Axi Test und Erfahrungen

| 🏦 Min. Einzahlung | USD 0 |

| 🛡️ Geregelt durch | FCA, CySEC, ASIC, DFSA |

| 💵 Handelskosten | USD 10 |

| ⚖️ Max. Hebelwirkung | 500:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4 |

| 💱 Instrumente | Kryptowährungen, Stock CFDs, Forex, Indices, Metalle, WTIs |

Zuletzt aktualisiert am Februar 28, 2025

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu Axi

An Deutsch broker with an excellent reputation, Axi is an MT4-only broker with three low-cost trading accounts and some of the best trading tools in the industry. We were also pleased to find that Axi is regulated by ASIC, an Deutsch regulator that provides a high level of investor protection.

Although Axi limits its platform choice to MT4, it offers traders free use of various powerful platform-integrated technical analysis tools, including Autochartist, MyFxBook, and PsyQuation to help experienced traders and serious beginners make better trading choices. We were also impressed that beginners have access to high-quality, structured learning material and frequent market analysis.

Axi’s range of financial instruments is slightly limited compared to other brokers, but it offers over 70 Forex pairs and has recently added share CFDs. Finance professionals and wealthy clients will also be pleased to note that they can access leverage of up to 400:1 for major Forex pairs on the Elite Account.

| 🏦 Min. Einzahlung | USD 0 |

| 🛡️ Geregelt durch | FCA, CySEC, ASIC, DFSA |

| 💵 Handelskosten | USD 10 |

| ⚖️ Max. Hebelwirkung | 500:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4 |

| 💱 Instrumente | Kryptowährungen, Stock CFDs, Forex, Indices, Metalle, WTIs |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Niedrige Mindesteinlage

- Enge Spreads

- Innovative Handelsinstrumente

Nachteile

- Nur MT4

- Limited range of assets

Is Axi Safe?

An ASIC-regulated broker, Axi is well-known for being reliable and trustworthy.

Trust: Established in 2007 and headquartered in Sydney, Axi has an excellent reputation in the Forex trading community. The company has also received multiple awards for its transparency and trustworthiness.

Safety Features: Considered one of the world’s top authorities, ASIC regulation means that Axi’s Deutsch clients are provided with a high level of protection, including segregating client funds from its operating funds and providing traders with negative balance protection. However, it also means that leverage is restricted to 30:1 (as opposed to 500:1 through its SVG FSA-regulated entity) and that Axi cannot offer traders bonuses or promotions.

Deutsch traders who are happy to waive these protections, can prove their professional trader status, and can afford the 25,000 USD deposit on the Elite account, have access to leverage of up to 400:1.

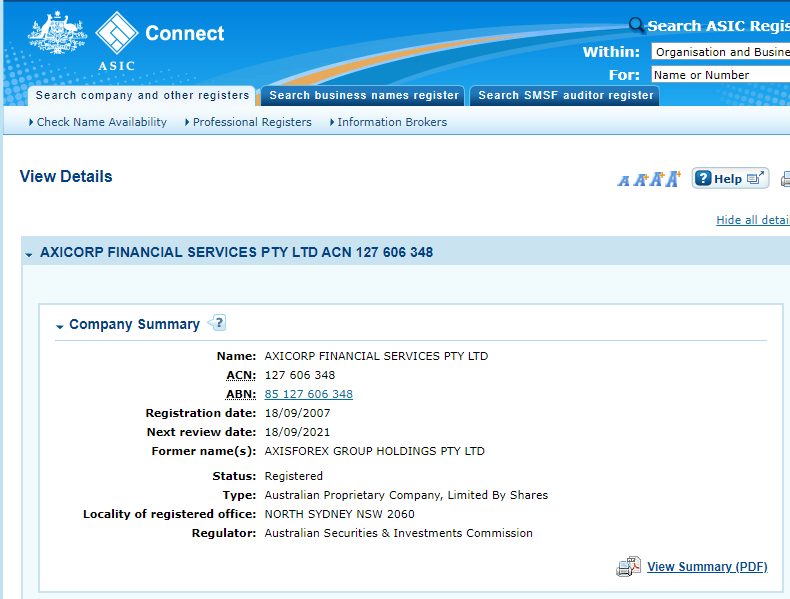

We checked Axi’s all Axi’s regulatory licences on the official registers. See below for the ASIC licence:

Company Details:

Axi’s Trading Instruments

Axi’s range of financial instruments to trade is smaller than most other brokers, but we were pleased to find that it recently added a range of share CFDs to its offering.

