FP Markets Test und Erfahrungen

Zuletzt aktualisiert am November 22, 2024

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu FP Markets

Bei FP Markets handelt es sich um einen gut regulierten Forex-Broker mit einer exzellenten Aktienhandelsplattform, die sich an erfahrene Börsianer/innen richtet. Zudem waren wir beeindruckt, wie einfach die FP Markets Handels-App zu bedienen ist und wie gut der Kundenservice von FP Markets ist, der auch auf Deutsch verfügbar ist.

In Bezug auf die Gebühren hat FP Markets ein “ECN-Preismodell”, das nach eigenen Angaben äußerst wettbewerbsfähige Kosten bietet. Bedauerlicherweise mussten wir feststellen, dass die Gebühren für die MT4- und MT5-Handelskonten höher sind als die der meisten ECN-Konkurrenten. Dennoch macht FP Markets Anfängern den Einstieg leicht, mit 50 EUR Mindesteinlage und unbegrenzten Demokonten. FP Markets zeichnet sich auch durch seine Unterstützung für aktive und professionelle Aktienhändler aus.

| 🏦 Min. Einzahlung | EUR 50 |

| 🛡️ Geregelt durch | ASIC, CySEC, FSC, CMA |

| 💵 Handelskosten | USD 6 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, MT5, cTrader, IRESS |

| 💱 Instrumente | Commodities, Kryptowährungen, Stock CFDs, Forex, Indices, Metalle, ETFs, Anleihen |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Trusted since 2005 with top-tier regulation

- 100 USD minimum deposit amount

- Supports MT4 MT5 cTrader and TradingView

- Spreads start at 1.0 pip and narrow to 0 pips with higher trading volumes

Nachteile

- Notably higher withdrawal fees than competitors

- Stock CFDs are limited on MT4/MT5 and primarily available through IRESS

Ist FP Markets sicher?

Der beliebte und gut regulierte Broker FP Markets genießt ein sehr hohes Vertrauen und ist seit 2005 ein zuverlässiger Handelspartner für deutsche Händler/innen. Allerdings sollten sich Händler/innen darüber im Klaren sein, dass sie über die in St. Vincent ansässige Einrichtung (SVG FSA) angebunden werden, die nur eine geringe regulatorische Aufsicht hat, es sei denn, sie wählen ihre Regulierung selbst aus.

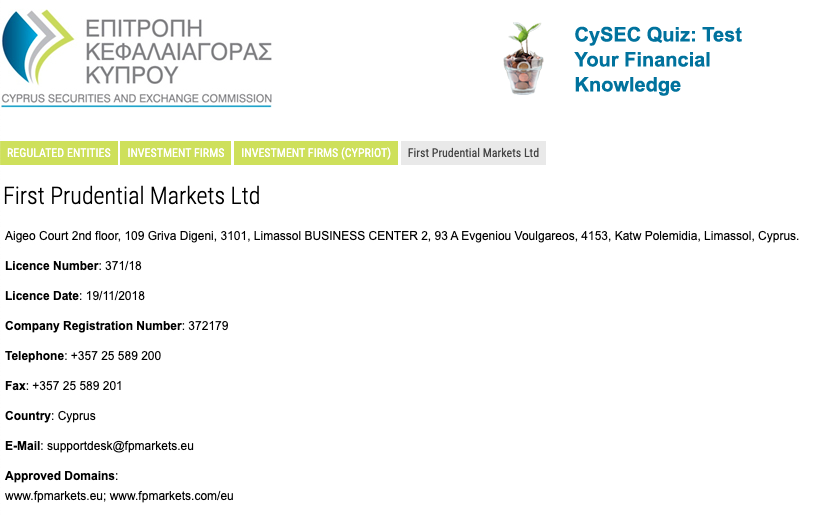

Regulierung: Kunden/innen von FP Markets aus Deutschland können wählen, unter welcher Tochtergesellschaft sie handeln möchten – ASIC, CySEC oder die SVG FSA-regulierte Stelle. Händler/innen, die sich nicht entscheiden, werden von der SVG FSA-regulierten Gesellschaft betreut, die nur wenig regulatorische Aufsicht bietet. Wir raten deutschen Händlern/innen, die CySEC-basierte Einrichtung von FP Markets zu wählen, da sie einen besseren regulatorischen Schutz bietet. Im Folgenden ist die Registrierungsmitteilung von FP Markets zu finden:

Sicherheitsmerkmale: Bei der CySEC handelt es sich um eine angesehene europäische Aufsichtsbehörde, die von FP Markets verlangt, allen Kunden einen Negativsaldo-Schutz zu bieten und die Betriebsmittel von den Kundenkonten getrennt zu halten. Darüber hinaus ist es FP Markets untersagt, einen Hebel von mehr als 30:1 für Forex-Paare anzubieten oder Werbeaktionen oder Boni zu offerieren. Finanzprofis und vermögende Kunden können auf diese Sicherheitsmerkmale verzichten, indem sie ihren Status als Großhändler nachweisen.

