IC Markets Test und Erfahrungen

Zuletzt aktualisiert am April 9, 2024

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu IC Markets

IC Markets akzeptiert kein Empfehlungsverkehr mehr in der EU. Sie können IC Markets direkt besuchen oder einen anderen unserer empfohlenen Forex-Broker auswählen.

Als hervorragender Allround-Broker mit einer sehr hohen Vertrauenswürdigkeit wurde IC Markets 2007 in Australien gegründet und besitzt Lizenzen von einigen der strengsten Regulierungsbehörden der Welt. IC Markets ist bekannt für seine niedrigen Handelskosten, die Auswahl an Handelsplattformen und die große Auswahl an Handelsinstrumenten.

IC Markets bietet eine kostengünstigere Handelsumgebung als fast jeder andere Broker, mit durchschnittlichen Spreads von 0.10 Pips (EUR/USD) auf seinem Raw Spread Account gegen eine niedrige Kommission von 6 USD (round turn) pro Lot.IC Markets ist einer der wenigen Forex-Broker, der alle drei großen Handelsplattformen unterstützt, darunter MetaTrader4, MetaTrader5 und cTrader, und bietet zahlreiche Handelswerkzeuge für jede Plattform an, darunter VPS-Services, Trading Central und verschiedene Copy-Trading-Services.

Gerade Neueinsteiger/innen profitieren vom hervorragenden Kundensupport von IC Markets, der rund um die Uhr zur Verfügung steht und bei allen Fragen zum Konto oder zu technischen Aspekten hilft. Der Bildungsbereich ist zwar umfangreicher als bei den meisten anderen Brokern, bietet aber nur eine recht begrenzte Auswahl an Marktanalysematerialien.

| 🏦 Min. Einzahlung | USD 200 |

| 🛡️ Geregelt durch | CySEC, FSA-Seychelles, SCB, CMA |

| 💵 Handelskosten | USD 8 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, MT5, cTrader, TradingView |

| 💱 Instrumente | Anleihen, Commodities, Kryptowährungen, Stock CFDs, Forex, Futures, Indices |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Streng reguliert

- Enge Spreads

- Große Auswahl an Anlagen

- Tolle Plattformauswahl

Nachteile

- Hohe Mindesteinlage

- Begrenzte Marktanalyse

Ist IC Markets sicher?

Bei IC Markets handelt es sich um einen sicheren Broker für deutsche Händler/innen. Das Unternehmen wird von den besten Regulierungsbehörden der Welt reguliert, darunter ASIC in Australien und CySEC in Zypern.

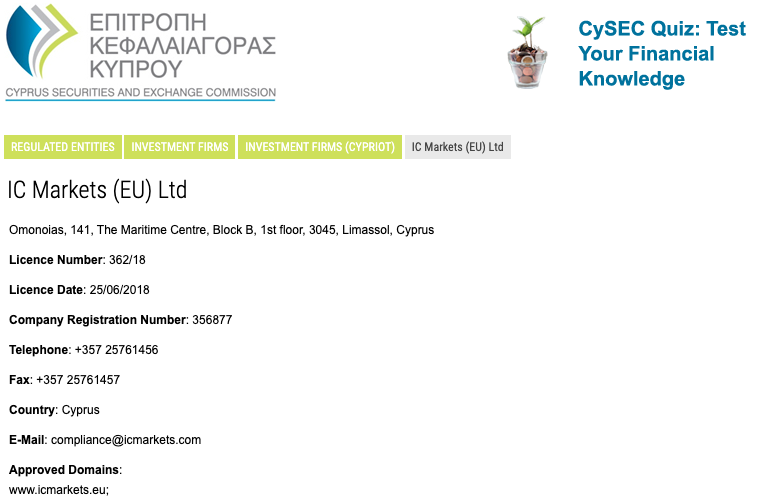

CySEC Regulierung: Deutsche werden unter der Tochtergesellschaft IC Markets EU Ltd. handeln, die von der Cyprus Securities and Exchange Commission (CySEC) zugelassen und reguliert wird.

Sicherheitsmerkmale: Als angesehene europäische Aufsichtsbehörde stellt die CySEC sicher, dass alle Kundengelder auf getrennten Konten gehalten werden und dass IC Markets seinen Händlern/innen einen Negativsaldo-Schutz bietet, der gewährleistet, dass die Kunden nicht mehr verlieren können, als sich auf ihrem Handelskonto befindet. Im Rahmen dieser Regulierung ist der Hebel bei den wichtigsten Währungspaaren auf 1:30 begrenzt, und es ist IC Markets untersagt, Boni und Werbeaktionen anzubieten.

