-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

IFX Brokers Broker Review

Last Updated On May 8, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on IFX Brokers

Founded in South Africa in 2018, IFX Brokers is a popular South African broker with a range of ZAR accounts, support for both MT4 and MT5 trading platforms, and a wide range of Forex pairs. However, trading costs are not transparent and are generally quite high. IFX also offers virtually no trading tools, educational support, or market analysis materials.

IFX has five live accounts with a range of minimum deposit requirements to suit traders of varying experience levels. Minimum deposits range between 10 USD up to 1000 USD, but trading costs don’t drop below 1 pip (EUR/USD).

Although deposits are generally instant and free, there is little information on the site regarding withdrawals. Traders will also be disappointed in the lack of education and market analysis materials, and that customer service is only available during business hours via telephone and email.

| 🏦 Min. Deposit | USD 10 |

| 🛡️ Regulated By | FSCA |

| 💵 Trading Cost | USD 16 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Great range of accounts

- Low minimum deposit

Cons

- Wide spreads

- Non-transparent spreads

- Poor education

- Limited market analysis

Is IFX Brokers Safe?

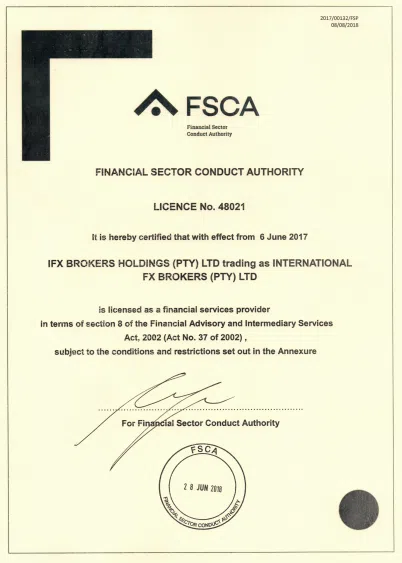

We consider IFX Broker a safe broker to trade with, but it only maintains regulation from the South African FSCA.

Regulation: Unlike other brokers that are regulated by a number of authorities from around the world, IFX Brokers is only regulated by a single tier 2 regulator: the South African FSCA.

Although the South African FSCA is not the strictest regulator, it is taking steps to improve its oversight and ensure that South Africans are better protected.

Safety Features: The FSCA ensures that IFX Brokers:

- Segregates all client money from its operating capital.

- Submits periodic financial reports to the FSCA.

Despite only holding a local licence from the FSCA, IFX Brokers does offer negative balance protection and takes the security of its client’s funds seriously.

Company Details:

![]()

![]()

Financial Instruments

We were dissatisfied with IFX Brokers’ instrument range, especially the complete lack of stocks, but it has over 70 currency pairs for trading.

Full list of Instruments and Leverage:

![]()

![]()

- Forex: IFX Brokers has 70 currency pairs, a broader range than most other brokers, including majors, minors, and exotics.

- Indices: There are 11 indices available for trading at IFX Brokers, a limited range compared to other brokers.

- Commodities: IFX Brokers offers trading on 8 commodities, an average selection compared to other brokers. These include Gold, Silver, Natural Gas, Brent Crude, and WTI crude.

- Cryptocurrencies: IFX Brokers only offers trading on 5 cryptocurrencies, again, limited compared to other brokers. These include Bitcoin, Ethereum, Litecoin, and Ripple.

Overall, IFX Brokers has fewer instruments to trade than most other brokers, which may leave some traders dissatisfied, but it has a higher number of Forex pairs.

Accounts and Trading Fees

IFX Brokers offers 5 trading accounts, a broader range than most other brokers, but its trading fees are average and it does not publish its spreads.

Trading Fees: IFX Brokers’ accounts have increasing minimum deposits linked to more account benefits and lower trading fees. For example, minimum deposits start at 10 USD on its commission-free Standard Account which has spreads that start at 1.3 pips on the EUR/USD; while its Raw Account has spreads of 0.5 pips (EUR/USD) with a 6 USD commission in exchange for a minimum deposit of 1000 USD. These trading costs are higher than the industry average – trading costs at other brokers tend to be 9 USD per lot of EUR/USD. See below for account details.

Account Trading Costs:

![]()

![]()

IFX Standard Account: The Standard Account requires a minimum deposit of 10 USD, and no commission is charged on trades. Spreads average at 1.3 pips, wider than other similar brokers. Leverage is up to 500:1 for Forex trading.

IFX Premium Account: The minimum deposit on this account is higher, at 250 USD and like the Standard Account, no commissions are charged. Spreads tighten to 1 pip on the EUR/USD, which is still wider than those on other brokers’ entry-level accounts.

IFX VIP Account: The VIP Account caters to more experienced traders with a minimum deposit of 1000 USD, spreads that start at 0.5 pips (EUR/USD), and a 6 USD commission. These trading fees are still higher than other brokers.

IFX Islamic Account: The Islamic Account is a swap-free account exclusively available for traders of the Muslim faith. It has a minimum deposit of 10 USD, spreads that start at 1.3 pips on the EUR/USD, and no commissions are charged for Forex trading.

IFX Cent Account: The IFX Cent Account is suited to beginner traders. Like the other accounts, it has a minimum deposit of 10 USD but allows Cent trading and trading in much smaller volumes, known as micro-lots. However, spreads on this account are wide, starting at 1.6 pips (EUR/USD).

Deposits and Withdrawals

We were pleased to find that IFX Brokers has a good choice of deposit and withdrawal methods. However, while it is transparent about its deposit fees and times, it does not publish information about withdrawals on its website.

Like most brokers, IFX Brokers does not allow funding to or from third parties. All withdrawal requests from a trading account must go to a funding source in the trader’s name.