Für einige deutsche Händler/innen könnten die niedrigen Hebel und die fehlenden Boni einschränkend sein. Wenn du dich nicht für den Status eines professionellen Händlers qualifizierst, besteht die einzige Möglichkeit, diese Einschränkungen zu umgehen, darin, mit einem Broker zu handeln, der nicht der CySEC-Regulierung unterliegt, was einen geringeren Schutz bedeutet.

Unternehmensangaben

Finanzinstrumente von FP Markets

Leider waren wir enttäuscht, dass die meisten Aktien-CFDs von FP Markets nur auf der IRESS-Handelsplattform verfügbar sind (nur über das ASIC-regulierte Unternehmen). Für Händler/innen, die die Plattformen MT4 und MT5 nutzen, sind die Möglichkeiten begrenzt.

Aktien-CFD-Handel: Händler/innen, die nach Aktien-CFDs suchen, stehen vor einer schwierigen Wahl. FP Markets bietet mehr als 10.000 Aktien-CFDs an, aber die meisten davon sind nur auf der IRESS-Handelsplattform verfügbar, einer hochentwickelten DMA-Plattform (Direct Market Access), die für Anfänger einschüchternd sein kann (und nur für Händler/innen verfügbar ist, die sich für die ASIC-regulierte Tochtergesellschaft entscheiden). Mit unserem MT5-Konto konnten wir etwa 1000 Aktien handeln, was nicht schlecht ist, aber mit unserem MT4-Konto waren es nur 8. Das macht Sinn, wenn man bedenkt, dass sich MT4 auf den Devisenhandel konzentriert, aber es könnte einige Händler/innen überraschen.

Devisen und Kryptowährungen: Devisenhändler/innen werden mit den mehr als 60 Währungspaaren von FP Markets zufrieden sein, allerdings stehen nur 11 Kryptowährungen zum Handel zur Verfügung.

Vollständige Liste der Instrumente und Hebelwirkung:

- Devisen: Bei FP Markets können mehr als 60 Währungspaare gehandelt werden. Damit ist das Angebot breiter als bei anderen CFD-Anbietern, einschließlich der Majors (EUR/USD, GBP/USD und USD/JPY) und Minors (NZD/CAD, EUR/JPY und USD/ZAR) sowie der Exoten.

- Aktien-CFDs: Mit einem Angebot von 10.000 Aktien-CFDs ist FP Markets breiter aufgestellt als die meisten anderen Broker, aber die meisten davon sind nur auf der IRESS-Plattform zu finden (nur über die ASIC-regulierte Einrichtung erhältlich). Auf MT4/MT5 gibt es 1000 Aktien-CFDs. Zur Auswahl stehen einige der wichtigsten US-amerikanischen, britischen und europäischen Börsenplätze.

- Indizes: Im Gegensatz zu anderen Brokern gibt es bei FP Markets nur 14 Indizes, die gehandelt werden können. Zu den beliebtesten Indizes gehören diejenigen, die die Aktien einiger der größten und weltweit anerkannten Unternehmen zusammenfassen.

- Rohstoffe: Im Vergleich zu anderen Brokern bietet FP Markets nur den Handel mit 6 Rohstoffen an. Zu den Rohstoffen gehören Metalle wie Gold und Silber, Erdgas und Ölenergien sowie Softs wie Baumwolle und Weizen.

- Kryptowährungen: Bei FP Markets können nur 11 Kryptowährungen gehandelt werden, darunter Bitcoin, Ethereum, Litecoin und Ripple, was im Vergleich zu anderen Brokern eine begrenzte Auswahl darstellt.

Auf den Handelsplattformen MT4 und MT5 bietet FP Markets eine begrenzte Auswahl an Instrumenten an. Allerdings wird diese Auswahl auf der IRESS-Handelsplattform massiv erweitert. FP Markets bietet außerdem mehr Forex-Paare an, als bei anderen Brokern üblich sind.

Konten und Handelsgebühren

Bei FP Markets gibt es zwei MT4/MT5-Konten und drei IRESS-Konten. Im Vergleich zu anderen Brokern sind die Gebühren für die Metatrader-Konten in der Regel niedrig. Für die IRESS-Konten sind die Mindesteinlagen deutlich höher und sie eignen sich eher für ernsthafte Aktienhändler (und sind für Kunden/innen nicht über die CySEC-regulierte Einrichtung verfügbar).