Unternehmensdetails:

Finanzinstrumente von IC Markets

Im Vergleich zu seinen Mitbewerbern bietet IC Markets eine durchschnittliche Auswahl an handelbaren Vermögenswerten.

Im Folgenden sind die von IC Markets angebotenen Instrumente und die entsprechenden Hebelwirkungen aufgeführt:

- Devisenpaare: Bei IC Markets kann man 64 Devisenpaare handeln, darunter Majors, Minors und Exoten wie USD/ZAR und ZAR/JPY. Das entspricht in etwa dem Durchschnitt des Angebots der nächsten Konkurrenten.

- Rohstoffe: IC Markets bietet den Handel mit 28 Rohstoffen an, darunter Metalle, Energie und Landwirtschaft, was in etwa dem Durchschnitt der meisten anderen Broker entspricht.

- Aktien-CFDs: Das Angebot von IC Markets an Aktien-CFDs ist im Vergleich zu den meisten Konkurrenten breit gefächert: 1.600 Aktien-CFDs stehen zum Handel zur Verfügung, darunter beliebte US-Tech-Unternehmen, ASX-Aktien, Aktien, die an der NASDAQ und NYSE notiert sind, und mehr. Händler/innen sollten beachten, dass der Aktien-CFD-Handel nur auf MT5 möglich ist.

- Indizes: Bei IC Markets werden Kassa- und Futures-Kontrakte auf 23 internationale Indizes angeboten, darunter der NASDAQ, S&P500, FTSE100 und der Nikkei. Das ist eine durchschnittliche Auswahl an Indizes im Vergleich zu anderen Brokern.

- Anleihen: Bei IC Markets kann man mit 9 Anleihen handeln, was im Vergleich zu den meisten anderen Brokern ein breiteres Angebot darstellt.

- Futures: IC Markets bietet den Handel mit 4 globalen Futures an, darunter der DXY, VIX, BRENT und WTI, was im Vergleich zu den meisten anderen Brokern durchschnittlich ist.

- Kryptowährungen: Das Angebot von IC Markets umfasst eine recht breite Palette an Kryptowährungen, darunter Bitcoin, Bitcoin Cash, Ethereum, Dash Coin, Ripple und Litecoin. Die Spreads für diese Währungen sind variabel und deutlich höher als für Fiat-Währungen, aber im Einklang mit anderen Brokern.

Im Vergleich zu anderen Brokern ist das Angebot an Finanzinstrumenten bei IC Markets breit gefächert und umfangreich.

Konten und Handelsgebühren von IC Markets

Im Vergleich zu anderen Brokern bietet IC Markets drei Konten an, was durchschnittlich ist, und alle Konten haben eine Mindesteinlage von 200 USD.

Handelsgebühren: Die Handelskonten von IC Markets sind auf drei verschiedenen Plattformen verfügbar, darunter MT4, MT5 und cTrader. Beim Standardkonto sind die Handelskosten im Spread enthalten, während die Konten Raw Spread und cTrader engere Spreads gegen eine Kommission pro Lot bieten.

IC Markets’ Konto Handelskosten:

Wie die Tabelle oben zeigt, sind die Handelskosten für das cTrader Raw Spread Konto niedriger als die der anderen beiden Konten. Bei den meisten anderen Brokern liegen die Handelskosten bei 9 USD, was IC Markets zu einem der günstigsten Broker in der Branche macht.

Weitere Informationen zum Konto:

Standard Konto

Beim Standardkonto handelt es sich um ein kommissionsfreies Konto mit Spreads, die bei 0,8 Pips auf EUR/USD beginnen, was enger ist als bei anderen ähnlichen Brokern. Es ist auf den Plattformen Metatrader 4 und Metatrader 5 verfügbar, und Händler/innen können auf einen Hebel von bis zu 30:1. Das Standard-Konto ist ideal für diskretionäre Händler/innen.

