Admiral Markets Test und Erfahrungen

Zuletzt aktualisiert am Februar 28, 2025

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu Admirals

Bitte beachten Sie, dass Admirals die Registrierung neuer Kunden in der EU vorübergehend ausgesetzt hat. Bestehende Kunden sind davon nicht betroffen.

Der vertrauenswürdige globale Online-Broker Admirals wird von einigen hochrangigen Behörden reguliert, darunter CySEC in der EU. Er bietet eine Reihe von kostengünstigen Konten und verfügt über eine hervorragende Auswahl an Handelswerkzeugen. Jedoch könnten Händler von den hohen Währungsumrechnungsgebühren für Konten, die auf andere Währungen lauten, etwas enttäuscht sein.

Neben der Unterstützung für die Handelsplattformen MT4 und MT5 bietet Admirals auch eine elegante mobile App, die intuitiv und einfach einzurichten ist. Admirals verfügt über ausgezeichnete Handelsbedingungen auf vier Live-Konten mit Spreads ab 0,5 Pips (EUR/USD) auf den kommissionsfreien Konten und Kommissionen von 6 USD (runde Summe) auf den Zero-Konten im Austausch für Spreads von 0,1 Pips (EUR/USD). Mit diesen Konditionen ist Admirals sehr wettbewerbsfähig.

Admirals ermöglicht den Handel mit über 3500 CFDs und mehr als 4500 Aktien. Zudem bietet es mit der MetaTrader Supreme Edition ein Plugin, das technische Analysen für nahezu jedes Finanzinstrument ermöglicht.

Insgesamt wird Admirals mit der EU-Regulierung, einigen der niedrigsten Handelsgebühren in der Branche, einer riesigen Auswahl an Finanzinstrumenten und hervorragenden Handelswerkzeugen viele deutsche Trader ansprechen.

| 🏦 Min. Einzahlung | EUR 25 |

| 🛡️ Geregelt durch | ASIC, CySEC, FCA, CMA |

| 💵 Handelskosten | USD 8 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, MT5, MT Supreme |

| 💱 Instrumente | Anleihen, Commodities, Kryptowährungen, Stock CFDs, ETFs, Forex, Indices, Metalle |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Streng reguliert

- Ausgezeichnete Bildung

- Große Auswahl an Anlagen

Nachteile

- Teure Rücknahmen

Ist Admirals sicher?

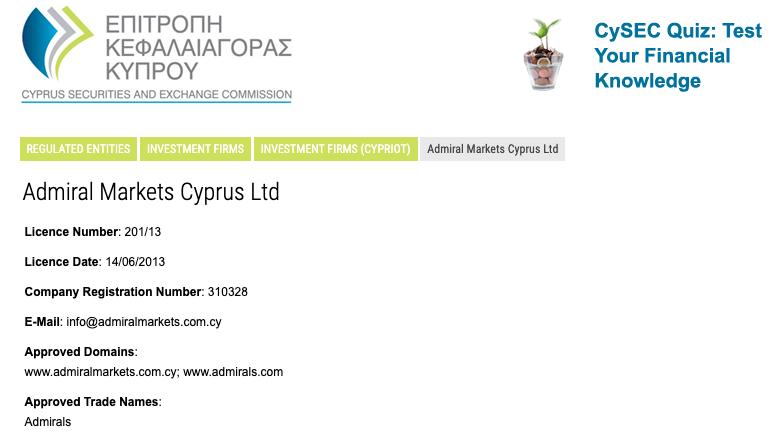

Admirals wird von einigen der besten Regulierungsbehörden der Welt reguliert, einschließlich der EU-Regulierung durch die CySEC in Zypern.

CySEC-Verordnung: Die in Deutschland ansässigen Kunden werden über die Tochtergesellschaft Admiral Markets Cyprus Ltd betreut, die in der EU von der CySEC zugelassen ist und reguliert wird:

Sicherheitsmerkmale: Die CySEC gilt als die wichtigste Regulierungsbehörde für Forex-Broker in der EU und gewährleistet, dass:

- Alle Kundengelder vollständig getrennt von den eigenen Vermögenswerten von Admirals in einem EWR-regulierten Kreditinstitut aufbewahrt werden.

- Admirals hat sich dem Investor Compensation Fund (ICF) angeschlossen, der maximal 20.000 EUR pro Forderung zahlt, sollte Admirals in Konkurs gehen.

