AvaTrade Test und Erfahrungen

Zuletzt aktualisiert am November 20, 2024

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu AvaTrade

Der Anbieter Avatrade gilt als einer der besten Allround-Broker und dürfte für die meisten deutschen Trader eine attraktive Wahl sein. Bei unserem Test haben wir festgestellt, dass Avatrade eine große Auswahl an handelbaren Vermögenswerten, niedrige Handelsgebühren und eine Auswahl von vier verschiedenen Handelsplattformen bietet. Zudem bietet Avatrade einige der besten Trading-Tools der Branche sowie eine erstklassige Auswahl an Bildungs- und Marktanalysematerialien in deutscher Sprache, die den Händlern alles bieten, was sie für ihre Handelsentscheidungen benötigen.

Darüber hinaus ist Avatrade für seine preisgekrönte mobile App AvatradeGO bekannt, die über hervorragende Risikomanagement-Tools und eine direkte Verbindung zu AvaSocial, dem beliebten Social Trading-System von AvaTrade, verfügt.

Für deutsche Händlerinnen und Händler bietet Avatrade außerdem einen lokalen Kundensupport über eine lokale Telefonnummer.

| 🏦 Min. Einzahlung | EUR 100 |

| 🛡️ Geregelt durch | ASIC, CySEC, CBI, FRSA |

| 💵 Handelskosten | USD 9 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, MT5, Avatrade Social, AvaOptions |

| 💱 Instrumente | Anleihen, Commodities, Kryptowährungen, Stock CFDs, ETFs, Forex, Indices, Vanilla Optionen |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Top-tier regulation and security with licenses from ASIC and CBI among others

- Accessible trading with a low minimum deposit of 100 USD

- Award-winning mobile trading with the AvaTradeGO app with social trading features

- Wide range of assets including unique instruments like vanilla options

- Educational material to support trader development and strategy enhancement

Nachteile

- Market analysis could be more extensive

- Avatrade is a Market Maker and operate a dealing desk which might not align with all trading preferences

Ist Avatrade sicher?

Das bekannte und gut regulierte Unternehmen Avatrade hat eine sehr hohe Vertrauenswürdigkeit und ist ein zuverlässiger Handelspartner für deutsche Trader.

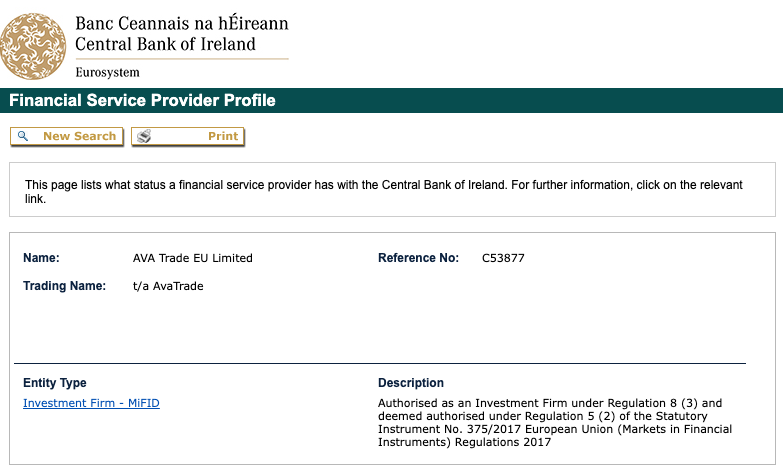

CBI-Regulierung: Das 2006 in Irland gegründete Unternehmen AvaTrade hat weltweit mehr als 200.000 registrierte Kunden und ist ein führender Forex- und CFD-Broker. Das Unternehmen wird von vielen guten Regulierungsbehörden reguliert, darunter die Central Bank of Ireland (CBI). Siehe unten für die Lizenz von Avatrade:

Sicherheitsmerkmale

Die Kundengelder werden bei Avatrade von den Betriebsgeldern bei erstklassigen Banken getrennt.

- Das bedeutet, dass Händler nicht mehr als ihre Ersteinzahlung verlieren können.

- Avatrade hat eine Vielzahl von Auszeichnungen erhalten, die seine Glaubwürdigkeit als sicherer Broker bestätigen.

- Die EU-Niederlassung von Avatrade (die von der CBI reguliert wird) nimmt an einem Anlegerschutzprogramm von bis zu 20.000 EUR teil, das eine zusätzliche Sicherheit für die Fonds bietet.

Unternehmensangaben:

Die Handelsinstrumente von Avatrade

Obwohl das Angebot an handelbaren Vermögenswerten bei Avatrade in etwa dem Branchendurchschnitt entspricht, werden auch spezielle Instrumente wie Vanilla-Optionen angeboten, die bei anderen Brokern selten zu finden sind.