Raw Spread Konto

Das echte ECN-Konto ist für den umfangreichen Handel oder für professionelle Händler/innen gedacht und erfordert eine Mindesteinlage von 200 USD. Die Spreads sind eng und liegen im 0.10 Pips auf den EUR/USD, allerdings wirdeine Kommission von 7 USD round turn pro Los berechnet, und die Hebelwirkung beträgt bis zu [fxs-broker-property identifier=”leverage”]. Auch dieses Konto ist nur auf den Metatrader-Plattformen verfügbar.

c-Trader Raw Spread Konto

Das für Daytrader und Scalper geeignete cTrader Raw Spread-Konto ist nur auf der c-Trader-Plattform verfügbar. Die Spreads beginnen bei 0,0 Pips auf den EUR/USD, und pro Lot wird eine Kommission von 6 USD (round turn) berechnet. Die Hebelwirkung beträgt auch bei diesem Konto bis zu 30:1, und die Mindesteinlage beträgt 200 USD. Trader sollten beachten, dass einige der bei IC Markets verfügbaren Tools nicht mit der cTrader-Plattform kompatibel sind.

Ein- und Auszahlungen

Bei IC Markets gibt es eine große Auswahl an Ein- und Auszahlungsmethoden. Während für die meisten Methoden keine Gebühren erhoben werden, sind Auszahlungen per Banküberweisung teuer.

Im Einklang mit den Anti-Geldwäsche-Bestimmungen bearbeitet IC Markets keine Zahlungen auf Konten Dritter. Sämtliche Auszahlungsanträge von einem Handelskonto werden auf ein Bankkonto oder eine Quelle auf den Namen des Händlers überwiesen.

Handelskontowährungen: Bei IC Markets kann man in zehn Basiswährungen handeln, darunter EUR, USD und GBP. Da wir Einzahlungen von einem europäischen Bankkonto in EUR auf unser EUR-Konto vorgenommen haben, wurden uns keine Gebühren für die Währungsumrechnung berechnet.

Einzahlungen und Abhebungen: Bei IC Markets gibt es eine Reihe von Einzahlungs- und Überweisungsmethoden, darunter Banküberweisung, Debit-/Kreditkarten und verschiedene eWallets. Einzahlungen sind bei allen Einzahlungsmethoden kostenlos und werden sofort oder innerhalb von 12 Stunden bearbeitet, außer bei Überweisungen von Broker zu Broker, die bis zu fünf Tage dauern können.

Auszahlungen, die vor 12 Uhr mittags (AEST/AEDT) eingehen, werden noch am selben Tag bearbeitet und IC Markets erhebt keine zusätzlichen Auszahlungsgebühren, außer bei internationalen Banküberweisungen. Je nach Zahlungsmethode können andere Gebühren anfallen:

- Auszahlungen per Kredit-/Debitkarte – Es fallen keine Auszahlungsgebühren an, aber es kann bis zu fünf Tage dauern, bis dein Konto erreicht wird.

- Internationale Banküberweisungen – Die IC Market-Bank erhebt eine Abhebungsgebühr von 20 AUD oder dem Gegenwert einer anderen Währung. Die Bearbeitung von Auszahlungen kann bis zu 14 Tage dauern.

- Auszahlungen per eWallet (Paypal/Neteller/Skrill) – Es werden keine Gebühren für Auszahlungen erhoben und sie werden sofort ausgeführt.

Alles in allem bietet IC Markets eine große Auswahl an Ein- und Auszahlungsmethoden, verlangt aber eine Gebühr von 20 AUD für Auszahlungen bei internationalen Banküberweisungen, was relativ teuer ist.

Mobile Handelsplattformen von IC Markets

Zwar hat IC Markets keine eigene Handels-App, aber MT4, MT5 und cTrader sind alle als mobile Apps verfügbar. Der cTrader ist einfacher zu bedienen als MT4 und MT5, da er eine modernere und intuitivere Oberfläche hat.

Alle drei Plattformen von IC Markets sind sowohl auf Android- als auch auf iOS-Mobilgeräten und Tablets verfügbar. Einsteiger sollten sich darüber im Klaren sein, dass es im Vergleich zu den Desktop-Handelsplattformen einige Einbußen bei der Funktionalität gibt, darunter reduzierte Zeitrahmen und weniger Charting-Optionen.

cTrader App

cTrader ist eine unserer beliebtesten Handelsplattformen, und IC Markets ist einer der wenigen Broker, die ihn unterstützen. Es handelt sich um eine der einsteigerfreundlichsten Handelsplattformen von Drittanbietern mit einer modernen Oberfläche, integrierten Bildungsinhalten und innovativen Risikomanagementfunktionen. Die mobile cTrader-App bietet die besten Funktionen der Desktop-Version, darunter die komplette Palette an Ordertypen, Handelsanalysen und Watchlists.

Darüber hinaus sind die Kosten für das cTrader Raw Spread-Konto von IC Markets niedriger als für die beiden anderen Konten.