Handelsgebühren: Für die Standard- und Raw-Metatrader-Konten ist eine Mindesteinlage von 50 EUR (oder gleichwertig) erforderlich und die Handelskosten liegen im oder unter dem Branchendurchschnitt. Bei den drei IRESS-Konten sind die Mindesteinlagen deutlich höher: Ab 1000 USD für das Standard-Konto und bis zu atemberaubenden 50.000 USD für das Premier-Konto. Für diese Konten, die sich an erfahrene oder professionelle Aktienhändler/innen richten, werden Provisionen pro Handel berechnet.

Handelskosten des Kontos:

In der Regel liegen die Handelskosten bei anderen Brokern bei etwa 9 USD pro EUR/USD-Lot, sodass die Handelskosten des MT4/MT5 Standardkontos durchschnittlich sind. Dafür sind die Kosten auf dem MT4/MT5 Raw Account niedrig, der eine Round-Turn-Provision von 6 USD und viel engere Spreads hat.

Die IRESS-Konten haben komplexere Handelsbedingungen, die im Abschnitt über die Konten weiter unten detailliert beschrieben werden.

Standard-Konto

Die beste Option, um provisionsfrei zu handeln, ist das Standard-Konto. Hier sind die Spreads größer als beim Raw-Konto und beginnen in der Regel bei 1,0 Pips, können aber bei hohem Handelsvolumen auch auf 0 Pips sinken. Die Mindesteinlage beträgt 50 EUR (oder den Gegenwert), und es können mehr als 60 Forex-Paare, Metalle, Rohstoffe und Indizes gehandelt werden.

Raw-Konten

Für dieses Konto gelten engere Spreads (0 Pips auf den EUR/USD), dafür wird aber eine Provision von 6 USD round turn pro Standard-Lot berechnet. Auch die Mindesteinlage ist auf 50 EUR (oder den Gegenwert) festgelegt. Der einzige wirkliche Unterschied zwischen diesem Konto und dem Standardkonto besteht also darin, ob die Maklergebühr auf die Provision oder den Spread aufgeschlagen wird, obwohl die Kosten für das Raw-Konto wesentlich niedriger sind. Raw-Konten sind in der Regel eher für Scalper und Daytrader geeignet.

Professionelles Konto

Für deutsche Bürgerinnen und Bürger besteht außerdem die Möglichkeit, ein Profikonto zu beantragen, was bedeutet, dass der Hebel auf 500:1 erhöht wird. Dies betrifft Händler/innen, die sich für den Handel über das CySEC-regulierte Unternehmen entscheiden. Hierfür müssen sie jedoch bestimmte Kriterien erfüllen:

- Nachweis über die letzten vier (4) Quartale hinweg durchschnittlich zehn (10) Transaktionen in signifikantem Umfang (d.h. 1 Lot) auf dem relevanten Markt getätigt zu haben.

- Nachweis, dass der Umfang des Portfolios an Finanzinstrumenten, das Bareinlagen und Finanzinstrumente umfasst, 500.000 EUR übersteigt.

- Nachweis, dass man mindestens ein (1) Jahr lang in einer beruflichen Position im Finanzsektor arbeitet oder gearbeitet hat, die Kenntnisse über die geplanten Transaktionen oder Dienstleistungen erfordert.

Professionelle Kontoinhaber/innen müssen sich darüber im Klaren sein, dass sie auf einige der Privilegien verzichten, die Kleinanleger/innen gewährt werden, z. B. auf die Entschädigung durch den Anlegerentschädigungsfonds.

IRESS-Kontotypen

Diese Information dient nur zu Informationszwecken, da IRESS für Händler/innen, die über die CySEC-basierte Einheit von FP Markets handeln, nicht verfügbar ist.

Bei IRESS-Suite handelt es sich um eine Sammlung von DMA-Plattformen (Direct Market Access) mit erweiterten Funktionen. Diese sind nur über das ASIC-regulierte Unternehmen verfügbar. Sie ermöglichen den CFD-Handel mit Aktien und Futures sowie mit anderen Finanzinstrumenten wie Forex, Indizes und Rohstoffen. Obwohl sich die Plattformen ähneln, ist IRESS Viewpoint eine aktualisierte Version von IRESS Trader, während IRESS Investor für Anleger/innen gedacht ist, die Hedging-Strategien anwenden möchten. Darüber hinaus ist die IRESS-Handelsplattform vollgepackt mit technischen Tools wie Charting-Tools, Zeichenwerkzeugen und detaillierten Marktdaten für verschiedene Zeitintervalle.

Handler/innen können zwischen drei IRESS-Konten wählen: Das Standard-, das Platin- und das Premier-Konto.