Spezialisierte Finanzinstrumente: Bei Avatrade gibt es mehrere Anlageklassen, die bei anderen Brokern nicht zu finden sind. Hierzu gehören 55 Vanilla-Optionen, die exklusiv auf der AvaOptions-Plattform von Avatrade gehandelt werden, zwei Anleihen und 59 ETFs, die Händlern eine hervorragende Vermögensdiversifizierung bieten.

Vollständige Liste der Instrumente und Hebelwirkung:

- Forex: Das Angebot an Währungspaaren bei Avatrade entspricht in etwa dem Branchendurchschnitt und umfasst Majors, Minors und Exotics.

- Aktien-CFDs: Die Auswahl an Aktien-CFDs bei Avatrade ist im Vergleich zu anderen großen internationalen Brokern durchschnittlich und umfasst beliebte US-Tech-Unternehmen und multinationale Energiekonzerne.

- Rohstoffe: Das Rohstoffangebot von Avatrade ist hervorragend, denn die meisten Broker bieten den Handel mit 5 bis 10 Rohstoffen an.

- Indizes: Avatrade bietet den Handel mit einer Vielzahl von Indizes an, und im Gegensatz zu vielen anderen Brokern ist auch der Handel mit dem VIX-Index möglich.

- Anleihen: Neben dem EURO-BUND und dem JAPAN GOVT BOND bietet Avatrade den Handel mit zwei Anleihen an. Das entspricht in etwa dem Branchendurchschnitt beim Handel mit Anleihen.

- ETFs: Exchange Traded Funds (börsengehandelte Fonds) haben in den letzten Jahren stark an Beliebtheit gewonnen. Im Vergleich zu anderen ähnlichen Brokern ist die Auswahl an ETFs bei Avatrade groß.

- Vanilla-Optionen: Händler können auf der AvaOptions-Plattform mit Währungspaaren sowie Gold und Silber handeln. Vanilla-Optionen werden bei anderen Brokern nur selten angeboten. Daher glänzt Avatrade in diesem Bereich.

Im Vergleich zu anderen Brokern verfügt Avatrade über eine ähnliche Anzahl an Vermögenswerten, hebt sich aber durch seine Spezialinstrumente ab, darunter Vanilla-Optionen, ETFs und Anleihen.

Konten und Handelsgebühren

Bei Avatrade gibt es ein provisionsfreies Handelskonto, und sowohl die anfänglichen als auch die laufenden Kosten liegen im Branchendurchschnitt.

Handelsgebühren: Für das Avatrade-Konto ist eine Mindesteinlage von 100 GBP/USD/EUR/CHF erforderlich, so dass es für die meisten Händler zugänglich ist. Es fallen jedoch keine Gebühren für den Forex-Handel an und die Spreads liegen bei 0,9 Pips (EUR/USD), was in etwa dem Branchendurchschnitt entspricht.

Konto-Handelskosten:

Wir haben ein Standard-Konto bei Avatrade eröffnet und getestet:

- Standard-Konto: Avatrade bietet ein einzelnes Live-Konto mit einer Mindesteinzahlung von 100 EUR, Spreads ab 0.90 Pips auf EUR/USD und einem Hebel von bis zu 30:1. Avatrade erlaubt alle Handelsstrategien, einschließlich Hedging, Scalping und Copy Trading.

- Professionelles Konto: Bei diesen Konten wird die maximale Hebelwirkung auf 500:1 erhöht. Allerdings geben professionelle Händler einige ihrer regulatorischen Schutzmechanismen auf. Avatrade bietet ein Profikonto für Händler an, die zwei der folgenden Kriterien erfüllen:

- Händler/innen sollten in den vorangegangenen vier Quartalen durchschnittlich 10 Geschäfte von erheblichem Umfang auf dem Markt getätigt haben.

- Händler/innen müssen mindestens ein Jahr lang in einer professionellen Position im Finanzsektor gearbeitet haben.

- Händler/innen sollten ein Finanzinstrumentenportfolio von über 500.000 EUR besitzen.

Einzahlungen und Auszahlungen

Bei Avatrade gibt es eine gute Auswahl an Einzahlungsmethoden, und wir waren erfreut, dass sowohl Einzahlungen als auch Auszahlungen kostenlos sind. Im Vergleich zu anderen Brokern haben wir jedoch festgestellt, dass die Auszahlungszeiten langsam sind.

Als streng regulierter Broker stellt Avatrade sicher, dass alle Anti-Geldwäsche-Bestimmungen befolgt werden. So werden alle nicht gewinnorientierten Auszahlungen an die Einzahlungsquelle zurückerstattet. Händler können nur bis zu 100% der ursprünglichen Einzahlung auf eine Kredit- oder Debitkarte abheben. Anschließend kann das Geld mit einer anderen Methode auf den Namen des Händlers abgehoben werden.