MT4 und MT5 APPs

MetaTrader 4 (MT4) ist aufgrund seiner Benutzerfreundlichkeit, der funktionsreichen Umgebung und der Möglichkeit zum automatisierten Handel nach wie vor die weltweit beliebteste Handelsplattform für Forex-Händler/innen. Die neue Version der MetaTrader-Plattformsuite, MT5, wird von immer mehr Händlern/innen angenommen. MT5 enthält alle wichtigen Funktionen von MT4 und eine optimierte Umgebung für den EA-Handel.

Mit den IC Markets MT4- und MT5-APPs können Händler/innen von überall aus arbeiten und verfügen über neun Zeitrahmen, 30 Indikatoren und interaktive Währungscharts. Funktionen zum Schließen und Ändern bestehender Orders, zur Berechnung von Gewinn/Verlust in Echtzeit und zum Tick-Chart-Handel unterstützen die Händler auch unterwegs.

Alles in allem sind die mobilen Apps von IC Markets benutzerfreundlich und gut gestaltet und bieten die meisten der in den Desktop-Versionen verfügbaren Funktionen.

Weitere Handelsplattformen

Mit den verfügbaren Plattformen MT4, MT5 und cTrader bietet IC Markets Unterstützung für mehr Handelsplattformen als die meisten anderen Broker.

IC Markets bietet Händlern/innen den MetaTrader 4 (MT4), den MetaTrader 5 (MT5) und den cTrader, die jeweils Expert Advisors, automatisierte Handelsunterstützung, Strategie-Backtesting, anpassbare Charts, Indikatoren und Copy-Trading-Funktionen bieten.

Alle angebotenen Plattformen sind kostenlos, können auf deinen PC oder Mac heruntergeladen werden und verfügen über eine Webversion der Plattform. Händler, die mehr EAs nutzen möchten und denen die veraltete Benutzeroberfläche nichts ausmacht, sollten eines der MetaTrader-Produkte in Betracht ziehen. Für Anfänger/innen ist der cTrader oft der Favorit, da er weniger Einrichtungsaufwand erfordert, eine modernere Benutzeroberfläche hat und mehr fortgeschrittene Ordertypen bietet.

Obwohl IC Markets keine hauseigene Plattform hat, die für Anfänger in der Regel leichter zu erlernen ist, wird die Wahl einer der drei großen Plattformen die meisten Händler/innen zufrieden stellen.

Vergleich der Handelsplattformen:

Kontoeröffnung bei IC Markets

Wir haben festgestellt, dass IC Markets bei der Kontoeröffnung hervorragend abschneidet. Er ist unkompliziert und mühelos, und die Konten sind in der Regel innerhalb eines Tages für den Handel bereit.

Alle in Deutschland ansässigen Personen können ein Konto bei IC Markets eröffnen, sofern sie die Mindesteinlage von 200 USD pro Konto erfüllen.

Die Kontoeröffnung erfolgt in fünf Schritten und ist in der Regel schon nach einem Tag abgeschlossen. IC Markets bietet Einzel-, Gemeinschafts- und Firmenkonten an, aber wir werden uns auf die Eröffnung eines Einzelkontos konzentrieren.

Anleitung zur Eröffnung eines Kontos bei IC Markets:

- Auf die Schaltfläche “Ein Live-Konto eröffnen” klicken und Ihre E-Mail-Adresse und Ihr Passwort registrieren.

- Als Nächstes müssen die Händler/innen ihre persönlichen Daten eingeben, einschließlich Geburtsdatum und Adresse usw.

- Beim dritten Schritt muss man seine bevorzugte Basiswährung und den Kontotyp auswählen.

- Anschließend müssen die Händler/innen einen kurzen Fragebogen ausfüllen, in dem sie angeben, wie viel Erfahrung sie im Handel haben. In einer Branche, der oft ein unverantwortlicher Umgang mit dem Verbraucherschutz vorgeworfen wird, ist dies ein verantwortungsvoller Schritt des Brokers.

- Im letzten Schritt muss man seine Identität bestätigen. IC Markets benötigt die folgenden zwei Dokumente:

- Einen Ausweis mit Foto (Reisepass, Führerschein oder Personalausweis) und;

- einen zweiten Nachweis (einen Kontoauszug oder einen Auszug eines Versorgungsunternehmens mit vollständigem Namen und Adresse aus den letzten drei Monaten).

Wir empfehlen Ihnen, die Risikoaufklärung, die Kundenvereinbarung und die Allgemeinen Geschäftsbedingungen von IC Markets zu lesen, bevor Sie mit dem Handel beginnen.