Standard-Konto

Zur Eröffnung dieses Kontos ist ein Mindestguthaben von 1.000 USD erforderlich. Die Brokergebühr für dieses Konto beträgt mindestens 10 USD, danach 0,1 %. Die IRESS Trader-Gebühr in Höhe von 55 USD entfällt, wenn man 150 USD an Provisionen/Monat erzielt. Zudem bietet es Zugang zu wettbewerbsfähigen DMA-Kommissions- und Margin-Sätzen.

Platin-Konto

Um ein Platinum-Konto zu eröffnen, ist ein Mindestguthaben von 25.000 USD erforderlich. Die Brokergebühr beträgt 9 USD, danach 0,09%. Wie beim Standardkonto entfällt die IRESS Trader-Gebühr von 55 USD, wenn man 150 USD an Provisionen/Monat erzielt. Damit bekommt man Zugang zu noch niedrigeren Provisionen und Finanzierungsraten.

Premier-Konto

Zur Eröffnung eines Kontos ist ein Mindestguthaben von 50.000 USD erforderlich. Für dieses Konto gibt es keine Mindestbrokergebühr und es werden 0,08% berechnet. Auf die IRESS Trader-Gebühr wird verzichtet, und es gibt keine Plattformgebühren und keine Maklergebühren.

Ein- und Auszahlungen

Bei FP Markets sind die Einzahlungsgebühren niedrig, dafür sind die Abhebungsgebühren höher als bei den meisten anderen Brokern.

Im Rahmen der Anti-Geldwäsche-Richtlinien akzeptiert FP Markets keine Zahlungen von Dritten und nimmt nur Gelder an, die direkt vom benannten Handelskontoinhaber eingehen. Bei der ersten Auszahlung muss ein herunterladbares Formular ausgefüllt und zusammen mit einem Lichtbildausweis zurückgeschickt werden.

Akzeptierte Einzahlungswährungen: Das FP Markets-Kundenportal ermöglicht es Händlern/innen, Einzahlungen in 3 Währungen vorzunehmen, darunter EUR, USD und GBP. Das ist besonders für deutsche Händler/innen von Vorteil, die wahrscheinlich Bankkonten in EUR haben und so keine Gebühren für die Währungsumrechnung zahlen müssen.

Hohe Auszahlungsgebühren: Bei FP Markets fallen keine Gebühren für Einzahlungen an, dafür aber hohe Auszahlungsgebühren für E-Wallets und Banküberweisungen:

- Visa/Mastercard: Nachfolgende Währungen werden akzeptiert: EUR, USD, und GBP. Für Ein- und Auszahlungen werden keine Gebühren erhoben. Einzahlungen sind sofort verfügbar, und die Bearbeitung von Auszahlungen kann bis zu einem Werktag dauern.

- Banküberweisung: Folgende Währungen werden akzeptiert: GBP, EUR und USD. Für Einzahlungen werden keine Gebühren erhoben und FP Markets übernimmt internationale Gebühren bis zu 50 USD für Einzahlungen von mehr als 10.000 USD. Die Dauer der Einzahlung beträgt einen Werktag. Bei Auszahlungen wird eine Gebühr von 10 AUD erhoben, und Auszahlungen werden innerhalb eines Werktages bearbeitet.

- Neteller: Folgende Währungen werden akzeptiert: EUR, GBP und USD. Bei Einzahlungen fallen keine Gebühren an, und sie werden sofort ausgeführt. Bei Auszahlungen wird eine Gebühr von 1 %, bis zu 30 USD und ggf. Ländergebühren erhoben, und Auszahlungen werden innerhalb eines Werktages bearbeitet.

- Skrill: Folgende Währungen werden akzeptiert: EUR, GBP und USD. Es werden keine Einzahlungsgebühren erhoben, und Einzahlungen werden sofort ausgeführt. Bei einer Auszahlung werden eine Gebühr von 1 % und (falls zutreffend) Ländergebühren erhoben. Die Bearbeitung von Auszahlungen erfolgt innerhalb eines Arbeitstages.

- PayPal: Die Einzahlungen sind kostenlos und werden innerhalb eines Arbeitstages bearbeitet. Es fallen keine Auszahlungsgebühren an, und auch diese werden innerhalb eines Werktages bearbeitet.

- Sofort: Folgende Währungen werden akzeptiert: EUR und GBP. Es werden keine Ein- oder Auszahlungsgebühren erhoben, Einzahlungen sind sofort möglich und Abhebungen dauern einen Werktag.

- Giropay: Es können nur Zahlungen in EUR getätigt werden. Für Einzahlungen werden keine Gebühren erhoben, sie sind sofort verfügbar, allerdings können maximal 10.000 EUR pro Tag eingezahlt werden. Auszahlungen sind kostenlos und werden innerhalb eines Arbeitstages bearbeitet.