Accepted Deposit Currencies: South African traders will be pleased that IFX Brokers offers trading accounts denominated in ZAR, EUR, USD, and GBP. However, because they can only open one account, currency conversion fees will apply when trading on instruments such as the EUR/USD. We advise that traders always check the exchange rate when converting from ZAR to other currencies as hidden conversion fees can make trading expensive and affect profitability.

Funding methods: IFX Brokers offers a range of deposit and withdrawal methods for South African traders, including OZOW, PayFast, MasterCard, Visa, Payfast, Skrill, Neteller, and cryptocurrencies (Bitcoin, Ethereum, Tether, Ripple).

Deposits are generally instant and free, but wire transfers take up to 48 hours. Unfortunately, IFX Brokers does not publish much information on the various withdrawal methods, only that withdrawals for South African clients are normally processed within 2-4 hours. This is unusual and not consumer-friendly, as most brokers publish all their deposit and withdrawal fees on their websites.

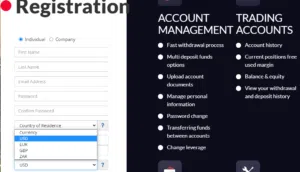

IFX Brokers’ Mobile Trading

With both MT4 and MT5 available, IFX Broker’s mobile trading platform choices are average compared to other brokers.

MT4 and MT5 Mobile Trading

The MT4 and MT5 trading platforms are available on both Android and iOS mobile devices and tablets. There is some loss in functionality when compared to the desktop versions of these trading platforms, including reduced timeframes and fewer charting options.

Other Trading Platforms

Like its mobile trading platform support, IFX Brokers only offers support for MT4 and MT5.

MT4 and MT5

The main benefit of using third-party platforms such as MT4 and MT5 is that traders can keep their own customised versions of the platforms should they choose to migrate to another broker. Both MT4 and MT5 are available for Windows, Android, iOS, and web browser.

Overall, IFX Broker’s platform support is about average when compared to other brokers. Additionally, MT4 and MT5 are generally more difficult to set up and are less user-friendly than the web-based platforms available at some other brokers.

Platform Overview

![]()

![]()

IFX Brokers’ Bonuses

According to the website, IFX Brokers offers a 50% bonus for new traders, but traders will have to read the supporting documentation to find out more about the terms and conditions of the bonus. Additionally, bonuses are only available on some of the account options.

Opening an Account at OctaFX

The account opening process at IFX Brokers is hassle-free and accounts are ready for trading in one day.

All South African residents are eligible to open an account at IFX Brokers if they meet the minimum deposit requirements on the account they choose.

Creating an account is straightforward, the process is fully digital, and accounts are available for trading within one day:

New traders will have to click on the “Start Trading” button at the top of the page where they will be directed to register an account.

- IFX Broker’s intake form requires clients to register an account with a name, email address and password, country of residence, telephone number, and base currency:

- Next, new traders will be sent a link via email to confirm their registration.

- Traders then need to select their preferred account type.

- Once this step is complete, traders will have to send support documentation to complete the KYC process. These include:

- Proof of Identification – IFX Brokers accepts all government-issued identification documents such as passports, national ID cards, driving licenses, or other government-issued IDs.

- Proof of Address – Proof of residence/address document must be issued in the name of the account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

- We advise that you read IFX Brokers’ risk disclosure, customer agreement, and terms of business before you start trading.

Once our documentation had been submitted, our account was ready for trading within 8 hours, which is around the industry average.

Trading Tools

Disappointingly IFX Brokers offers no trading tools. Most other brokers offer tools such as Autochartist or Trading Central to help traders make better trading decisions.

Market Research

IFX Brokers’ market analysis is severely limited compared to other South African brokers

Alongside a basic Economic Calendar, IFX Brokers offers virtually no market analysis. Traders will therefore have to supplement their trading strategies by performing their own research using the materials provided on other larger broker sites or using independent third-party tools.

Trading Tools Comparison:

![]()

![]()

Education

Like its market research, IFX Brokers offers no educational materials.

While IFX Brokers may argue that it provides a blog with information on how to trade, and how to use MT4 and MT5, these articles are few and far between. The majority of the content on the blog seems to compare IFX Brokers to other notable brokers in South Africa and promotes IFX Brokers as better. This is very misleading, as we have found that IFX Brokers lacks transparency and does not measure up to the major brokers in any respect.

Additionally, unlike other South African brokers, such as HFM (previously Hotforex) and Khwezi Trade, IFX Brokers does not offer in-house training or webinars to help traders find their footing.

Education Comparison:

![]()

![]()

Customer Service

Available during business hours, 5 days a week, IFX Brokers’ customer service is poor compared to other brokers.

Customer service at IFX Brokers is available Monday to Friday 10 am – 6 pm SAST, via telephone, and email in English. We tested the customer service via telephone and found that the agents were responsive but unable to answer most of our questions. We were also disappointed to find that IFX Brokers does not offer a live chat option.

Safety and Industry Recognition

Regulation: Founded in 2018 and based in South Africa, IFX Brokers is an online Forex and CFD broker that is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa:

- IFX Brokers Holdings (Pty) Ltd (Pty) Ltd (company number 2017/027249/07) is authorized and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa with License no. 48021.

Awards

Unfortunately, IFX Brokers has received no awards, but we put this down to its relative youth.

Overview

An FSCA-regulated broker, IFX Brokers is a popular broker in South Africa with a range of ZAR accounts and trading on both the MT4 and MT5 platforms. While its trading conditions are average, and there are virtually no market analysis and educational materials, IFX Brokers offers over 70 Forex pairs for trading. However, we were disappointed with the lack of transparency on its spreads and withdrawals.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how IFX Brokers stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.