FIBO Group Test und Erfahrungen

Zuletzt aktualisiert am Februar 28, 2025

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu Fibo Group

With a variety of low-deposit accounts, including a Cent Account with excellent trading conditions, FIBO Group appeals to beginner traders looking to reduce their risk. However, beginners will be disappointed at the lack of educational and market analysis materials available.

FIBO Group offers six live accounts with various spread/commission combinations and execution choices available on all three major trading platforms – MT4, MT5, and cTrader. Trading conditions are average compared to other brokers across all six accounts, but FIBO Group’s non-trading fees are high, including fees for deposits, withdrawals, and inactivity fees.

Although trading tools are limited, beginners will be able to subscribe to sophisticated automated trading signals and for PAMM accounts. FIBO Group also offers a relatively disappointing range of CFDs, but what is available should be enough to satisfy most beginners.

| 🏦 Min. Einzahlung | USD 0 |

| 🛡️ Geregelt durch | CySEC, BaFin, B.V.I FSC, FSC |

| 💵 Handelskosten | USD 6 |

| ⚖️ Max. Hebelwirkung | 1000:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, MT5, cTrader |

| 💱 Instrumente | Commodities, Kryptowährungen, Forex, Indices, Metalle, Shares |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Tolle Plattformauswahl

- Niedrige Mindesteinlage

Nachteile

- Begrenzte Ausbildung

Is FIBO Group Safe?

Yes FIBO Group is a safe broker for Deutschs to trade with. It maintains regulation from CySEC in Cyprus and the FSC of the British Virgin Islands.

Founded in 1998, FIBO Group Holdings is a hybrid ECN/NDD market maker which has been authorised and regulated by CySEC since 2010 (licence number 118/10). It is also a member of the Investor Compensation Fund (ICF), and in the unlikely event of FIBO Group’s bankruptcy, the ICF will compensate traders up to a maximum of 20,000 EUR.

In addition, FIBO Group Ltd is incorporated in the British Virgin Islands and has been regulated by the BVI FSC since 2016 (No. SIBA/L/13/1063). FIBO Group uses it is BVI office to provide services to customers outside of the EU. Clients trading under the BVI-regulated entity will not be covered by the ICF compensation scheme.

Deutsch traders will be trading under the FIBO Group entity regulated by the Financial Services Commission of the British Virgin Islands (BVI FSC).

Unlike regulators such as the FCA and ASIC, the BVI FSC has gained a reputation for being less stringent with regard to the regulation of financial services providers. However, it does require that brokers keep client funds in segregated accounts and that brokers issue monthly statements. In compliance with these rules, FIBO Group ensures that all client funds are held in segregated accounts at tier-1 banks.

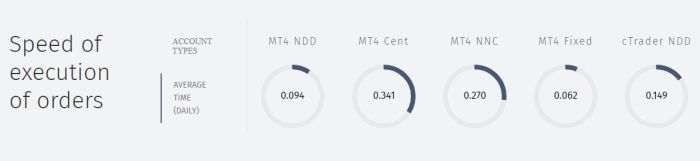

FIBO Group also publishes all trading statistics for all accounts, including execution speed, average and minimum spreads, and slippage percentages.

Additionally, FIBO Group operates as either an ECN or a No Dealing Desk (NDD) market maker. Either way, all client trades are executed without any dealing desk interference, preventing any conflict of interest, except on one of its accounts.

However, clients are not provided with negative balance protection. Additionally, FIBO Group offers high leverage to its clients – up to 1000:1 on some of its account types. It also has low minimum deposit requirements, which means for traders who deposit small amounts, it will be difficult to hold a substantial trading position without getting stopped out and losing the money in their trading account, and possibly going into a negative balance.

Overall, because of its long history of responsible behaviour, strong international regulation, and transparency, we consider FIBO Group a safe broker to trade with. However, traders should be aware of the high leverage, low minimum deposit requirements, and lack of negative balance protection, which could see their trading accounts wiped out or even incur a negative balance.

FIBO Group’s Trading Fees

FIBO Groups trading fees are generally in line with what is seen at other similar brokers.

Unlike other brokers that offer a range of accounts with higher minimum deposits linked to tighter spreads, FIBO Group offers six account types with a variety of platform and execution choices.

