FxPro Test und Erfahrungen

Zuletzt aktualisiert am Dezember 18, 2023

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu FxPro

Der streng regulierte Broker FxPro bietet eine große Auswahl an Konten, vernünftige Mindesteinlagen, eine hervorragende Auswahl an Handelsplattformen und großartige Handelswerkzeuge. Für deutsche Händler/innen ist es außerdem interessant, dass FxPro in der EU reguliert ist und eine Reihe von Schutzmechanismen bietet, wie z. B. den Schutz vor negativen Salden und Entschädigungen für Anleger/innen.

Einige Probleme, die wir bei FxPro gefunden haben, sind jedoch, dass die Handelskosten im Allgemeinen viel höher sind als bei anderen Brokern und dass das Bildungsangebot und die Marktanalysen begrenzt sind. Allerdings waren wir beeindruckt von der Benutzerfreundlichkeit der mobilen Handels-App von FxPro und der Qualität des Kundensupports, den wir erhielten. Der Kundendienst ist in mehreren Sprachen, darunter auch Deutsch, 24 Stunden am Tag und sieben Tage die Woche erreichbar.

| 🏦 Min. Einzahlung | USD 100 |

| 🛡️ Geregelt durch | FCA, CySEC, FSCA, DFSA |

| 💵 Handelskosten | USD 14 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, MT5, cTrader, FxProEdge |

| 💱 Instrumente | Kryptowährungen, Energien, Stock CFDs, Forex, Futures, Indices, Metalle |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Streng reguliert

- Tolle Plattformauswahl

- Enge Spreads

Nachteile

- Begrenzte Ausbildung

Ist FxPro sicher?

Da FxPro von einigen der weltweit führenden Behörden reguliert wird, gilt es als sicherer Broker für deutsche Trader.

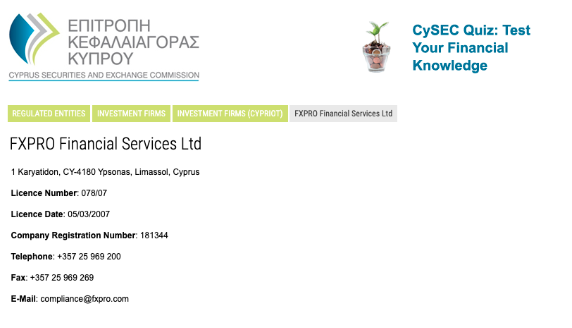

CySEC Regulierung: Die deutschen Händler/innen von FxPro werden über die Tochtergesellschaft FxPro Financial Services Ltd. handeln, die von der Cyprus Securities and Exchange Commission (CySEC) zugelassen ist und reguliert wird:

Sicherheitsmerkmale: Zum Schutz der Händler/innen hat die CySEC eine Reihe von Beschränkungen eingeführt. Sie schützt deutsche Kunden, indem sie sicherstellt, dass FxPro:

- Die Kundengelder werden vom Betriebskapital getrennt.

- Beschränkt die Hebelwirkung beim Devisenhandel auf 30:1.

- Alle Kunden/innen sind gegen einen negativen Kontostand geschützt, d.h. Händler/innen können nie mehr Geld verlieren, als sie auf ihren Handelskonten haben.

Unternehmensangaben:

Finanzielle Instrumente

Im Vergleich zu anderen Brokern ist das Angebot an Finanzinstrumenten bei FxPro etwas begrenzt, aber es bietet eine anständige Auswahl an Forex-Paaren und Kryptowährungen.

Finanzinstrumente und Hebelwirkung:

- Forex: Über 70 Währungspaare stehen bei FxPro zum Handel zur Verfügung, darunter Majors (EUR/USD, GBP/USD und USD/JPY) und Minors (NZD/CAD, EUR/JPY und USD/ZAR) sowie Exoten. Die Hebelwirkung auf Forex-Paare beträgt bis zu 30:1.

- Aktien-CFDs: Das Angebot von FxPro umfasst 275 Aktien-CFDs, was im Vergleich zu anderen Brokern wenig ist. Die Auswahl umfasst jedoch einige der größten US-Unternehmen, darunter Mcdonald’s, Adobe, Mastercard und Facebook. Der Hebel bei Aktien-CFDs liegt bei bis zu 5:1.

