to the point. We found the live chat agents were polite and responsive, and they were able to answer all our questions. After logging into the live chat, we were connected to an agent who replied to our message within 30 seconds.

Safety and Industry Recognition

Regulation: As mentioned at the to of the review, IG is regulated by 17 national authorities. Highlights include:

- IG Markets Ltd is authorised and regulated by ASIC (license 22044) and the FMA (FSP No. 18923)

- IG Markets Deutschland Pty Ltd is authorised and regulated by ASIC, license 515106

- IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority, license 195355.

As you can see, IG operates two subsidiaries in Deutschland. This is due to the changes in ASIC regulation announced in October 2020 and which came into force in March 2021.

Deutsch residents who were clients of IG prior to November 2020 will still be trading with IG Ltd, the larger international body which is headquartered in London. Traders who signed up with IG after November 2020 will be trading with the newly formed IG Deutschland Pty Ltd, an Deutsch-based subsidiary with a singular focus on the Deutsch market.

Awards: In addition to its broad regulatory supervision and long track record of responsible operation, IG continues to receive industry recognition both in Deutschland and overseas.

- Number 1 in Deutschland by primary relationships, CFDs & FX (Investment Trends December 2020 Leveraged Trading Report)

- Best Finance App 2020 (ADVFN International Financial Awards)

- Best Multi-Platform Provider 2020 (ADVFN International Financial Awards)

- Overall Personal Wealth Provider 2020 (Online Personal Wealth Awards)

- Best CFD Provider 2020 (Online Personal Wealth Awards)

- Winner of Best Forex Trader 2019 (Investopedia Online Brokers Awards)

Because of the active internal client protection policies and processes, strong regulation, and acclaim from the industry, we consider IG a safe and trustworthy broker.

Evaluation Method

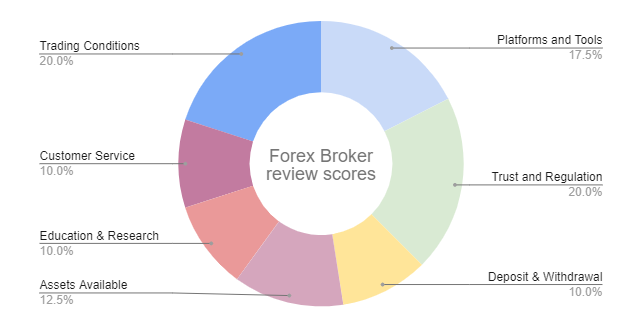

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker’s platform offering, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

IG’s Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. IG would like you to know that: CFDs are high-risk financial products, which are not suitable for many members of the public. If you choose to enter into a contract with us or instruct us to conduct a transaction on your behalf, it is important that you remain aware of the risks involved, that you have adequate financial resources to bear such risks, and that you monitor your positions carefully.

Overview

Founded in 1974 and the largest broker in the world by revenue, IG is the clear global leader in the CFD trading market. The sheer number of CFDs available to trade could be overwhelming for new traders, especially considering the range of trading platforms and trading methods.

IG’s spreads on Forex are generally tighter than other large brokers, and commissions are low on the DMA account. With a variety of trading platforms, including MT4 and the L2 Dealer platform for experienced traders, along with a catalogue of education, analysis, and webinars, IG is a good choice for traders of all experience levels.

A publicly listed company with regulation from ASIC, FCA, and the FMA – and constant industry acclaim – IG is possibly the safest and most secure broker in the world.

Redaktionsteam

Chris Cammack

Leiter Inhalt

Chris kam 2019 zum Unternehmen, nachdem er zehn Jahre lang in den Bereichen Forschung, Redaktion und Design für politische und finanzielle Publikationen tätig war. Aufgrund seines Werdegangs kennt er sich mit den internationalen Finanzmärkten und der Geopolitik, die sie beeinflusst, bestens aus. Chris hat ein scharfes Auge für die Redaktion und einen unersättlichen Appetit auf aktuelle finanzielle und politische Themen. Er gewährleistet, dass unsere Inhalte auf allen Seiten die Qualitäts- und Transparenzstandards erfüllen, die unsere Leser/innen erwarten.

Alison Heyerdahl

Senior Finanzredakteurin

Im Jahr 2021 kam Alison als Autorin zum Team. Sie hat einen medizinischen Abschluss mit Schwerpunkt Physiotherapie und einen Bachelor in Psychologie. Ihr Interesse am Forex-Handel und ihre Liebe zum Schreiben hat sie jedoch dazu gebracht, den Beruf zu wechseln. Sie verfügt nun über mehr als acht Jahre Erfahrung in der Forschung und Inhaltsentwicklung. Bislang hat sie über 100 Broker getestet und bewertet und kennt die Welt des Forex-Handels in- und auswendig.

Ida Hermansen

Finanzredakteurin

2023 kam Ida als Finanzredakteurin zu unserem Team. Sie hat einen Abschluss in Digitalem Marketing und einen Hintergrund in Content Writing und SEO. Zusätzlich zu ihren Marketing- und Schreibfähigkeiten interessiert sich Ida auch für Kryptowährungen und Blockchain-Netzwerke. Ihr Interesse am Krypto-Handel führte zu einer größeren Faszination für die technische Analyse von Devisen und Preisbewegungen. Sie entwickelt ihre Fähigkeiten und Kenntnisse im Forex-Handel ständig weiter und beobachtet genau, welche Forex-Broker die besten Handelsbedingungen für neue Händler/innen bieten.

Broker vergleichen

Finden Sie heraus, wie IG im Vergleich zu anderen Brokern abschneidet.

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.