Each account is associated with a different platform (either MT4, MT5, or cTrader), and traders can choose the spread/commission structure that suits their strategy. One drawback of this account structure is that for traders familiar with a particular platform, there is not much choice. For example, there are four MT4 accounts, but only one cTrader and one MT5 account.

FIBO Group’s accounts were assessed to compare the costs to those of other forex brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spreads and commission.

When making this calculation, we used one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table above, in some cases the trading costs are built into the spread, and in others, there is a spread mark-up in addition to a commission per lot.

The trading costs on FIBO Group’s accounts are around the average seen at other brokers. Most good brokers have an average trading cost of around 9 USD per lot traded. FIBO Group’s Cent, MT4 NDD, and cTrader accounts have low ongoing trading costs and have low minimum deposit requirements.

Swap Fees

The final trading cost to consider at FIBO Group is the swap rate charged on positions held overnight. Interest is paid (or received) for each night a position is held. In the case of Forex instruments, the amount charged depends on both the positions taken (i.e. long or short) and the rate differentials between the two currencies traded. FIBO Group’s swap rates are published on its website for each financial instrument, and the exchange is automatically converted to the base currency of the trading account of the client.

Overall, FIBO Group’s trading costs are slightly higher than average across all accounts, except on the Cent Account, but trading volumes are limited.

Non-trading Fees

FIBO Group’s non-trading fees are higher than average.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

FIBO Group charges a commission on most deposit and withdrawal methods (click here for more on deposits and withdrawals), in addition to inactivity fees. For example, a fee of 2.5%+1.5 EUR applies to withdrawals by credit card or debit card. FIBO Group also charges an inactivity fee of 5 USD per month after 91 days of account dormancy.

Overall, these non-trading fees are some of the highest in the industry.

Opening an Account at FIBO Group

The account-opening and verification process at FIBO Group is seamless, fully digital and accounts are ready for trading immediately.

All Deutsch residents are eligible to open an account at FIBO Group, as long as they meet the following minimum deposit requirements:

- Cent Account: 0 USD

- MT4 Fixed Account: 50 USD

- MT4 NDD Account: 50 USD

- MT4 NDD No Commission: 50 USD

- cTrader NDD Account: 50 USD

- MT5 NDD Account: 50 USD

FIBO Group offers corporate and individual accounts. For the purposes of this review, we will outline the process for opening an individual account:

- From the FIBO Group homepage, you will have to click on the ‘Live Account’ tab where you will be directed to register an account with a name, email address, and telephone number.

- A confirmation pin will be sent to your email address to confirm its validity. A confirmation pin will also be sent to the registered telephone number.

- FIBO Group’s registration form requires traders to fill in their personal details, including physical address, date of birth, and ID number.

- Next, traders are required to fill in their financial details, employment status, and trading knowledge.

- Traders will then have to choose their preferred account type (click here for more on FIBO Group’s account types), level of leverage, and account currency.

- Traders can then deposit funds into their accounts and begin trading.

- In order to use the full range of services available at FIBO Group and to be able to withdraw funds, FIBO Group requires the following documents:

- Proof of Identification – FIBO Group accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

Overall, FIBO Group’s account-opening process is fully digital and hassle-free and accounts are ready for trading immediately.

FIBO Group’s Account Types

FIBO Group offers six accounts, which is more than other brokers, and its accounts are suitable for beginners and more experienced traders.

A no dealing desk broker, FIBOGroup offers market execution, and most trades are executed in under 0.2 seconds.

Minimum deposits start at 0 USD on FIBOGroup’s Cent Account, making this a good option for beginner traders. Additionally, it allows beginners to trade in smaller trade sizes, measured micro-lots.

We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek.

FIBO Group also offers another 5 accounts with minimum deposits of 50 USD, making them accessible to beginner traders. However, the trading conditions on the cTrader and MT4 NDD No Commission accounts may be appealing to more experienced traders.

In general, experienced traders tend to prefer accounts with higher minimum deposits and tighter spreads, which, as mentioned above is not the case at FIBO Group, as all accounts, except for the Cent Account, have a minimum deposit of 50 USD.

Trading is offered on Forex, indices, commodities, metals, and cryptocurrencies (click here for more on FIBO Group’s financial instruments), but only some assets are available on some account types.