- Futures: Das Angebot an Futures ist im Vergleich zu anderen Brokern begrenzt: Es stehen 20 Future-CFDs zum Handel zur Verfügung. Der maximale Hebel für alle Futures beträgt bis zu 20:1, aber bei Energie-Futures können Händler/innen auf einen Hebel von bis zu 10:1 zurückgreifen.

- Indizes: Im Vergleich zu anderen Brokern ist das Angebot an Indizes bei FxPro ebenfalls begrenzt: Es gibt nur 19 Indizes. Am beliebtesten sind die Indizes, die die Aktien einiger der größten und weltweit anerkannten Unternehmen zusammenfassen. Die Hebelwirkung bei Indizes beträgt bis zu 20:1.

- Spot-Metalle: Bei FxPro ist der Handel mit 7 Spotmetallen möglich, darunter Gold, Silber und Platin. Die Hebelwirkung beträgt bis zu 1:20 bei Gold und Silber, aber 1:10 bei Platin.

- Kryptowährungen: Mit 28 Kryptowährungen bietet FxPro ein breiteres Spektrum als andere ähnliche Broker.

Im Vergleich zu anderen ähnlichen Brokern bietet FxPro insgesamt eine begrenzte Auswahl an Finanzanlagen, aber das Angebot an Devisen und Kryptowährungen ist hervorragend.

Konten- und Handelsgebühren

Obgleich FxPro mehr Kontooptionen als andere Broker bietet, sind die anfallenden Handelsgebühren überdurchschnittlich hoch.

Handelsgebühren: Bei unserer Überprüfung haben wir festgestellt, dass FxPro fünf Live-Kontotypen anbietet, die alle eine Mindesteinzahlung von 100 EUR erfordern, aber FxPro empfiehlt eine Einzahlung von 1.000 EUR. Handelsgebühren variieren je nach der vom Händler gewählten Plattform. Bei den MT4-, MT5- und FxPro Edge-Konten sind die Handelsgebühren im Spread enthalten, während das cTrader-Konto engere Spreads gegen eine Provision bietet.

Konto-Handelskosten:

Wie die Tabelle oben zeigt, sind die Handelskosten beim cTrader-Konto niedriger als bei den anderen Konten, aber immer noch höher als bei anderen Brokern. Bei den anderen drei Konten sind die Handelskosten in den Spreads enthalten, die ebenfalls deutlich über dem Branchendurchschnitt liegen. Wettbewerbsfähigere Broker haben in der Regel Handelskosten von durchschnittlich 9 USD für ihre kommissionsfreien Konten und etwa 8 USD für Konten, für die Provisionen erhoben werden.

MT4-Konto

Beim MT4-Konto handelt es sich um ein Marktausführungskonto, das den Handel mit Devisen, Metallen, Aktien, Indizes, Energien und Futures ermöglicht. In den Spreads sind die Gebühren enthalten. Sie liegen im Durchschnitt bei 1,71 Pips für den EUR/USD und sind damit deutlich höher als bei anderen Brokern.

MT4 Instant-Konto

Das MT4 Instant-Konto ist ähnlich wie das MT4 Konto, mit dem Unterschied, dass es eine sofortige Ausführung bietet. Die Gebühren sind im Spread enthalten, der im Durchschnitt bei 1,84 Pips für den EUR/USD liegt, und der Handel wird in Mikrolosen angeboten.

MT5-Konto

Mit dem MetaTrader 5-Konto nutzt man die neueste Generation der beliebten Handelsplattform. Dieses Konto bietet Marktausführung und variable Spreads, die bei 1,41 Pips für EUR/USD beginnen und im Durchschnitt bei 1,65 Pips liegen, was breiter ist als bei anderen ähnlichen Brokern. Sämtliche Gebühren sind in den Spreads enthalten, und es werden keine Provisionen erhoben.

cTrader-Konto

In diesem Konto liegen die Spreads im Durchschnitt bei 0,31 Pips für den EUR/USD und es wird eine Kommission von 9 USD pro gehandeltem Lot berechnet. Diese Handelsgebühren sind zwar niedriger als bei anderen Konten, aber immer noch höher als bei anderen ähnlichen Brokern. Der Handel wird für Devisen, Metalle, Indizes und Energien angeboten.

