Capital.com Test und Erfahrungen

| 🏦 Min. Einzahlung | USD 20 |

| 🛡️ Geregelt durch | FCA, CySEC, ASIC, SCB |

| 💵 Handelskosten | USD 6 |

| ⚖️ Max. Hebelwirkung | 200:1 |

| 💹 Copy Trading | Keine |

| 🖥️ Platforms | MT4, TradingView, Capital.com |

| 💱 Instrumente | Commodities, Kryptowährungen, Stock CFDs, Forex, Indices |

Zuletzt aktualisiert am Oktober 14, 2024

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu Capital.com

Das 2016 in London (Großbritannien) gegründete Unternehmen Capital.com hat sich mit seinen niedrigen Kosten, der großen Auswahl an Instrumenten und der benutzerfreundlichen Handelsplattform schnell zu einem der beliebtesten Forex-Broker gemausert. Nach unserem Test für diesen Bericht freuen wir uns, sagen zu können, dass wir sie auch mögen. Capital.com hat sorgfältig darüber nachgedacht, was Händler von ihrem Broker erwarten und hat erfolgreich eine einladende Umgebung sowohl für Anfänger als auch für Profis geschaffen.

Bei Capital.com gibt es ein kommissionsfreies Live-Konto mit Handelsgebühren, die deutlich niedriger sind als bei anderen Brokern. Die durchschnittlichen Spreads liegen bei 0,6 Pips für EUR/USD, und es werden keine Gebühren für Einzahlungen, Abhebungen oder inaktive Konten erhoben. Darüber hinaus bietet Capital.com eines der umfangreichsten Angebote an Instrumenten, darunter über 138 Forex-Paare und 3300 Aktien-CFDs. Alle Instrumente sind auf MT4 und der preisgekrönten hauseigenen Plattform und App von Capital.com verfügbar. Anfänger werden es zu schätzen wissen, dass der Kundensupport rund um die Uhr in deutscher Sprache erreichbar ist. Dies gilt auch für die Bereiche Bildung und Marktanalyse von Capital.com, die zu den besten der Branche gehören und ebenfalls vollständig ins Deutsche übersetzt sind.

| 🏦 Min. Einzahlung | USD 20 |

| 🛡️ Geregelt durch | FCA, CySEC, ASIC, SCB |

| 💵 Handelskosten | USD 6 |

| ⚖️ Max. Hebelwirkung | 200:1 |

| 💹 Copy Trading | Keine |

| 🖥️ Platforms | MT4, TradingView, Capital.com |

| 💱 Instrumente | Commodities, Kryptowährungen, Stock CFDs, Forex, Indices |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Enge Spreads

- Niedrige Mindesteinlage

- Ausgezeichnete Bildung

Nachteile

- Begrenzte Kontooptionen

Ist Capital.com sicher ?

Ja, Capital.com ist ein sicherer Broker für deutsche Trader. Es wird von bedeutenden globalen Regulierungsbehörden überwacht, darunter die Securities and Exchange Commission der Bahamas (SCB), die Securities and Commodities Authority der Vereinigten Arabischen Emirate (SCA), die FCA in Großbritannien, ASIC in Australien und CySEC in Zypern.

CySEC-Regulierung: Deutsche Trader handeln über die Tochtergesellschaft Capital Com SV Investments Limited, die in der EU von der Cyprus Securities and Exchange Commission (CySEC) reguliert wird.

Sicherheitsmerkmale: Der führende Regulierer der EU, CySEC, stellt sicher, dass alle Kundengelder von Capital.com auf separaten Konten aufbewahrt werden und dass Capital.com seinen Tradern einen Schutz vor negativem Kontostand bietet, sodass Kunden nicht mehr verlieren können, als auf ihrem Handelskonto vorhanden ist. Unter dieser Regulierung ist der Hebel auf 1:30 für Hauptwährungspaare begrenzt, und es ist Capital.com untersagt, Boni und Werbeaktionen anzubieten. Deutsche Trader werden erfreut feststellen, dass ihre Gelder durch den Anlegerentschädigungsfonds gemäß den regulatorischen Bestimmungen geschützt sind.