Leverage also varies depending on the account type. For example, traders can access leverage of up to 1000:1 on the MT4 Cent Account, and 400:1 on most other accounts.

Traders should, however, be aware of trading with such high leverage, because in combination with the low minimum deposits, it will be difficult to hold a substantial trading position without getting stopped out and losing the money in their trading account, and possibly going into a negative balance. On the whole, this is an irresponsible move on the part of the broker.

All accounts are available as demo accounts but only the MT4 Fixed Account is available as an Islamic Account (swap-free).

FIBO Group also offers PAMM (Percentage Allocation Money Management) Accounts, where professional traders manage the funds of many investors (for a fee) on a single trading account. PAMM Accounts are available on the MT4 Fixed, MT4 NDD, and MT4 NDD No Commission Accounts. See below for account details:

MT4 Cent: The MT4 Cent Account is an ideal account for beginners or traders looking to test new trading robots. The minimum deposit is 0 USD, the maximum leverage is 1000:1, and the average spread on the EUR/USD is 0.60 pips, making it an extremely low cost account all round. However, trade size is limited to one standard lot, and traders cannot trade commodities or indices on this account. Additionally, there are only 38 Forex pairs available for trading.

MT4 NDD: The MT4 NDD account requires a minimum deposit of 50 USD, maximum leverage of 1:400, and has an average spread on the EUR/USD of 0.3 pips. This account also has a commission of 3 USD/lot per side (6 USD round turn). Overall, these trading costs are around the average charged at other brokers.

MT4 NDD No Commission: This account has all the same parameters as the MT4 NDD Account except the trading cost is captured in the spread and no commission is charged. As such, the average spread on the EUR/USD is higher, at 0.8 pips, which is slightly lower than the trading costs at other similar brokers.

MT4 Fixed: As one might expect, this MT4 account features fixed spreads, instant execution, and no commission. While traders lose the advantages of market execution with this account – such as tight variable spreads and no-requotes – this account suffers less slippage and volatility. The minimum deposit is 50 USD and the maximum leverage is 1:400. Spreads are fixed and start at 2 pips on the EUR/USD, which is significantly higher than the costs at other brokers.

MT5 NDD: This is the only MT5 account and has a much higher minimum deposit of 50 USD. All trades are executed on the market, with average spreads on the EUR/USD at 0.2 pips. A commission of 10 USD is charged per lot and traders will be unable to open new positions if their balance falls below 100 USD. The trading costs on this account are above those of other brokers.

cTrader NDD: This account is almost an exact replica of the MT4 NDD Account but using the cTrader platform. The minimum deposit is 50 USD, maximum leverage is 1:400, and spreads on the EUR/USD average 0.2 pips. The commission is 6 USD per lot. These trading costs are in line with what is charged at other brokers.

Deposits and Withdrawals

FIBOGroup offers a wide range of payment methods, but traders are charged a commission on both deposits and withdrawals.

As a well-regulated broker, FIBO Group ensures that all Anti-Money Laundering rules and regulations are followed.

FIBO Group allows deposits and withdrawals in EUR, USD, GBP, CHF, and a range of cryptocurrencies via a wide variety of payment methods. While FIBO Group states that it does not charge for deposits or withdrawals, most deposit and withdrawals methods do have a commission or fee:

- Bank Wire: Deposits are free and can be made in EUR and USD. Deposits take 2 – 5 days to be processed. A fee of 35-50 USD is charged for withdrawals, and it can take 5 – 8 business days to complete.

- Visa/Mastercard: FIBO Group uses Connectum and RegularPay to handle credit card funding payments. Via both methods deposits can be made in EUR and USD and are free and instant. With Connectum, withdrawals can be made in EUR and USD, will be charged a 2.5% + 1.5 EUR commission, and can take up to 5 days. With RegularPay, withdrawals can be made in EUR and USD, will be charged a commission of 10 USD, and can take up to 10 days.

- Neteller: Neteller deposits are instant and can be made in USD and EUR. A deposit fee of 4.9% is charged. Withdrawals can be made in USD and EUR will be charged a 2% commission, and can take up to 2 days.

- Skrill: Skrill deposits can be made in USD, will be charged a 3.9% commission, and are instant. Withdrawals are made in USD, will be charged a 1% commission, and can take 2 days to be processed.