FxPro (EDGE)

Auch das FXPro Edge-Konto ist ein Marktausführungskonto, das den Handel mit allen Instrumenten (Forex, Metalle, Indizes, Kryptos, Energien, Aktien und Anteile) ermöglicht. Der durchschnittliche Spread für den EUR/USD liegt bei 1,71 Pips und es fallen keine Gebühren an, wie beim MT4-Marktkonto. Da dieses Konto nur auf der hauseigenen Plattform von FxPro verfügbar ist, ist kein algorithmischer Handel möglich.

Islamische Swap-freie Konten

Bei FxPro werden nur Swap-freie Konten für religiöse Zwecke gemäß dem Scharia-Gesetz angeboten. Um ein Konto zu eröffnen, müssen Händler/innen ein offizielles Dokument wie eine Geburts- oder Heiratsurkunde oder ein offizielles Schreiben des Leiters ihrer lokalen muslimischen Gemeinde vorlegen. Statt der Zinsen für Übernachtpositionen wird islamischen Händlern/innen eine Provision von 7,50 USD pro Lot berechnet, die jedoch erst ab der 8. Nacht des Handels.

FxPro Ein- und Auszahlungen

Im Vergleich zu anderen Brokern sind die Ein- und Auszahlungsgebühren bei FxPro niedrig. Allerdings erhebt FxPro bei bestimmten Auszahlungsmethoden eine Gebühr, wenn kein Handel stattgefunden hat.

Als streng regulierter Broker stellt FxPro sicher, dass alle Anti-Geldwäsche-Bestimmungen befolgt werden und dass alle nicht gewinnbringenden Auszahlungen an die Einzahlungsquelle zurückgegeben werden.

Akzeptierte Einzahlungswährungen: Bei der Eröffnung unseres Kontos stellten wir fest, dass das FxPro-Kundenportal Händlern die Wahl zwischen acht Basiswährungen ermöglicht, darunter USD, EUR, GBP, CHF, PLN, AUD, JPY und ZAR. Da wir Einzahlungen in EUR von unserem deutschen Bankkonto auf unser EUR-basiertes Handelskonto vorgenommen haben, wurden uns keine Währungsumrechnungsgebühren berechnet.

Einzahlungsmethoden: Zu unserer Freude bietet FxPro eine große Auswahl an Zahlungsmethoden an und erhebt keine Gebühren für Ein- oder Auszahlungen. Im Folgenden ist eine vollständige Liste der Zahlungsoptionen und Auszahlungsbedingungen:

Für Auszahlungen über E-Wallets wie Skrill und Neteller wird keine Gebühr erhoben, aber es gibt Bedingungen:

- Skrill: Eine Gebühr von bis zu 2,6 % wird erhoben, wenn eine Auszahlung beantragt wird, ohne dass gehandelt wurde.

- Neteller: Eine Gebühr von bis zu 2 % wird erhoben, wenn eine Auszahlung beantragt wird, ohne dass gehandelt wurde.

Im Großen und Ganzen bietet FxPro eine anständige Auswahl an Ein- und Auszahlungsmethoden und die Gebühren sind im Vergleich zu anderen ähnlichen Brokern niedrig.

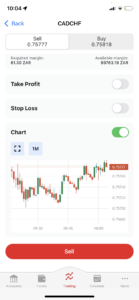

Mobile Handelsplattformen von FxPro

Die Unterstützung der mobilen Plattformen von FxPro ist sowohl für Android als auch für iOS verfügbar und ist im Vergleich zu anderen ähnlichen Brokern hervorragend.

FxPro Mobiler Handel

Benutzerfreundlich: Wir haben festgestellt, dass die App sehr einfach einzurichten und zu nutzen ist. Der biometrische Login ist sehr praktisch, und wir konnten ganz einfach nach unseren Vermögenswerten und Geschäften suchen, sie überwachen und Watchlists erstellen. Zudem verfügt die App über einen interaktiven Wirtschaftskalender, und wir konnten Geld überweisen, einzahlen und abheben.

|  |

Nachteile: Im Gegensatz zur Webtrader-Version der Plattform gibt es leider keine technischen Indikatoren oder grafischen Objekte, eine geringere Anzahl von Zeitrahmen und nur vier statt sechs Charttypen. Außerdem unterstützt die FxPro Mobile Trading App keinen automatisierten Handel, aber FxPro bietet für diese Zwecke MT4, MT5 und cTrader an.