Limited Instruments: While Axi does offer a selection of CFDs to trade, it only provides support for the MT4 trading platform, which is historically and primarily a platform for trading Forex. This shows in Axi’s relatively limited range of financial instruments.

Full List of Instruments and Leverage:

Forex: At Axi, there are more pairs to trade than most other Forex brokers. These include majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and GBP/NZD), and exotics (EUR/NOK, USD/SEK and EUR/ZAR).

Indices: Axi has a wider selection of indices than other similar brokers, and includes the likes of the NASDAQ, FTSE100, DAX30, and Hang Seng.

Share CFDs: Axi recently added share CFDs to its offering – it now offers shares from the top 50 companies listed in the United States, the United Kingdom, and European markets, including popular and liquid stocks like Apple, Amazon, and Netflix.

Commodities: Axi offers trading on a good range of commodities, including gold, silver, platinum, petroleum, and soft commodities such as coffee, cocoa, and soya beans.

Cryptocurrencies: Axi’s range of cryptocurrencies is around the industry average and includes favorites like Bitcoin, Ethereum, Ripple, Cardano, DogeCoin, Polkadot, EOS, Chainlink, and Stellar Lumen.

Axi’s Accounts and Trading Costs

We were impressed to find that both Axi’s minimum deposits and ongoing trading costs are significantly lower than most other brokers.

Trading Costs: Axi offers three MT4 market-execution accounts, two with no minimum deposits and a professional trading account with a very high minimum deposit, but extraordinarily low trading costs. The Standard Account has the trading costs included in the spread while the Pro and Elite accounts offer tighter spreads and a small commission per trade.

Account Trading Costs

As you can see from the table above, Axi’s trading costs are about average on the Standard Account – most good brokers will have a cost of around 9 USD per lot of EUR/USD – and lower than average on the Pro and Elite Accounts.

MT4 Standard Account

With no minimum deposit, the MT4 Standard Account is a commission-free account where spreads start at 1 pip. This gives you access to over 70 FX pairs, maximum leverage of 30:1, free AutoChartist, and a free VPS service (the VPS service is subject to a minimum trading volume).

MT4 Pro account

The MT4 Pro Account is very similar to the MT4 Standard Account, with the same perks and trading assets, the only difference being that this is a commission account, with a 7 USD round trip commission on trades and minimum spreads starting at 0 pips.

Elite Account

The Elite Account is designed for wholesale or professional traders. It has a minimum deposit of 25,000 USD, spreads that start at 0.0 pips on the EUR/USD, and a commission of only 3.5 USD round trip, making it one of the lowest cost accounts in the industry. Elite account-holders also have access to exclusive market analysis, free VPS services, and specialised trading tools. Traders also have access to leverage of up to 400:1.

Spread Comparison:

Axi’s Deposit & Withdrawal fees

Axi has a limited range of funding methods and Deutsch traders can only withdraw via bank transfer, but it allows accounts to be deposited in AUD. It also charges no fees for deposits or withdrawals via any method, a rare feature amongst Forex brokers.

A well-regulated broker, Axi ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all non-profit withdrawals are returned to the deposit source. Note that Axi does not allow any withdrawals whatsoever by credit/debit card.

Base Currencies: Axi allows deposits and withdrawals in most common currencies, including AUD. Be aware that you will pay a conversion fee if the base currency of your account is anything other than your deposit currency. However, while most Deutschs will want to have their trading accounts denominated in AUD, some traders may want to have multiple accounts with different base currencies so as not to pay conversion fees when trading. The wide range of base currencies available at Axi allows for traders to do this and is welcomed.

All deposits and withdrawals are free of charge, and you can fund your account via:

- Debit and Credit Cards – Deposits with debit and credit cards will fund your account instantly but withdrawals are not available.

- Bank Transfer – Deposits and withdrawals are free via bank transfers but can take up to three days to reflect. International bank transfers will take 3-5 business days for the funds to reflect in your account and may be liable for further bank fees which will not be covered by Axi. There is a minimum withdrawal of 50 AUD via bank transfer.

- POLi: Deposits via POLi are free and will fund a trading account instantly, but withdrawals are not available.

Withdrawals are generally processed within 1-2 days, and all withdrawal requests must be made from within the client portal:

Axi Mobile Trading Platforms

Axi recently launched its own mobile app, but this is not yet available in Deutschland. Traders can download MT4 on Android and iOS.