- WebMoney: Deposits can be made in EUR and USD and are free and instant upon payment of the invoice. Withdrawals can be made in EUR and USD, a commission of 0.8% is charged and can take up to 2 days to be processed.

- Fasapay: Deposits can be made in USD and IDR and a commission of 0.5% is charged (up to a maximum of 5 USD) and are instant within working hours. Withdrawals are not allowed.

- paysafecard: Deposits can be made in USD and are free and instant upon payment of the invoice. Withdrawals are not allowed.

- PerfectMoney: Deposits can be made in USD and an exorbitant commission of 9.99% is charged. Traders are charged a commission of 0.5% for withdrawing via PerfectMoney, and withdrawal requests are processed within 2 days.

FIBO Group also accepts payment in a range of cryptocurrencies, including BTC, ETH, BCH, XRP, and RFC. Accepted payment providers are Raido Finance, bitpay, BLOCKCHAIN, and Raido Spare. Deposits are generally free and instant, but withdrawals are charged a 0.5% commission and can take up to two days.

Overall, FIBOGroup’s processing times are slower than the industry average, and FIBOGroup charges high fees for deposits and withdrawal on most payment methods.

Base Currencies

FIBO Group offers a limited range of base currencies compared to other similar brokers.

FIBO Group clients can choose between 4 base currencies, including EUR, USD, GBP, and CHF.

However, FIBO Group does not offer AUD trading accounts, which is a disadvantage for Deutschs who will likely have bank accounts denominated in AUD, and who will have to pay currency conversion fees on deposits and withdrawals.

For traders that trade in large volumes (more than 10 lots a month), it is better to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with another currency account, there will be a small conversion fee for every trade made.

Overall, FIBO Group offers fewer trading account currencies than most other large international brokers and it doesn’t offer accounts denominated in AUD.

FIBO Group Trading Platforms

FIBOGroup’s platform support is excellent compared to other similar brokers.

FIBO Group is unusual in that it offers all three of the major trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. While 4 of the 6 account types at FIBO Group are on the MT4 platform, there is only a single account each for MT5 and cTrader. All three platforms are available via web browser, desktop applications, and mobile apps.

MetaTrader 4

MT4 is widely recognised for its trade execution speeds, charting tools, and customisability and it is available in many languages. The benefit of using a third-party platform such as MT4 is that traders can use the platform should they choose to migrate to another broker. Traders can also trade on a variety of CFDs, including Forex, metals, cryptocurrencies, indices, and cryptocurrencies. Other features of MT4 include:

- Four types of order execution, including Market, Limit, Stop, and Trailing Stop orders.

- Superior charting tools in nine timeframes

- 30 technical indicators

- 23 analytical objects

- Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

- Backtesting capabilities

- Dedicated customer support

MetaTrader 5

The MT5 trading platform is being adopted by more Forex brokers all the time, it has a more modern interface, allows for an unlimited number of charts to be used, shows Depth of Market, and has a built-in Economic Calendar. It also has a larger number of pending order types than MT4 and features an embedded chat system. In addition, the MQL5 scripting language is more efficient than its precursor and MT5 has more advanced charting tools than MT4. Other features of MT5 include:

- 12 timeframes

- 38 built-in indicators

- 37 graphical objects

- Six pending order types

- Multi-threaded strategy tester

cTrader

cTrader is built and managed by Spotware and functions only as an NDD platform (market execution only with no broker intervention). Because it is NDD-only, traders will have to pay a commission on cTrader accounts. The user interface is more intuitive and modern than the MetaTrader platforms and the application is constantly being updated and improved by Spotware in response to user feedback. cTrader comes with many modern features such as automated trading with cAlgo, depth of market feature, one-click trading, and advanced charting.

cTrader is also one of the most beginner-friendly platforms, with an intuitive interface and clean design.

Overall, FIBOGroup’s trading platform support is one of the best in the industry. In addition to its excellent Metatrader offering, it provides cTrader, which is generally easier to set up and use.

FIBOGroup’s Mobile Trading Platforms

FIBOGroup’s mobile trading platforms are average when compared to other similar brokers

All of FIBOGroup’s trading platforms are available on both Android and iOS mobile devices and tablets. As with the web trading platform, traders can choose from multiple languages. Although there is slightly limited functionality compared to the desktop version of the platform, with reduced timeframes and fewer charting options, traders will still have access to analytics with technical indicators, graphical objects, and a full set of trading orders.