Unternehmensdetails:

Finanzinstrumente von Capital.com

Das Angebot an Finanzinstrumenten, die bei Capital.com gehandelt werden können, ist breiter als bei den meisten anderen Brokern, mit einer großen Anzahl von CFDs auf Aktien, Kryptowährungen und Forex-Paare, die selten bei anderen Brokern zu finden sind.

Aktien-CFDs: Aktienhändler werden Capital.com als eine gute Wahl empfinden. Es bietet über 3.300 CFDs zum Handel an (während die meisten anderen Broker nur etwa 1.000 haben), eine der umfangreichsten Angebote der Branche.

Forex- und Krypto-Paare: Capital.com zeichnet sich auch durch die Anzahl der Forex- und Krypto-Paare aus. Mit 138 Forex-Paaren und über 400 Kryptowährungspaaren im Angebot sind die verfügbaren Bereiche doppelt so groß wie bei den meisten anderen Brokern.

Vollständige Liste der Instrumente und der Hebelwirkung:

-

Forex: Capital.com bietet über 120 Währungspaare zum Handel an, eine weitaus größere Auswahl im Vergleich zu den meisten anderen Brokern. Dazu gehören Hauptwährungspaare (EUR/USD, GBP/USD und USD/JPY), Nebenwährungspaare (NZD/JPY, GBP/JPY und USD/ZAR) und exotische Paare.

-

Aktien-CFDs: Capital.com bietet über 2.700 Aktien-CFDs an, weit mehr als andere große internationale Broker. Die verfügbare Auswahl umfasst einige der wichtigsten Börsen in den USA, Großbritannien und Europa.

-

Indizes: Bei Capital.com sind 19 Indizes für den Handel verfügbar, was der durchschnittlichen Anzahl entspricht, die von ähnlichen Brokern angeboten wird. Die beliebtesten Indizes kombinieren Aktien einiger der größten und bekanntesten Unternehmen weltweit.

-

Rohstoffe: Capital.com bietet den Handel von CFDs auf 19 Rohstoffe an, was im Durchschnitt mit ähnlichen Brokern vergleichbar ist. Die Rohstoffe umfassen Metalle wie Gold und Silber, Energien wie Öl und Erdgas sowie Agrarrohstoffe wie Zucker, Kakao und Baumwolle.

-

Kryptowährungen: Mit über 20 handelbaren Krypto-Paaren bietet Capital.com eine breite Palette an Kryptowährungen für den CFD-Handel an. Die Spreads variieren im Vergleich zu anderen traditionellen Fiat-Währungen erheblich.

Insgesamt bietet Capital.com eine breite Palette von Finanzinstrumenten an, darunter Aktien, Forex-Paare und Kryptowährungen.

Handelsgebühren und Konten

Obwohl Capital.com keine Möglichkeit bietet, zwischen verschiedenen Kontotypen zu wählen, sind seine Handelsgebühren niedriger als bei ähnlichen Brokern.

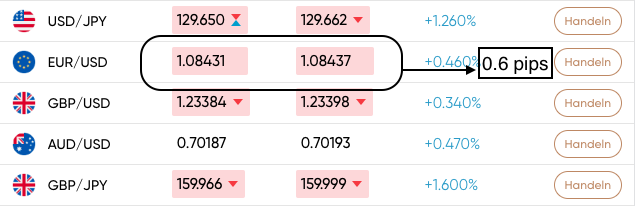

Handelsgebühren: Das Konto von Capital.com erfordert eine Mindesteinzahlung von nur £10/$10 USD/€10, was es für die meisten Trader zugänglich macht. Das CFD-Handelskonto ist gebührenfrei, mit Spreads ab 0,6 Pips auf EUR/USD, was es zu einem der günstigsten Konten in der Branche macht. Die meisten anderen guten Broker haben durchschnittliche Handelskosten von 9 USD pro Lot EUR/USD.

Nicht-Handelsgebühren: Auch die Nicht-Handelsgebühren von Capital.com sind niedriger als bei anderen Brokern. Es fallen keine Einzahlungs-, Abhebungs- oder Inaktivitätsgebühren an. Im Gegensatz zu anderen Brokern erhebt Capital.com Swap-Gebühren nur auf den geliehenen Betrag und nicht auf die gesamte Positionsgröße.

Es sei darauf hingewiesen, dass Capital.com in Deutschland keine islamischen Konten ohne Swap anbietet.