Akzeptierte Einzahlungswährungen: Bei der Eröffnung unseres Kontos haben wir festgestellt, dass wir im Kundenportal von Avatrade zwischen vier Basiswährungen wählen können, darunter USD, EUR, GBP und CHF. Da wir EUR von unserem deutschen Bankkonto auf unser EUR-basiertes Handelskonto einzahlten, wurden uns keine Gebühren für die Währungsumrechnung berechnet.

Einzahlungsmethoden: Avatrade bietet eine gute Auswahl an Zahlungsmethoden an und erhebt keine Gebühren für Ein- oder Auszahlungen. Für deutsche Kunden ist es jedoch nicht möglich, Einzahlungen oder Auszahlungen per E-Wallet vorzunehmen. Eine vollständige Liste der Zahlungsoptionen und Abhebungszeiten ist unten zu finden:

Die Ein- und Auszahlungen sind zwar kostenlos, aber die Bearbeitungszeiten von Avatrade bei Ein- und Auszahlungen haben uns enttäuscht.

Die mobilen Handelsplattformen von Avatrade

Dank der Unterstützung von vier mobilen Handelsapps, darunter das preisgekrönte AvatradeGO, bietet Avatrade ein hervorragendes mobiles Handelserlebnis.

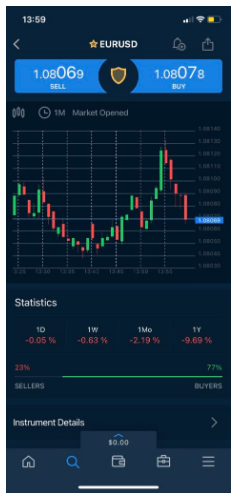

AvatradeGO Trading-App

Schnell wurde uns klar, dass die AvatradeGO App keine Handelsplattform ist, sondern eher ein Portal, mit dem Trader ihre Metatrader 4 Plattform von einem mobilen Gerät oder Tablet aus verwalten können. Die App ist sowohl für Android als auch für iOS verfügbar und ist mit der Social Trading-Anwendung von Avatrade integriert.

AvatradeGO-Merkmale: Wir fanden es sehr gut, wie einfach die AvatradeGO App zu bedienen ist. Sie bietet ein ausgeklügeltes Dashboard und einen intuitiven Startbildschirm, über den man Lernvideos und Marktanalysematerialien ansehen und den Kundensupport direkt aus der App heraus kontaktieren kann. Darüber hinaus gibt es eine hervorragende Suchfunktion und es ist einfach, Aufträge zu erteilen, Preiswarnungen einzustellen, Watchlists zu erstellen und Live-Kurse und Charts anzuzeigen:

Handelswerkzeuge: In der mobilen App ist auch AvaProtect enthalten, das Risikomanagement-System von Avatrade. Dieses einmalige Trading-Tool ermöglicht es Kunden, sich für einen bestimmten Zeitraum gegen Verlustgeschäfte abzusichern. Wird ein Handel während dieses Zeitraums geschlossen, werden alle Verluste vollständig erstattet.

Alles in allem bietet die AvatradeGO Mobile App ein reibungsloses Handelserlebnis mit einem intuitiven Dashboard. Außerdem hat uns die Schritt-für-Schritt-Anleitung zur Nutzung der App gefallen.

MetaTrader 4 und MetaTrader 5

Die Plattformen MT4 und MT5 von Avatrade sind sowohl für Android als auch für iOS verfügbar. Obwohl die Funktionalität im Vergleich zu den Desktop-Versionen der Plattformen leicht eingeschränkt ist, mit reduzierten Zeitrahmen und weniger Charting-Optionen, haben Händler dennoch Zugang zu Analysen mit technischen Indikatoren, grafischen Objekten und einem vollständigen Satz von Handelsaufträgen.

Mobile Anwendung von AvaOptions

Im Unterschied zu den meisten anderen Brokern bietet Avatrade den Handel mit Vanilla-Optionen an. Das Unternehmen hat auch eine eigene mobile Handelsplattform für Optionen entwickelt. Händler/innen können zwischen mehr als 40 Währungspaaren sowie Gold und Silber wählen. Über die Plattform hat man die volle Kontrolle über sein Portfolio und kann Risiko und Ertrag so ausbalancieren, dass es zu seiner Marktmeinung passt.

Insgesamt ist die Unterstützung für den mobilen Handel bei Avatrade im Vergleich zu anderen Brokern hervorragend. Zusätzlich zu den AvatradeGO- und AvaOptions-Handelsapps stehen die mobilen Versionen MT4 und MT5 zur Verfügung.

Andere Handelsplattformen

Im Vergleich zu anderen Brokern bietet Avatrade eine größere Auswahl an Handelsplattformen an, darunter MT4, MT5 und die hauseigenen Plattformen Avatrade Webtrader und AvaOptions.

Im Rahmen dieses Tests haben wir die Webtrader-Plattform von Avatrade getestet. Wenn man sich in seinem Konto anmeldet, wird man sofort zur Plattform weitergeleitet.