- Alle Händler einen Schutz gegen negative Salden haben.

Aufgrund der EU-Vorschriften für den Forex-Handel beschränkt die CySEC den Hebel auf 30:1 und verbietet Admirals, Boni und Werbeaktionen anzubieten. Dies gilt jedoch für alle CySEC-regulierten Broker.

Unternehmensdetails:

Finanzinstrumente von Admirals

Mit über 3500 Aktien-CFDs, 4500 Aktien und 375 ETFs ist die Auswahl an Finanzanlagen bei Admirals größer als bei anderen ähnlichen Brokern.

Im Folgenden sind die Instrumente von Admirals und die entsprechenden Hebelwirkungen aufgeführt:

- Forex: Admirals bietet über 40 Währungspaare für den Handel an, was in etwa dem Branchendurchschnitt entspricht. Darunter sind Hauptwährungen (EUR/USD, GBP/USD und USD/JPY), Nebenwährungen (NZD/CAD, EUR/JPY und USD/ZAR) und Exoten.

- Aktien-CFDs: Mit 3350 Aktien-CFDs bietet Admirals mehr an als andere große internationale Broker. Die Auswahl umfasst einige der wichtigsten US-amerikanischen, britischen und europäischen Börsenplätze

- Kryptowährungen: Mit über 42 Krypto-Paaren bietet Admirals ein viel breiteres Spektrum als andere ähnliche Broker.

- Indexe: Kennzahlen: Es gibt 43 verschiedene Indexe, die bei Admirals gehandelt werden können, das sind mehr als bei anderen ähnlichen Brokern. Die beliebtesten Indexe sind diejenigen, die die Aktien einiger der größten und weltweit anerkannten Unternehmen zusammenfassen.

- Rohstoffe: Mit 28 Rohstoffen bietet Admirals ein viel breiteres Angebot als andere Broker. Die meisten anderen Broker bieten zwischen 5 und 10 Rohstoffen an. Zu den Rohstoffen gehören Metalle wie Gold und Silber, Energieträger wie Öl und Weichwaren wie Zucker, Kakao und Baumwolle.

- Anleihen: Ähnlich wie andere Broker bietet Admirals den Handel mit zwei Anleihen an, nämlich dem 10-jährigen Deutschland-Bund-Futures-CFD und dem 10-jährigen US Treasury Note Futures-CFD.

- ETFs: Mit 375 ETFs bietet Admirals ein größeres Angebot als andere ähnliche Broker.

Allgemein bietet Admirals ein viel breiteres Spektrum an handelbaren Instrumenten als andere Broker und stellt seine Konkurrenten bei den Angeboten für Rohstoffe, Aktien-CFDs und ETFs wirklich in den Schatten.

Konten bei Admirals und Handelsgebühren

Die Besonderheit von Admirals unter den Brokern besteht darin, dass vier verschiedene Kontotypen angeboten werden, deren Handelsbedingungen je nach gewählter Plattform variieren.

Handelskosten: Bei allen Konten von Admirals beträgt die Mindesteinlage 100 EUR, was etwas höher ist als bei anderen Brokern. Allerdings liegen die Handelskosten bei den Trade MT4/MT5-Konten bei etwa 5 USD pro gehandeltem Lot, während die Handelskosten bei den MT4/MT5 Zero-Konten bei etwa 7 USD pro gehandeltem Lot liegen. Diese Handelskosten gehören zu den niedrigsten in der Branche.

Darüber hinaus bietet Admirals auch ein Anlagekonto für den realen Aktienhandel an, aber der Schwerpunkt dieses Beitrags liegt auf dem CFD-Handel.

Siehe unten für weitere Informationen:

Handelskosten für das Admirals-Konto:

Trade.MT5

Das Trade.MT5-Konto hat eine Mindesteinlage von 25 EUR, einen Hebel von bis zu 30:1, und es werden keine Provisionen für den Forex-Handel erhoben. Die Spreads beginnen bei 0.80 Pips für den EUR/USD, und es ist als islamisches swapfreies Konto verfügbar.