Demokonto: Capital.com bietet ein kostenloses Demokonto an, auf dem Kunden Handelsstrategien mit bis zu 100.000 USD in virtuellem Kapital testen können. Das Kundenserviceteam steht rund um die Uhr zur Verfügung, um bei der Kontoerstellung oder technischen Problemen zu helfen.

Handelskosten eines Kontos:

Wir eröffneten und testeten das Capital.com-Konto und stellten fest, dass die Spreads, wie angekündigt, 0,6 Pips auf EUR/USD betragen:

Gemäß den CySEC-Bestimmungen ist der Hebel auf 30:1 begrenzt.

Allgemein bietet Capital.com eine der wettbewerbsfähigsten Preisgestaltungen in der Branche.

Ein- und Auszahlungen

Capital.com bietet eine breite Palette von Ein- und Auszahlungsmethoden ohne zusätzliche Gebühren an.

Capital.com, ein gut regulierter Broker, stellt sicher, dass alle Anti-Geldwäsche-Vorschriften eingehalten werden. Daher werden alle Auszahlungen an die ursprüngliche Quelle der Einzahlung zurücküberwiesen.

Akzeptierte Währungen: Bei der Eröffnung unseres Kontos hatten wir die Wahl zwischen vier Basiswährungen – EUR, USD, GBP und PLN. Dies liegt im Durchschnitt im Vergleich zu anderen Brokern und ist vorteilhaft für deutsche Trader, die wahrscheinlich Bankkonten in EUR haben und so Währungsumrechnungsgebühren bei Einzahlungen und Auszahlungen vermeiden können.

Zahlungsmethoden: Capital.com bietet gebührenfreie Ein- und Auszahlungsoptionen, die über die Handelsplattform des Brokers ausgeführt werden können. Zu den angebotenen Ein- und Auszahlungsmethoden gehören Banküberweisungen, Kreditkartenüberweisungen, Paypal, Sofort, Trustly und Apple Pay.

Die Mindesteinzahlung beträgt 20 EUR, 20 USD, 20 GBP oder 100 PLN für alle Zahlungsmethoden, außer bei einer Banküberweisung, die ein Minimum von 250 EUR (oder den Gegenwert in der Währung deines Handelskontos) erfordert.

Auszahlungsanforderungen werden innerhalb von 24 Stunden bearbeitet, können jedoch fünf bis sieben Werktage dauern, bis die Gelder auf den Konten der Kunden eingehen. Banküberweisungen könnten länger dauern.

Details siehe unten:

Insgesamt bietet Capital.com eine breite Palette von Finanzierungsmethoden an und erhebt außergewöhnlicherweise keine Gebühren für Ein- oder Auszahlungen. Wir waren auch erfreut festzustellen, dass die Bearbeitungszeiten in der Regel schnell sind.

Mobiler Handel

|

|  |

Sonstige Handelsplattformen

Mit seiner intuitiven Webplattform, MT4 und TradingView bietet Capital.com eine bessere Handelsplattform-Unterstützung als die meisten anderen Broker.

Capital.com Webplattform

Capital.com hat eine eigene Handelsplattform entwickelt, die über Webbrowser verfügbar ist. Die Plattform ist benutzerfreundlich, intuitiv und einfach einzurichten, was sie ideal für Anfänger macht.

Die maßgeschneiderte Plattform bietet eine tiefgehende Finanzanalyse mit über 75 technischen Indikatoren, verschiedenen Charttypen und zahlreichen Zeichenwerkzeugen. Sie ermöglicht es den Nutzern auch, mühelos zwischen bis zu sechs Tabs zu wechseln, um alle verfügbaren Charts und Tools in ihrem Handelsarsenal im Blick zu behalten. Zudem können mehrere Watchlists erstellt werden, um ausgewählte Märkte zu überwachen. Darüber hinaus bietet sie den Tradern intelligente Risikomanagement-Tools, die es ihnen ermöglichen, das Risiko mit verschiedenen Stop-Loss- und Take-Profit-Instrumenten zu kontrollieren.

Ein Nachteil der Plattform ist, dass sie weder automatisierte Handelslösungen noch Strategien von Drittanbietern unterstützt.