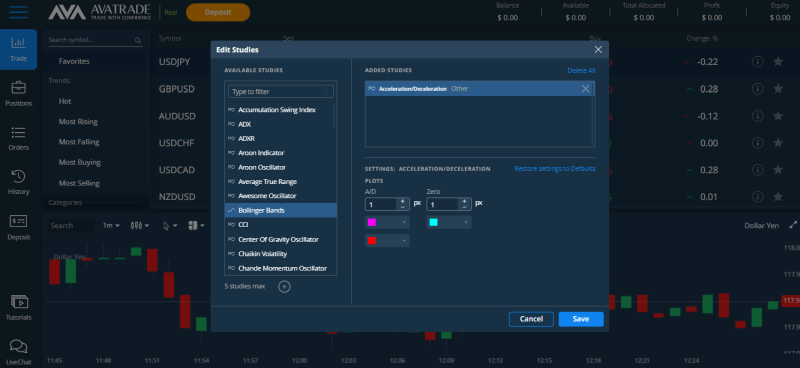

Avatrade Webtrader

Für die Webtrader-Plattform sind keine Downloads oder Installationen erforderlich und sie ist für alle Geräte verfügbar. Die Benutzeroberfläche des Webtraders ist übersichtlich und intuitiv gestaltet und lässt sich leicht navigieren und nach verschiedenen Instrumenten durchsuchen, was ihn zu einer guten Option für Anfänger macht. Es gibt drei Charttypen, darunter Linien-, Balken- und Candlestick-Charts. Darüber hinaus kann man auf eine große Auswahl an Indikatoren in verschiedenen Zeitrahmen zugreifen. Siehe unten:

Einer der Nachteile ist, dass die Plattform nicht anpassbar ist und Händler die Größe und Position der Tabs nicht ändern können. Zudem können Händler auf der Plattform keine Kurswarnungen und Benachrichtigungen einstellen. Fortgeschrittene Händler werden vielleicht MT4 oder MT5 bevorzugen, die beide bei Avatrade erhältlich sind. Auf diesen Plattformen können Händler ihre Indikatoren anpassen, es gibt viel mehr Charttypen und algorithmischen (oder automatisierten) Handel.

Zu unserer Freude ist Trading Central, eines der beliebtesten Trading-Tools von Drittanbietern auf dem Markt, vollständig in die Plattform integriert und bietet technische Einblicke und sofortige Mustererkennung.

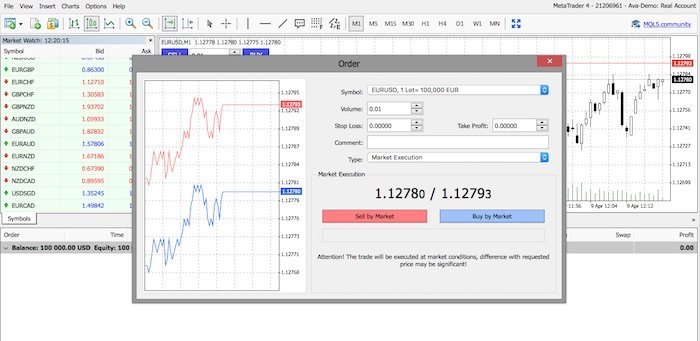

Metatrader 4 (MT4)

Wie bei den meisten Brokern haben wir festgestellt, dass die MT4-Plattform von Avatrade die Standardversion mit 24 grafischen Objekten und 30 integrierten Indikatoren ist. Im Unterschied zum Avatrade-eigenen Webtrader ist der algorithmische Handel verfügbar, und MT4 ist vollständig anpassbar.

In der folgenden Abbildung sind nur die grundlegenden Orders verfügbar: Market, Limit, Stop und Trailing Stop.

Metatrader 5 (MT5)

Auch MT5, die neuere Version von MT4, ist bei Avatrade verfügbar. Die zwei Plattformen unterscheiden sich darin, dass MT4 eine reine Forex-Plattform ist, während MT5 den Handel mit allen bei Avatrade verfügbaren Vermögenswerten ermöglicht. Wir empfehlen MT5, wenn du nach einer leistungsfähigeren und schnelleren Handelsplattform für Backtesting-Funktionen für automatisierte Handelsalgorithmen suchst. Darüber hinaus bevorzugen Trader MT5 wegen der tieferen Marktdarstellung, der zusätzlichen technischen Indikatoren und der Analysetools.

AvaOptions

Auf AvaTrade können Sie mit Vanilla-Optionen handeln. Der Handel mit Optionen bietet Händlern die Möglichkeit, von mehr als nur der 2-dimensionalen Natur des Devisenhandels zu profitieren. Es stehen Vanilla-Optionen für mehr als 40 Währungspaare, Gold und Silber zur Verfügung. Das Handeln mit Optionen kann ein komplexes Unterfangen sein, aber die AvaOptions-Plattform vereinfacht den Prozess.