Nachdem der Kundendienst Ihre Unterlagen überprüft hat, können Sie sich einloggen und Ihr Konto mit der Basiswährung Ihrer Wahl aufladen.

Verglichen mit anderen ähnlichen Brokern ist der Kontoeröffnungsprozess bei IC Markets schnell, in der Regel problemlos und vollständig digital.

Handelsinstrumente

Im Vergleich zu anderen ähnlichen Brokern sind die Handelswerkzeuge von IC Markets hervorragend.

Bei IC Markets gibt es eine Reihe nützlicher Trading-Tools, darunter einen kostenlosen VPS-Service, MAM/PAMM-Konten, Trading Central und fortschrittliche MT4-Trading-Tools. Zulutrade, myfxbook Autotrade und Autochartist sind über das Partnerprogramm von IC Markets verfügbar, aber die Nutzung dieser Dienste ist mit zusätzlichen Kosten verbunden. Weitere Informationen hierzu:

VPS

Bei IC Markets gibt es einen VPS-Service über drei Anbieter, nämlich ForexVPs.net, Beeks FX VPS und New York City Servers. Alle Dienstleistungen sind als monatliches Abonnement erhältlich, aber IC Markets übernimmt die Kosten, wenn das Handelsvolumen eines Kunden 15 Lots (Round Turn) pro Monat übersteigt.

VPS-Hosting ermöglicht es Händlern/innen, automatisierte algorithmische Strategien, einschließlich Expert Advisors, 24 Stunden am Tag, 7 Tage die Woche auf einer virtuellen Maschine laufen zu lassen. VPS-Dienste haben den Vorteil, dass es nie zu Verbindungsproblemen kommt und die Latenzzeit aufgrund der Nähe zu den großen internationalen Börsen extrem niedrig ist.

MAM/PAMM Konto

Bei IC Markets gibt es einen Kontoverwaltungsservice, der es den Kunden ermöglicht, in ihrem Namen zu handeln. Für diesen Service ist eine maßgeschneiderte Technologie oder Software erforderlich, die auch als MAM/PAMM bezeichnet wird. Die MAM-Software kommuniziert alle Zuweisungseinstellungen direkt mit dem IC Markets MetaTrader 4 Server.

MAM steht für Multi-Account Manager, der eine Reihe von anpassbaren Möglichkeiten für die Unterzuteilung von Geschäften bietet. PAMM steht für Percentage Allocation Module Manager, was bedeutet, dass Anleger Teil einer Reihe von Unterkonten sein können, die gemeinsam von einem Money Manager oder Trader gehandelt werden, der von den Kunden/innen die Erlaubnis hat, auf ihren Konten zu handeln. Die Kontoverwalter erhalten einen Teil der Gewinne, die mit den Geschäften erzielt werden.

Verwaltete Konten sind ideal für Einsteiger/innen, die nur wenig Erfahrung mit dem Handel haben.

Erweiterte Handelsinstrumente für MT4

Bei IC Markets gibt es 20 exklusive Handelswerkzeuge, die auf der MT4-Plattform verfügbar sind. Mit den erweiterten Handelsinstrumenten von MT4 können Händler/innen ihr Risiko verwalten, alle Transaktionen von einem einzigen Terminal aus kontrollieren und die Korrelationen zwischen Währungspaaren und anderen CFDs einsehen. Zu den Tools gehören unter anderem ausgefeilte Alarm- und Übertragungsfunktionen, eine Korrelationsmatrix, ein Sentiment Trader, eine Session Map sowie aktuelle Marktdaten und Funktionen.

Myfxbook Autotrade

Myfxbook Autotrade gehört zu den beliebtesten Copy-Trading-Plattformen auf dem Markt. Mit diesem Dienst kann man die Trades eines beliebigen Systems direkt auf sein IC Markets MetaTrader 4-Konto kopieren. Autotrade erhebt einen Spread-Aufschlag von 0,6 Pips für alle Kontooptionen, der relativ teuer ist.

Zu den Vorteilen der Myfxbook Autotrade Copy Trading Plattform gehört ihre Funktionalität. Sie bietet mehrere Copy-Trading-Modi und es gibt keine Begrenzung für die Anzahl der Strategieanbieter, denen man folgen kann.

Alles in allem ist das Copy Trading für Händler/innen nützlich, die sich für die Finanzmärkte interessieren, denen aber die Erfahrung und das Wissen fehlen.