MetaTrader Mobile Trading

Die MT4- und MT5-Apps erlauben es Händlern/innen, von überall aus zu arbeiten. Sie bieten neun Zeitrahmen, 30 Indikatoren und interaktive Währungsdiagramme. Funktionen zum Schließen und Ändern bestehender Aufträge, zur Berechnung von Gewinnen/Verlusten in Echtzeit und zum Handel mit Tick-Charts unterstützen die Händler/innen auch von unterwegs.

cTrader Mobile Trading

Die cTrader Mobile App hat die meisten der besten Funktionen aus der Desktop-Version übernommen, darunter die komplette Palette an Ordertypen, Preiswarnungen, Handelsanalysen und Symbolüberwachungslisten. Allerdings wurden die Charttypen auf 4 reduziert.

Andere Handelsplattformen von FxPro

Durch die Unterstützung von MT4, MT5, cTrader und dem FX Pro Edge verfügt FxPro über mehr Handelsplattformen als die meisten anderen Makler.

FxPro Edge

Wir glauben, dass die FxPro-Plattform eine großartige Option für diejenigen ist, die ihre Gelder bequem verwalten und die gesamte Palette der CFD-Anlageklassen direkt von der FxPro-App aus handeln möchten, ohne weitere Anwendungen installieren zu müssen. Die Plattform bietet über 50 technische Indikatoren und Charting-Tools, abnehmbare Chart-Fenster, nützliche Trading-Widgets, ein anpassbares Layout und 6 Chart-Typen mit 15 Zeitrahmen. Im Gegensatz zu den anderen Plattformen lässt sich die FxPro-Plattform jedoch nicht mit Trading Central integrieren, bietet keinen algorithmischen Handel und hat nicht die Ausführungsgeschwindigkeit von MT4/5. Darüber hinaus bietet die FxPro-Handelsplattform im Gegensatz zu cTrader keinen Zugang zur vollen Markttiefe.

MT4, MT5, und cTrader

Die Handelsplattformen MT4, MT5 und cTrader gehören zu den besten in der Branche. Obwohl MT5 eine neuere und verbesserte Version der MT4-Plattform ist, bleibt die MT4-Plattform der Industriestandard. Für Anfänger können MT4 und MT5 schwierig einzurichten sein, aber es gibt zahlreiche Anleitungen im Text- und Videoformat, die dich durch diesen Prozess führen. cTrader ist einsteigerfreundlicher und erfordert weniger Anpassungen, um ihn für den Devisenhandel zu optimieren. Allerdings gibt es weniger Anleitungen, die im Internet frei verfügbar sind.

Der Kundendienst für die Handelsplattform von FxPro gehört zu den besten in der Branche. Abgesehen von dem hervorragenden Metatrader-Angebot bietet FxPro auch den cTrader und eine eigene Plattform an, die im Allgemeinen einfacher einzurichten und zu nutzen sind.

Plattformvergleich:

Kontoeröffnung bei FxPro

Die Kontoeröffnung ist bei FxPro besonders gut. Es ist unkompliziert und mühelos, und die Konten sind in der Regel innerhalb von zwei Stunden für den Handel bereit.

Als deutsche(r) Händler/in kann man bei FxPro ein Konto eröffnen, muss aber sicherstellen, dass man über ausreichende Handelskenntnisse und/oder -erfahrungen verfügt, um die mit dem Handel von Hebelprodukten verbundenen Risiken zu verstehen. Obwohl dies als lästig erscheinen mag, ist es ein verantwortungsvoller Schritt des Brokers, um den Kundenschutz zu gewährleisten.

Die Kontoeröffnung läuft wie folgt ab:

- Das Anmeldeformular von FxPro verlangt von den Kunden, dass sie ihre E-Mail-Adresse, ihren Namen, ihre Telefonnummer, das Land ihres Wohnsitzes und ihr Geburtsdatum angeben. An die angegebene E-Mail-Adresse wird ein Bestätigungs-Pin gesendet.