Zero.MT5

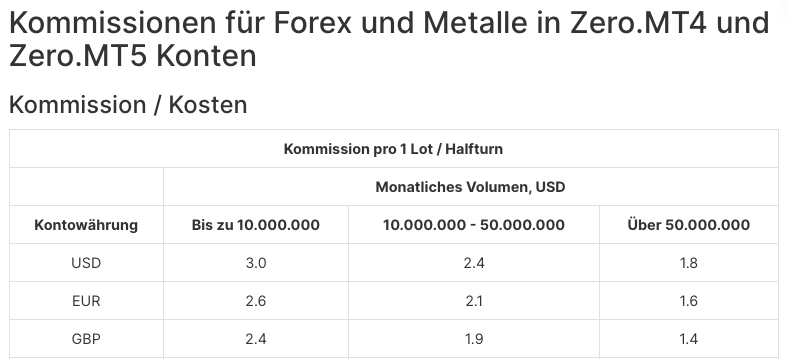

Das Zero.MT5-Konto mit einer Mindesteinlage von 100 EUR hat Spreads ab 0,0 Pips auf EUR/USD und eine Kommission zwischen 1,8 und 3 USD pro Lot und Seite (siehe unten für die Provisionsstruktur).

Trade.MT4

Auch bei diesem Konto beträgt die Mindesteinlage 25 EUR. Die Spreads beginnen bei diesem Konto bei 0,5 Pips (EUR/USD), und es werden keine Provisionen erhoben. Beachte, dass es auf diesem Konto keine islamischen swapfreien Optionen gibt (siehe unten zur Provisionsstruktur).

Zero.MT4

Die Mindesteinlage beträgt bei diesem Konto 25 EUR on this account, leverage is up to 30:1, und die Spreads beginnen bei 0,0 Pips auf den EUR/USD. Pro Seite und gehandeltem Lot wird eine Kommission zwischen 1,8 und 3 USD berechnet, abhängig vom Handelsvolumen (siehe unten für die Provisionsstruktur). Dieses Konto bietet keine islamischen swapfreien Optionen an.

Invest.MT5

Zur Kontoeröffnung müssen die Händler eine Einzahlung von 1 EUR leisten. Händler können nur auf Aktien und ETFs spekulieren. Die Spreads beginnen bei 0 Pips auf den EUR/USD und die Kommissionen beginnen bei 0,02 USD pro Aktie.

Kommissionsstruktur

Allgemein sind die Handelskosten und Mindesteinzahlungsanforderungen bei Admirals niedriger als bei anderen ähnlichen Brokern. Darüber hinaus bietet Admirals den Handel mit einer breiten Palette von Vermögenswerten an, was ihn sowohl für Anfänger als auch für erfahrene Trader attraktiv macht.

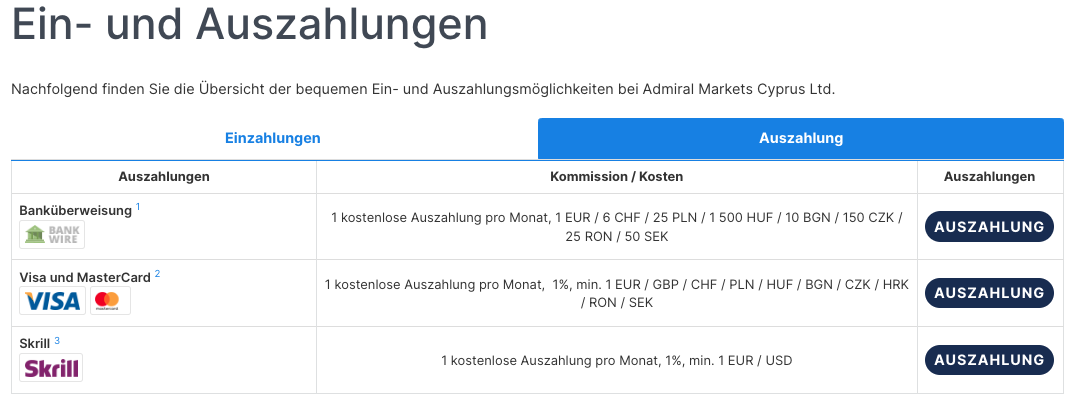

Einzahlungen und Auszahlungen

Im Vergleich zu den meisten anderen Brokern bietet Admirals nur eine begrenzte Anzahl von Einzahlungsmöglichkeiten. Außerdem sind die Ein- und Auszahlungsgebühren für andere Währungen als die, die von Admirals unterstützt werden, hoch und die Bearbeitungszeiten sind langsam.