Although Axi only supports the MetaTrader 4 (MT4) platform, it is truly customisable, with a range of tools and plugins that can be added to the platform to make it more powerful.

We tested Axi’s MT4 app on an i-phone 11 and found that it synced well with the desktop and web trader versions. It allows traders to monitor and modify their trades, manage their accounts, add stops to positions, and delete orders. Traders can also follow the latest research and trends on real-time charts.

Axi’s Other Trading Platforms

Axi is an MT4-only broker, but this singular focus provides for one of the best MT4 trading experiences in the world.

The main benefit of using third-party platforms such as MT4 is that traders can keep their own customised versions of the platforms should they choose to migrate to another broker. MT4 is available for Windows, Mac, and web browsers. Axi’s trading tools transform the MT4 platform into a state-of-the-art trading terminal. Read the trading tools section for more details.

Trading Platform Comparison:

Axi’s Trading Tools

Axi offers an excellent range of trading tools that integrate seamlessly with the MT4 platform.

Axi has a carefully selected range of trading tools that all MT4 users will find useful. While all of these tools are “free” to Axi clients, many of them are conditional on higher minimum deposits – highlights include:

AutoChartist

Free to all Axi clients no matter their account balance, Autochartist is an award-winning automated technical analysis tool that plugs into MT4 and scans all available CFD markets for trading opportunities.

Autochartist’s advanced pattern recognition engine identifies the strongest potential trading opportunities and predicts future price movements. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

The market scanner provides statistically significant market movements and identifies important price levels that are catalysts for market movements.

PsyQuation Premium

With a minimum deposit of 500 AUD (or currency equivalent) you will get access to PsyQuation Premium. PsyQuation is one of the world’s most advanced data analytics plugins for retail traders. Using highly sophisticated algorithms, it works like a trading coach, analysing your trading style, identifying mistakes, and helping you avoid making similar mistakes again. Because every Axi client gets a unique PsyQuation Score, you can use the PsyQuation leaderboard to follow the most successful traders – details provided include performance history and equity curve.

Auto/Social/Copy Trading

Axi also offers DupliTrade (with a 5000 AUD minimum deposit), a powerful auto-execution system that duplicates the trades of chosen strategy providers; Myfxbook, a free social trading plugin that allows you to follow and copy other traders; and ZuluTrade, another free social trading platform that easily allows you to follow and copy other traders.

MT4 Forex VPS Hosting

Axi clients can also subscribe to an MT4 Forex VPS hosting service from external third-party providers, helping ensure trades are never disrupted by technological or connectivity issues. Prices and exact services offered vary by provider, but some are free once you hit a minimum trading volume of 20 lots PCM.

Opening a Trading Account with Axi

Opening an account at Axi is a quick and hassle-free process. Our accounts were approved within minutes, which is exceptionally fast for the industry.

All Deutschs are eligible to open a trading account at Axi but will have to follow the fully digital three-step application process.

How to open an account with Axi:

- Create your login via the Axi website, you will be asked for your name, email address, country of residence, phone number, and whether you want an individual, joint or company account. We will be focusing on opening an individual account.

- The second step is to confirm your identification. Axi needs two ID documents from you, the easiest way to provide these documents is to take a photo of them with a mobile phone:

- A photo ID (passport, driver’s license or national ID card) and;

- A secondary ID (a bank or utility statement with your full name and address dated in the last three months).

- Important: Axi will not accept ID documents that are black and white images, scanned copies, blurry or damaged.

- Once your application is approved, you can log in and fund your account in the base currency of your choosing.

Compared to other similar brokers, Axi’s account opening process is fast, hassle-free, and fully digital.

Axi’s Research and Analysis

We found that Axi’s market analysis is less frequent than many other large international brokers, but the quality is excellent.

Aside from a perfectly functional Economic Calendar, Axi also runs a Market News Blog which features regular analysis, both technical and fundamental, as well as educational pieces and features. The regular analysis includes a weekly market preview, charts of the day, charts of the week, and a daily briefing on the market open.

Overall, not as in-depth as you may expect from a broker of this type, but all analysis is solid and well-written.

Axi’s Educational Content

Axi’s trader education is better than most other ECN brokers, with detailed information in video and text format for both beginners and more experienced traders. It also offers a free demo account, but it expires in 30 days.