- FxPro bittet die angehenden Händler/innen dann, Fragen zu ihrem Finanzwissen und ihrer Handelserfahrung zu beantworten.

- Daraufhin wählen die Händler/innen eine Handelsplattform (MT4, MT5, FxPro Edge oder cTrader), den Standardhebel, die Basiswährung und ihre bevorzugte Kommunikationssprache.

- Zur Überprüfung ihrer Identität müssen sie eine Kopie ihres Personalausweises oder Reisepasses mit der Unterschriftenseite sowie eine Kopie einer aktuellen Rechnung eines Versorgungsunternehmens oder eines Kontoauszugs, der den Namen und die Adresse des Kunden enthält und nicht älter als drei Monate ist, einreichen.

- Nach Ausfüllen des “Antragsformulars zur Kontoeröffnung” wird FxPro die Informationen nutzen, um weitere Nachforschungen über potenzielle Händler/innen anzustellen, um deren Eignung festzustellen. FxPro behält sich das Recht vor, in jeder Phase der Beziehung zu seinen Kunden/innen eine Bewertung vorzunehmen.

Gegenüber anderen ähnlichen Brokern ist der Kontoeröffnungsprozess bei FxPro schnell und in der Regel problemlos und die Konten sind in der Regel innerhalb von zwei Stunden für den Handel verfügbar.

Handelsinstrumente

Im Vergleich zu anderen ähnlichen Brokern sind die Handelsinstrumente von FxPro durchschnittlich. Allerdings bietet das Unternehmen Zugang zu Trading Central, einem weltweit führenden Anbieter für technische und fundamentale Analysen, und einen VPS-Service.

Die Handelsinstrumente von FxPro umfassen den Zugang zu Trading Central, einen VPS-Service gegen Aufpreis, einen Wirtschaftskalender und verschiedene Rechner.

Trading Central

Trading Central steht allen FxPro-Kunden kostenlos zur Verfügung. Als Instrument eines Drittanbieters nutzen die professionellen Analysten von Trading Central die fortschrittlichsten technischen Analysetools der Branche, um alle umfassenden und detaillierten Informationen zu sammeln. Bei ihren Entscheidungen stützen sie sich auf die Bildung von Preiskorridoren und Widerstandsniveaus, digitale und grafische Indikatoren für verschiedene Klassen sowie das Erkennen von Candlestick-Mustern. Dieses Instrument unterstützt im Wesentlichen Händler/innen ohne technisches Know-how bei ihren Handelsentscheidungen. Dieses dynamische Produktpaket steht Händlern über die Plattformen MT4/MT5 zur Verfügung. Trading Central gehört zu den besten Handelsinstrumenten in der Branche, und FxPro tut gut daran, seinen Kunden dieses Tool anzubieten.

VPS

Die FxPro Virtual Private Server (Forex VPS) ermöglichen es, die MT4 Expert Advisors und cAlgo Robots 24 Stunden am Tag hochzuladen und zu betreiben, ohne dass man sein Trading-Terminal laufen lassen muss. Die VPS-Dienste von FxPro sind für 30 USD pro Monat erhältlich und werden von einem Drittanbieter, Beeks FX VPS, bereitgestellt. VPS-Dienste bieten den Vorteil, dass es nie zu Verbindungsproblemen kommt und die Latenzzeit aufgrund der Nähe zu den großen internationalen Börsen extrem niedrig ist.

Wirtschaftskalender

Bei FxPro gibt es einen guten Wirtschaftskalender, der Händlern/innen hilft, ihren Handel auf der Grundlage von anstehenden Wirtschaftsberichten, früheren wirtschaftlichen Ereignissen, Konsensprognosen und der geschätzten Volatilität zu planen.

Trading-Rechner

Mit den verschiedenen Rechnern von FxPro können Händler/innen die Provisionen, die benötigte Marge und die Gesamtkosten für ihre Geschäfte berechnen.

Im Vergleich zu anderen ähnlichen Brokern bietet FxPro insgesamt eine durchschnittliche Auswahl an Tools, und seine VPS-Dienste sind gegen Aufpreis erhältlich.