Plattform-Überblick:

Kontoeröffnung bei AvaTrade

Die Kontoeröffnung bei Avatrade verlief im Vergleich zu den meisten anderen Brokern schnell und problemlos.

Es dauerte etwa 5 Minuten, um ein Konto bei AvaTrade zu eröffnen. Sobald wir unsere Unterlagen eingereicht hatten, waren unsere Konten sofort für den Handel bereit. Außerdem waren wir angenehm überrascht, dass wir einen Anruf vom Kundenservice erhielten, der uns bei allen Problemen half.

Als deutsche Händlerin oder deutscher Händler kann man bei Avatrade ein Konto eröffnen, solange man die Mindesteinlage von 100 EUR erfüllt.

Die Kontoeröffnung ist schnell und erfolgt vollständig digital, und die Konten sind in der Regel innerhalb weniger Minuten für den Handel bereit.

Wie man ein Konto bei Avatrade eröffnet:

- Nach einem Klick auf die Schaltfläche “Jetzt registrieren” oben auf der Avatrade-Hauptseite konnten wir wählen, ob wir ein Echtgeld- oder ein Demokonto eröffnen wollten. Wir wählten die Option “Echtes Konto”.

- Anschließend wurden wir zum Anmeldeformular von Avatrade weitergeleitet, in das wir unseren Namen und unsere E-Mail-Adresse eintragen mussten.

- Dann wurden wir gebeten, ein kurzes Formular auszufüllen, um Avatrade dabei zu helfen, den Stand unserer Finanzen und unsere Handelskenntnisse einzuschätzen. Dieser Schritt wird von vielen Brokern bei der Kontoeröffnung ausgelassen, ist aber in einer Branche, die oft beschuldigt wird, Kunden nicht zu schützen, ein verantwortungsvoller Schritt.

- Zuletzt benötigte Avatrade mindestens zwei Dokumente, um uns als Einzelkunden zu akzeptieren; diese sind:

- Identitätsnachweis – aktuelle (nicht abgelaufene) farbige gescannte Kopie (im PDF- oder JPG-Format) eines Reisepasses. Falls kein gültiger Reisepass vorhanden ist, reicht auch ein ähnliches Ausweisdokument mit Foto, z. B. ein Personalausweis oder Führerschein.

- Adressnachweis – ein Kontoauszug oder eine Stromrechnung. Die Dokumente dürfen jedoch nicht älter als 6 Monate sein und müssen den Handelsnamen und die Adresse enthalten. Die Unterlagen können eingescannt oder als hochwertiges Digitalfoto eingesandt werden.

- Sobald alle Dokumente eingereicht waren, war unser Konto innerhalb weniger Minuten für den Handel bereit.

Avatrade’s Recherche- und Handelswerkzeuge

Die Marktforschung von Avatrade ist im Vergleich zu anderen ähnlichen Brokern durchschnittlich, und die meisten Analysen werden von Drittanbietern kuratiert. Darüber hinaus bietet Avatrade die Dienste von Trading Central an, einem weltweit führenden Unternehmen für technische und fundamentale Analysen.

Die Recherche ist über die Web-Handelsplattform, die MetaTrader-Plattform, die AvaOptions-Handelsplattform und auf der Website von Avatrade verfügbar:

- Trading Central: Trading Central ist ein Drittanbieter, der den Kunden von Avatrade Marktinformationen und Handelsanalysen zur Verfügung stellt. Diese Angebote sind über die Avatrade-eigenen Schnittstellen (WebTrader und AvaTradeGO) und über Benachrichtigungen (SMS/E-Mail/Push) verfügbar. Die Marktanalysen, die von Trading Central bereitgestellt werden, helfen den Händlern bei ihren Strategien und Handelsplänen und werden von erfahrenen Analysten erstellt.

Das Werkzeug hilft dabei, die Ansichten dieser Experten mit automatisierten Algorithmen zu vereinen und bietet Mustererkennung, um Handelsideen auszulösen. Darüber hinaus liefert Trading Central einen täglichen Strategie-Newsletter, der sowohl technische als auch fundamentale Analysen direkt in deinen Posteingang sendet. Für jeden Vermögenswert bietet Trading Central einen aktualisierten Nachrichten-Feed, der auch einen Sentiment-Score für diesen Vermögenswert enthält. Eine weitere Funktion von Trading Central ist die Trendanalyse, die vorhersagt, ob und um wie viel Prozent Vermögenswerte steigen oder fallen werden.

- Blog: Darüber hinaus stellt Avatrade einen Blog zur Verfügung, in dem täglich über Marktbewegungen und relevante Nachrichten berichtet wird, sowie einen regelmäßigen Marktkommentar im Videoformat.