Zulutrade

Zulutrade, eine Drittanbieterplattform, ist eine Peer-to-Peer Social-Trading-Anwendung, bei der Händler/innen unter Tausenden von registrierten Händlern/innen aus 192 Ländern wählen können. Die Händler/innen werden mit dem “ZuluRank” nach einer Reihe verschiedener Kriterien eingestuft, darunter ihre Gesamtleistung, Stabilität, Laufzeit, Engagement und das erforderliche Mindestkapital.

Für die Nutzung dieses Dienstes müssen die Händler/innen insgesamt einen Aufschlag von 2,2 Pips auf den Spread zahlen, was relativ hoch ist.

Autochartist

Autochartist ist ein automatisches Analysetool, das im Rahmen des Partnerschaftsprogramms von IC Markets angeboten wird, sodass für die Nutzung des Dienstes zusätzliche Kosten anfallen. Für nähere Informationen zu diesen Kosten müssen sich Händler/innen an den Kundendienst wenden.

Autochartist beobachtet 250+ CFDs rund um die Uhr und warnt Händler/innen automatisch vor wichtigen Handelsgelegenheiten und sich bildenden Trends mit der höchsten Wahrscheinlichkeit, den prognostizierten Preis zu treffen. Einige der wichtigsten Funktionen von Autochartist sind:

- Erkennung von Chartmustern

- Erkennung von Fibonacci-Mustern

- Analyse der Schlüsselebenen

- Anzeige der Qualität von Mustern

Insgesamt ist Autochartist eines der besten technischen Analysetools auf dem Markt.

Trading Central

Trading Central ist für Kunden zugänglich, die ein Live-Konto registrieren. Es handelt sich um ein Tool von Drittanbietern. Die professionellen Analysten von Trading Central nutzen die fortschrittlichsten technischen Analysetools der Branche, um relevante Informationen zusammenzustellen. Dieses Tool unterstützt vor allem Händler/innen ohne technisches Know-how bei ihren Handelsentscheidungen. Trading Central gehört zu den beliebtesten Trading-Tools und bietet hervorragende Marktanalysen, und IC Markets tut gut daran, seinen Kunden diesen Service zu bieten.

Alles in allem bietet IC Markets im Vergleich zu den meisten anderen Brokern eine große Anzahl an Handelswerkzeugen, mit denen die meisten Händler/innen zufrieden sein dürften. Einige der Tools sind jedoch nur auf den MetaTrader-Plattformen verfügbar.

IC Markets für Einsteiger

Bei IC Markets handelt es sich um einen der wenigen echten ECN-Broker, die für Anfänger/innen zugänglich sind. Bei vielen anderen ECN-Brokern gibt es keine Schulungen und Analysen, so dass die Händler/innen gezwungen sind, sich mit Material von Dritten weiterzubilden. Mit einer umfangreichen Bibliothek von Kursmaterialien, unabhängigen Marktanalysen und Webinaren bietet IC Markets neuen Händlern/innen eine umfassende Ausbildung im Devisenhandel. Allerdings sind die meisten Materialien nur auf Englisch verfügbar. IC Markets unterstützt außerdem alle drei führenden Software-Optionen und bietet einen 24/7 Kundendienst in deutscher Sprache.

Bildungsmaterial

Im Vergleich zu seinen Mitbewerbern ist das Lehrmaterial von IC Markets hervorragend. Die Materialien sind gut strukturiert und umfangreich und richten sich sowohl an Anfänger als auch an erfahrene Händler/innen.

IC Markets verfügt über ein umfangreiches, kostenloses Bildungsportal, das jedem offensteht, egal ob er ein Konto bei IC Markets hat oder nicht. Im Gegensatz zu anderen Brokern, bei denen das Bildungsmaterial oft unstrukturiert ist, bietet IC Markets eine Auswahl von Blogbeiträgen, die nach Themen geordnet sind. Darüber hinaus ist es offensichtlich, dass IC Markets viel in die Ausbildung von Tradern aller Erfahrungsstufen investiert hat. Die wichtigsten Elemente des Bildungsbereichs sind:

- Forex-Grundlagen

- Technische Analyse

- Fundamentale Analyse

- Risikomanagement

- Handelspsychologie

- Handelsplan

Für neue Kunden gibt es Anleitungsvideos, die bei der Einrichtung der Handelssoftware helfen. Die Videos behandeln Themen wie das Herunterladen eines Demokontos, die Verwendung des One-Click-Trade-Managers, die Absicherung einer Order im MetaTrader 4 und die Verwendung des Handelsterminals. Darüber hinaus behandeln die Videos weitere nützliche Themen wie technische Analyse und Risikomanagement.