Als gut regulierter Broker verarbeitet Admirals keine Zahlungen an Dritte. Alle Auszahlungsanträge von einem Handelskonto müssen an ein Bankkonto oder eine Quelle auf den Namen des Händlers gehen.

Handelskontowährungen: Die meisten nationalen Währungen, in denen Einzahlungen auf Handelskonten vorgenommen werden können, werden anschließend in EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN oder RON oder andere Währungen umgerechnet. Mit Konten, die auf EUR lauten, können deutsche Händler die Zahlung von Währungsumrechnungsgebühren für Ein- und Auszahlungen vermeiden. Wenn jedoch bei einer internen Überweisung zwischen den Konten eines Kunden ein Unterschied in den Basiswährungen besteht, wird eine Gebühr von 1 % des überwiesenen Betrags erhoben.

Einzahlungen und Auszahlungen: Einzahlungen können per Kreditkarte/Debitkarte, E-Wallets (Skrill und Neteller) und Banküberweisung vorgenommen werden. Kreditkarten/Guthabenkarten werden sofort bearbeitet, aber Einzahlungen per Banküberweisung können 3 Banktage dauern, bis sie verbucht werden. Sollten jedoch die Basiswährung des Handelskontos eines Kunden und die Basiswährung des überwiesenen Betrags voneinander abweichen, wird der überwiesene Betrag in die Basiswährung des Handelskontos des Kunden umgerechnet und eine Gebühr von 0,3 % erhoben. Bei Überweisungen über E-Wallets in einer anderen Basiswährung sind die ersten 5 Überweisungen kostenlos, danach wird 1% des Betrags berechnet.

Auszahlungen sind nur per Überweisung mit einer Bearbeitungszeit von 1-3 Werktagen möglich. Bei Inlandsüberweisungen wird eine Gebühr von 3 USD (oder dem Gegenwert) erhoben, bei Auslandsüberweisungen bis zu 20 USD.

Siehe unten für weitere Informationen:

- Banküberweisung: Die Bearbeitung von Einzahlungen dauert 3 Tage, ist jedoch kostenlos. Es gibt keinen maximalen Einzahlungsbetrag. Die Bearbeitung von Abhebungen dauert 3 bis 5 Tage, und es gibt eine kostenlose Abhebungsanfrage pro Monat.

- Kreditkarte/Guthabenkarte: Eine Einzahlung ist jederzeit möglich und kostenlos. Auszahlungen können nicht über Kredit-/Debitkarten vorgenommen werden.

- e-Wallets (Skrill/Neteller): Die ersten 5 Einzahlungen und Abhebungen sind kostenlos, danach wird 1% des Betrags berechnet.

Im Allgemeinen sind die Gebühren für Ein- und Auszahlungen, die nicht mit dem Handel verbunden sind, bei Admirals hoch, vor allem, wenn mit anderen Währungen als den von dem Unternehmen unterstützten gehandelt wird. Darüber hinaus sind die Bearbeitungszeiten bei Admirals langsamer als bei anderen vergleichbaren Online-Brokern und das Unternehmen bietet nur eine begrenzte Anzahl von Einzahlungsmethoden an.

Mobile Apps von Admirals

Die mobilen Handelsplattformen von Admirals sind im Vergleich zu anderen ähnlichen Brokern überdurchschnittlich gut.

Die Handels-App von Admiral Markets

Die eigens entwickelte Admirals-App ist sowohl für Android als auch für iOS verfügbar.

Merkmale: Unsere Erfahrung zeigt, dass die Admirals Trading App eine übersichtliche Oberfläche hat und einfach zu bedienen ist. Sie bietet ein durchdachtes Dashboard und einen intuitiven Startbildschirm, über den man Instrumente zu seinen Watchlists hinzufügen, Marktanalysen einsehen und den Kundensupport direkt aus der App heraus kontaktieren kann. Außerdem verfügt sie über eine hervorragende Suchfunktion und es ist einfach, Aufträge zu erteilen, Preiswarnungen einzustellen und Live-Kurse und Charts anzuzeigen. Zudem hat Admirals seine Charts aktualisiert und Händler können mit einem Finger auf den Preis für einen ausgewählten Zeitraum oder mit zwei Fingern auf die Preisdifferenz für einen ausgewählten Bereich tippen.

Damit konnten wir bequem Geld einzahlen und abheben und unsere Dokumente hochladen und scannen.