- Wirtschaftskalender: Der Wirtschaftskalender von Avatrade bietet eine gute Auswahl an Fundamentaldaten. Zudem bietet er eine Funktion, mit der Händler die historische Volatilität und Trends einschätzen können, einschließlich eines “Impact”-Buttons, um zu sehen, wie verschiedene Kurse durch bestimmte Nachrichten beeinflusst wurden. Um diesen Premium-Inhalt nutzen zu können, müssen Händler/innen ein Konto einrichten.

- Handelsrechner: Wie die meisten Broker bietet auch Avatrade einen Handelsrechner an, mit dem Händler die möglichen Gewinne, Verluste und Kosten des Handels berechnen können. Die Ergebnisse der Berechnung helfen Händlern zu entscheiden, ob oder wann sie eine Position eröffnen, welche Marge erforderlich ist und wie hoch die Kosten für den Handel sein werden.

- AvaProtect: Dieses einzigartige Handelsinstrument ermöglicht es Kunden, für eine bestimmte Zeit einen Schutz gegen Verlustgeschäfte zu erwerben. Sollte ein Geschäft während dieses Zeitraums geschlossen werden, werden alle Verluste vollständig erstattet. Solange die AvaProtect-Funktion aktiv ist, können Händler/innen immer noch von allen Gewinnen einer Position profitieren. Die Kosten für AvaProtect richten sich nach dem Markt und dem Umfang des Handels. AvaProtect ist auch in der AvaTradeGO App verfügbar. Diese Funktion ist nicht für Limit-Orders, sondern nur für Market-Orders verfügbar.

Social Trading

Im Vergleich zu anderen Brokern haben wir festgestellt, dass AvaTrade ein hervorragendes und abwechslungsreiches Social Trading-Erlebnis bietet.

Wir waren positiv überrascht, dass Avatrade zwei Copy Trading Plattformen und eine eigene Social Trading Plattform anbietet:

- Duplitrade, eine Drittanbieter-Copy-Trading-Plattform

- Zulutrade, ebenso eine Drittanbieter-Copy-Trading-Plattform

- AvaSocial, die eigene Social-Trading-Plattform von Avatrade

Duplitrade: Bei Duplitrade handelt es sich um eine beliebte Copy-Trading-Plattform, die mit der MT4-Handelsplattform verbunden werden kann. DupliTrade erlaubt es Händlern, die Handlungen von erfahrenen Händlern (mit nachgewiesener Historie) automatisch direkt in ihr AvaTrade-Handelskonto zu kopieren. Um Duplitrade nutzen zu können, müssen Händler jedoch einen Mindestbetrag von 2.000 USD einzahlen, was weit über der erforderlichen Mindesteinlage liegt. Im Vergleich zu anderen ähnlichen Brokern erschien uns dieses Angebot teuer.

Zulutrade: Auch Zulutrade, eine beliebte automatische Handelsplattform, ist sehr beliebt. Denn Zulutrade setzt die Empfehlungen erfahrener Händler/innen um und führt die Transaktionen automatisch in deinem AvaTrade-Konto aus.

Außerdem gefällt uns, dass Zulutrade zwar automatisierten Handel anbietet, Copy Trader aber alle offenen Positionen in Echtzeit überwachen können und die volle Kontrolle über ihre Gelder haben. Copy Trader können aus einer großen Anzahl von erfahrenen und hochrangigen Tradern mit vielen Followern wählen. Um ein Copy Trading-Konto zu eröffnen, solltest du auf “Neues Konto” klicken und Zulutrade als Handelsplattform auswählen.

AvaSocial: Darüber hinaus können Kunden von AvaTrade die Social- und Copy-Trading-Plattform des Brokers herunterladen – AvaSocial. Die mobile App ist für iOS- und Android-Geräte verfügbar und bietet Kunden die Möglichkeit, die Trades erfolgreicher Investoren zu kopieren. Man kann entweder manuell auf Marktsignale handeln oder einem vollautomatischen Service folgen.

Über Community-Channels können Nutzer/innen mit anderen Händler/innen interagieren und Fragen zu bestimmten Strategien stellen, mehr über die Kryptomärkte erfahren oder einen Trading-Mentor suchen, was die App zu einem großartigen Werkzeug für Anfänger/innen macht.

Im Vergleich zu anderen Brokern bietet Avatrade ein umfassendes Social- und Copy-Trading-Erlebnis.

AvaTrade`s Lehrmaterial

Im Vergleich zu anderen ähnlichen Brokern bietet Avatrade eine hervorragende Auswahl an Bildungsmaterialien. Das Bildungsangebot richtet sich sowohl an Anfänger als auch an erfahrene Trader. Wir haben uns auch darüber gefreut, dass alle Lehrmaterialien von Avatrade auf Deutsch verfügbar sind.