Trader education at Axi is detailed and flexible, available in both written and video format. Highlights of the education available include:

- Video tutorials on demand

- Courses available in 24 languages

- An eBook with a simple lesson structure

- Frequent tests to monitor your progress

- Frequent webinars on both basic and advanced topics

Subjects covered include:

- Forex trading basics: Currency pairs, leverage, spreads, opening/closing trades

- Analysis techniques: Charts, technical analysis, support/resistance, using indicators and oscillators to support trading strategies

- Developing a trading strategy: Including day trading, news trading, trend trading and more

- Trading psychology: Risk management, greed and overcoming the fear of loss

While Axi’s educational content is not as broad or as deep as the best trading educators, like BDSwiss or IG Markets, it is still better than most ECN brokers and will be useful for both beginners and experienced traders.

Demo Account

Axi offers a demo account with a virtual balance of 50,000 AUD that remains open for 30 days. While using your demo account, Axi will provide you with a dedicated account manager to assist you and answer any questions you may have. The demo account is an opportunity to experience Axi’s services without risking your money, but the 30-day limit is unusual – many brokers offer unlimited demo accounts (but without the dedicated account management service).

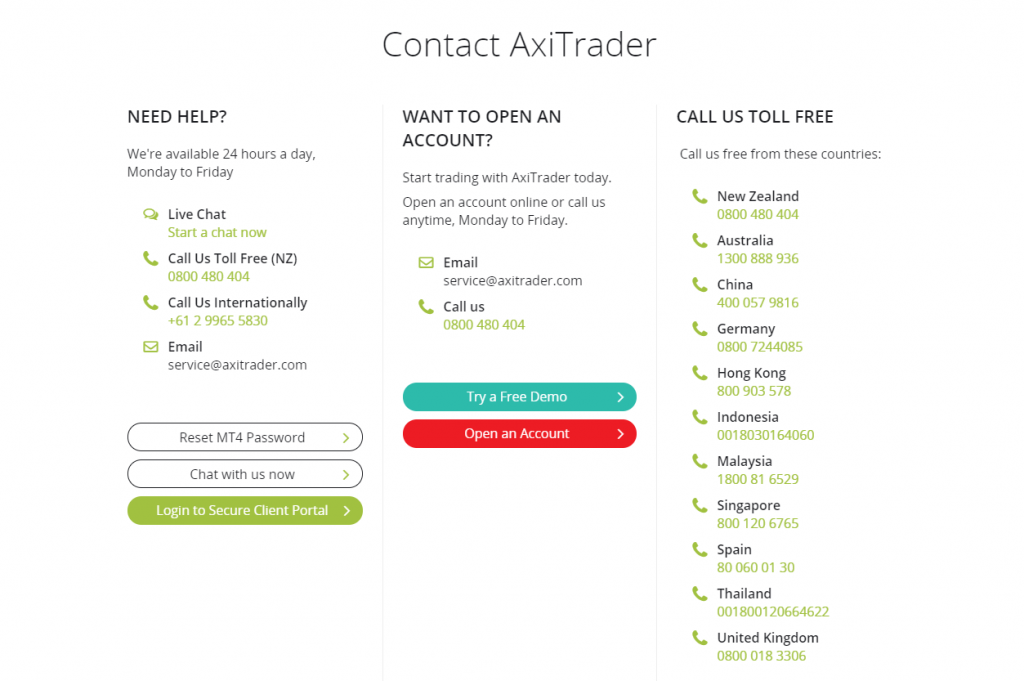

Axi’s Customer Support

All new and existing clients have dedicated account management and access to customer support 24/5 via telephone, email, and live chat. Toll-free numbers are available in Deutschland, China, Germany, Hong Kong, Indonesia, Malaysia, New Zealand, Singapore, Spain, Thailand, and the UK.

This support will help you get started and learn how to trade at any time of day that suits your schedule. For the purposes of the review, we tested the live chat and email services. Our email was answered within hours to our satisfaction. The live chat agents were also responsive and highly knowledgeable.