MT4/MT5 – Mobile Anwendungen

Diese beiden Handelsplattformen sind auf Android- und iOS-Mobilgeräten und Tablets verfügbar. Neueinsteiger sollten sich darüber im Klaren sein, dass es im Vergleich zu Desktop-Handelsplattformen einige Einbußen bei der Funktionalität gibt, z. B. reduzierte Zeitrahmen und weniger Charting-Optionen. Außerdem können punktuelle Verbindungen das Handelserlebnis insgesamt beeinträchtigen. In der Regel ist es sinnvoller, den täglichen Handel am Desktop zu erledigen und ein mobiles Gerät zu benutzen, um die Märkte im Auge zu behalten oder offene Positionen zu schließen.

Die Admirals MT4- und MT5-Apps ermöglichen es Händlern, von überall aus zu arbeiten und bieten Funktionen zum Schließen und Ändern bestehender Orders, zur Berechnung von Gewinnen/Verlusten in Echtzeit und zum Tick-Chart-Handel, um Händler auch unterwegs zu unterstützen.

Alles in allem ist die Unterstützung für den mobilen Handel bei Admirals besser als bei anderen Brokern, mit Unterstützung für die MT4/MT5-Apps und die eigene mobile App.

Weitere Handelsplattformen

Die Trading-Plattformen MT4 und MT5 sind als Download für den Computer und als Webtrader im Browser verfügbar.

MT4 und MT5

Die Tatsache, dass Admirals Plattformen von Drittanbietern wie MT4 und MT5 angeboten werden, hat den Vorteil, dass Händler ihre eigene angepasste Version der Plattform mitnehmen können, wenn sie zu einem anderen Broker wechseln. Darüber hinaus sind für beide MetaTrader-Plattformen Tausende von Plugins und Tools verfügbar.

MT4 ist zwar sehr anpassungsfähig, aber die Plattform wirkt veraltet und einige Funktionen sind schwer zu finden. MT5 ist leistungsfähiger und schneller als MT4, was die Backtesting-Funktionen für automatisierte Handelsalgorithmen angeht. Zudem verfügt er über einen integrierten Nachrichten-Feed, einen Indikator für die Markttiefe, einen Wirtschaftskalender und ermöglicht den Handel in den Charts.

Vergleich der Handelsplattformen:

Handelswerkzeuge

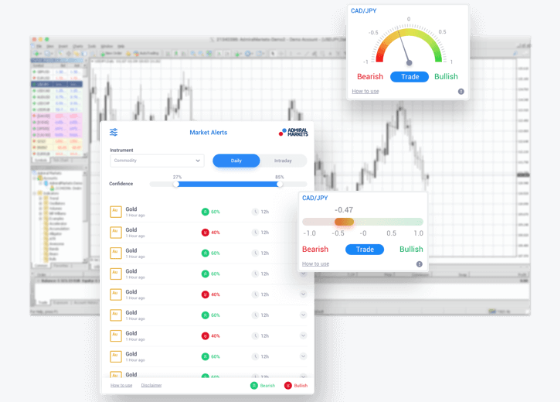

Im Vergleich zu anderen, ähnlichen Brokern sind die Handelswerkzeuge von Admirals weit überlegen. Die MetaTrader Supreme Edition ist eines der besten MetaTrader-Plugins auf dem Markt. In die Metatrader Supreme Edition sind Trading Central und eine Reihe anderer nützlicher Tools integriert. Zudem bietet es einen VPS-Service an.

Admirals hat sich mit Trading Central zu einer Partnerschaft zusammengeschlossen, um dessen Indikatoren (Forex Featured Ideas und Technical Insight) in die MetaTrader Supreme Edition zu integrieren. Mit diesen beiden hochgradig anpassbaren Werkzeugen lassen sich Mustererkennung und technische Analyse für fast alle Finanzinstrumente durchführen. Der VPS-Service wird auch für Kunden angeboten, die ein Eigenkapital von 5000 EUR (oder einen entsprechenden Betrag) auf ihrem Handelskonto haben.