Bei der ersten Auszahlung ist ein Formular auszufüllen, das heruntergeladen werden kann, und zusammen mit einem Lichtbildausweis einzureichen ist.

Im Großen und Ganzen bietet FP Markets eine breite Palette von Einzahlungsmethoden an. Während für Einzahlungen keine Gebühren erhoben werden, sind die Gebühren für Auszahlungen hoch.

Mobile Handels-Apps

FP Markets verfügt über eine eigene mobile Handels-App für iOS und Android. Das Design und die einfache Bedienung haben uns gut gefallen. Darüber hinaus unterstützt FP Markets die mobilen Apps MT4 und MT5 sowie die IRESS Mobile App für IRESS-Kontoinhaber/innen.

FP Markets Handels-App

Wir haben festgestellt, dass sich die FP Markets Handels-App problemlos mit unserem MT4-Konto verbinden ließ und dank der übersichtlichen Oberfläche sehr einfach zu bedienen war. Auch auf älteren Android-Telefonen lief sie reibungslos, und Anfänger/innen dürften das vereinfachte Layout im Vergleich zu den MT4- und MT5-Apps schätzen.

Hauptmerkmale:

- Ein- und Auszahlungen vornehmen.

- Handelstransaktionen durchführen, überwachen und überprüfen.

- Das Menü “Favoriten” für ein schnelleres und nahtloses Handelserlebnis nutzen.

- Änderungen der Einstellungen über das Kundenportal

- Zugriff auf Echtzeit-Kurse

- Recherchen und Analysen mit einer Reihe von Handelswerkzeugen durchführen

- Anmeldung bei dem MetaTrader 4-Konto mit denselben Anmeldedaten

Mobiler Handel mit MT4 und MT5

FP Markets bietet Unterstützung für MT4 und MT5 Mobile Handelsapps für Android und iOS. Im Vergleich zu den Desktop-Handelsplattformen sollten sich Händler/innen darüber im Klaren sein, dass es einige Einbußen bei der Funktionalität gibt, wie z.B. reduzierte Zeitrahmen und weniger Charting-Optionen. Dennoch können Händler/innen bestehende Aufträge schließen und ändern, Gewinne und Verluste berechnen und in den Charts handeln.

Die IRESS Mobil-App (Nicht verfügbar für Händler/innen über die CySEC-regulierte Einrichtung)

Die Mobilversion von IRESS bietet Händlern/innen viele der gleichen Funktionen wie die Desktop-Version. Dazu gehören:

- Dynamische Preise in Echtzeit

- Zugang zu Finanznachrichten in Echtzeit

- Portfolio und Bestände verfolgen

- Erweiterte Auftragsverwaltung

- Erweitertes Charting

Im Großen und Ganzen übertrifft das mobile Handelserlebnis von FP Markets das anderer Broker.

Weitere Handelsplattformen

Die MT4- und MT5-Handelsplattformen sind als Download für den Computer und als Webtrader im Browser verfügbar. Die IRESS Trading Suite steht ebenfalls zum Download bereit.

MT4 und MT5

Da FP Markets Plattformen von Drittanbietern wie MT4 und MT5 anbietet, haben Händler/innen den Vorteil, dass sie ihre eigene, angepasste Version der Plattform mitnehmen können, wenn sie zu einem anderen Broker wechseln möchten. Darüber hinaus sind für beide MetaTrader-Plattformen Tausende von Plugins und Tools verfügbar.

MT4 bietet zwar großartige Anpassungsmöglichkeiten, doch die Plattform fühlt sich veraltet an, und einige Funktionen sind schwer zu finden. Wenn es um Backtesting-Funktionen für automatisierte Handelsalgorithmen geht, ist MT5 leistungsfähiger und schneller als MT4. Zudem gibt es einen integrierten Nachrichten-Feed, einen Indikator für die Markttiefe, einen Wirtschaftskalender und es können Transaktionen in den Charts durchgeführt werden.

IRESS-Plattform (nur über die ASIC-regulierte Einrichtung verfügbar)

Bei IRESS Trader handelt es sich um eine fortschrittliche institutionelle Handelsplattform. Für die Plattform erhebt FP Markets eine monatliche Gebühr, doch wenn man ein(e) aktive(r) Händler/in ist und durch die Nutzung der Plattform eine Provision für den Broker erwirtschaftet, entfällt die Lizenzgebühr.

Gegenüber der MetaTrader-Plattform hat IRESS eine intuitivere Benutzeroberfläche und mehr Funktionen. Zu den Funktionen gehören die erweiterte Auftragsvergabe, das Einstellen von Alarmen für Nachrichten und Kursniveaus, anpassbare Charts, erweiterte Watchlist-Funktionen und der Zugang zu über 10.000 Handelsinstrumenten.