Handelsinstrumente im Vergleich:

FxPro für Anfänger

Bei FxPro handelt es sich um einen der größten und angesehensten Broker in der Branche, der eine ausgezeichnete Wahl für neue Händler/innen ist – er bietet einen 24/7-Kundensupport in deutscher Sprache. Im Vergleich zu anderen Brokern bietet FxPro jedoch nur eine begrenzte Auswahl an Bildungs- und Marktanalysematerialien. Diese werden in schriftlicher Form und als Video präsentiert.

Bildungsinhalte von FxPro

Im Vergleich zu anderen ähnlichen Brokern bietet FxPro nur eine begrenzte Auswahl an Bildungsmaterialien, aber ein gutes Demokonto.

Das Angebot von FxPro umfasst eine öffentlich zugängliche Bibliothek mit Informationen zu Forex, technischer Analyse, Fundamentalanalyse und Handelspsychologie. Obwohl das Material wenig Struktur und Tiefe hat, sind die Informationen genau.

Das Bildungsangebot umfasst eine Reihe von Artikeln über die Grundlagen des Forex-Handels, die zwar begrenzt, aber für Anfänger hilfreich sind. Es gibt auch einige Ressourcen für fortgeschrittene Händler, wie z. B. Fundamentalanalyse 2.0. Die Videos behandeln Themen wie Handelsgewohnheiten, Währungspaare und Marktteilnehmer.

Die Webinare von FxPro finden mehrmals pro Woche statt und können live besucht werden, wenn du ein Konto registrierst. Zudem werden die Webinare auf den YouTube-Kanal hochgeladen und können zu einem späteren Zeitpunkt angesehen werden. Die Themen der Webinare variieren von Handelsstrategien bis hin zu technischen und fundamentalen Analysen.

Demo-Konten

Interessierte Händler/innen können auf jeder der unterstützten Plattformen ein FxPro-Demokonto eröffnen. Mit einem virtuellen Guthaben von 500.000 USD ausgestattet, sind Demokonten für alle Plattformen verfügbar. Mit Demokonten kann man sich mit den Märkten vertraut machen und Handelsstrategien üben.

Allgemein ist der Bildungsbereich von FxPro begrenzt und bietet Anfängern und fortgeschrittenen Händlern/innen nur wenig Unterstützung.

Bildungsvergleich:

Analyse-Material

Gegenüber anderen ähnlichen Brokern bietet FxPro nur eine begrenzte Auswahl an Marktanalysematerialien an, und diese sind nur auf Englisch verfügbar.

Das Angebot von FxPro umfasst eine Vielzahl von Nachrichtenressourcen, darunter auch einen Marktüberblick, der von unserem hauseigenen Analystenteam kuratiert wird. Die Inhalte werden täglich aktualisiert, und der News-Blog unterstützt die Leser mit Kommentaren, Analysen und täglichen Berichten über zukünftige Marktbewegungen und Handelsmöglichkeiten. Dagegen bieten andere große internationale Broker regelmäßige Kommentare im Videoformat an, die bei FxPro nicht verfügbar sind.

Zudem bietet FxPro umfangreiche technische Analysen in schriftlicher Form an. Die technischen Analysen werden mehrmals am Tag aktualisiert und sind kurze Artikel. Des Weiteren bietet FxPro einen Wirtschaftskalender und einen Bankenkalender an, damit die Händler ihre Geschäfte planen können.

Im Großen und Ganzen ist die Marktanalyse von FxPro nicht so umfangreich und tiefgründig wie bei anderen großen Brokern, aber sie wird sicherlich ausreichen, um die meisten Händler/innen zufriedenzustellen.

Kundendienst

Ein mehrsprachiges Team in den FxPro-Büros auf der ganzen Welt bietet 24/7 Support. Dies ist außergewöhnlich für eine Branche, in der 24/5 die Norm ist. Der Kundendienst ist in 18 Sprachen, darunter Deutsch, per E-Mail, Live-Chat, Rückrufservice und Telefon über eine lokale Nummer erreichbar. Die Mitarbeiter des FxPro-Kundendienstes helfen bei technischen und kontobezogenen Fragen, können aber, wie bei allen regulierten Brokern, keine Anlageberatung anbieten.

Wir haben festgestellt, dass der Live-Chat-Support reaktionsschnell und höflich ist und schnell relevante Antworten liefert.