Metatrader Supreme Edition

Trading Central

Als Drittanbieter-Tool nutzen die professionellen Analysten von Trading Central die fortschrittlichsten technischen Analysetools der Branche, um die umfassendsten und tiefgreifendsten Marktinformationen zu sammeln. Dieses Tool unterstützt vor allem Händler ohne technisches Know-how bei ihren Handelsentscheidungen. Das dynamische Produktpaket steht den Händlern über die MetaTrader Supreme Edition zur Verfügung. Trading Central gilt als eines der besten Handelswerkzeuge in der Branche, und Admirals tut gut daran, seinen Kunden dieses Tool anzubieten.

Global Opinion Toolset

Zudem ist in der MetaTrader Supreme Edition das Global Opinion Toolset enthalten. Diese Werkzeuge scannen und kontextualisieren täglich Millionen von Finanznachrichten und Posts in den sozialen Medien und geben Händlern einen dynamischen Überblick über die Marktstimmung. Dadurch können sie die Zeit, die Händler für die tägliche Recherche aufwenden müssen, drastisch reduzieren, indem sie auf die besten Vermögenswerte für den Handel hinweisen und vor Marktveränderungen warnen, die den Handelserfolg beeinflussen könnten.

Mini-Terminal

Zusätzlich erleichtert ein neues Mini-Terminal das Handelsmanagement, indem es häufig genutzte Handelsfunktionen leichter zugänglich macht als in der nativen Version der Software. Dank einer Mini-Chart-Funktion können Händler außerdem mehrere Zeitrahmen und Charttypen in einem einzigen Chart sehen.

Eine weitere Handels-Terminal-Funktion hilft Händlern, mehrere Aufträge gleichzeitig zu verwalten, indem sie dieselben fortschrittlichen Handelsmanagement-Funktionen des Mini-Terminals nutzt.

Tick Chart Trader

Mithilfe des Tick Chart Traders kannst du schnell und präzise mit Tick-Charts handeln. Ein weiteres Indikatorenpaket mit der neuesten Indikatorentechnologie liefert mehr Chartinformationen und Handelssignale innerhalb des Trading-Tools.

Trading Simulator

Darüber hinaus steht ein Handelssimulator zur Verfügung, mit dem du Strategien anhand historischer Kursdaten backtest. Bis zur Entwicklung dieser Funktion waren Händler/innen darauf beschränkt, Strategien mit einem Demokonto in Echtzeit zu testen. Mit dem Trading-Simulator können Händler/innen mehrere Strategien mit demselben Datensatz testen, um die optimale Strategie für verschiedene Marktsituationen zu finden.

VPS

Admirals stellt Händlern, die mehr als 5000 EUR auf ihr Handelskonto einzahlen, einen VPS-Service (Virtual Private Server) zur Verfügung. VPS-Hosting ermöglicht es Händlern, automatisierte algorithmische Strategien, einschließlich Expert Advisors, 24 Stunden am Tag und 7 Tage die Woche auf einer virtuellen Maschine auszuführen. VPS-Dienste haben den Vorteil, dass es nie zu Verbindungsproblemen kommt und die Latenzzeit aufgrund der Nähe zu den großen internationalen Börsen extrem niedrig ist.

Allgemein bietet Admirals eine viel umfangreichere Palette an Handelswerkzeugen als andere ähnliche Broker.

Admirals für Anfänger

Admirals setzt alles daran, neuen Händlern den Einstieg zu erleichtern, und bietet eine umfangreiche Bibliothek mit Bildungsartikeln, Tutorials und Webinaren, die alle in deutscher Sprache verfügbar sind. Für Kunden, die aktive Unterstützung suchen, bietet Trading Central Chartanalysen und Analystenempfehlungen.

Bildungsmaterialien

Admirals verfügt über ein exzellentes Bildungsangebot, das für Händler aller Erfahrungsstufen geeignet ist.

Das bei Admirals verfügbare Bildungsmaterial ist umfangreich und vielfältig. Es ist in verschiedene Abschnitte unterteilt und bietet einen strukturierten Kurs, eine Wissensdatenbank, einen Überblick über das Risikomanagement und regelmäßige Webinare.

Admirals bietet auch einen kostenlosen, strukturierten Forex- und CFD-Handelskurs namens Forex 101 an, der Einsteigern helfen soll, den Handel zu erlernen. Dieser Kurs besteht aus neun Online-Lektionen, die in Anfänger-, Mittelstufen- und Fortgeschrittenenkurse unterteilt sind und von professionellen Händlern unterrichtet werden. Der Kurs deckt alles ab, von der Einrichtung von MT4 bis zum Risikomanagement, und ist eine hervorragende Ressource für neue Händler/innen.