Handelsplattformen im Vergleich:

Kontoeröffnung bei FP Markets

Im Vergleich zu anderen Brokern ist der Kontoeröffnungsprozess bei FP Markets vollständig digital, schnell und problemlos.

Bei FP Markets können alle deutschen Händler/innen ein Konto eröffnen, wenn sie die Mindesteinlage von 50 EUR erfüllen.

Die Einrichtung eines Kontos ist unkompliziert; der Prozess ist vollständig digital und die Konten sind in der Regel innerhalb eines Tages fertig. FP Markets bietet Gemeinschafts- und Einzelkonten an, doch wir konzentrieren uns auf die Eröffnung eines Privatkontos:

Wie man ein Konto bei FP Markets eröffnet:

- Neue Händler/innen müssen auf die Schaltfläche “Start Trading” oben auf der Seite klicken, um ein Konto zu registrieren.

- Das Anmeldeformular von FP Markets verlangt von den Kunden, dass sie ihre persönlichen Daten angeben (u.a. Name, Land des Wohnsitzes, E-Mail-Adresse, Geburtsdatum und Bildungsstand).

- Potenzielle Händler/innen müssen dann den Kontotyp, die Handelsplattform und die gewünschte Basiswährung auswählen.

- Sobald dieser Schritt abgeschlossen ist, werden Händler/innen gebeten, ein kurzes Formular auszufüllen, das FP Markets hilft, den Stand ihrer Finanzen und Handelskenntnisse einzuschätzen. Während die meisten Broker diesen Schritt bei der Kontoeröffnung auslassen, ist dies ein verantwortungsvoller Schritt in einer Branche, der oft ein unverantwortlicher Umgang mit dem Verbraucherschutz vorgeworfen wird.

- Um als Kunde/in akzeptiert zu werden, benötigt FP Markets mindestens zwei Dokumente:

-

- Identitätsnachweis – Eine aktuelle (nicht abgelaufene) farbige gescannte Kopie (im PDF- oder JPG-Format) deines Reisepasses. Sollte kein gültiger Reisepass vorhanden sein, reicht auch ein ähnliches Ausweisdokument mit deinem Foto, z. B. ein Personalausweis oder Führerschein.

- Adressnachweis – ein Kontoauszug oder eine Stromrechnung. Allerdings sollte das Dokument nicht älter als 6 Monate sein und der Name und die Adresse müssen klar ersichtlich sein.

Bevor man mit dem Handel beginnt, sollte man die Risikoaufklärung, die Kundenvereinbarung und die Geschäftsbedingungen von FP Markets lesen.

Nach der Genehmigung des Antrags können sich die Händler/innen einloggen und ihr Konto aufladen.

Im Vergleich zu anderen ähnlichen Brokern ist der Prozess der Kontoeröffnung bei FP Markets schnell, in der Regel problemlos und vollständig digital, und die Konten sind innerhalb eines Tages für den Handel einsatzbereit.

Handelsinstrumente von FP Markets

Im Vergleich zu anderen ähnlichen Brokern bietet FP Markets eine hervorragende Auswahl an Handelsinstrumenten.

Zum Angebot von FP Markets gehören ein VPS-Service und eine Traders Toolbox, die aus 12 Online-Handelstools besteht. Für beide Tools müssen Händler/innen eine Mindesteinlage von 1.000 USD (oder den Gegenwert einer anderen Währung) leisten.

VPS

Für Händler/innen, die mindestens 1000 USD oder den Gegenwert einer anderen Währung einzahlen, bietet FP Markets einen kostenlosen VPS-Service an. Der Service wird auch für Händler/innen mit hohem Handelsvolumen subventioniert, die mehr als 10 Lots pro Monat auf dem Standard-Konto oder 20 Lots auf dem Raw-Konto handeln. Mit dem VPS-Service wird sichergestellt, dass der Handel nicht durch technische Probleme oder Konnektivitätsprobleme unterbrochen wird. Weitere Vorteile des VPS-Dienstes sind:

- 24/6 VPS E-Mail-Support

- 24/7 Redundante Stromversorgung für deinen VPS

- 24/7 Redundante Internetverbindung zu deinem VPS

- Geringe Latenzzeiten zu den FP Markets Handelsservern für präzisen Handel

- Kontinuierlicher EA-Handel

Trader’s Toolbox

Nur auf MT4 verfügbar, bietet FP Markets eine Trader’s Toolbox für Kunden/innen, die mehr als 1.000 USD oder den Gegenwert einzahlen. Bei der Toolbox handelt es sich um ein Paket von 12 Online-Handelswerkzeugen, darunter Markteinblicke, ein Wirtschaftskalender mit relevanten Nachrichten, die sich auf die Marktpreise auswirken, Risikomanagement-Tools, Korrelationsmatrizen, Tick-Charts, Session Maps, Stimmungsindikatoren, Analysetools und vieles mehr. Im Folgenden werden einige der Tools vorgestellt:

- Mini-Terminal: Dank zahlreicher konfigurierbarer neuer Funktionen können Händler/innen die MT4-Dealtickets und Charts an ihre Vorlieben anpassen.