MetaTrader Mobile Trading

The MT4 and MT5 apps allow traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. Functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading further assists traders while on the move.

cTrader Mobile Trading

The cTrader mobile app carries over most of the best parts from the desktop version, including the complete range of order types, price alerts, trade analysis, and symbol watchlists. Chart types have been reduced to 4 however.

FIBO Group’s Trading Tools

Disappointingly, FIBO Group offers virtually no trading tools, other than the option of PAMM accounts and various automated trading solutions.

FIBO Group offers none of the technical or fundamental analytics tools available at other brokers. However, it offers PAMM accounts and automated trading solutions.

PAMM

FIBO Group offers an account management service to its clients which allows account managers to trade on their behalf. In order to perform this service, bespoke technology or software is required, also known as MAM/PAMM.

PAMM stands for Percentage Allocation Module Manager which means investors can be part of a set of sub-accounts that are traded together by a money manager or trader who has permission from clients to trade on their accounts. Account Managers take a portion of the profits generated by the trades.

Managed accounts are great for beginner traders who have limited experience with trading.

Signals Rating

FIBO Group offers a small collection of trading signals provided by managers of MetaTrader terminal. In addition, it provides reviews of the signals’ strategy which are attached to the accounts that appear in the rating. Also, for each signal published, useful recommendations regarding the terminal settings to connect to the selected signal are available. Traders can follow the various signal providers that are ranked according to a number of metrics, including their overall performance, stability, maturity, exposure, and minimum equity required.

Traders have to pay a fee for following a particular signal provider in addition to a subscription fee for using the service.

Overall, FIBO Group would do well to add some more tools to its trading arsenal to help clients make better trading decisions.

FIBO Group’s Financial Instruments

FIBO Group’s range of instruments for CFD trading is severely limited compared to other brokers, but it offers an extensive range of shares.

FIBO Group’s range of financial instruments for CFD trading (click here for more details on CFD trading), includes Forex, shares, commodities (energies, metals, and softs), indices, and cryptocurrencies:

- Forex: FIBO Group has 48 currency pairs available for trading, an average range compared to most other brokers. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/JPY, GBP/JPY, and USD/ZAR), and exotics.

-

Shares: FIBO Group offers 8000 shares available for trading, an impressive range compared to most other brokers. However, these are not share CFDs, but rather investment shares.

-

Indices: There are 8 indices available for trading at FIBO Group, which is limited compared to most other brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

-

Metals: FIBO Group offers trading on 3 metals, including silver, gold, and copper.

-

Commodities: FIBO Group offers trading on 11 commodities, which is average compared to other brokers. These include metals (as mentioned above), energies, and soft such as wheat and cotton.

-

Cryptocurrencies: At the time of writing, there are 9 crypto pairs available, including Bitcoin and Ethereum, among others, which is average compared to other brokers. Traders should be aware that the spreads vary significantly compared to other traditional Fiat currencies, so if you trade on these assets, watch your margins.

Overall, FIBO Group’s CFD offering is limited to other brokers, which may leave more experienced traders dissatisfied.

FIBO Group for Beginners

In terms of trading conditions for beginners, FIBO Group really excels. The MT4 Cent Account has excellent trading conditions and will appeal to beginners who want to get a feel for the live markets in a low-risk environment. In addition, a range of PAMM Accounts is available for beginners who want to invest with professional traders.

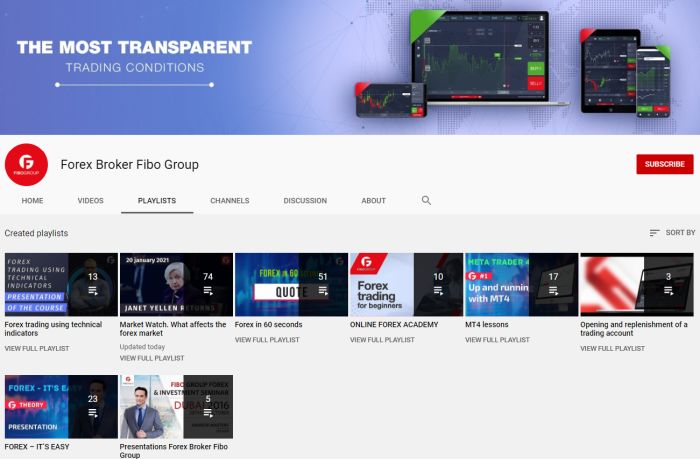

Unfortunately, in terms of training and analysis, FIBO Group is not the most welcoming environment for beginner traders. Most of the educational material is left to FIBO Group’s YouTube channel, and market analysis is infrequent. Customer support is available 24/5 via telephone and live chat.