Bildung für das Risikomanagement bei Admiral Markets

Darüber hinaus bieten die Admirals von Experten geleitete Webinare an. Dazu gehören Kommentare zur kommenden Woche oder lehrreiche Webinare wie Mastering the 4Ms of Trading, die Händlern helfen, ihre Handelsfähigkeiten zu entwickeln und Vertrauen aufzubauen.

Insgesamt ist der Bildungsbereich von Admirals umfassend und detailliert und richtet sich sowohl an Anfänger als auch an fortgeschrittene Händler.

Analyse-Material

Admirals Marktforschungsmaterialien sind umfassend und gut strukturiert und stehen im Vergleich zu anderen großen internationalen Brokern gut da. Außerdem haben wir uns darüber gefreut, dass alle Materialien auf Deutsch verfügbar sind.

- Handelsnachrichten: Der Trader`s Blog, der allen Kunden offensteht, liefert täglich Wirtschaftsnachrichten und Kontext oder Analysen, die Händlern helfen, durch aufschlussreiche und praktische Marktinformationen neue Chancen zu finden. In anderen Artikeln wird ein bestimmtes Thema eingehender analysiert.

- Marktstimmung: Das Werkzeug “Market Sentiment” ist eine visuelle Interpretation aggregierter Daten von mehreren Dienstleistern, die das Verhältnis zwischen offenen Long- und Short-Positionen zeigt. Marktstimmungsdaten sind nützlich, um Makrotrends und die Stimmung des Handelskollektivs zu verstehen. Diese Informationen sind besonders nützlich für Händler, die Positionen über längere Zeiträume halten.

- Premium-Analysen: Die im September 2019 eingeführte Premium-Analytik wurde mit kostenlosem Zugang für Demo- und Live-Konten eingeführt. Dabei werden Premium-Datenfeeds verwendet, um den Händlern die besten Informationen zu liefern. In diesem Video (33 Minuten) wird das Produkt ausführlich vorgestellt.

- Wöchentlicher Podcast: Der wöchentliche Podcast von Admirals enthält die interessantesten und informativsten Handelsnachrichten und Analysen. An jedem Montag gibt es neue Podcasts, die sich mit den Wirtschaftsnachrichten und Ereignissen der vergangenen und kommenden Woche befassen und Marktanalysen und Handelsstrategien bieten.

- Forex-Kalender, oder Wirtschaftskalender: Eine Liste der geplanten Ereignisse, die die Devisenmärkte beeinflussen könnten.

Kundendienst

Das Team des Admirals-Kundendienstes ist während der Geschäftszeiten an fünf Tagen in der Woche per Live-Chat, E-Mail und Telefon in 23 verschiedenen Sprachen, darunter auch Deutsch, erreichbar. Zudem kann man in jedem der Büros einen persönlichen Termin vereinbaren.

Des Weiteren steht den Kunden während der Geschäftszeiten ein Fernsupport für technische Probleme mit dem MetaTrader oder der MetaTrader Supreme Edition zur Verfügung.

Für die Zwecke dieser Bewertung fanden wir den Kundenservice reaktionsschnell, sachkundig und höflich.

Sicherheit und Anerkennung in der Industrie

Anerkennung in der Industrie: Gegründet im Jahr 2001 und mit Hauptsitz in Großbritannien und Estland, wird Admirals von der Financial Conduct Authority (FCA), der Cyprus Securities and Exchange Commission (CySEC), der Australian Securities and Investments Commission (ASIC) und der Jordan Securities Commission (JSC) reguliert. Im Folgenden ist eine Liste der bei Admirals registrierten Unternehmen zu finden:

- Admirals UK Ltd ist im Vereinigten Königreich beim Companies House unter der Nummer 08171762 registriert. Admirals UK Ltd wird von der Financial Conduct Authority (FCA) zugelassen und reguliert – registration number 595450.

- Admirals Cyprus Ltd ist in Zypern registriert – mit der Unternehmensregistrierungsnummer 310328 beim Department of the Registrar of Companies and Official Receiver. Admirals Cyprus Ltd wird von der Cyprus Securities and Exchange Commission (CySEC) zugelassen und reguliert, license number 201/13.