Safety and Industry Recognition

Regulation: Axi (formerly AxiTrader) is an ECN-only Forex and CFD broker founded in Sydney in 2007. Axi has expanded rapidly since its foundation and has become one of the most respected brands in Forex and CFD trading, with over 42’000 traders on its books and satellite offices in London, Dubai, Singapore, Germany, and China. See below for a list of Axi registered companies:

- AxiTrader Limited is incorporated in St Vincent and the Grenadines and registered with the FSA (number 25417)

- AxiCorp Financial Services Pty Ltd is incorporated in Deutschland (ACN 127 606 348) and regulated by ASIC (license # 318232)

- AxiCorp Ltd is authorised and regulated by the FCA (licence number 509746)

- AxiCorp Financial Services Pty Ltd (DIFC Branch) is regulated by the DFSA and holds a category 4 license

Awards

Axi has won many awards in the industry, substantiating its credentials as a safe broker. Some recent awards include:

- Best EMEA Region Broker 2020 (ADVFN International Financial Awards)

- Best Forex Broker Europe 2019 (forex-awards.com)

- Best MT4 Forex Broker 2019 (atozmarkets.com)

- Most Trusted Forex Broker (UK Forex Awards 2018)

With over a decade of responsible behaviour toward its clients, a large international customer base, regulation from some of the strictest authorities in the world, and ongoing industry recognition, we consider Axi a reliable and safe Forex broker.

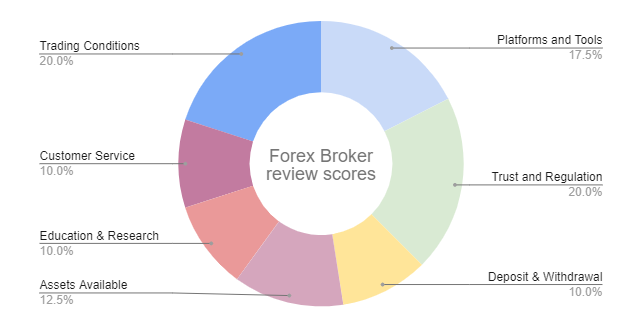

Evaluation Process

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Axi offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded on 200+ metrics across seven areas of interest, and an overall score is calculated and assigned to the broker according to the diagram below:

Axi Risk Warning

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Axi would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

For experienced traders who value simple account options, strict regulation and the heavily customisable MT4 platform, Axi is a very tempting option. The limited demo account, single platform support and complex trading tools on offer may put off some beginner traders, but there is no required minimum deposit and all clients get a dedicated account manager.

Education and market analysis are good, and experienced traders will appreciate the wide range of currency pairs. Overall Axi is good for serious beginner traders and more experienced MT4 users looking for a new broker.

Redaktionsteam

Chris Cammack

Leiter Inhalt

Chris kam 2019 zum Unternehmen, nachdem er zehn Jahre lang in den Bereichen Forschung, Redaktion und Design für politische und finanzielle Publikationen tätig war. Aufgrund seines Werdegangs kennt er sich mit den internationalen Finanzmärkten und der Geopolitik, die sie beeinflusst, bestens aus. Chris hat ein scharfes Auge für die Redaktion und einen unersättlichen Appetit auf aktuelle finanzielle und politische Themen. Er gewährleistet, dass unsere Inhalte auf allen Seiten die Qualitäts- und Transparenzstandards erfüllen, die unsere Leser/innen erwarten.

Alison Heyerdahl

Senior Finanzredakteurin

Im Jahr 2021 kam Alison als Autorin zum Team. Sie hat einen medizinischen Abschluss mit Schwerpunkt Physiotherapie und einen Bachelor in Psychologie. Ihr Interesse am Forex-Handel und ihre Liebe zum Schreiben hat sie jedoch dazu gebracht, den Beruf zu wechseln. Sie verfügt nun über mehr als acht Jahre Erfahrung in der Forschung und Inhaltsentwicklung. Bislang hat sie über 100 Broker getestet und bewertet und kennt die Welt des Forex-Handels in- und auswendig.

Ida Hermansen

Finanzredakteurin

2023 kam Ida als Finanzredakteurin zu unserem Team. Sie hat einen Abschluss in Digitalem Marketing und einen Hintergrund in Content Writing und SEO. Zusätzlich zu ihren Marketing- und Schreibfähigkeiten interessiert sich Ida auch für Kryptowährungen und Blockchain-Netzwerke. Ihr Interesse am Krypto-Handel führte zu einer größeren Faszination für die technische Analyse von Devisen und Preisbewegungen. Sie entwickelt ihre Fähigkeiten und Kenntnisse im Forex-Handel ständig weiter und beobachtet genau, welche Forex-Broker die besten Handelsbedingungen für neue Händler/innen bieten.

Broker vergleichen

Finden Sie heraus, wie Axi im Vergleich zu anderen Brokern abschneidet.

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.