MetaTrader 4

MT4, entwickelt von MetaQuotes im Jahr 2002, ist nach wie vor eine der weltweit beliebtesten Plattformen für CFD-Handel. Obwohl die Benutzeroberfläche mittlerweile etwas veraltet ist, wird MT4 weiterhin für seine schnelle Ausführung, die breite Palette von Analysewerkzeugen, den algorithmischen Handel und die Anpassungsmöglichkeiten geschätzt. Weitere Funktionen von MT4 umfassen:

- Unterstützung bei der Erstellung, Bearbeitung und Nutzung von automatisierten Handelsstrategien.

- Algorithmischer Handel, der es ermöglicht, jede Handelsstrategie als Expert Advisor (EA) zu implementieren.

- Die Möglichkeit für Trader, eigene benutzerdefinierte Indikatoren zu entwickeln.

- Zusätzliche Smart Trader-Tools, die 30 beliebte technische Indikatoren und 24 analytische Objekte umfassen.

TradingView

Capital.com hat kürzlich TradingView in sein Handelsplattform-Portfolio aufgenommen. TradingView Basic ist kostenlos für Trader, die ein echtes Konto bei Capital.com eröffnen. Es ist jedoch zu beachten, dass die Premium-Versionen von TradingView mit monatlichen Abonnementgebühren verbunden sind.

TradingView ist nicht nur eine Handelsplattform mit detaillierten Informationen, die Tradern helfen, Handelsentscheidungen zu treffen. Es beinhaltet auch eine der größten Social-Trading-Communities, was besonders für Anfänger oder vielbeschäftigte Trader, die nicht manuell handeln möchten, von Vorteil ist.

Die Vorteile von TradingView umfassen:

- Unübertroffene Charting-Fähigkeiten, die sowohl für Anfänger als auch für fortgeschrittene Trader geeignet sind.

- Eine große Social-Trading-Community mit über 50 Millionen Nutzern.

- Die Möglichkeit, eigene Indikatoren und Strategien mit der Programmiersprache Pine Script von TradingView zu entwerfen.

- Die Option, Handelsideen mit der Bar-by-Bar-Wiedergabefunktion von TradingView zu validieren.

- Eine große Auswahl an fundamentalen Daten.

- Echtzeit-Berichterstattung über globale Nachrichten.

Der Vorteil, dass Capital.com Drittanbieter-Plattformen wie MT4 und TradingView anbietet, besteht darin, dass Trader ihre eigene, personalisierte Version der Plattform mitnehmen können, wenn sie zu einem anderen Broker wechseln. Darüber hinaus sind Tausende von Plugins und Tools für MT4 und TradingView verfügbar.

Insgesamt ist die Plattformunterstützung von Capital.com im Vergleich zu anderen ähnlichen Brokern durchschnittlich, bietet jedoch eine proprietäre Plattform, die einfacher zu bedienen und zu konfigurieren ist als MT4.

Kontoeröffnung bei Capital.com

Die Eröffnung eines Kontos bei Capital.com ist ausgezeichnet: Sie erfolgt intuitiv, schnell und einfach, und Konten werden in der Regel innerhalb eines Werktages genehmigt.

Die Eröffnung eines Kontos bei Capital.com hat etwa 3 Minuten gedauert. Einzahlungen auf unsere Konten konnten wir sofort vornehmen, und der Kundenservice bestätigte unser Konto innerhalb von 24 Stunden.

Für deutsche Händler/innen besteht die Möglichkeit, ein Firmenkonto zu eröffnen (in diesem Fall müssen sich die Kunden an den Kundendienst wenden) oder ein individuelles Konto, um das es in diesem Bericht gehen wird:

- Oben rechts auf der Website klickten wir auf die Schaltfläche “Jetzt handeln”.

- Daraufhin wurden wir aufgefordert, unsere Daten einzugeben, darunter Name, Land des Wohnsitzes, Beschäftigungsstatus, Finanzstatus usw.

- Im nächsten Schritt mussten wir unsere bevorzugte Basiswährung auswählen.

- Um uns als Privatkunden zu akzeptieren, benötigt Capital.com mindestens zwei Dokumente:

-

- Identifikationsnachweis – Bei Capital.com werden alle von der Regierung ausgestellten Identifikationsdokumente akzeptiert, wie z.B. Reisepass, Personalausweis, Führerschein oder ein anderer von der Regierung ausgestellter Ausweis.