Educational Material

The education section at FIBO Group consists of a single page with an explanation of the basics of Forex trading. The most useful parts of this page are the links out to FIBO Group’s YouTube channel where traders will find a selection of helpful videos in a structured course format.

Playlists included are FOREX – IT’S EASY and ONLINE FOREX ACADEMY, which are both good video primers for new traders. More advanced educational playlists include Forex Trading Using Technical Indicators and MT4 Lessons. The information presented in all videos is accurate and detailed.

Analysis Material

Market analysis at FIBO Group consists of a weekly video forecast looking forward to the week ahead. It also offers various articles written by its in-house team of analysts, but these are not updated often. Beginners who require deeper market analysis should use other third-party market research to supplement this information.

Customer Service

FIBOGroup’s customer service is poor compared to other similar brokers.

Customer support is available via telephone, a call-back service, and email 24/5 in 12 languages. Most other brokers offer a live chat feature so that traders can have their questions answered quickly and easily.

We tried the call-back service, but to date have not received a callback. Overall, this is disappointing for beginner traders finding their footing in the forex trading space.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the FIBO Group’s offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. FIBO Group would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 58% of investor accounts lose money when trading CFDs with this broker. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

FIBO Group is an NDD broker with a long history of client satisfaction and reasonable trading conditions across a wide range of accounts. MT4, MT5, and cTrader are all fully supported, and minimum deposits are low. Forex education and analysis are not as detailed as many of FIBO Group’s competitors, forcing traders to self-educate with third-party materials. Deposit and withdrawal fees are higher than many brokers too, but options do exist for instant and free funding.

Redaktionsteam

Chris Cammack

Leiter Inhalt

Chris kam 2019 zum Unternehmen, nachdem er zehn Jahre lang in den Bereichen Forschung, Redaktion und Design für politische und finanzielle Publikationen tätig war. Aufgrund seines Werdegangs kennt er sich mit den internationalen Finanzmärkten und der Geopolitik, die sie beeinflusst, bestens aus. Chris hat ein scharfes Auge für die Redaktion und einen unersättlichen Appetit auf aktuelle finanzielle und politische Themen. Er gewährleistet, dass unsere Inhalte auf allen Seiten die Qualitäts- und Transparenzstandards erfüllen, die unsere Leser/innen erwarten.

Alison Heyerdahl

Senior Finanzredakteurin

Im Jahr 2021 kam Alison als Autorin zum Team. Sie hat einen medizinischen Abschluss mit Schwerpunkt Physiotherapie und einen Bachelor in Psychologie. Ihr Interesse am Forex-Handel und ihre Liebe zum Schreiben hat sie jedoch dazu gebracht, den Beruf zu wechseln. Sie verfügt nun über mehr als acht Jahre Erfahrung in der Forschung und Inhaltsentwicklung. Bislang hat sie über 100 Broker getestet und bewertet und kennt die Welt des Forex-Handels in- und auswendig.

Ida Hermansen

Finanzredakteurin

2023 kam Ida als Finanzredakteurin zu unserem Team. Sie hat einen Abschluss in Digitalem Marketing und einen Hintergrund in Content Writing und SEO. Zusätzlich zu ihren Marketing- und Schreibfähigkeiten interessiert sich Ida auch für Kryptowährungen und Blockchain-Netzwerke. Ihr Interesse am Krypto-Handel führte zu einer größeren Faszination für die technische Analyse von Devisen und Preisbewegungen. Sie entwickelt ihre Fähigkeiten und Kenntnisse im Forex-Handel ständig weiter und beobachtet genau, welche Forex-Broker die besten Handelsbedingungen für neue Händler/innen bieten.

Broker vergleichen

Finden Sie heraus, wie Fibo Group im Vergleich zu anderen Brokern abschneidet.

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.