- Session Map: Eine Landkarte, die die globalen Finanzmärkte abbildet, und ein Wirtschaftskalender, der die neuesten Schlüsselinformationen bietet.

- Stealth-Orders: Dies ermöglicht es Händlern/innen, ihre Transaktionen anonym zu halten.

- Korrelationsmatrix: Damit kann man sehen, wie sehr die beobachteten Märkte miteinander korrelieren und sein Risiko entsprechend begrenzen.

- Sentiment Trader: Mit dieser Funktion können Händler/innen die Marktstimmung analysieren oder ein historisches Diagramm von Preis und Stimmung anzeigen.

FP Markets für Anfänger

Unserer Meinung nach werden sich Anfänger/innen wohl fühlen, wenn sie ihre Handelslaufbahn bei FP Markets beginnen. Das Demokonto läuft nie ab, der Bildungsbereich ist vielfältig und die Marktanalysen sind sowohl in Video- als auch in Artikelform verfügbar. Der Kundenservice ist rund um die Uhr in deutscher Sprache erreichbar. Zudem waren wir von der Qualität des Supports beeindruckt, den wir erhielten.

Demo-Konto

Bei FP Markets gibt es ein Demokonto, das bereits mit 100.000 virtuellen Guthaben in der gewünschten Basiswährung ausgestattet ist. Die Demo-Konten von FP Markets laufen nicht ab, es sei denn, sie bleiben mehr als 30 Tage lang inaktiv.

Bildung

Im Vergleich zu den meisten anderen großen internationalen Brokern ist der Bildungsbereich von FP Markets ziemlich gut. Allerdings ist ein Teil davon nur registrierten Kunden/innen vorbehalten. Die Inhalte sind sowohl für Anfänger/innen als auch für erfahrene Händler/innen geeignet.

Bei FP Markets gibt es eine Reihe von Bildungsmaterialien, darunter Ebooks, Tutorials, Video-Tutorials, Webinare und ein Glossar. Das Bildungsmaterial konzentriert sich auf die CFD-Branche im Allgemeinen, einschließlich Anleitungen zum Handel mit Aktien, Indizes und Rohstoffen:

- eBooks: Die umfassenden eBooks von FP Markets bieten detaillierte Informationen zu den wichtigsten Aspekten des Devisenhandels, darunter Geldmanagement, Handelssysteme und Volatilität. Weitere Themen sind die technische und fundamentale Analyse sowie Tipps, wie man Handelsmöglichkeiten erkennt.

- Video-Tutorials: Zur Einführung von Forex-Händlern/innen in die MetaTrader-Plattformen stellt FP Markets eine Reihe von Videos zur Verfügung. Diese Videos dienen als Schritt-für-Schritt-Anleitung für diejenigen, die den Handel mit MT4/MT5 erlernen möchten.

- Glossar: Das Glossar bietet umfassende Definitionen und Erklärungen zu verschiedenen Finanzbegriffen.

- Webinare: In regelmäßigen Abständen veranstaltet FP Markets Webinare, die von seinem Team aus professionellen Händlern/innen gehalten werden. Diese Webinare richten sich an Trader aller Erfahrungsstufen und behandeln Themen wie Trading-Psychologie, Chart-Psychologie, fortgeschrittene Fibonacci-Strategien und Backtesting einer Handelsstrategie.

Bildung im Vergleich:

Marktforschung und Analysen

Die Analysen und Marktforschung von FP Markets entsprechen dem, was wir von einem großen internationalen Broker erwarten würden. Die Analysen sind sowohl im Artikel- als auch im Videoformat verfügbar und werden täglich veröffentlicht.

Die Analyse-Rubrik von FP Markets umfasst sowohl technische als auch fundamentale Analysen:

- Täglicher Bericht: Bei FP gibt es einen täglichen Marktbericht über alle Finanzmärkte und einen wöchentlichen Ausblick (im Video- und Textformat). Der Tagesbericht gibt einen kurzen Einblick in die globalen Märkte, einschließlich Rohstoffe, Indizes und Devisen.

- Markteinblicke: FP Markets bietet Handelsideen für die beliebtesten Finanzanlagen in verschiedenen Zeitrahmen.