- Adressennachweis – Der Wohnsitz-/Adressennachweis muss innerhalb der letzten 6 Monate auf den Namen des Capital.com-Kontoinhabers ausgestellt worden sein und muss den vollständigen Namen des Händlers, die aktuelle Wohnadresse, das Ausstellungsdatum und die ausstellende Behörde enthalten.

Sobald wir unsere Unterlagen eingereicht hatten, wurde unser Konto eröffnet und wir konnten sofort mit dem Handel beginnen. Die Genehmigung für unsere Konten wurde innerhalb von 24 Stunden erteilt.

Es empfiehlt sich, die Risikoaufklärung, die Kundenvereinbarung und die Geschäftsbedingungen von Capital.com zu lesen, bevor man mit dem Handel beginnt.

Handelsinstrumente

Wie bei den Schulungsmaterialien übertrifft die auf Capital.com verfügbare Marktanalyse die der meisten anderen Broker.

Ihre Broker-Seite auf TradingView ist voller gut präsentierter, aktueller und fundamentaler Analysen. Die Gesamtqualität der Inhalte, die tiefgehende Analyse und der pädagogische Wert der Recherchen übertreffen das Angebot der Konkurrenz. Ein Wirtschaftskalender ist ebenfalls über Capital.com verfügbar.

Vergleich der Handelsinstrumente:

Capital.com für Anfänger

Capital.com bietet eine umfangreiche und gut organisierte Auswahl an Bildungs- und Marktanalysematerialien, die weit über dem Angebot anderer Broker liegt, und die meisten Inhalte sind auf Deutsch verfügbar. Besonders erwähnenswert ist Capital.com TV, moderiert von David Jones, das zahlreiche hochwertige Videos präsentiert, die verschiedene Themen rund um den Handel abdecken und Handelsideen zu aktuellen Marktereignissen bieten.

Materialien zur Marktanalyse

Die auf Capital.com verfügbare Marktanalyse übertrifft die der meisten anderen Broker. Das Material ist gut strukturiert, umfassend und tiefgehend, und bietet den Tradern wertvolle Handelsideen.

Die Rubrik „Nachrichten und Finanzfunktionen“ ist voller gut präsentierter, aktueller Analysen und Fundamentalanalysen. Die Gesamtqualität der Inhalte, die umfassende Analyse und der pädagogische Wert der Forschung übertreffen die Konkurrenz bei Weitem. Dieses Forschungsmaterial ist mit den auf der Capital.com TV-Plattform präsentierten Videos verknüpft. Ein Wirtschaftskalender ist ebenfalls verfügbar.

Bildungsmaterial

Die Bildungsressourcen von Capital.com sind im Vergleich zu anderen ähnlichen Brokern hervorragend.

Capital.com bietet eine umfangreiche Auswahl an Bildungs- und Marktanalysematerialien, die gut organisiert sind. Sie produzieren hochwertige Videos, die eine breite Palette von Inhalten rund um den Handel abdecken.

Die Bildungsressourcen von Capital.com umfassen:

- Demokonto

- Allgemeine Bildungsvideos

- Webinare

- Qualitativ hochwertige Lehrartikel

- Glossar

Die exzellenten schriftlichen Bildungsressourcen von Capital.com können Tradern helfen, die Fähigkeiten zu entwickeln, um ihre Handelsperformance zu verbessern. Zahlreiche Anleitungen wurden in ihrem Education Hub zusammengestellt und decken Themen ab, die von grundlegenden Handelsstrategien bis hin zu Finanzmärkten und -instrumenten reichen.

Capital.com bietet auch Videokurse an, die eine tiefgehende Einführung in die grundlegendsten Elemente des Handels bieten, sodass Trader verschiedene Handelsansätze erkunden können.

Kundendienst

Sicherheit und Anerkennung der Industrie

Gegründet im Jahr 2016 und mit Sitz auf Zypern, wird Capital.com von der Securities Commission der Bahamas (SCB), der Financial Conduct Authority (FCA) im Vereinigten Königreich, der Cyprus Securities and Exchange Commission (CySEC), der Australian Securities and Investments Commission (ASIC) und der Securities and Commodities Authority (SCA) der Vereinigten Arabischen Emirate autorisiert und reguliert. Hier ist eine Liste der registrierten Unternehmen von Capital.com:

- Capital Com Online Investments Ltd ist als International Business Company unter der Registrierungsnummer 209236B registriert und wird von der Securities Commission der Bahamas (SCB) unter der Lizenznummer SIA-F245 überwacht.