- Admirals Pty Ltd registriertes Büro: Ebene 10, 17 Castlereagh Street Sydney NSW 2000. Admirals Pty Ltd (ABN 63 151 613 839) besitzt eine australische Finanzdienstleistungslizenz (AFSL), um in Australien Finanzdienstleistungen zu erbringen, die auf die von ihrer AFSL – 410681– abgedeckten Finanzdienstleistungen beschränkt sind.

- Admirals AS Jordan Ltd ist von der jordanischen Wertpapierkommission (JSC) im Haschemitischen Königreich Jordanien unter der Registrierungsnummer 57026 zum Betreiben von Anlagegeschäften zugelassen und reguliert.

- Admirals SA (Pty) Ltd ist in Südafrika bei der Companies and Intellectual Property Commission (CIPC) registriert – Registrierungsnummer – 2019 / 620981 / 07. Admirals SA (Pty) Ltd ist ein zugelassener Finanzdienstleister (FSP51311), der bei der Financial Sector Conduct Authority registriert ist. Der eingetragene Sitz von Admirals SA (Pty) Ltd ist: Unit OG/N1, 33 Scott Street, Waverley, Johannesburg, Gauteng, 2090.

Auszeichnungen

Admirals hat im Laufe der Jahre viele Branchenpreise gewonnen:

- Deutschland: Best CFD Broker 2021 (Brokervergleich.de)

- Best Financial Service Provider 2021 (Handelsblatt)

- Focus Money Award 2021 (Focus Money)

- Chile – Best Forex Broker 2021 (Rankia)

Während sich die Auszeichnungen der letzten Jahre auf die breite Stärke von Admirals als Broker konzentrierten, wird das Unternehmen oft für sein Engagement in den Bereichen Handelstechnologie, Benutzererfahrung und Kundenservice gewürdigt.

Aufgrund der langjährigen Erfahrung mit verantwortungsbewusstem Handeln, strengen internen Prozessen und einer starken internationalen Regulierung halten wir Admirals für einen sicheren Broker, bei dem man sicher handeln kann.

Bewertungsmethode

Bei der Überprüfung unserer Partner legen wir Wert auf Transparenz und Offenheit. Deshalb haben wir unser Bewertungsverfahren veröffentlicht. Im Mittelpunkt dieses Prozesses steht die Bewertung der Zuverlässigkeit des Brokers, des Plattformangebots des Brokers und der Handelsbedingungen für die Kunden, die in dieser Bewertung zusammengefasst sind. Jeder dieser Punkte wird benotet, und es wird eine Gesamtnote berechnet und dem Broker zugewiesen.

Admirals Marktrisiko-Erklärung

Gemäß der Regulierung sind Broker verpflichtet, Forex-Händlern gegenüber transparent zu sein, was die Komplexität ihrer Finanzprodukte angeht, und auch offenzulegen, in welchem Umfang Händler ihr Geld verlieren können. Admiral Markets informiert darüber: CFDs sind komplexe Instrumente und bergen aufgrund der Hebelwirkung ein hohes Risiko, schnell Geld zu verlieren. 76% der Konten von Kleinanlegern verlieren Geld beim Handel mit CFDs bei diesem Anbieter. Deshalb sollte man sich überlegen, ob man versteht, wie CFDs funktionieren und ob man das hohe Risiko, sein Geld zu verlieren, eingehen kann.

Überblick

Bei Admirals handelt es sich um einen weltweit führenden Online-Broker. Er bietet hervorragende Handelsbedingungen, darunter enge Spreads, niedrige Mindesteinlagen und niedrige Provisionen sowohl auf der MT4- als auch auf der MT5-Plattform. Dank der ausgezeichneten Regulierung, der umfassenden Handelswerkzeuge und der erstklassigen Bildungs- und Marktanalysematerialien, die in deutscher Sprache verfügbar sind, hat sich Admirals aus gutem Grund einen Ruf als einer der besten Forex- und CFD-Broker erworben. Das einzige Manko des ansonsten hervorragenden Gesamtangebots sind die hohen Gebühren, die Admirals für den Nicht-Handel erhebt.

Finden Sie heraus, wie Admirals im Vergleich zu anderen Brokern abschneidet.Broker vergleichen

Auf dem neuesten Stand bleiben

Dieses Formular hat Double Opt-In aktiviert. Sie müssen Ihre E-Mail-Adresse bestätigen, bevor Sie in die Liste aufgenommen werden.