IC Markets stellt auch eine Reihe von zuvor aufgezeichneten Webinaren zur Verfügung, die von sachkundigen Pädagogen gehalten werden, die ihr Fachwissen genau kennen. In den Webinaren geht es hauptsächlich um technische Analysen wie Muster, Fibonacci im Handel, Candlesticks sowie Fading und Scalping. Zusätzlich gibt es Sitzungen zu den Themen Marktstruktur, Marktdynamik und Psychologie für professionelle Trader.

Alles in allem ist der Bildungsbereich von IC Markets gut strukturiert und detailliert und richtet sich an Händler/innen aller Erfahrungsstufen.

Bildung im Vergleich:

Analysematerial

Im Vergleich zu anderen großen internationalen Brokern sind die Marktforschungsmaterialien von IC Markets etwas begrenzt, aber IC Markets bietet allen Kunden/innen, die ein Konto eröffnen, die Dienste der Trading Central an.

Auf dem Blog von IC Markets werden täglich aktuelle Marktanalysen zu den neuesten Marktbewegungen veröffentlicht. Außerdem gibt es täglich Artikel zur technischen Analyse und zur Fundamentalanalyse, die einen detaillierten Einblick in die beliebtesten handelbaren Instrumente geben.

Mit der Registrierung eines Kontos erhalten Kunden/innen auch Zugang zur Trading Central-Analyse. Trading Central ist ein unabhängiges Unternehmenstool, das für neue Händler/innen empfohlen wird, die die technische Analyse erlernen möchten, oder für diejenigen, die eine unabhängige Meinung zu ihren Geschäften haben möchten.

Alles in allem ist der Marktanalysebereich von IC Markets gut, aber das Unternehmen könnte sein Marktanalysematerial verbessern, indem es umfassendere und formatübergreifende Inhalte anbietet.

Kundendienst

Im Vergleich zu anderen Brokern ist der Kundendienst von IC Markets hervorragend und rund um die Uhr erreichbar, was außergewöhnlich ist, wenn man bedenkt, dass die Norm 24/5 ist.

IC Markets verfügt über eine eigene Support-Abteilung, die rund um die Uhr per Live-Chat, E-Mail und Telefon in deutscher Sprache erreichbar ist. Bei allgemeinen Fragen und Anliegen helfen Live-Chat und Telefon-Support weiter. Anfragen, die sich an bestimmte Abteilungen richten, wie z.B. die Buchhaltung, sind jedoch nur per E-Mail möglich. Zudem gibt es einen umfassenden FAQ-Bereich, in dem die am häufigsten gestellten Fragen beantwortet werden.

Im Rahmen dieser Bewertung empfanden wir den Kundendienst als höflich, reaktionsschnell und sachkundig – er konnte die meisten unserer Fragen beantworten.

Sicherheit und Anerkennung der Industrie

Geschichte: Bei IC Markets handelt es sich um einen reinen ECN-Devisen- und CFD-Broker, der 2007 gegründet wurde und seinen Hauptsitz in Sydney, Australien, hat. Seit seiner Gründung ist IC Markets schnell gewachsen und hat sich zu einer der angesehensten Marken im CFD-Handel entwickelt. Täglich werden mehr als 500.000 Transaktionen mit einem Gesamtvolumen von 15 Milliarden USD getätigt.

Regulierung: Die Regulierung von IC Markets erfolgt durch die Australian Securities and Investment Commission (ASIC), die Cyprus Securities and Exchange Commission (CySEC), die Financial Services Authority of Seychelles (FSA) und die Securities Commission of the Bahamas (SCB). Weitere Informationen:

- International Capital Markets Pty Ltd (ACN 123 289 109), wird von der Australian Securities and Investment Commission reguliert und zugelassen, license 335692.

- IC Markets EU Ltd ist autorisiert und reguliert von der Cyprus Securities and Exchange Commission mit der Lizenznummer 362/18.

- IC Markets Ltd, ist auf den Bahamas unter der Registrierungsnummer 76823 C registriert und wird von der Securities Commission of The Bahamas unter der Lizenznummer SIA-F214 reguliert.

- Raw Trading Ltd (Trading as IC Markets Global) – wird von der Financial Services Authority of Seychelles mit einer Wertpapierhändlerlizenznummer reguliert: SD018.

Auszeichnungen:

Im Laufe der Jahre hat IC Markets auch zahlreiche Branchenauszeichnungen erhalten, darunter Best Forex MT5 Broker 2020 (FX Scouts) für seine bemerkenswerten Ausführungsgeschwindigkeiten und seine Handelsflexibilität auf der MT5-Plattform.