- Capital Com Australia Pty Ltd ist in Australien unter der Registrierungsnummer ABN 47 625 601 489 registriert. Es ist von der Australian Securities and Investments Commission (ASIC) unter der Lizenznummer 513393 autorisiert und reguliert.

- Capital Com (UK) Limited ist in England und Wales unter der Registrierungsnummer 10506220 registriert und wird von der Financial Conduct Authority (FCA) unter der Registrierungsnummer 793714 autorisiert und reguliert.

- Capital Com SV Investments Limited ist eine regulierte Investmentgesellschaft auf Zypern mit der Registrierungsnummer HE 354252 und wird von der Cyprus Securities and Exchange Commission unter der Lizenznummer 319/17 autorisiert und reguliert (alle Einheiten werden im Folgenden als „wir“, „das Unternehmen“ oder „Capital.com“ bezeichnet).

- Capital Com Mena Securities Trading L.L.C. ist eine Gesellschaft mit beschränkter Haftung, registriert unter der Nummer 1994695. Sie ist in Dubai, Vereinigte Arabische Emirate, registriert und wird von der Securities and Commodities Authority unter der Lizenznummer 20200000176 autorisiert.

Capital.com, mit Sitz in der Europäischen Union, erfüllt die Anforderungen der Richtlinie über Märkte für Finanzinstrumente (MiFID).

Auszeichnungen

Capital.com hat in den letzten Jahren viele Auszeichnungen gewonnen und damit seinen Ruf als sicherer Broker weiter gestärkt. Zu den jüngsten Auszeichnungen gehören:

- 2024: Beste Handelsplattform (Online Money Awards 2024)

- 2024: 1. Platz in der 3. Ausgabe der Deloitte Tech Middle East und Zypern Fast 50 Rankings

- 2023: Beste Trading-App (Good Money Guide)

- 2023: Bester CFD-Anbieter (Online Money Awards)

Insgesamt betrachten wir Capital.com aufgrund seiner verantwortungsvollen Geschichte, der starken internationalen Regulierung und der zahlreichen Branchenauszeichnungen als sicheren Broker für deutsche Trader.

Bewertungsmethode

Bei der Überprüfung unserer Partner legen wir Wert auf Transparenz und Offenheit. Deshalb haben wir unser Bewertungsverfahren veröffentlicht. Im Mittelpunkt dieses Prozesses steht die Bewertung der Zuverlässigkeit des Brokers, des Plattformangebots des Brokers und der Handelsbedingungen für die Kunden, die in dieser Bewertung zusammengefasst sind. Jeder dieser Punkte wird benotet, und es wird eine Gesamtnote berechnet und dem Broker zugewiesen.

Risikoerklärung von Capital.com

Der Forex-Handel ist riskant, und jeder Broker ist verpflichtet, seine Kunden über das Risiko des Handels mit Forex-CFDs zu informieren. Capital.com möchte Sie darüber informieren: 87,41 % der Konten von Kleinanlegern/innen verlieren Geld beim Handel mit Spread-Wetten und/oder CFDs bei diesem Anbieter. Daher sollte man sich überlegen, ob man das hohe Risiko, sein Geld zu verlieren, eingehen kann.

Überblick

Als streng regulierter Broker bietet Capital.com wettbewerbsfähige, variable Spreads für eine breite Palette von Vermögenswerten und erhebt keine Provisionen, Inaktivitäts-, Abhebungs- oder Einzahlungsgebühren.

Dank der umfangreichen, gut organisierten Auswahl an Bildungs- und Forschungsmaterialien ist Capital.com eine ausgezeichnete Wahl für Trading-Anfänger. Die hauseigene Plattform ist benutzerfreundlich und verfügt über eine breite Palette von Funktionen. Alles in allem ist Capital.com eine hervorragende Wahl für deutsche Trader, die eine kostengünstige Handelsumgebung und eine große Anzahl von handelbaren Vermögenswerten auf einer einfach zu bedienenden Handelsplattform suchen.

Finden Sie heraus, wie Capital.com im Vergleich zu anderen Brokern abschneidet.Broker vergleichen

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.