Die Bibliothek mit Lehrmaterial von Avatrade ist erstklassig und kann mit einigen der besten Broker der Welt mithalten. Das Angebot umfasst Trading-Videos, einen Bereich für Trading-Anfänger, korrekte Trading-Regeln, Leitfäden für Online-Trading-Strategien, Ordertypen, Indikatoren und Strategien der technischen Analyse, Wirtschaftsindikatoren, Marktbegriffe und ein kostenloses Trading-E-Book. Das Material ist detailliert und gut strukturiert und richtet sich sowohl an Anfänger als auch an erfahrene Trader. Darüber hinaus bietet Avatrade ein Demokonto an, mit dem Händler/innen ihren Handel üben können:

- Trading for beginners – Im Abschnitt “Trading for beginners” erhält man alle Informationen, die man braucht, um Forex- und CFD-Instrumente mit Zuversicht anzugehen. In diesem Bereich können sich Trader über viele Handelsthemen informieren, z. B. “Was ist Forex?”, “Was ist ein Pip?”, “Was ist Metatrader?”, “MACD-Handelsstrategien”, “Wie man ein Forex-Chart liest”, “Technische Analyse” und vieles mehr.

- Videoschulung – AvaTrades-Videobereich ist sehr umfangreich und deckt viele verschiedene Themen ab, darunter Handelswerkzeuge für Fortgeschrittene, Lektionen für Anfänger, Forex-Handelsstrategien und mehr.

- Richtige Handelsregeln: Diese Ratgeber zeigen Händlern/innen, wie sie effizient handeln, die Grundlagen beherrschen und zu fortgeschrittenen Handelstechniken und -strategien übergehen können.

- Online-Handelsstrategien: Dieser Teil behandelt verschiedene Online-Handelsstrategien, darunter Daytrading, Swingtrading und Finanzinstrumente.

- Auftragsarten: In diesem Kapitel geht es um verschiedene Arten von Market Orders, Pending Orders und bedingten Orders, die auf den Finanzmärkten verwendet werden.

- Technische Analyse-Indikatoren und -Strategien: Die meisten CFD- und Forex-Händler/innen setzen technische Analysemethoden ein, um die Kursveränderungen ihrer bevorzugten Vermögenswerte zu analysieren. In diesen Artikeln kann man mehr über Preisaktionsmethoden (Candlestick-Typen und Candlestick-Muster, Trends, Volatilität, Marktzyklen usw.) erfahren.

- Wirtschaftsindikatoren: Diese Beiträge geben einen Überblick über die Arten von Wirtschaftsindikatoren und ihre Bedeutung beim Handel.

- Marktbegriffe für Profis: Diese Wegweiser helfen Händlern/innen, alle relevanten Schlüsselbegriffe zu verstehen, sich auf professionelleren Seiten weiterzubilden und an interessanten, auf Händler/innen ausgerichteten Foren teilzunehmen.

- Ebook – Das AvaTrade Ebook gibt Händlern/innen einen guten Überblick über die grundlegende Forex-Terminologie und die verschiedenen Gruppen der verfügbaren Währungspaare. Das Ebook erklärt auch, wie man einen Forex-Kurs liest und welche Vorteile der Forex-Handel hat.

- Demo-Konto: Das kostenlose Demokonto von AvaTrade ist ein praktisches Tool, um den Handel zu üben, einen Expert Advisor zu testen oder sich mit der Funktionsweise des Devisenhandels vertraut zu machen. Das Demokonto mit einem virtuellen Guthaben von 100.000 USD simuliert das echte Konto von AvaTrade. Es verfällt jedoch nach 21 Tagen.

Der Avatrade-Kundendienst

Im Vergleich zu anderen ähnlichen Brokern finden wir den Kundenservice von Avatrade hervorragend.

Der Kundendienst ist für den CFD-Handel rund um die Uhr erreichbar. Er ist in verschiedenen Sprachen, darunter Deutsch, per E-Mail, Live-Chat und über eine lokale Telefonnummer erreichbar.

Für die Zwecke dieser Bewertung haben wir den Live-Chat und die E-Mail getestet. Unsere E-Mail wurde innerhalb von ein paar Stunden beantwortet, und die Antwort war sachdienlich und auf den Punkt gebracht. Unsere Live-Chat-Agenten waren höflich und reaktionsschnell und konnten alle unsere Fragen beantworten.

Sicherheit und Anerkennung der Industrie

Regulierung: Die Firmenstruktur von Avatrade besteht aus mehreren regulierten Einheiten, die in verschiedenen Regionen der Welt tätig sind, darunter Südafrika, Australien, Zypern, Japan, Abu Dhabi und die Britischen Jungferninseln. Weitere Informationen dazu:

- AVA Trade EU Ltdist mit der MiFID konform und wird von der Central Bank of Ireland reguliert, Referenz No.C53877.

- Ava Capital Markets Australia Pty Ltd wird von der ASIC reguliert (No.406684).

- DT Direct Investment Hub Ltd. wird von der zypriotischen Wertpapier- und Börsenaufsichtsbehörde (Nr. 347/17) reguliert.