- Technischer Bericht: Jede Woche wird ein technischer Bericht veröffentlicht, der sich mit den verschiedenen Marktbewegungen und deren Auswirkungen auf die entsprechenden Finanzanlagen befasst. Der Bericht ist ausführlich und sehr detailliert.

- Forex Nachrichten: Diese Rubrik enthält Artikel, die weniger häufig veröffentlicht werden, aber alle wichtigen Marktereignisse abdecken.

- Tägliche Analyse: Hier erscheinen täglich Artikel über verschiedene globale Ereignisse und wie sie die Märkte beeinflussen.

- Währungspunkt: Die Artikel werden wöchentlich veröffentlicht und behandeln die verschiedenen Währungsbewegungen.

Marktforschungsvergleich:

Kundendienst

Der mehrfach ausgezeichnete Kundensupport ist rund um die Uhr per Live-Chat, E-Mail und Telefon erreichbar. Am Wochenende ist der Support auf 08:00 – 16:00 Uhr beschränkt. Er ist in sieben Sprachen verfügbar, darunter auch in Deutsch.

Unsere Fragen wurden sofort beantwortet. Der Kundenservice war schnell, höflich und sehr sachkundig.

Regulierung und Vertrauen

Regulierung: Das 2005 gegründete Unternehmen FP Markets mit Hauptsitz in Sydney ist von der Australian Securities and Investments Commission (ASIC) und der Cyprus Securities and Exchange Commission zugelassen und wird von diesen reguliert und ist in St. Vincent und den Grenadinen registriert. Weitere Informationen zu den registrierten Unternehmen:

- First Prudential Markets Pty Ltd ist von ASIC, AFSL Licence 286354 zugelassen und wird von ihr reguliert.

- First Prudential Markets Pty Ltd ist von der CySEC zugelassen und wird von ihr reguliert, license 371/18.

- FP Markets LLC. ist ein auf St. Vincent und den Grenadinen eingetragenes Unternehmen mit der Limited Liability Number 126 LLC 2019.

Branchenauszeichnungen: Mit über 40 Auszeichnungen seit der Gründung hat FP Markets auch viel Anerkennung in der Branche erhalten. Einige dieser Auszeichnungen sind Höchste Kundenzufriedenheit 2020, Beste Handelsausführung 2020, Bester Kundenservice 2020 und Bestes Schulungsmaterial (alle von Investment Trends). FP Markets erhielt 2019 zahlreiche Auszeichnungen für seinen Kundenservice von der LiveHelpNow Challenge – einer australischen Institution, die sich der Anerkennung von Unternehmen mit hervorragendem Kundensupport widmet.

Dank seiner langen Geschichte verantwortungsvollen Handelns, der ASIC- und CySEC-Regulierung, der strengen Prüfungsprozesse und der breiten Anerkennung in der Branche halten wir FP Markets insgesamt für einen vertrauenswürdigen Broker.

Bewertungsmethode

Bei der Überprüfung unserer Partner legen wir Wert auf Transparenz und Offenheit. Deshalb haben wir unser Bewertungsverfahren veröffentlicht. Im Mittelpunkt dieses Prozesses steht die Bewertung der Zuverlässigkeit des Brokers, des Plattformangebots des Brokers und der Handelsbedingungen für die Kunden, die in dieser Bewertung zusammengefasst sind. Jeder dieser Punkte wird benotet, und es wird eine Gesamtnote berechnet und dem Broker zugewiesen.

FP Markets Marktrisiko-Erklärung

Gemäß der Regulierung müssen Broker gegenüber Devisenhändlern transparent sein, was die Komplexität der Finanzprodukte angeht, und offenlegen, in welchem Umfang Händler ihr Geld verlieren können. FP Markets informiert darüber: CFDs (Contracts for Difference) sind Derivate und können risikoreich sein. Verluste können Ihre ursprüngliche Zahlung übersteigen, und Sie müssen in der Lage sein, alle Nachschussanforderungen zu erfüllen, sobald sie gestellt werden. Wenn Sie CFDs handeln, besitzen Sie keine Rechte an den zugrunde liegenden Vermögenswerten des CFDs.

Überblick

Als streng regulierter australischer Broker bietet FP Markets zwei einfache Kontooptionen mit niedrigen Handelsgebühren auf MT4 und MT5 sowie eine Reihe von spannenden Instrumenten für Händler/innen, die mehr als 1.000 USD einzahlen. FP Markets lässt alle Handelsstrategien zu und bietet gute Bildungs- und Marktanalysematerialien, die sich an Händler/innen aller Erfahrungsstufen richten und in deutscher Sprache verfügbar sind.

Broker vergleichen

Finden Sie heraus, wie FP Markets im Vergleich zu anderen Brokern abschneidet.

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.