Mit über einem Jahrzehnt verantwortungsvollen Handelns und einer strengen Aufsicht durch einige der strengsten Regulierungsbehörden der Welt gilt IC Markets als sicherer Broker, bei dem es sich lohnt zu handeln.

Bewertungsmethode

Bei der Überprüfung unserer Partner legen wir Wert auf Transparenz und Offenheit. Um die Transparenz in den Vordergrund zu rücken, haben wir unseren Bewertungsbericht veröffentlicht. Entscheidend ist dabei die Bewertung der Zuverlässigkeit des Brokers, des Plattformangebots des Brokers und der Handelsbedingungen, die den Kunden/innen angeboten werden und die in dieser Bewertung zusammengefasst sind. Die einzelnen Punkte werden benotet und eine Gesamtnote wird berechnet und dem Broker zugewiesen.

Risikoerklärung von IC Markets

Der Devisenhandel ist riskant, und jeder Broker ist verpflichtet, seinen Kunden/innen genau zu erklären, wie riskant der Handel mit Forex CFDs ist. IC Markets informiert darüber: CFDs sind komplexe Instrumente und bergen aufgrund der Hebelwirkung ein hohes Risiko, schnell Geld zu verlieren. 74-89% der Konten von Privatanlegern verlieren beim Handel mit CFDs Geld. Sie sollten sich überlegen, ob Sie verstehen, wie CFDs funktionieren und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren.

Überblick

Der streng regulierte Broker IC Markets ist ein hochmoderner ECN-Forex-Broker, der sein Netzwerk von Liquiditätsanbietern nutzt, um seinen Kunden/innen die besten Handelsbedingungen zu bieten. IC Markets stellt drei Live-Handelskonten zur Verfügung, die sowohl für Anfänger als auch für erfahrene Händler/innen auf den Plattformen MT4, MT5 und cTrader geeignet sind, und bietet eine breite Palette an Handelswerkzeugen. Anfängern bietet IC Markets einen hochwertigen deutschsprachigen 24/7-Kundendienst, der den Einstieg in den Handel erleichtert, sowie ein erstklassiges Angebot an Lehrmaterial. Alles in allem ist IC Markets eine verlässliche Wahl für Händler/innen aller Erfahrungsstufen.

Redaktionsteam

Chris Cammack

Leiter Inhalt

Chris kam 2019 zum Unternehmen, nachdem er zehn Jahre lang in den Bereichen Forschung, Redaktion und Design für politische und finanzielle Publikationen tätig war. Aufgrund seines Werdegangs kennt er sich mit den internationalen Finanzmärkten und der Geopolitik, die sie beeinflusst, bestens aus. Chris hat ein scharfes Auge für die Redaktion und einen unersättlichen Appetit auf aktuelle finanzielle und politische Themen. Er gewährleistet, dass unsere Inhalte auf allen Seiten die Qualitäts- und Transparenzstandards erfüllen, die unsere Leser/innen erwarten.

Alison Heyerdahl

Senior Finanzredakteurin

Im Jahr 2021 kam Alison als Autorin zum Team. Sie hat einen medizinischen Abschluss mit Schwerpunkt Physiotherapie und einen Bachelor in Psychologie. Ihr Interesse am Forex-Handel und ihre Liebe zum Schreiben hat sie jedoch dazu gebracht, den Beruf zu wechseln. Sie verfügt nun über mehr als acht Jahre Erfahrung in der Forschung und Inhaltsentwicklung. Bislang hat sie über 100 Broker getestet und bewertet und kennt die Welt des Forex-Handels in- und auswendig.

Ida Hermansen

Finanzredakteurin

2023 kam Ida als Finanzredakteurin zu unserem Team. Sie hat einen Abschluss in Digitalem Marketing und einen Hintergrund in Content Writing und SEO. Zusätzlich zu ihren Marketing- und Schreibfähigkeiten interessiert sich Ida auch für Kryptowährungen und Blockchain-Netzwerke. Ihr Interesse am Krypto-Handel führte zu einer größeren Faszination für die technische Analyse von Devisen und Preisbewegungen. Sie entwickelt ihre Fähigkeiten und Kenntnisse im Forex-Handel ständig weiter und beobachtet genau, welche Forex-Broker die besten Handelsbedingungen für neue Händler/innen bieten.

Broker vergleichen

Finden Sie heraus, wie IC Markets im Vergleich zu anderen Brokern abschneidet.

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.