Sicherheit und Anerkennung in der Industrie

Regulierung: Der 2006 gegründete No-Dealing-Desk (NDD) Market Maker FxPro hat seinen Hauptsitz in London. Er verfügt über einen Kundenstamm von mehr als 870 000 Kunden aus 173 Ländern und wird von vielen hochrangigen Regulierungsbehörden reguliert, darunter die britische Financial Conduct Authority (FCA), die Cyprus Securities and Exchange Commission (CySEC), die Financial Sector Conduct Authority (FSCA) in Südafrika und die Securities Commission of the Bahamas (SCB). Im Folgenden ist eine Liste der bei FxPro registrierten Unternehmen:

- FxPro UK Limited ist von der FCA zugelassen und wird von ihr reguliert (registration number 509956).

- FxPro Financial Services Ltd ist von der CySEC zugelassen und reguliert (license number 078/07).

- FxPro Financial Services Ltd wird von der FSCA zugelassen und reguliert (authorisation number 45052).

- FxPro Global Markets Ltd ist von der SCB zugelassen und reguliert, license no. SIA-F184.

Auszeichnungen

In seiner Branche hat FxPro bereits über 80 Auszeichnungen erhalten. Zu den jüngsten Auszeichnungen gehören:

- Best Broker UK 2021 (Ultimate Fintech Awards)

- Best FX Provider 2021 (Online Personal Wealth Awards)

- Best Trading Platform (2020)

- Best Broker 2014-2020 (Financial Times and Investors Chronicles Awards)

Aufgrund der langen Geschichte des verantwortungsvollen Handelns, der strengen Bankenstandards, der erstklassigen internationalen Regulierung und des Lobes der Branche halten wir FxPro für einen vertrauenswürdigen und sicheren Broker für deutsche Händler/innen.

Bewertungsmethode

Bei der Überprüfung unserer Partner legen wir Wert auf Transparenz und Offenheit. Deshalb haben wir unser Bewertungsverfahren veröffentlicht. Im Mittelpunkt dieses Prozesses steht die Bewertung der Zuverlässigkeit des Brokers, des Plattformangebots des Brokers und der Handelsbedingungen für die Kunden, die in dieser Bewertung zusammengefasst sind. Jeder dieser Punkte wird benotet, und es wird eine Gesamtnote berechnet und dem Broker zugewiesen.

FP Markets Marktrisiko-Erklärung

Der Devisenhandel ist riskant und jeder Broker ist verpflichtet, seinen Kunden/innen genau mitzuteilen, wie riskant der Handel mit Forex CFDs ist. FxPro informiert darüber: Der CFD-Handel birgt ein hohes Risiko und ist möglicherweise nicht für alle Anleger/innen geeignet. Es kann sein, dass nicht alle Anleger/innen geeignet sind. Daher sollte man sich über die Risiken im Klaren sein, da man sein gesamtes investiertes Kapital verlieren kann. 75% . Die bisherige Wertentwicklung von CFDs ist kein zuverlässiger Indikator für die zukünftige Wertentwicklung. Für die meisten CFDs gibt es kein festes Fälligkeitsdatum, und eine CFD-Position wird an dem Tag fällig, an dem eine offene Position geschlossen wird.

Überblick

Der regulierte Market-Maker-Broker FxPro verfügt über einen großen internationalen Kundenstamm und wirbt mit den Auszeichnungen, die er im Laufe der Jahre erhalten hat.

Der Broker bietet fünf Live-Konten auf einer breiteren Palette von Plattformen an, als es bei anderen Brokern üblich ist, aber seine Handelskosten sind deutlich höher als der Branchendurchschnitt.

Die Marketingstrategie von FXPro sieht ein offenes Schulungskonzept vor, aber Kontoinhaber sollten keine detaillierten oder gut strukturierten Unterlagen erwarten. Dennoch ist der Kundendienst gut erreichbar und reaktionsschnell, ein echter Vorteil für Anfänger mit vielen Fragen.

Im Großen und Ganzen ist FxPro eine verlässliche Wahl für Händler/innen, die einen starken, traditionellen und sicheren Broker suchen.

Finden Sie heraus, wie FxPro im Vergleich zu anderen Brokern abschneidet.Broker vergleichen

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.