- ATrade Ltd wird in Israel von der israelischen Wertpapierbehörde reguliert (No. 514666577).

- Ava Trade Middle East Ltd wird von der Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA) reguliert (No.190018).

- Ava Trade Japan K.K. ist in Japan von der Finanzdienstleistungsagentur lizenziert und reguliert (Lizenz-Nr.: 1662), der Financial Futures Association of Japan (Lizenz-Nr.: 1574).

- Ava Capital Markets Pty ist von der südafrikanischen FSCA zugelassen und wird von ihr reguliert (Lizenz-Nr. No.45984).

- Ava Trade Ltd wird von der FSC der Britischen Jungferninseln reguliert No. SIBA/L/13/1049.

Anerkennung der Industrie: Neben der Regulierung durch mehrere nationale Behörden hat AvaTrade in der Branche viel Anerkennung für seine hervorragenden Handelsbedingungen und Innovationen erhalten. Zu den jüngsten Auszeichnungen gehören:

- Vertrauenswürdigste Handelsplattform Europa 2022 (“International Business Magazine”)

- Beste mobile Handelsplattform 2022 (“Investingoal”)

- Bester Gesamtbroker 2022 (“Daytrading”)

- Bester Broker UK 2022 (“World Economic Magazine”)

Bewertungsmethode

Bei der Überprüfung unserer Partner legen wir Wert auf Transparenz und Offenheit. Daher haben wir unser Bewertungsverfahren veröffentlicht, um die Transparenz in den Vordergrund zu rücken. Im Mittelpunkt dieses Prozesses steht die Bewertung der Zuverlässigkeit des Brokers, des Plattformangebots und der Handelskonditionen für die Kunden, die in dieser Bewertung zusammengefasst sind.

Für jeden dieser Punkte werden über 200 Kriterien aus sieben Bereichen bewertet, und es wird eine Gesamtnote errechnet, die dem Broker gemäß dem unten stehenden Diagramm zugewiesen wird.

AvaTrade-Risikoerklärung

Der Forexhandel ist riskant und jeder Broker ist verpflichtet, seine Kunden über das Risiko beim Handel mit Forex-CFDs zu informieren. AvaTrade informiert darüber: Bei CFDs handelt es sich um komplexe Instrumente, bei denen aufgrund der Hebelwirkung ein hohes Risiko besteht, schnell Geld zu verlieren. 76% der Kleinanlegerkonten verlieren Geld beim Handel mit CFDs bei diesem Anbieter. Daher sollte man sich überlegen, ob man versteht, wie CFDs funktionieren und ob man das hohe Risiko, sein Geld zu verlieren, eingehen kann.

Überblick

Aus gutem Grund ist AvaTrade einer der besten, größten und renommiertesten Broker der Welt. Das Unternehmen bietet eine breite Palette von Handelsplattformen an, darunter auch die preisgekrönte mobile Trading-App AvatradeGO. Darüber hinaus bietet Avatrade eine erstklassige Auswahl an Handelswerkzeugen, darunter Trading Central, sowie hervorragende Analyse- und Bildungsbereiche in deutscher Sprache.

Obwohl die Handelskosten von Avatrade nicht die niedrigsten in der Branche sind, werden sie von den Händlern als akzeptabel empfunden. Die Spreads beginnen bei 0,9 Pips auf den EUR/USD und das bei einer Mindesteinzahlung von nur 100 EUR.

FAQ

Ist AvaTrade sicher?

Ja. AvaTrade ist ein international regulierter Forex CFD-Broker.

Wie hoch ist die Mindesteinlage bei AvaTrade?

Mit 100 EUR können Kunden ein Live-Konto bei AvaTrade eröffnen.

Wie kann ich mein Avatrade-Konto aufladen?

Einzahlungen auf Konten können mit Bankwire, ETF und Kreditkarten vorgenommen werden. Je nach Einzahlungsmethode werden die Einzahlungen innerhalb von 1-5 Tagen auf deinem Handelskonto verbucht.

Wie kann ich Geld bei Avatrade abheben?

Auszahlungen können nur mit der Zahlungsmethode vorgenommen werden, mit der du dein Konto eingezahlt hast. Eine Ausnahme gilt nur für Kunden, die Gewinne abheben und bereits eine Abhebung über die ursprüngliche Einzahlungsmethode vorgenommen haben. Auszahlungen werden in der Regel innerhalb von 1 bis 2 Werktagen bearbeitet und verschickt.

Bietet AvaTrade ein Demokonto an?

Auf dem kostenlosen AvaTrade-Demokonto befinden sich 100.000 USD virtuelles Kapital. Das Konto läuft nach 21 Tagen ab, kann aber vom Support-Team wiedereröffnet werden.

Finden Sie heraus, wie AvaTrade im Vergleich zu anderen Brokern abschneidet.Broker vergleichen

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.